Position in Rating | Overall Rating | Trading Terminals |

46th  | 4.3 Overall Rating |  |

Tickmill Review

Tickmill is a broker that many traders appreciate for its low trading costs and fast execution. Spreads are tight, especially on the Pro and VIP accounts, making it a solid choice for scalpers and day traders. What sets Tickmill apart further is its growing focus on futures trading, offering access to major global exchanges like CME, NYMEX, and EUREX. With competitive commissions and advanced platforms like CQG and AgenaTrader, it appeals to both experienced futures traders and those looking to diversify beyond forex.

The withdrawal process with Tickmill is generally smooth, with most payments processed within a day. Traders also highlight the broker’s strong regulation and negative balance protection, which adds a layer of security. However, while the futures offering is a strong point, the overall range of other trading instruments is still somewhat limited compared to larger multi-asset brokers.

Customer support is reliable, though some traders mention that responses can be slow during peak hours. Despite this, Tickmill remains a preferred choice for those who prioritize low fees, fast execution, and now, increasingly, access to robust futures trading capabilities. Overall, it’s a strong option not just for forex traders, but also for those exploring cost-effective futures trading in a secure, well-regulated environment.

What is Tickmill?

Tickmill is a trustworthy broker offering forex and CFD trading with low spreads and competitive trading conditions. It is regulated by multiple authorities, including the Financial Sector Conduct Authority in South Africa, the Dubai Financial Services Authority, and the Cyprus Securities and Exchange Commission. Through entities like Tickmill UK Ltd and Tickmill Europe Ltd, the broker provides services to both retail and professional clients across the globe. Traders can open a Classic Account, Raw Account, or Pro Account, all benefiting from direct market access, negative balance protection, and the secure handling of client funds.

Beyond forex and CFDs, Tickmill extends its offering with direct access to global futures markets, giving traders the ability to engage with major exchanges through advanced trading infrastructure. This adds a valuable edge for those seeking exposure to more sophisticated instruments.

With access to multiple trading platforms, including mobile trading apps, Tickmill ensures a smooth experience for both new and experienced traders. It supports copy trading, automated strategies, and trading signals, catering to a variety of trading styles. Fund transfers are straightforward, supporting international bank transfers, and the broker maintains an industry-average minimum deposit. Tickmill also permits scalping, news trading, and offers a variety of financial instruments, including currency pairs, commodities, and indices. Combined with flexible leverage, tight spreads, and low-cost execution, Tickmill stands out as a strong choice for those looking to participate in the global financial markets, including the expanding space of futures trading.

Tickmill offers futures trading services, providing clients with access to five globally regulated futures exchanges: CME, CBOT, NYMEX, COMEX, and EUREX. This enables trading in various asset classes, including indices, metals, and foreign exchange.

Key features of Tickmill’s futures trading include:

Competitive Commissions: Standard contracts are priced at $1.30 per side, while micro contracts are $0.85 per side.

Low Deposit Requirement: Clients can start trading futures with a minimum deposit of $1,000 (or equivalent in another currency).

Advanced Trading Platforms: Tickmill provides access to industry-leading platforms such as CQG and AgenaTrader, which offer robust tools for market analysis and trade execution. Tickmill Ltd

Educational Resources: The broker offers a comprehensive Education Hub with tutorial videos and online courses to help traders understand futures and options trading.

For detailed information on futures trading conditions, including margin requirements and trading hours, you can visit Tickmill’s official website.

