ThinkMarkets Review

ThinkMarkets is a global online trading platform that offers access to various financial markets, including forex trading, commodities, indices, and stocks. The platform is designed to cater to both beginner and advanced traders, providing intuitive trading tools and user-friendly interfaces to simplify market participation.

One of the key features of ThinkMarkets is its competitive trading conditions, with tight spreads, low fees, and fast execution speeds. The platform supports advanced trading software like MetaTrader 4, MetaTrader 5, and its proprietary ThinkTrader, which offers robust analytical tools and mobile-friendly functionality.

ThinkMarkets emphasizes security and reliability, operating under the regulation of multiple global authorities. It also provides extensive educational resources and 24/7 customer support, making it a well-rounded option for traders seeking a secure and efficient trading experience.

What is ThinkMarkets?

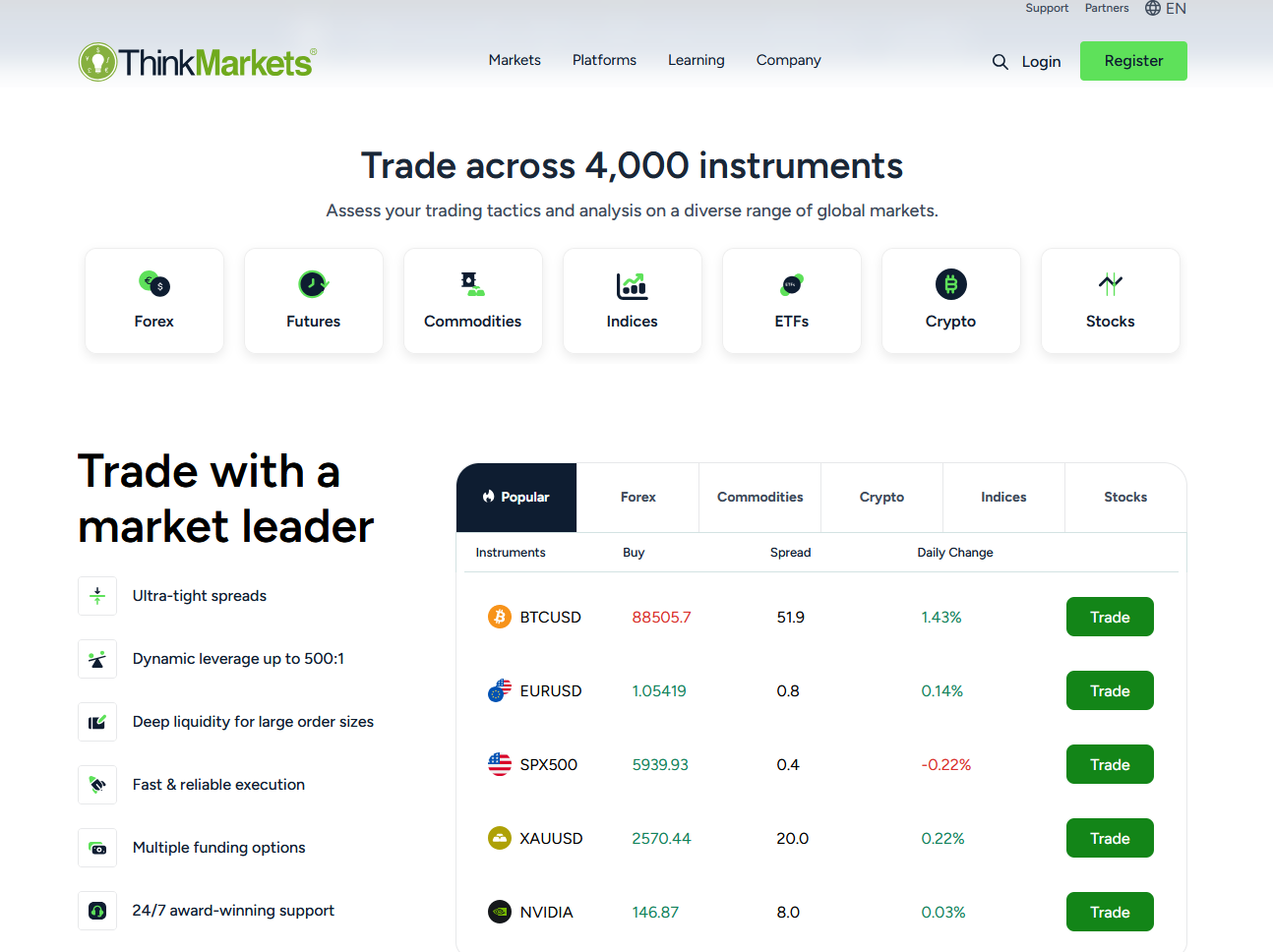

ThinkMarkets is a global online brokerage firm established in 2010, offering trading services across various financial markets, including forex, commodities, indices, stocks, cryptocurrencies, ETFs, and futures. The company provides access to over 4,000 instruments, catering to both novice and experienced traders.

Utilizing advanced trading platforms such as MetaTrader 4, MetaTrader 5, and their proprietary ThinkTrader, ThinkMarkets ensures efficient trade execution and comprehensive analytical tools. The firm emphasizes client security by adhering to international regulatory standards and employing robust encryption technologies.

In addition to trading services, ThinkMarkets offers educational resources, including webinars, articles, and tutorials, to help clients enhance their trading knowledge and skills. With a commitment to customer support, the company provides assistance through multiple channels, ensuring traders receive timely and effective help.

ThinkMarkets Regulation and Safety

ThinkMarkets operates as a globally recognized broker, holding licenses from multiple regulatory authorities. ThinkMarkets is regulated in multiple countries. TF Global Markets (UK) Limited is authorised and regulated by the Financial Conduct Authority (FCA),the Financial Services Authority and Investments Commission (ASIC). This regulatory oversight ensures compliance with strict standards for transparency, financial integrity,client protection and superior trading conditions.

