China’s stock market continues to thrive, fueled by an expanding economy and increased participation from domestic and international investors. In 2024, selecting the best stock brokers in China becomes essential for traders seeking low trading fees, reliable platforms, and compliance with the China Securities Regulatory Commission. With the rise of online trading platforms and growing interest from foreign investors, understanding the right choice is crucial for successful investments.

From day trading to forex trading, traders are looking for platforms offering advanced tools like technical indicators, real-time data, and fractional shares. Chinese traders and experienced investors prioritize trading costs, minimum deposit, and access to global markets like the New York Stock Exchange and London Stock Exchange. Reliable CFD brokers provide access to complex instruments, including currency pairs, exchange traded funds, and precious metals. Choosing platforms with competitive spreads, educational resources, and robust copy trading services ensures traders can start trading confidently while navigating risks like losing money rapidly.

Criteria for Selecting the Best Stock Brokers

When selecting the best stock brokers in China, investors must consider trading fees and commissions, as competitive pricing ensures cost-effective trading. The platform usability and tools also play a key role, especially for day trading and forex traders relying on advanced chart patterns and real-time data. Regulatory compliance, such as adherence to the China Securities Regulatory Commission (CSRC), guarantees a regulated broker that safeguards client funds.

A wide range of trading instruments, including stocks, CFDs, forex trading, and exchange-traded funds, is critical for experienced investors and retail investor accounts. Brokers must also offer robust customer support and educational resources for Chinese traders and international investors. Features like fractional shares, copy trading services, and smart portfolios enhance accessibility for active traders and foreign investors in mainland China and other countries.