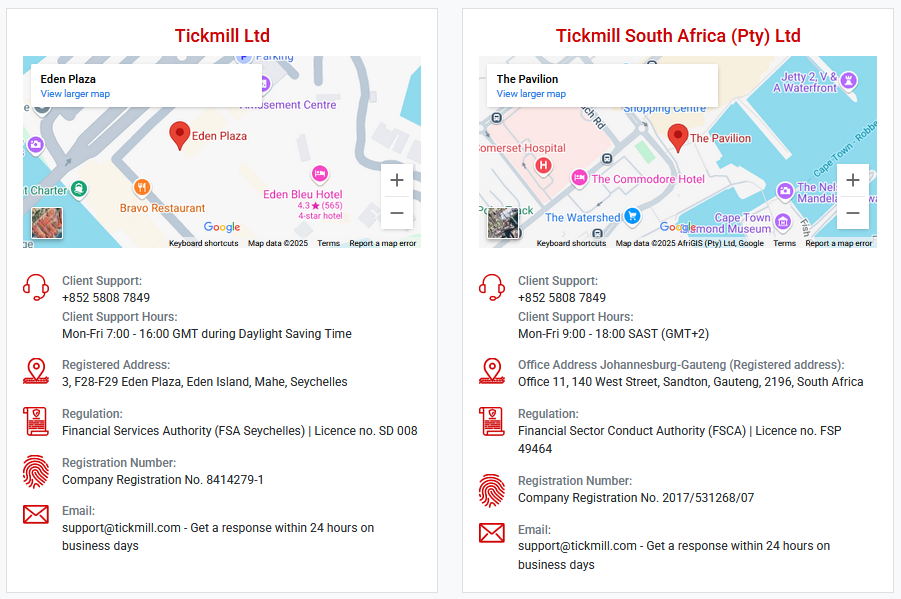

Tickmill Regulation and Safety

Tickmill is a trustworthy broker regulated by multiple financial authorities, ensuring a secure trading environment for retail clients and professional clients. It operates under the Financial Sector Conduct Authority in South Africa, the Dubai Financial Services Authority, and the Cyprus Securities and Exchange Commission. Tickmill UK Ltd and Tickmill Europe Ltd also hold strong regulatory licenses, reinforcing the broker’s credibility. With negative balance protection, a compensation scheme, and strict security protocols, Tickmill prioritizes the safety of client funds.

To further enhance security, Tickmill offers segregated accounts, ensuring that retail investor accounts remain separate from the company’s operational funds. It follows industry standards for fund protection and provides secure payment options, as Tickmill accepts payments through international bank transfers and other reliable methods. Traders benefit from direct market access, low spreads, and competitive trading conditions, making Tickmill not only a transparent broker but also a solid choice for those seeking a safe and regulated trading experience.

Tickmill Pros and Cons

Pros:

- Low spreads

- Fast execution

- Multiple platforms

- Good liquidity

Cons:

- Limited research

- Withdrawal fees

- Inactivity fees

- Limited education

Benefits of Trading with Tickmill

Tickmill has built a strong reputation among traders for its tight spreads and fast execution. Many appreciate the competitive pricing, particularly on forex pairs, as it significantly reduces trading costs. The lack of requotes and minimal slippage on most trades makes it a dependable choice for strategies that rely on precise order execution.

A major advantage of Tickmill lies in its flexible account types and customizable leverage options. With access to raw spreads and low commissions, the broker appeals to both scalpers and long-term traders looking to optimize their performance. The availability of high leverage gives traders the ability to scale positions based on their individual risk tolerance and strategy.

In terms of trader support, Tickmill delivers a well-rounded experience with advanced charting tools, VPS hosting, and an intuitive platform interface. These tools are especially useful for those employing algorithmic or signal-based strategies. Additionally, for traders interested in expanding into more advanced markets, Tickmill’s infrastructure supports efficient execution across a wide range of instruments, including derivatives like futures, via professional-grade platforms.

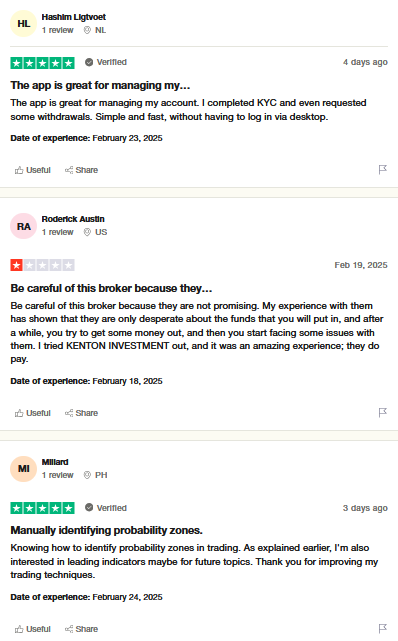

Tickmill Customer Reviews

Many traders who have used Tickmill highlight its reliability and cost-effectiveness. The low spreads and fast execution speed are frequently mentioned as key advantages, especially for forex traders. Scalpers and day traders appreciate the lack of requotes, which allows them to enter and exit positions without unnecessary delays.