To enhance safety, ThinkMarkets implements measures like segregated accounts, keeping client funds separate from operational accounts. This approach minimizes risks in case of insolvency and helps ensure that traders’ funds remain secure. Additionally, the platform offers negative balance protection, preventing clients from losing more than their initial deposits during market volatility.

With these safeguards in place, ThinkMarkets provides a reliable trading environment for its users. Its global regulatory coverage and robust security features make it a trusted option for traders looking for a secure platform.

ThinkMarkets Pros and Cons

Pros

- Diverse instruments

- User-friendly

- Competitive spreads

- Educational resources

Cons

- Limited regulation

- Support delays

- Withdrawal issues

- Asset limitations

Benefits of Trading with ThinkMarkets

ThinkMarkets offers traders access to a wide range of financial instruments, including forex currency pairs, commodities, indices, and stocks, allowing for diversified investment opportunities and trading portfolio. The platform provides competitive trading conditions with tight spreads and high leverage options, enhancing potential profitability.

Utilizing advanced trading platforms like ThinkTrader and MetaTrader 4/5, ThinkMarkets ensures efficient trade execution and comprehensive analytical tools to support informed decision-making. The user-friendly interface caters to both novice and experienced traders, facilitating a seamless trading experience.

Committed to client security, ThinkMarkets operates under stringent regulatory frameworks, offering negative balance protection and segregated client funds to safeguard investments. Additionally, the platform provides educational resources and responsive support team to assist traders in navigating the financial markets effectively.

ThinkMarkets Customer Reviews

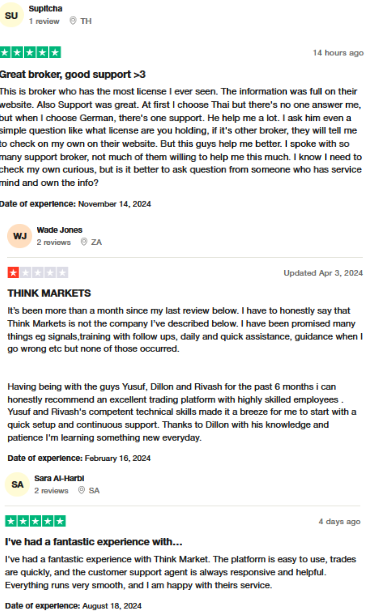

ThinkMarkets has garnered a strong positive review among traders, with many praising its user-friendly platforms and diverse range of financial instruments. Clients often highlight the broker’s competitive spreads and efficient trade execution, which contribute to a seamless trading experience.