The 5 Best Stock Brokers in China for 2024

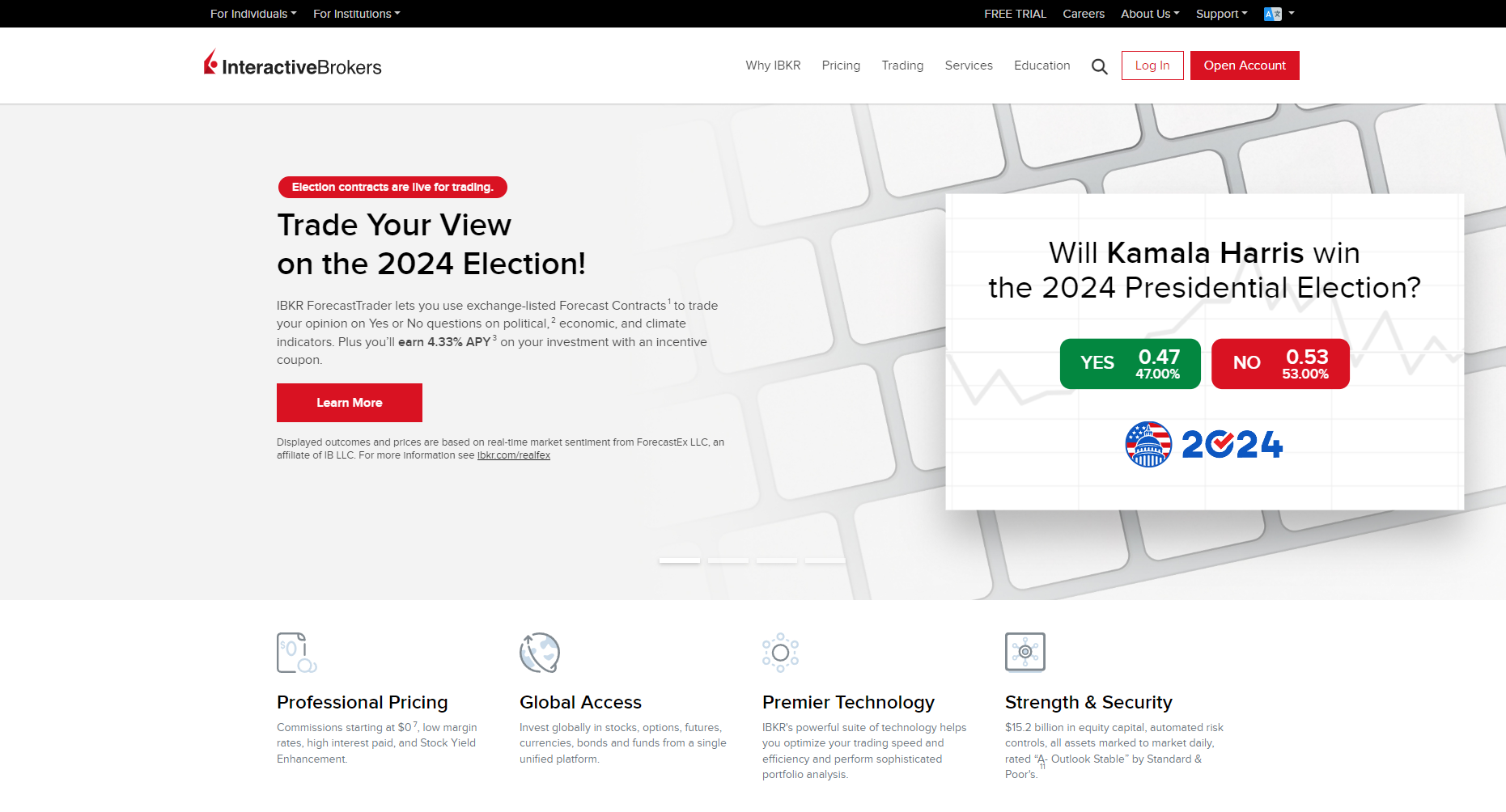

#1. Interactive Brokers

What is Interactive Brokers?

Interactive Brokers is a globally recognized brokerage firm offering access to a wide range of financial markets, including stocks, forex, and futures. Known for its advanced trading platforms, it caters to both professional traders and institutional investors. Interactive Brokers provides competitive pricing and extensive tools, making it a preferred choice for active traders. Its reach spans over 150 markets in more than 30 countries.

Advantages and Disadvantages of Interactive Brokers

Interactive Brokers Commissions and Fees

Interactive Brokers is known for its transparent and competitive commissions structure, charging low fees for trades across various asset classes. The platform follows a tiered pricing system that benefits high-volume traders. For U.S. stocks, commissions start as low as $0.005 per share, with no hidden markups. Interactive Brokers ensures cost efficiency while maintaining access to global markets.

OPEN AN ACCOUNT NOW WITH INTERACTIVE BROKERS AND GET YOUR WELCOME BONUS

#2. Fidelity

What is Fidelity?

Fidelity is a leading financial services provider offering investment solutions, wealth management, and retirement planning. Known for its robust research tools and user-friendly platforms, it caters to both beginners and seasoned investors. Fidelity’s vast selection of low-cost funds and comprehensive educational resources make it a go-to choice for long-term investing.

Advantages and Disadvantages of Fidelity

Fidelity Commissions and Fees

Fidelity offers a zero-commission structure on U.S. stocks, ETFs, and options, making it cost-effective for investors. Mutual fund fees are competitive, with many funds having no transaction fees. Options contracts carry a $0.65 per contract charge, which aligns with industry standards. Fidelity’s transparent pricing enhances its appeal for budget-conscious traders.