Another aspect traders value is the broker’s transparency in fees and withdrawals. Tickmill offers commission-free trading on some accounts, while its Pro and VIP accounts provide raw spreads with minimal charges. Withdrawals are processed efficiently, with most traders reporting smooth transactions and no hidden fees.

Customer support is generally well-received, with traders noting the responsiveness of the team. Tickmill provides multilingual support, which helps traders from different regions get assistance quickly. While some traders mention room for improvement in educational resources, the overall experience remains positive for both beginners and experienced traders.

Tickmill Spreads, Fees, and Commissions

Traders appreciate Tickmill for its low spreads and competitive pricing structure. The broker offers raw spreads starting from 0.0 pips on Pro and VIP accounts, making it ideal for scalpers and high-frequency traders. Standard accounts come with slightly higher spreads but have no commissions, which suits those who prefer a simple cost structure.

When it comes to fees, Tickmill keeps things transparent. There are no hidden charges, and most payment methods for deposits and withdrawals are free of extra costs. Traders using the Pro and VIP accounts pay a low commission per lot, ensuring affordability compared to many other brokers.

Many traders also highlight the smooth withdrawal process with Tickmill. Transactions are usually processed within one business day, and there are no surprise fees. This level of efficiency and cost-effectiveness makes it a preferred choice for those looking to minimize trading expenses.

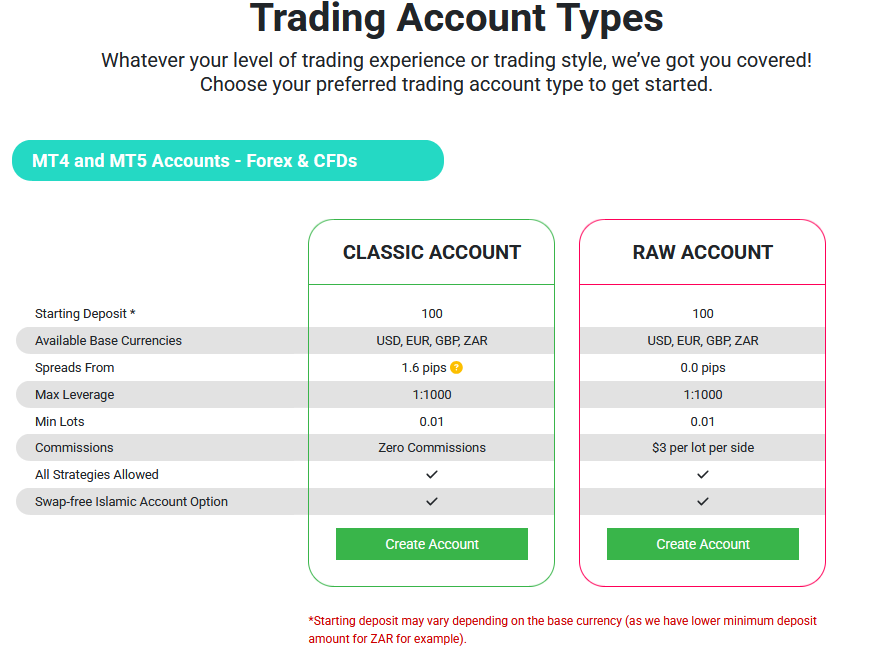

Account Types

There are several account types offered by Tickmill, each designed to cater to the varying needs of traders with different experience levels and trading preferences. These accounts provide flexibility in trading conditions, spreads, and commissions, ensuring traders can find a suitable option for their trading style.

Classic Account

The Tickmill Classic Account is ideal for traders who prefer a straightforward, commission-free experience. It offers spreads from 1.6 pips and a starting deposit of $100, making it accessible to most traders. This account type is suitable for those who want a simple, no-commission approach to trading.

