Titan FX Review

Titan FX Limited is a forex and CFD broker known for offering competitive spreads and a wide range of trading instruments. This broker primarily caters to retail and professional traders looking for low-cost trading options in forex, commodities, and indices. Titan FX operates with a no-dealing desk model, meaning it directly connects traders to the market for faster and more transparent order execution.

Titan FX provides access to reliable trading servers and platforms including MetaTrader 4 and MetaTrader 5, offering advanced features for technical analysis and automatic trading. These platforms are accessible on desktop, web, and mobile, making it convenient for traders to manage their accounts on the go. With a focus on transparency and competitive pricing, Titan FX appeals to traders looking for efficiency and reliability.

Customer support at Titan FX is available through email, live chat, and phone, providing assistance across multiple languages. The broker also offers educational resources and market insights, helping traders to make informed decisions. Overall, Titan FX is a solid choice for traders seeking a straightforward, cost-effective trading experience with global market access.

What is Titan FX?

Titan FX is a forex and CFD broker designed for retail and professional traders who prioritize low trading costs and direct market access. Operating with a no-dealing desk model, Titan FX connects traders to the market for faster, more transparent execution. This setup is ideal for those looking to trade forex, commodities, and indices with competitive spreads and minimal intervention.

Titan FX offers MetaTrader 4 and MetaTrader 5, well-known platforms for technical analysis and automated trading, available on desktop, web, and mobile devices. With reliable customer support, educational tools, and a focus on efficiency, Titan FX provides a streamlined trading experience that appeals to traders seeking global market access at low cost.

Titan FX aims to strengthen its presence in Southeast Asia by promoting its social trading feature, a tool designed for traders seeking collaborative and interactive trading experiences. This feature allows users to follow and copy the strategies of experienced traders, making it particularly appealing for beginners who can learn while potentially earning. As social trading gains traction globally, Titan FX positions itself to meet the demands of a digitally connected audience in this region.

Titan FX Regulation and Safety

Titan FX operates under the regulatory oversight of the Vanuatu Financial Services Commission (VFSC) with registration number 40313. The broker is also a member of The Financial Commission, an independent organization providing dispute resolution services in the forex market. This regulatory framework offers a moderate level of oversight but is not as stringent as that provided by top-tier authorities like the Financial Conduct Authority (FCA) or the the Seychelles Financial Services Authority.

Titan FX is licensed and regulated in the British Virgin Islands and Seychelles, ensuring a secure trading environment for its clients. These regulatory frameworks focus on maintaining transparency and financial stability. While they provide credibility, traders may prefer stricter regulations for enhanced protection.

To ensure client safety, Titan FX employs standard protective measures, such as segregated client accounts and SSL encryption to safeguard funds and personal information. However, traders should consider that the regulatory protections here may not match the higher standards of brokers regulated by top-tier authorities. In summary, Titan FX provides a secure trading environment but with mid-tier regulatory oversight.

Titan FX Pros and Cons

Pros

- Competitive spreads

- Fast execution

- Multiple platforms

- High leverage

Cons

- Limited regulation

- High Deposit Requirement

- Restricted instruments

- No U.S. clients

Benefits of Trading with Titan FX

Southeast Asia represents a prime opportunity for Titan FX, as the region has seen rapid growth in online trading activity, driven by increasing internet penetration and a young, tech-savvy population. Social trading aligns with the cultural preference for community-based decisions, making it a natural fit for the market. Titan FX’s focus on this feature reflects its understanding of regional trends and consumer behavior.

The social trading feature integrates seamlessly with platforms like ZuluTrade, providing access to a diverse network of traders. This functionality enables users to diversify their portfolios effortlessly, enhancing accessibility to complex trading strategies. By leveraging the power of community-driven insights, Titan FX is setting itself apart from competitors in the highly competitive Southeast Asian market.

Using MetaTrader 4 and MetaTrader 5 platforms, Titan FX accommodates both new and experienced traders with advanced charting tools and automated trading options. The broker also supports leverage up to 1:500, catering to a range of trading styles and risk levels. Additionally, Titan FX provides reliable customer support and educational resources, enhancing the trading experience and helping traders make informed decisions.