Customer support is frequently commended for its responsiveness and professionalism, providing timely assistance to users. Additionally, ThinkMarkets offers a variety of educational resources, aiding both novice and experienced traders in enhancing their market knowledge.

While the majority of feedback is positive, some users have noted occasional delays in withdrawal processing. However, ThinkMarkets continues to address these concerns, striving to improve its services and maintain client satisfaction.

ThinkMarkets Spreads, Fees, and Commissions

ThinkMarkets offers competitive spreads and transparent fees designed to cater to various trading needs. Spreads for major currency pairs, such as EUR/USD, start from 0.0 pips on the ThinkZero account, which is ideal for traders seeking tight pricing. Standard account holders experience slightly higher spreads but benefit from a commission-free trading structure.

For traders using the ThinkZero account, ThinkMarkets applies a commission of $3.50 per side per standard lot, providing cost-effective trading for those who prioritize lower spreads. Swap fees are also charged for positions held overnight, with rates varying depending on the instrument and market conditions.

ThinkMarkets does not impose deposit or withdrawal fees, but third-party providers may apply their own charges. This transparent structure, combined with competitive pricing, makes ThinkMarkets a suitable option for both beginners and experienced traders.

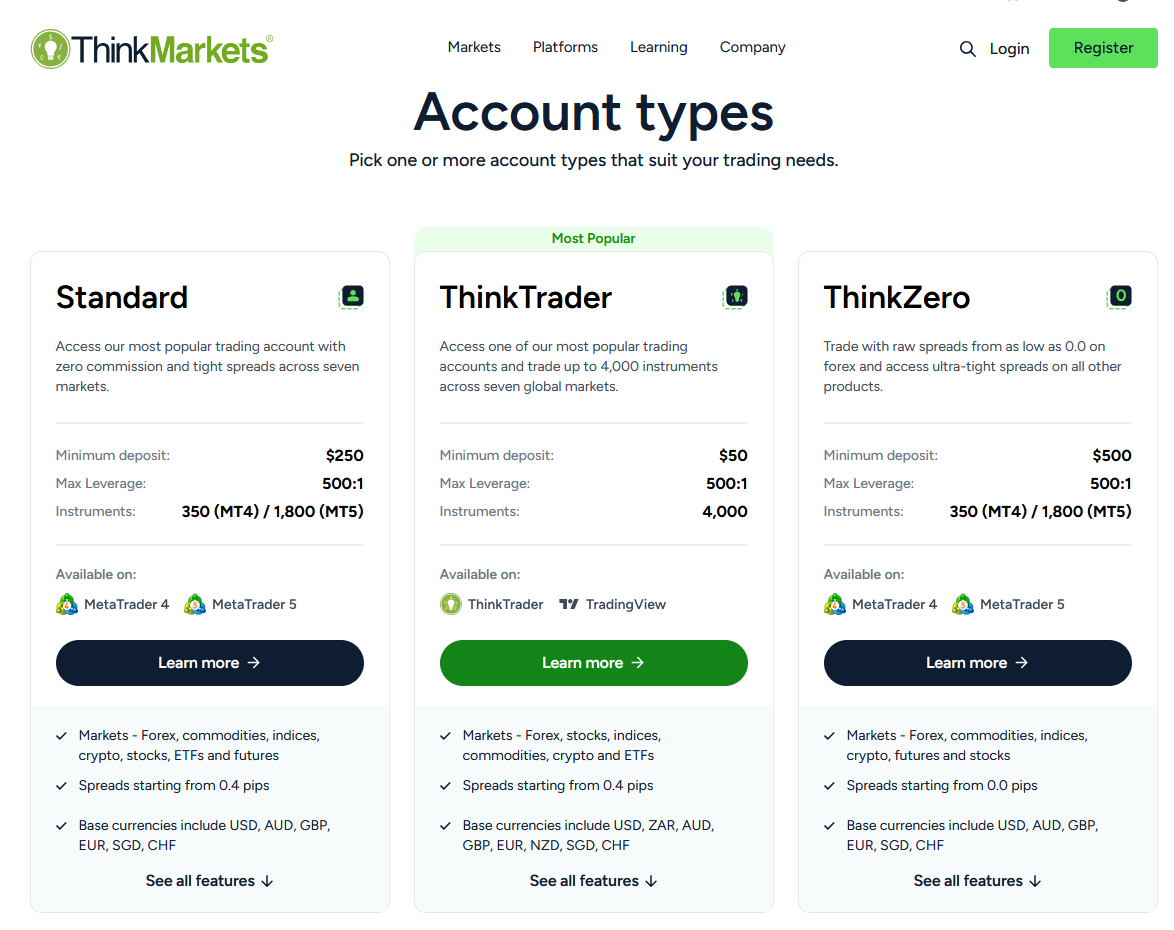

Account Types