Raw Account

For traders looking for tighter spreads, the Tickmill Raw Account provides spreads from 0.0 pips with a commission of $3 per lot per side. It also requires a starting deposit of $100 and allows all trading strategies. This account type is well-suited for more experienced traders seeking lower costs per trade.

Islamic Account

The Tickmill Islamic Account is designed for traders who follow Islamic principles, offering a swap-free trading environment. Available for both Classic and Raw accounts, this account ensures that there are no overnight interest charges, in line with Islamic finance guidelines.

Demo Account

The Demo Account offers traders the opportunity to practice and familiarize themselves with the trading platform without any financial risk. It simulates live market conditions, making it a valuable tool for beginners and those testing new strategies.

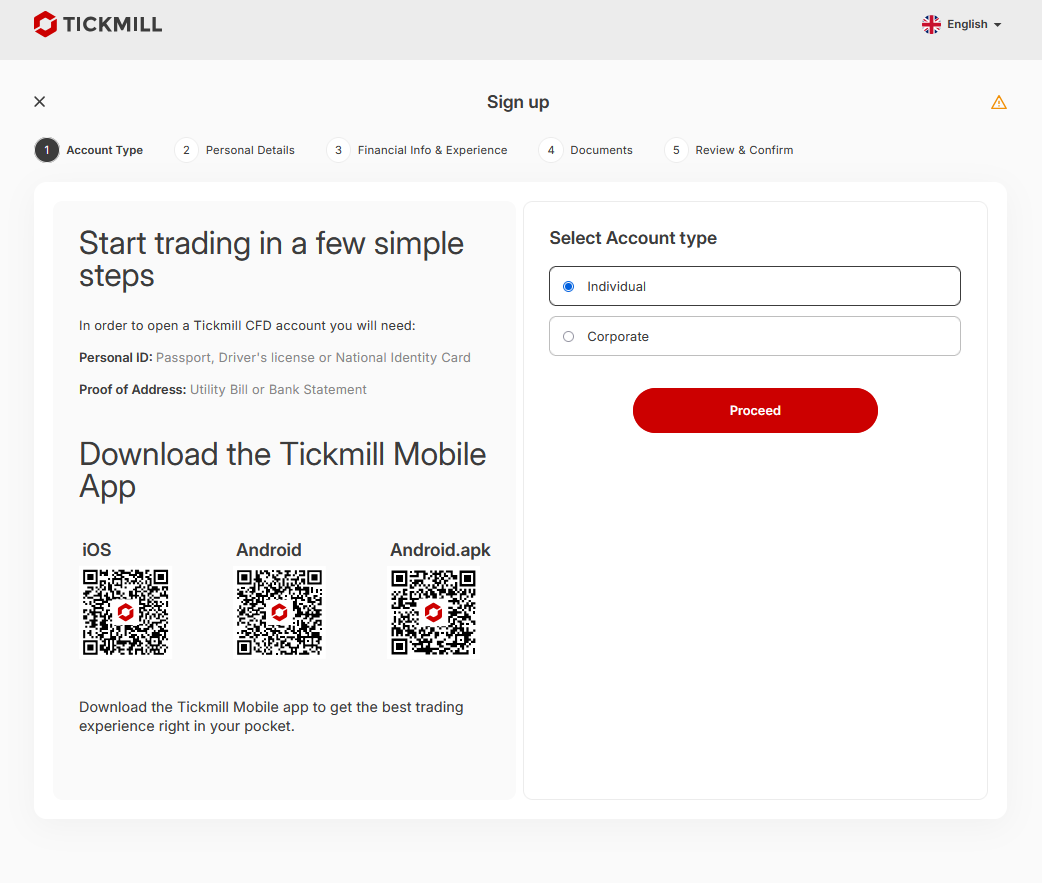

How to Open Your Account

Opening an account with Tickmill is a simple process that allows you to start trading or accessing financial services. By following a few easy steps, you can create your account and begin using the platform in no time.