Titan FX Customer Reviews

Titan FX has received a range of customer reviews, with mixed feedback on its services. Some traders commend the broker for its competitive spreads and fast execution, which supports various trading strategies effectively. These aspects make Titan FX appealing to those who prioritize cost-efficiency and reliable trade execution.

However, some users express concerns about Titan FX’s regulatory framework and responsiveness in customer support. For potential clients, it’s essential to weigh both the benefits and drawbacks reported by current users. Overall, Titan FX can be a good choice for traders seeking low costs and quick trades but may require more consideration regarding its regulatory structure and support.

Titan FX Spreads, Fees, and Commissions

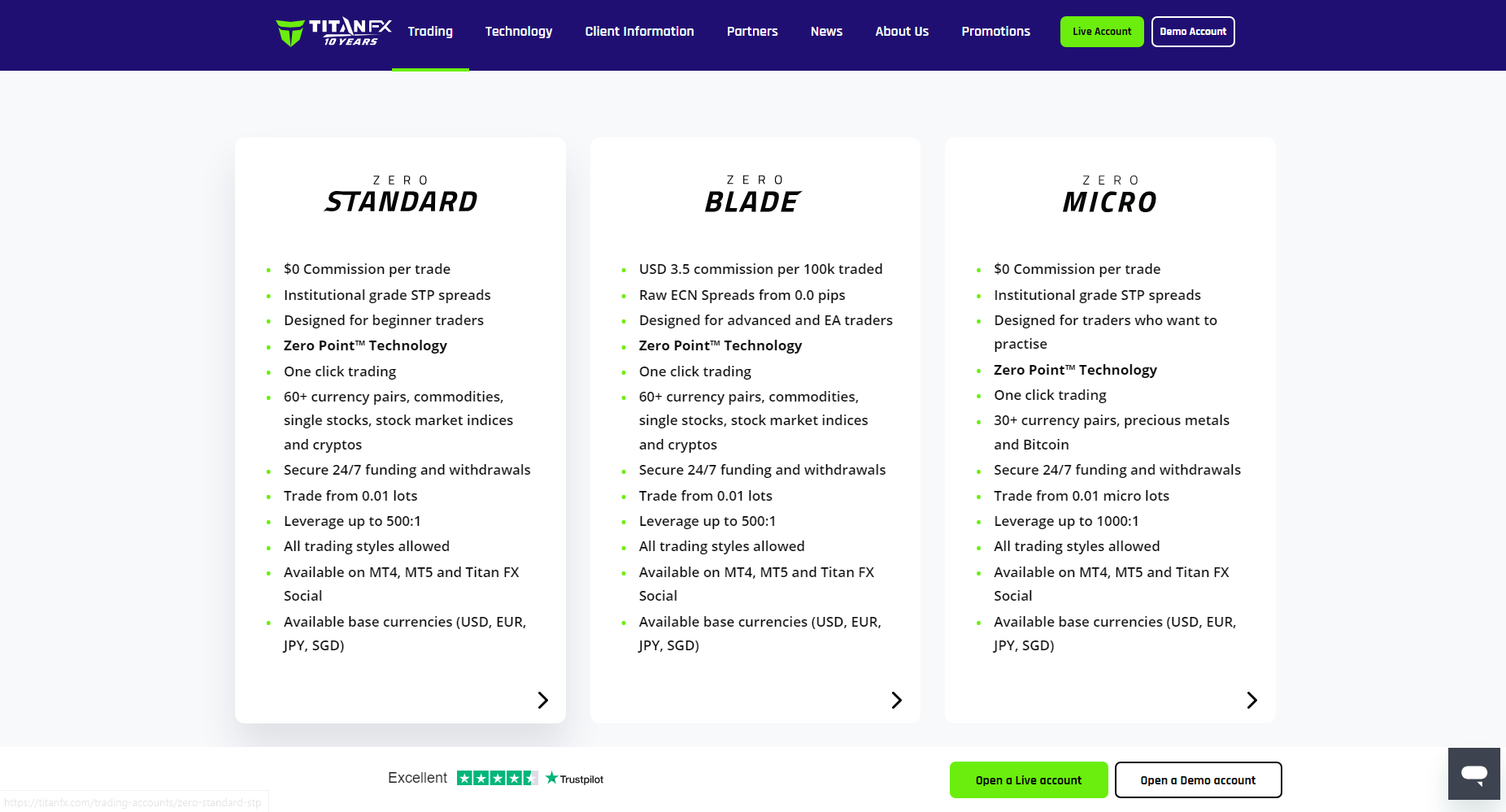

Titan FX provides a competitive and transparent fee structure suited to different trading needs. The broker offers two primary account types: the Standard STP and the Blade ECN. The Standard STP account has no commission per trade, offering institutional-grade spreads, which is ideal for traders preferring a straightforward fee setup. In comparison, the Blade ECN account provides raw spreads starting from 0.0 pips, with a commission of $7 per round turn for every 100,000 units traded, appealing to traders focused on tight spreads.

