Trading theta option contracts are a way for option traders to make a profit off of expiring options contracts that they own. They can also be used as a hedge against anticipated losses in the financial markets.

Also Read: How To Use Pocket Options

Contents

- What is an options contract?

- What is options trading?

- Options Contracts: Intrinsic Value

- Option Contracts: Extrinsic Value

- The Greeks

- What is Theta Decay?

- Profitability of Option Contracts

- Strategies for Trading Theta Options

- Conclusion

- FAQs

What is an options contract?

Option buyers, also referred to as owners and holders, purchase options contracts so that they can have the right, but not the obligation, to purchase the contract’s underlying stock. The right to buy the underlying stock expires on the contract expiry date. Option sellers are obligated to sell the underlying stocks to the option buyers if the option buyers exercise their contract rights. The premium paid by the option buyer is the option price.

What is options trading?

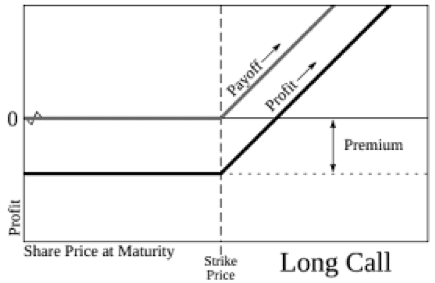

Options trading involves the writing, buying, and selling of options contracts. Traders can profit from going long on calls, long on puts, shorting calls, and shorting puts. Moreover, as the value of an options contract’s premium declines, the owner of the options contract may trade the contract for another with a later expiration date or hold it and offset the potential loss against the profits earned from other options contracts.

Trading theta options contracts, the options contracts with declining premium values that are approaching their expiry dates, is a way for traders to profit from options contracts that are near their expiration dates.

Options Contracts: Intrinsic Value

The intrinsic valuation of an option contract is the difference between the strike price and the stock’s current price. The option’s premium, the option contract’s purchase price, is determined by a number of factors including the value of the underlying asset, contract expiration date, reports released by the underlying asset’s company, etc.

Option Contracts: Extrinsic Value

The extrinsic value is also referred to as the “time value,” “time premium,” and “time decay” of an option contract. It is the value of the contract that has not been included in the contract’s intrinsic valuation. Basically, it is the difference between the option contract’s strike price and intrinsic value. The extrinsic valuation is affected by political, social, and economic events that may affect the value of the options contract’s underlying asset.

The extrinsic valuation is the value that decays from the time the contract is written to its expiration date. When the contract matures (i.e., expires) the extrinsic value of the contract is zero.

With the passage of time, the option contract’s value to the buyer decreases. As the value decreases for the buyer, it increases for the seller. Thus, if the contract expires without being exercised, the option seller gets 100% of the premium paid, the option’s extrinsic value, and the option buyer loses all the money paid for the right to buy the underlying asset.

Extrinsic Value Example

An overly simplified example of extrinsic valuation is the decrease in value of a monthly car insurance policy payment over time. Every month, the car owner is required to pay a car insurance premium.

At the beginning of the month, the car owner pays the insurance policy premium. The car owner pays the insurance company $200, the car insurance policy premium. If the car owner doesn’t file a claim with the insurance company (that the insurance company must pay) the car owner loses the money paid to the insurance company, and the insurance company gains the entire monthly insurance premium. However, if the car owner files a claim with the insurance company (that the insurance company must pay), the insurance company doesn’t get the premium.

The Greeks

The loss in option contract value from the time of purchase to the expiration date of the option contract is affected by several variables. The variables, the Greeks, affect the rate of devaluation of the contract. They are sensitive to different aspects of the contract. It is their changing daily values that results in a non-linear rate of decline of the option contract over time.

The Greeks are Delta, Gamma, Vega, Theta, and Rho. The value of the Greeks are affected by the following contract-related factors:

- Delta measures the sensitivity of a $1 change in price of the underlying stock.

- Gamma measures the sensitivity of the options’ Delta in relation to a $1 change in the underlying stock.

- Vega tells how the option’s price theoretically changes for each 1 percentage point move in implied volatility.

- Theta is the rate at which the premium changes in value from day-to-day until expiration of the options contract.

Lesser Greeks

The major Greeks are the first-order derivatives. There are also second-order and third order derivatives that affect the theta value. Some second- and third-order derivatives are Lambda, Epsilon, Vomma, Vera, Speed, Zomma, Color, and Ultima.

The minor Greeks influence the values of the major Greeks (e.g., Delta, Vega). Increasingly, they are being incorporated into computer algorithms that compute and predict the probable values of the major Greeks and ultimately the theta value (i.e., rate of theta decay).

Analyzing Theta in Isolation

When looking at the theta value, all the other Greeks are assumed to be constant. If they are constant, then any change in the contract’s premium must be due to the changing theta value, also referred to as theta decay. Since theta decay is affected by the asset’s price volatility, price movement, and time decay, its value changes daily.

If the only factor that affects the theta value is the passage of time, then theta represents the option’s time decay rate as the option contract approaches maturity.

Also Read: How to Trade with Option Greeks

What is Theta Decay?

If all the other Greeks are held constant, except the theta value, theta decay will determine how fast the premium approaches zero. For a long call option, there is negative theta decay. For a short call option, there is positive theta decay. This means that for a short call option, as time passes, the value of the premium increases for the buyer and decreases for the seller.