Step #1: Visit the Tickmill Website

To get started, visit the official Tickmill website and click on the “Open Account” button. You’ll be directed to a registration page where you’ll need to provide your personal information.

Step #2: Complete the Registration Form

Fill out the required registration form with accurate details like your name, email, and phone number. Ensure that all information is correct to avoid delays in processing your account.

Step #3: Verify Your Identity

After completing the registration, you will need to verify your identity. This involves submitting a government-issued ID or passport and proof of address, such as a utility bill.

Step #4: Fund Your Account

Once your account is verified, you can fund it by choosing from various payment methods provided by Tickmill. Select the method most convenient for you and deposit the desired amount.

Step #5: Start Trading

With your account funded, you’re all set to begin trading. Log in to your Tickmill account and access the tools and resources available to start your trading journey.

Tickmill Trading Platforms

Traders using Tickmill have access to the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are known for their reliability, fast execution, and advanced charting tools, making them suitable for both beginners and experienced traders. Many appreciate the customizable features, allowing them to set up indicators, scripts, and expert advisors for automated trading.

One of the biggest advantages of Tickmill’s trading platforms is their stability and low latency. Traders report smooth order execution with minimal slippage, especially during high-volatility market conditions. The availability of a VPS service further enhances performance, ensuring uninterrupted trading for those using automated strategies.

For traders on the go, Tickmill offers mobile and web versions of MT4 and MT5. The platforms maintain full functionality, allowing users to analyze charts, place trades, and manage positions from anywhere. This flexibility is a key reason why many traders continue to choose Tickmill for their trading needs.