OPEN AN ACCOUNT NOW WITH FIDELITY AND GET YOUR WELCOME BONUS

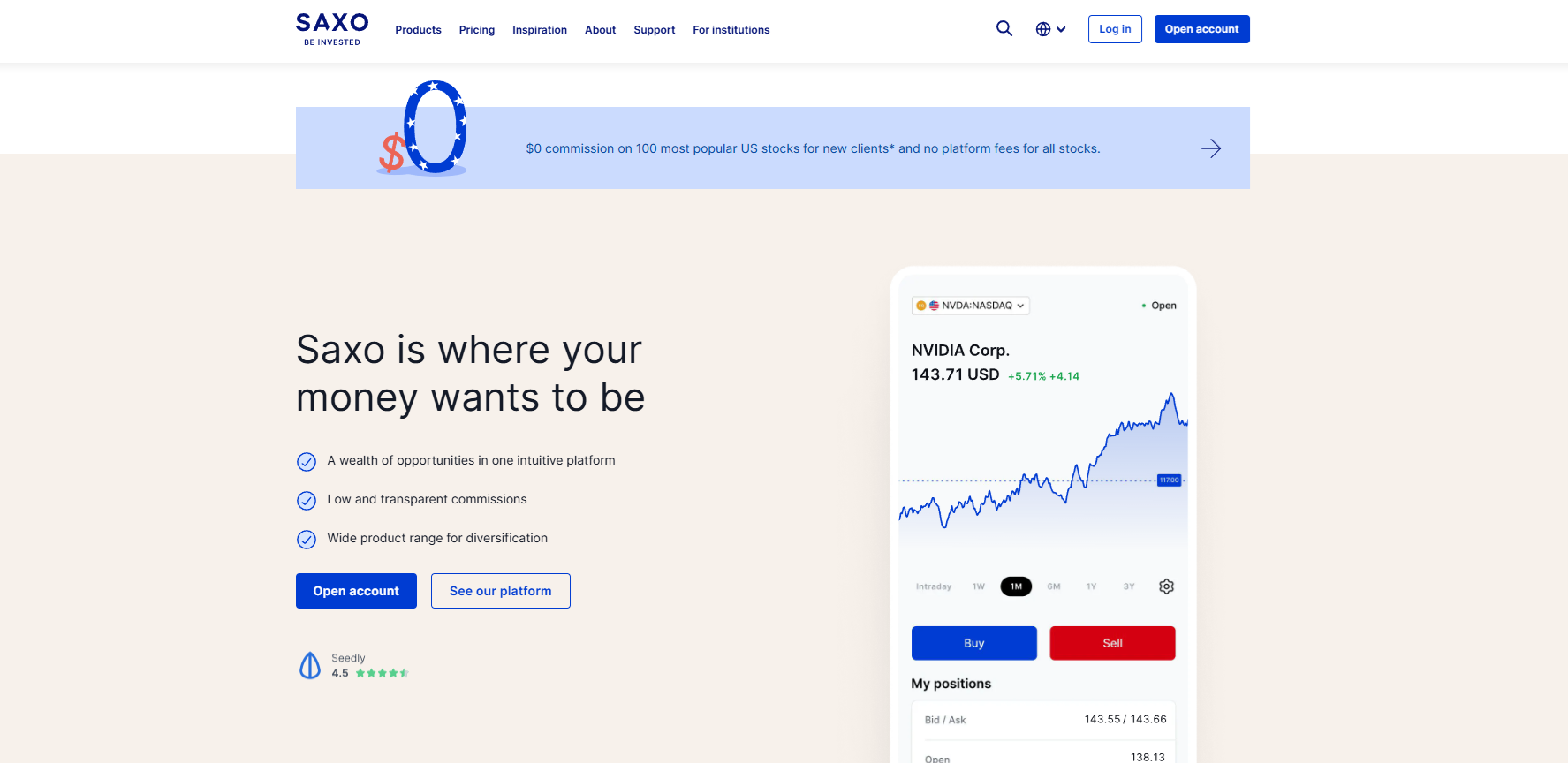

#3. Saxo Bank

What is Saxo Bank?

Saxo Bank is a leading global investment bank providing online trading and investment services across multiple asset classes. It is known for its advanced trading platforms, offering access to over 40,000 financial instruments, including forex, stocks, and derivatives. Saxo Bank caters to both retail and institutional clients, emphasizing transparency and technology-driven solutions. Its global reach and strong regulatory framework make it a preferred choice for professional traders.