Titan FX does not charge fees for account maintenance or opening, making it a cost-effective choice. Traders have access to leverage options up to 1:500 for Standard and Blade accounts, and up to 1:1000 for Micro accounts, which helps manage different risk levels. Additionally, Titan FX does not impose withdrawal fees, allowing traders to access funds without additional costs, further enhancing its appeal for cost-conscious traders.

Account Types

Titan FX offers a range of trading account types designed to meet the needs of various traders, from beginners to professionals. Each account type is structured to provide specific benefits, enabling traders to choose an option that aligns with their trading style and goals. Below is an overview of the account types available with Titan FX.

Standard Zero Account

The Standard Zero Account is ideal for traders looking for a straightforward fee structure with no commissions. This account provides access to competitive spreads, making it suitable for traders who prefer a simpler cost model.

Blade Zero Account

The Blade Zero Account offers raw spreads starting from 0.0 pips, with a small commission on trades. This account type is designed for traders who prioritize tight spreads and fast execution, making it ideal for scalping and high-frequency trading strategies.

Micro Zero Account

Titan FX introduced the Zero Micro Account on February 27, 2023, to cater to traders seeking smaller contract sizes and higher leverage. This account type allows trading with micro lots, starting from 0.01 lots, and offers leverage up to 1,000:1, enabling traders to manage risk effectively with a smaller initial investment.

Demo Account

The Demo Account allows traders to practice and familiarize themselves with Titan FX’s platform without financial risk. This account mirrors real trading conditions, making it suitable for new traders or those testing strategies.

These account types provide Titan FX clients with flexible options, from commission-free trading to specialized accounts, catering to a broad range of trading preferences. All account type comparison 6.0 Average 2 types of accounts with high leverage features no trading restrictions multiple base currencies support negative balance protection.

How to Open Your Account

Opening an account with Titan FX is a straightforward process designed to get traders started quickly. The broker has streamlined the steps to ensure a hassle-free experience. Below is a guide to opening an account with Titan FX.

Step 1: Registration

Begin by visiting the Titan FX website and clicking on the “Open Account” button. Fill out the registration form with your personal details, including name, email address, and phone number. Create a secure password to protect your account.

Step 2: Account Verification

After registration, verify your identity by providing the required documents, such as a government-issued ID and proof of address. This step ensures compliance with regulatory standards and secures your account.

Step 3: Funding Your Account

Once your account is verified, proceed to deposit funds. Titan FX offers various funding options, including bank transfers, credit/debit cards, and e-wallets. Choose the method that best suits your needs and follow the instructions to complete the deposit.

Step 4: Downloading the Trading Platform

With your account funded, download the trading platform of your choice—MetaTrader 4 or MetaTrader 5. Install the platform on your device and log in using the credentials provided by Titan FX.

Step 5: Starting to Trade

After setting up the platform, you can begin trading. Familiarize yourself with the platform’s features and tools to make informed trading decisions. Titan FX also provides educational resources to assist you in your trading journey.

By following these steps, traders can efficiently open an account with Titan FX and start trading in the financial markets.

Titan FX Trading Platforms

Titan FX offers trading platforms that cater to both new and experienced traders, providing tools for comprehensive market analysis and automation. The broker supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both widely recognized for their reliability and range of features. MT4 is favored by forex traders for its user-friendly interface and basic trading tools, while MT5 offers additional features like advanced charting and more order types, appealing to those seeking a broader trading experience.

These platforms are accessible across devices, including desktop, web, and mobile, allowing traders to manage their accounts from anywhere. Titan FX also provides VPS hosting for uninterrupted trading, which is especially beneficial for those using automated strategies. With these platform options, Titan FX ensures that traders have access to robust and flexible tools, enhancing their ability to trade effectively.