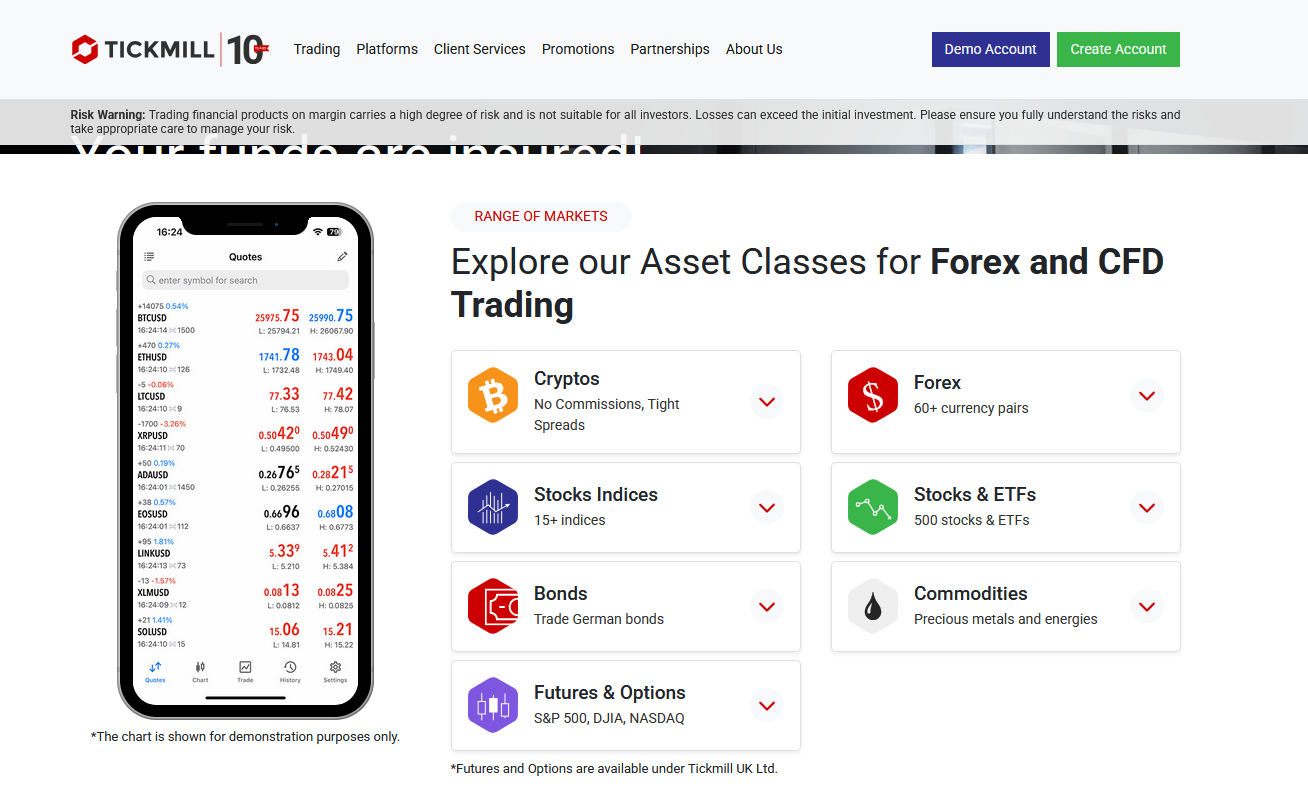

What Can You Trade on Tickmill

Tickmill offers a wide range of trading instruments for both new and experienced traders. With its user-friendly platform, Tickmill provides access to financial markets, allowing traders to buy and sell a variety of assets. From Forex to commodities, Tickmill gives opportunities for diverse trading strategies.

Forex

Forex trading on Tickmill allows individuals to trade global currencies in the foreign exchange market. It is one of the most popular types of trading, where traders speculate on currency pairs’ price fluctuations, aiming to profit from market movements.

Futures

Tickmill also offers direct access to futures trading through major global exchanges such as CME, NYMEX, and EUREX. Futures contracts cover a wide range of asset classes, including indices, commodities, and currencies. With professional-grade platforms like CQG and AgenaTrader, traders can take advantage of advanced tools and fast execution, making it a powerful option for those seeking to trade standardized contracts in highly liquid markets.

Commodities

Tickmill also enables traders to engage in commodities trading, such as gold, oil, and agricultural products. These assets are traded on the platform through CFDs (Contracts for Difference), allowing traders to profit from both rising and falling prices.

Indices

Indices trading on Tickmill involves buying and selling stock market indices, which represent a group of stocks. Traders can speculate on the performance of an entire market or sector, allowing for more diversified trading strategies.

Stocks

With Tickmill, traders can buy and sell individual stocks of global companies. Stock trading allows individuals to invest in well-known corporations, benefiting from price movements based on company performance and market trends.

Cryptocurrencies

Tickmill provides access to cryptocurrency trading, enabling users to trade popular digital currencies like Bitcoin and Ethereum. This form of trading is highly volatile and allows traders to potentially profit from significant price swings in the cryptocurrency market.

Tickmill Customer Support

Traders generally find Tickmill’s customer support to be responsive and professional. The support team is available via live chat, email, and phone, providing quick assistance for account-related issues, technical difficulties, and trading inquiries. Many traders appreciate the multilingual support, which helps cater to a global client base.

One of the standout aspects of Tickmill’s support service is its efficiency. Most queries are resolved within a short time, especially through live chat, where traders report getting answers within minutes. Email responses are also relatively fast, typically within 24 hours, making it convenient for non-urgent concerns.

While customer support is well-rated, some traders believe there is room for improvement in educational resources and trading guides. However, the overall experience remains positive, with many traders valuing Tickmill’s reliability and commitment to assisting its clients.

Advantages and Disadvantages of Tickmill Customer Support

Withdrawal Options and Fees

When using trading platforms like Tickmill, it is important for traders to understand the different withdrawal options available and any associated fees. Each method comes with its own processing time and cost structure, which can affect the overall trading experience. By choosing the most suitable withdrawal option, traders can ensure efficient and cost-effective access to their funds.

Bank Transfer

Bank transfers are a common withdrawal method that allows traders to transfer their funds directly to their bank accounts. However, this method may involve higher fees and take several business days to process, depending on the bank and country.

E-wallets

E-wallets, such as Skrill or Neteller, offer a quicker and often cheaper alternative to traditional bank transfers. They typically allow traders to access their funds almost immediately, but some platforms may charge a small fee for this convenience.