ThinkMarkets provides various trading account types to meet the diverse needs of traders, offering options that cater to both beginners and professionals. Each ThinkMarkets account type offers unique features in terms of spreads, commissions, and minimum deposit requirements, giving users flexibility based on their trading experience and strategy.

ThinkTrader Account

The ThinkTrader Account is ideal for beginners, offering zero commission with competitive floating spreads. With a low minimum deposit requirement, it allows traders to start with a smaller capital while accessing all core features on the platform.

Standard Account

The Standard Account is tailored for experienced traders, featuring tighter spreads starting from 0.1 pips and a small commission per lot. This account type is designed to provide enhanced pricing and execution quality for high-volume or professional traders.

ThinkZero Account

The VIP Account is best suited for high-net-worth individuals or institutional traders, offering the tightest spreads and a dedicated account manager. This premium account requires a higher minimum deposit and provides exclusive access to advanced tools and priority customer support.

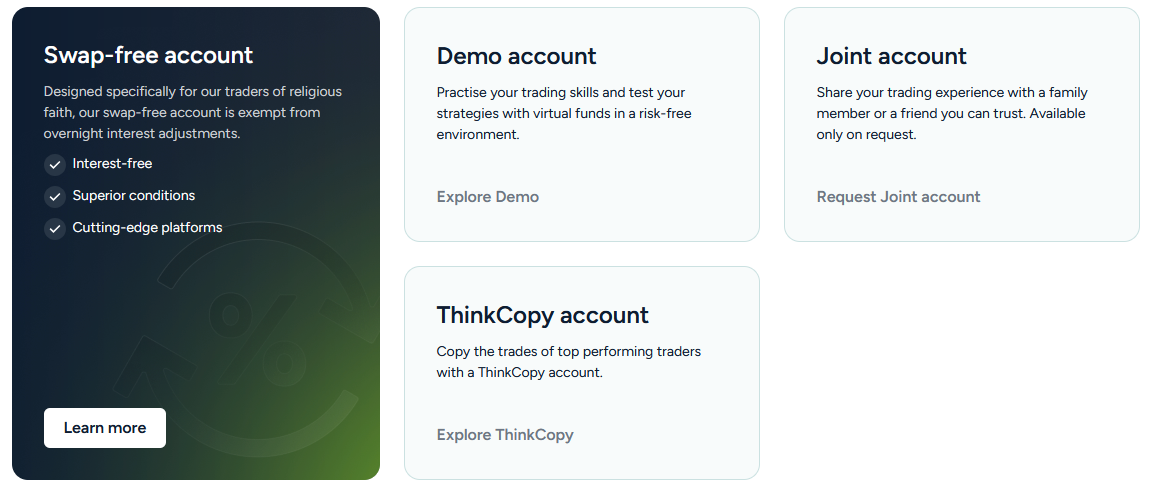

ThinkMarkets offers Islamic trading accounts, also known as swap-free accounts, designed to comply with Sharia law by eliminating interest charges on overnight positions. Also, they offer retail investor accounts, providing individual traders with access to a wide range of financial instruments, including forex, commodities, indices, and stocks.