What Can You Trade on Titan FX

Titan FX offers traders a diverse range of instruments across multiple asset classes, enabling them to implement various trading strategies. This variety allows traders to diversify their portfolios and capitalize on different market opportunities. Below is an overview of the available trading options on Titan FX.

Forex

Titan FX provides access to major, minor, and exotic currency pairs, allowing traders to participate in the global foreign exchange market. This includes popular pairs like EUR/USD, GBP/JPY, and AUD/CHF, facilitating strategies based on currency fluctuations.

Commodities

Traders can engage with commodities such as precious metals and energies. Titan FX offers instruments like gold (XAU/USD), silver, and crude oil, enabling traders to speculate on commodity price movements.

Indices

Titan FX offers trading on major global indices, including the S&P 500, FTSE 100, and DAX. This allows traders to speculate on the performance of a group of stocks representing a specific market segment.

Cryptocurrencies

For those interested in digital assets, Titan FX provides access to popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP). This enables traders to participate in the volatile cryptocurrency markets.

By offering these diverse trading instruments, Titan FX caters to a wide range of trading preferences and strategies, supporting traders in achieving their financial objectives.

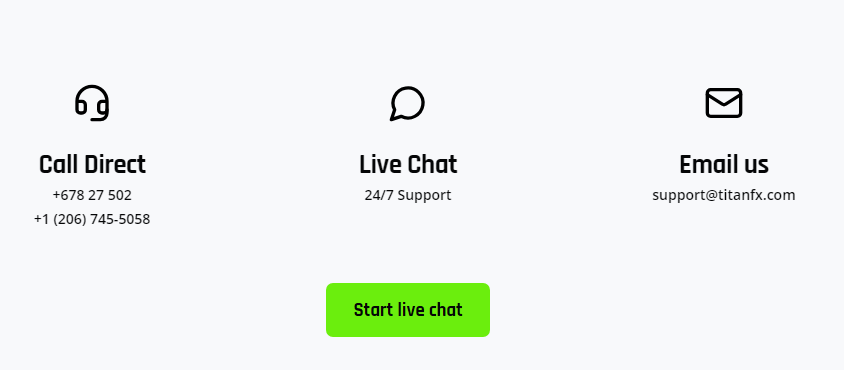

Titan FX Customer Support

Titan FX offers customer support through multiple channels to assist traders with any issues they may encounter. Support is available via email, live chat, and phone, ensuring that traders have access to help when they need it. This multi-channel approach provides flexibility, allowing traders to choose the method that best suits their needs.

The support team at Titan FX is available in multiple languages, making it accessible to a global client base. Additionally, the broker provides educational resources and market insights to help traders make informed decisions. With a focus on accessibility and support, Titan FX aims to provide a dependable experience for both new and experienced traders.

Here are some great customer support access from Titan FX;+678 27 502 support@titanfx.com 1st Floor Govant Building, 1276 Kumul Highway, Port Vila, Republic of Vanuatu. Customer support team are available 24/5 so most of the inquiries like asking for international or local bank transfers, deposit methods, forex pairs, or about such tight spreads will be given with great live chat support. Titan FX is the most suitable broker for early trading.

Advantages and Disadvantages of Titan FX Customer Support

Withdrawal Options and Fees

Titan FX provides multiple withdrawal options to ensure traders can access their funds conveniently. The broker aims to keep withdrawals straightforward and secure, with clear fee structures depending on the chosen method. Below are the available withdrawal options with Titan FX.

Bank Transfer

Bank transfers allow traders to withdraw funds directly to their bank accounts. While this option is secure, it may take a few business days for processing, and fees may vary based on the bank and region.

Credit/Debit Card

Titan FX offers withdrawals to credit and debit cards for quick and easy access to funds. Processing times are generally shorter, but availability may depend on the card provider and country.

Skrill

Skrill is an e-wallet option for faster withdrawals, making it ideal for traders who prefer digital wallets. This method typically has quick processing times, with minimal fees associated.

Neteller

Neteller is another e-wallet option provided by Titan FX, allowing traders to withdraw funds with ease. It’s a popular choice for those who value speed and convenience in accessing their trading profits.