Moreover, the theta values are very different for weekly versus monthly option contracts. Monthly options contracts have lower theta values than weekly options contracts. Finally, the rate of decay increases as the contract approaches its maturity date (i.e., expiration date).

Profitability of Option Contracts

An options contract can be described in three ways: in the money (ITM), at the money (ATM), and out of the money (OTM).

In the Money (ITM)

“In the money” means that the options contract’s underlying asset’s current price has moved in a price direction that is favorable to the option buyer. This means that the options buyer can earn a profit by exercising the contract rights.

At the Money (ATM)

“At the money” means that the underlying asset’s current price has barely moved in favor of the options contract buyer. If the option buyer exercises the contract, the buyer will realize very little profit from it.

Out of the Money (OTM)

“Out of the money” means that the underlying asset’s price has moved against the options buyer or is outside the contract’s price range. This means that if the options buyer exercises the contract, there will be a net loss.

Strategies for Trading Theta Options

There are many strategies for trading options. Trading theta options is an advanced trading strategy. The trader is trading expiring options with the goal of making enough profitable options trades that the losses from the unprofitable options trades can be absorbed by the profits and there still be a net profit.

Three strategies for trading theta options are listed here.

Strategy #1: Short OTM Vertical Spread

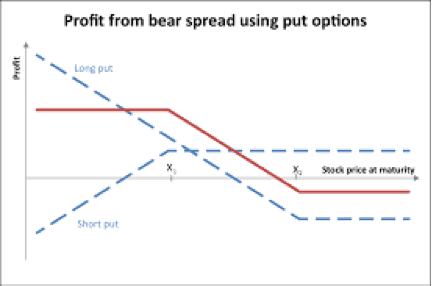

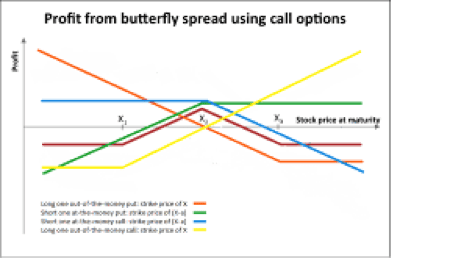

In the short OTM vertical spread, traders sell an option that is ATM or slightly OTM and buy an option that is further OTM.

A call vertical spread has two call options and a put vertical has two put options. Vertical spreads have directionless bias in the underlying asset. The short call vertical is bearish and the short put call is bullish.

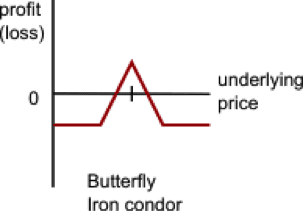

Strategy #2: Iron Condor

An iron condor has 4 theta options that expire on the same day, but have different strike prices. The four options are a long call, short call, long put, and short put. Traders profit the most from this strategy when the underlying asset has almost no price movement.

The strategy earns money when the underlying asset’s price closes at a strike price that is between the two middle strike prices. Maximum loss is limited to the price differences between the long call and short call, or the long put and short put.

It is a low risk trading strategy that also has limited profit potential. The long call and long put keep the strategy trend neutral. It is neither bullish nor bearish. Moreover, they protect the trader from sudden price increases and decreases.

Strategy #3: Calendar Spread

The calendar enables traders to profit from changes in the volatility of the underlying asset and time decay. In this strategy, the trader owns options in an underlying asset that are nearing their expiration date and buys options (with the same underlying asset) with a later expiration date. The options used for this strategy can be calls or puts, and they must all have the same strike price.

The trader makes money as the option nearing expiration rapidly declines in value, while the options with later expiration dates increase in value. This profit would be the result of anticipated time decay and the effect of theta decay on the option’s premium.

Traders can also profit from this strategy if the volatility of the option nearing its expiration date declines, or the volatility of the option with the later expiration increases. Basically, when the volatility of the underlying asset declines, the option declines in value. However, when the volatility of the underlying asset increases, the value of the option increases.

This strategy can lose money in at least 4 different ways. The trader must have a plan to exit this strategy for each instance in which it may become unprofitable.

Conclusion

Theta decay is the rate at which the extrinsic value of an options contract declines from the time it is purchased to its expiration date. There are different ways to trade theta options. The different strategies have different reward risk ratios.

The options contracts with the best reward risk ratios are more likely to produce profitable trades, but the profit will be less than trades with lower reward risk ratios. This makes sense because traders willing to take greater risks in the market should be rewarded for their risks when their trades are successful.

Theta options trading is not for novice or inexperienced traders. Traders must understand how theta is calculated and ho the Greeks that factor into it are likely to change over time. The values cannot be easily calculated or estimated. Thus, the traders must have some experience working with theta options and balancing winning and losing trades so that the net trading outcome is profit for the trader.

FAQs

What is theta decay?

Theta decay is the negative theta rate that is applied to the option contract’s premium. Over time, the options premium decreases at a non-linear rate until it is worth nothing on its expiration date.

What is the difference between extrinsic and intrinsic value?

Intrinsic value refers to the difference in value between the strike price and the current price of the underlying stock. Whereas, the extrinsic value of the options contract is the difference between the strike price and the intrinsic price.

Why do traders buy options contracts?

Traders buy options contracts because they want the right to buy the options contract’s underlying assets, but not be required to do so. Options contracts’ premiums are cheaper than purchasing the underlying asset. Also, options contracts can be sold before their expiration date or closed at any time before the contract reaches maturity (i.e., expires).