How to Open Your Account

Opening an account with ThinkMarkets is a straightforward process designed to get traders started quickly. By following a series of simple steps, individuals can set up their trading accounts and begin accessing a wide range of trading instruments.

Step 1: Registration

Visit the ThinkMarkets official website and click on the “Create Account” button. Provide the required personal information, including your country of residence, email address, and a secure password. Ensure that all details are accurate to facilitate a smooth registration process.

Step 2: Account Verification

After registration, verify your email address by clicking on the link sent to your inbox. Next, complete your profile by providing additional personal information, such as your full name, date of birth, and contact number. This step is crucial for account security and compliance with regulatory requirements.

Step 3: Document Submission

Upload the necessary identification documents to verify your identity and address. Acceptable forms of ID include a valid passport, driver’s license, or national ID card. For proof of residence, submit a recent utility bill or bank statement. Ensure that the documents are clear and up-to-date to expedite the verification process.

Step 4: Account Funding

Once your account is verified, log in to your ThinkMarkets portal and navigate to the “Deposit Funds” section. Choose your preferred funding method, such as bank transfer, credit/debit card, or electronic payment systems. Follow the on-screen instructions to complete the deposit, keeping in mind any minimum deposit requirements associated with your chosen account type.

Step 5: Start Trading

With funds in your account, download the ThinkMarkets trading platform of your choice, such as MetaTrader 4, MetaTrader 5, or the proprietary ThinkTrader platform. Log in using your account credentials and begin exploring the available financial instruments. Before initiating live trades, consider utilizing the demo account feature to familiarize yourself with the platform’s functionalities and refine your trading strategies.

By following these steps, traders can efficiently set up their accounts with ThinkMarkets and embark on their trading journey with confidence.

ThinkMarkets Trading Platforms

ThinkMarkets offers three trading platforms to accommodate different trader preferences and needs. Their proprietary platform, ThinkTrader, is designed for both web and mobile use, providing an intuitive interface with advanced charting tools and real-time price alerts. This platform supports trading across multiple asset classes, including forex, commodities, indices, and stocks.

For traders who prefer established platforms, ThinkMarkets supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5). MT4 is renowned for its user-friendly interface and robust analytical tools, making it a popular choice among forex traders. MT5 offers additional features, such as more timeframes and advanced order types, catering to those seeking enhanced trading capabilities.

Additionally, ThinkMarkets integrates with TradingView, a platform known for its powerful charting and social trading features. This integration allows traders to execute trades directly from TradingView charts, combining advanced analysis with seamless execution. By offering these diverse platforms, ThinkMarkets ensures that traders can select the environment that best suits their trading style and preferences.

What Can You Trade on ThinkMarkets

ThinkMarkets offers traders access to a diverse array of financial instruments, enabling portfolio diversification and exposure to various global markets. This comprehensive selection caters to both novice and experienced traders, providing opportunities across multiple asset classes.

Forex

Foreign exchange trading, or forex, involves the buying and selling of currency pairs. ThinkMarkets provides access to over 46 currency pairs, including majors, minors, and exotics, allowing traders to speculate on global currency movements.

Commodities

Commodities trading includes assets like gold, silver, oil, and agricultural products. Through ThinkMarkets, traders can engage in commodities trading via Contracts for Difference (CFD trading), enabling speculation on price movements without owning the physical assets.

Indices

Indices represent the performance of a group of stocks from a specific market or sector. ThinkMarkets offers CFDs on major global indices such as the S&P 500, NASDAQ, and FTSE 100, allowing traders to gain exposure to broader market movements.

Stocks

Stock trading involves buying and selling shares of individual companies. ThinkMarkets provides access to over 1,500 share CFDs from various global markets, enabling traders to speculate on individual company performance without owning the actual shares.