Credit/Debit Cards

Withdrawing funds to a credit or debit card is another option that is commonly available. This method is usually faster than a bank transfer, but like bank transfers, there may be fees involved depending on the card provider and the platform.

Cryptocurrencies

For those who prefer digital currencies, withdrawing funds to a cryptocurrency wallet is an option. This method can be fast and have minimal fees, but it also depends on the blockchain’s transaction speed and any additional network charges.

Tickmill Vs Other Brokers

#1. Tickmill vs AvaTrade

Tickmill and AvaTrade are both popular online brokers with distinct features. Tickmill is known for offering low spreads and high leverage, making it appealing to active traders and scalpers. Its focus is on providing fast execution and low-cost trading in forex, commodities, and indices. AvaTrade, on the other hand, offers a wider range of instruments, including options and cryptocurrencies, and provides a broader selection of trading platforms, such as MetaTrader 4, MetaTrader 5, and its proprietary AvaTradeGo app. AvaTrade also offers more robust educational resources, making it suitable for beginner traders.

Verdict: Tickmill is better suited for experienced traders looking for low-cost, high-leverage trading, while AvaTrade is ideal for those seeking a wider range of assets and platforms with strong educational support.

#2. Tickmill vs RoboForex

Tickmill and RoboForex are both popular online forex and CFD brokers, each offering a range of trading platforms and account types. Tickmill is known for its competitive spreads and low commissions, making it appealing to active traders and those focused on scalping. It offers the MetaTrader 4 and MetaTrader 5 platforms, along with an advanced trading experience. RoboForex, on the other hand, has a broader selection of account types, including cent accounts, and offers more flexibility in trading conditions, catering to both beginners and experienced traders. It also provides more platform options, such as MetaTrader, cTrader, and R Trader, and features a higher leverage offering compared to Tickmill.

Verdict: Tickmill is more suited for experienced traders looking for low spreads and commissions, while RoboForex is a better choice for traders who value flexibility in account types and platforms, with more options for leverage.

#3. Tickmill vs Exness

Tickmill and Exness are both prominent forex brokers with their own strengths. Tickmill is well-known for its low spreads and commissions, catering to traders who prioritize cost-efficiency, especially in ECN accounts. Exness, on the other hand, offers a wider range of account types, including those with high leverage options, appealing to traders who need flexible margin levels. While Exness provides 24/7 customer support and a large number of trading instruments, Tickmill tends to focus more on forex and is renowned for its solid regulatory compliance and transparent pricing model.

Verdict: If you prioritize low spreads and commission-based pricing, Tickmill is a solid choice. However, if you need high leverage and a broader selection of assets, Exness may better suit your trading needs.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: Tickmill Review

Overall, traders find Tickmill to be a reliable and cost-effective broker with competitive spreads, low fees, and fast execution. The availability of multiple account types makes it suitable for different trading strategies, from scalping to long-term investing. Many traders also appreciate the transparent pricing and smooth withdrawal process, which adds to the broker’s credibility.

The trading platforms, including MetaTrader 4 and MetaTrader 5, are well-received for their stability and advanced features. Traders benefit from a seamless trading experience, whether they use automated strategies or prefer manual trading. Additionally, Tickmill’s VPS service and mobile trading options provide flexibility for those who need uninterrupted access to the markets.

Customer support is another strong point, with quick response times and multilingual assistance. While some traders feel that educational resources could be improved, Tickmill remains a top choice for those looking for a trustworthy broker with low trading costs and efficient service.

Tickmill Review: FAQs

What is the minimum deposit for Tickmill?

The minimum deposit for Tickmill is $100, making it accessible for traders of all levels.

Does Tickmill charge withdrawal fees?

No, Tickmill does not charge withdrawal fees for most payment methods, but some banks or payment providers may apply their own charges.

Is Tickmill a regulated broker?

Yes, Tickmill is regulated by multiple financial authorities, including the FCA, CySEC, and FSA, ensuring a secure trading environment.

OPEN AN ACCOUNT NOW WITH TICKMILL AND GET YOUR BONUS