With these flexible withdrawal options, Titan FX ensures that traders can manage their funds efficiently while choosing the method that best suits their needs

Titan FX Vs Other Brokers

#1. Titan FX vs AvaTrade

Titan FX offers a direct, commission-based trading model ideal for those looking for low spreads, appealing to active and high-volume traders. With ECN execution, it prioritizes fast and efficient trades without interference from a dealing desk, which suits professional traders. In contrast, AvaTrade caters more to beginner and intermediate traders, featuring a broader range of tools, including educational resources and fixed spreads, which provide cost predictability. AvaTrade also supports a larger variety of platforms and trading assets, making it more versatile for those who trade beyond Forex.

Verdict: For cost-focused, high-frequency traders, Titan FX stands out with its low-spread, commission-based model. For those who prioritize platform variety and educational tools, AvaTrade offers a more supportive environment.

#2. Titan FX vs RoboForex

Titan FX and RoboForex are both online brokers offering access to various financial markets, including forex, commodities, and indices. Titan FX, established in 2013, operates as an ECN broker, providing direct market access with low spreads and fast execution speeds, which is advantageous for high-frequency traders. It supports MetaTrader 4 and MetaTrader 5 platforms and offers leverage up to 1:500. RoboForex, founded in 2009, offers a broader range of trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and its proprietary R StocksTrader platform. It provides access to over 12,000 instruments, including stocks, ETFs, and cryptocurrencies, with leverage up to 1:2000. RoboForex also offers various account types, including cent accounts for beginners and ECN accounts for professionals. Both brokers are regulated, with Titan FX overseen by the Vanuatu Financial Services Commission and RoboForex by the International Financial Services Commission of Belize.

Verdict: For traders seeking a wide range of instruments and higher leverage options, RoboForex may be more suitable. Conversely, those prioritizing ECN execution with low spreads might prefer Titan FX.

#3. Titan FX vs Exness

Titan FX and Exness are both reputable forex brokers offering a range of trading services. Titan FX, established in 2013, operates as an ECN broker, providing direct market access with low spreads and fast execution speeds, which is advantageous for high-frequency traders. It supports MetaTrader 4 and MetaTrader 5 platforms and offers leverage up to 1:500. Exness, founded in 2008, offers a broader range of trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and its proprietary Exness Terminal. It provides access to over 12,000 instruments, including stocks, ETFs, and cryptocurrencies, with leverage up to 1:2000. Exness also offers various account types, including cent accounts for beginners and ECN accounts for professionals. Both brokers are regulated, with Titan FX overseen by the Vanuatu Financial Services Commission and Exness by the International Financial Services Commission of Belize.

Verdict: For traders seeking a wide range of instruments and higher leverage options, Exness may be more suitable. Conversely, those prioritizing ECN execution with low spreads might prefer Titan FX.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: Titan FX Review

Just like in other Titan FX reviews, it always stands out as a broker focused on cost-effective trading with transparent fees and competitive spreads. By providing two main account types with varying spread and commission options, Titan FX appeals to traders who prioritize affordability and flexibility in their trading. The no-dealing desk model enhances trade execution speed and transparency, giving traders a direct link to the market.

The availability of MetaTrader 4 and MetaTrader 5 platforms, accessible across multiple devices, allows Titan FX to cater to both beginner and advanced traders. Support for high leverage, a range of trading instruments, and no withdrawal fees further add to its appeal for traders looking to maximize their trading potential. With reliable customer support and educational resources, Titan FX provides a solid choice for those seeking a straightforward, efficient trading experience.

With its great social trading feature, Titan FX is poised to capture a larger share of the Southeast Asian market. By focusing on technology, community, and education, the company is creating a compelling value proposition for both novice and experienced traders. This strategic emphasis underscores Titan FX‘s commitment to innovation and market-specific adaptability.

Titan FX Review: FAQs

How do I open an account with Titan FX?

Opening an account involves selecting your preferred account type, filling out the registration form, and verifying your identity as required. You can then fund the account to start trading.

What are the deposit and withdrawal options?

Titan FX provides options such as bank transfer, credit card, and e-wallets. Processing times and availability may vary depending on the chosen method.

What trading platforms are available?

Titan FX supports MetaTrader 4 and MetaTrader 5, both of which are available on desktop, web, and mobile, offering flexibility and advanced trading features.

OPEN AN ACCOUNT NOW WITH TITAN FX AND GET YOUR BONUS