Cryptocurrencies

Cryptocurrency trading allows speculation on digital currencies like Bitcoin, Ethereum, and Litecoin. ThinkMarkets offers CFDs on multiple cryptocurrencies, providing opportunities to trade these volatile assets without the need for a digital wallet.

Futures

Futures contracts are agreements to buy or sell an asset at a predetermined price at a specified time in the future. ThinkMarkets enables trading on futures price movements through CFDs, covering various commodities and indices, allowing traders to hedge or speculate on future price changes.

By offering this extensive range of tradable instruments, ThinkMarkets caters to diverse trading strategies and preferences, supporting traders in achieving their financial objectives.

Thinkmarkets Customer Support

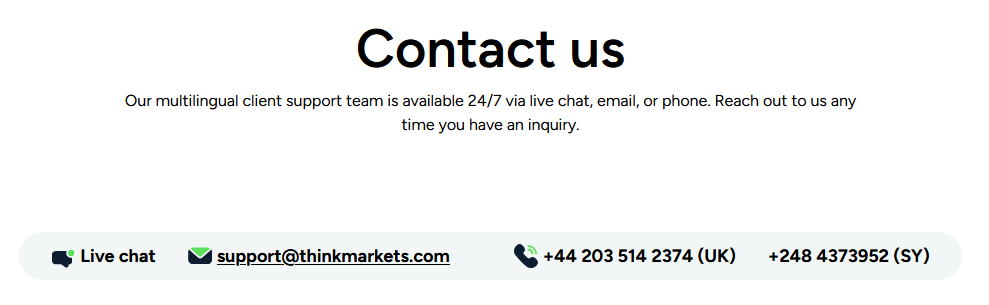

ThinkMarkets offers 24/7 customer support team through live chat, email, and phone, ensuring clients can access assistance at any time. Their multilingual team is equipped to handle inquiries from a diverse global clientele, providing prompt and effective solutions.

Clients can reach out via live chat for immediate responses, or send detailed queries to support@thinkmarkets.com. For those preferring direct communication, ThinkMarkets provides phone support with dedicated lines for various regions.

In addition to direct support channels, ThinkMarkets team maintains a comprehensive Support Center and trading operations on their website. This resource addresses common questions and offers guidance on account management, trading platforms, and funding options, empowering clients to find answers independently just like the other forex broker in the financial industry.

Advantages and Disadvantages of ThinkMarkets Customer Support

Withdrawal Options and Fees

ThinkMarkets offers a variety of withdrawal options designed for flexibility and convenience, with most transactions processed efficiently. While ThinkMarkets does not typically charge withdrawal fees, certain methods may incur third-party costs.

Bank Wire Transfer

Clients can withdraw funds directly to their bank accounts via wire transfer, with processing times ranging from 1 to 7 business days. ThinkMarkets does not charge for this service, but intermediary banks may apply their own fees.

Credit/Debit Cards

Withdrawals can be processed back to the original credit or debit card used for deposits, typically within 1 to 7 business days. ThinkMarkets follows a “return to source” policy, ensuring funds are sent back to the same card.

E-Wallets

Options like Skrill and Neteller offer a swift alternative, with transactions usually completed within 24 hours. While ThinkMarkets does not impose fees, some e-wallet providers may charge for their services.

Cryptocurrencies

ThinkMarkets also allows withdrawals via USDT using TRC20 and ERC20 networks, providing a modern option for digital currency users. Processing times and potential fees depend on blockchain network conditions.

ThinkMarkets maintains a “return to source” policy, processing withdrawals back to the original method of deposit. While the broker strives for prompt processing, actual times may vary based on the withdrawal method and external processing requirements.

ThinkMarkets Vs Other Brokers

#1. ThinkMarkets vs AvaTrade

ThinkMarkets and AvaTrade are both reputable brokers offering a range of financial instruments, including forex, commodities, indices, and stocks. ThinkMarkets provides access to over 3,500 assets, featuring competitive spreads and the choice between the proprietary ThinkTrader platform and MetaTrader 4 and 5. AvaTrade, established in 2006, offers a diverse selection of over 1,250 instruments, including forex, CFDs, and options, with access to platforms like MetaTrader 4 and 5, AvaTradeGO, and AvaOptions. Both brokers are regulated by multiple authorities, ensuring a secure trading environment.

Verdict: AvaTrade stands out for its extensive range of trading platforms and instruments, making it a strong choice for traders seeking variety and advanced tools. ThinkMarkets appeals to those who prioritize a broad asset selection and the flexibility of multiple platform options.

#2. ThinkMarkets vs RoboForex

ThinkMarkets and RoboForex are both prominent online brokers offering a range of financial instruments, including forex, commodities, indices, and stocks. ThinkMarkets is regulated by top-tier authorities such as the UK Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC), providing a high level of investor protection. In contrast, RoboForex operates under the International Financial Services Commission (IFSC) of Belize, which offers a lower degree of regulatory oversight. ThinkMarkets utilizes the proprietary ThinkTrader platform alongside MetaTrader 4 and 5, catering to various trading preferences, while RoboForex supports MetaTrader 4, 5, and cTrader, appealing to traders seeking platform diversity. Regarding trading conditions, RoboForex offers higher leverage options, up to 1:2000, compared to ThinkMarkets‘ maximum of 1:500, which may attract traders with a higher risk appetite. However, ThinkMarkets provides a more robust regulatory framework and a proprietary trading platform, which may be preferable for traders prioritizing security and platform innovation.

Verdict: For traders who prioritize stringent regulatory oversight and a proprietary trading platform, ThinkMarkets is the more suitable choice. Conversely, those seeking higher leverage and a variety of trading platforms may find RoboForex more aligned with their trading strategies.

#3. ThinkMarkets vs Exness

ThinkMarkets and Exness are both reputable online brokers offering a range of financial instruments, including forex, commodities, indices, and stocks. ThinkMarkets, established in 2010, is regulated by top-tier authorities such as the FCA and ASIC, providing clients with access to the MetaTrader 4, MetaTrader 5, and ThinkTrader platforms. The broker offers competitive spreads, with the ThinkZero account featuring spreads from 0 pips and a commission of $3.5 per side. Exness, founded in 2008, is regulated by CySEC and other authorities, offering the MetaTrader 4 and MetaTrader 5 platforms. Exness provides a variety of account types, including Standard and Professional accounts, with spreads starting from 0.3 pips and no commission on Standard accounts. Both brokers support multiple deposit and withdrawal methods, with ThinkMarkets offering a minimum deposit of $0 and Exness requiring a minimum deposit of $1.

Verdict: ThinkMarkets stands out for its robust regulatory oversight and diverse platform offerings, making it a strong choice for traders seeking a secure and versatile trading environment. Exness appeals to traders looking for low entry barriers and a variety of account options, though its regulatory framework is less stringent compared to ThinkMarkets.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH THINKMARKETS

Conclusion: ThinkMarkets Review

In conclusion, ThinkMarkets is a trading platform that offers a variety of financial instruments, making it suitable for both beginners and experienced traders. The platform provides access to competitive spreads, user-friendly tools, and a secure trading environment, attracting those who value efficiency and safety.

ThinkMarkets also stands out for its regulatory compliance, which provides a layer of investor protection not always available with other brokers. While some may find the range of assets narrower than alternatives, ThinkMarkets delivers a solid experience with essential tools and responsive customer support. Overall, it is a dependable option for traders seeking a balanced and secure trading experience.

ThinkMarkets Review: FAQs

What is ThinkMarkets?

ThinkMarkets is an online brokerage offering trading in forex, commodities, indices, and cryptocurrencies.

What trading platforms does ThinkMarkets offer?

ThinkMarkets provides ThinkTrader and MetaTrader 4/5 to cater to various trading preferences.

What account types are available?

Clients can choose between the Standard and ThinkZero accounts, each with different spreads and commission structures.

OPEN AN ACCOUNT NOW WITH THINKMARKETS AND GET YOUR BONUS