Advantages and Disadvantages of Saxo Bank

Saxo Bank Commissions and Fees

Saxo Bank offers competitive commissions and fees but primarily caters to high-volume and professional traders. Trading costs vary based on account type, with tighter spreads and lower commissions for premium accounts. However, the bank imposes inactivity fees and a minimum deposit requirement, which may deter casual investors. Transparent pricing structures ensure clarity for experienced traders looking for advanced solutions.

OPEN AN ACCOUNT NOW WITH SAXO BANK AND GET YOUR WELCOME BONUS

#4. eToro

What is eToro?

eToro is a leading online trading platform known for its social trading features. It allows users to trade a wide range of assets, including stocks, forex, cryptocurrencies, and commodities. With its user-friendly interface and innovative tools, eToro has attracted millions of investors globally. The platform also supports copy trading, enabling beginners to replicate strategies from experienced traders.

Advantages and Disadvantages of eToro

eToro Commissions and Fees

eToro’s commissions and fees are competitive but come with notable charges. The platform offers commission-free trading on stocks but applies spreads on other assets like forex and cryptocurrencies. Users should also be aware of withdrawal fees and inactivity charges for dormant accounts. Despite these fees, eToro remains attractive due to its innovative trading features and global accessibility.

OPEN AN ACCOUNT NOW WITH ETORO AND GET YOUR WELCOME BONUS

#5. Charles Schwab

What is Charles Schwab?

Charles Schwab is a well-established online brokerage firm offering a wide range of investment options like stocks, ETFs, options, and mutual funds. Known for its robust trading platforms and advanced tools, it caters to both beginners and seasoned investors. It provides extensive educational resources to help users improve their trading knowledge.

Advantages and Disadvantages of Charles Schwab

Charles Schwab Commissions and Fees

Charles Schwab charges $0 commission on stocks, ETFs, and options, with a $0.65 fee per options contract. For mutual funds, transaction fees can go up to $49.99. While basic trades are commission-free, broker-assisted trades cost $25. Advanced traders may incur additional fees for margin trading, but the platform’s competitive structure still offers great value.

OPEN AN ACCOUNT NOW WITH CHARLES SCHWAB AND GET YOUR WELCOME BONUS

Why Choosing the Right Broker Matters

Choosing the right broker is essential for navigating the financial markets efficiently. A regulated forex broker ensures security for retail investor accounts, particularly in markets like mainland China, where the China Securities Regulatory Commission enforces strict rules. Investors can benefit from low trading fees, reduced trading costs, and access to diverse trading instruments, including exchange traded funds, currency pairs, and precious metals. With the rise of online trading platforms, brokers now offer advanced charting tools, real-time data, and analysis tools to assist forex traders and experienced investors.

A reliable broker caters to both active traders and foreign investors looking to sell stocks or engage in trading CFDs on major exchanges like the New York Stock Exchange or London Stock Exchange. Additionally, features like copy trading services, demo accounts, and educational resources help chinese traders start trading with confidence. Brokers with tight spreads, low minimum deposits, and smart portfolios attract international investors seeking competitive advantages in asian markets such as Hong Kong. By offering efficient tools and addressing high leverage risks, the right broker enhances performance in day trading and spread bets while ensuring client funds are protected.

Also Read: The 5 Best Crypto Brokers in China in 2024: Smart Trading

Conclusion

When selecting from the best stock brokers in China, it is crucial to align choices with your trading goals and experience. Brokers offering low trading fees, access to global markets like the York Stock Exchange and London Stock Exchange, and advanced trading platforms in China cater to both forex traders and retail investor accounts. Top brokers provide real-time data, technical indicators, and educational resources to empower informed decisions.

To make the most of the financial markets, consider factors like trading costs, available trading instruments, and access to copy trading services or fractional shares. Whether trading CFDs, currency pairs, or exchange-traded funds, evaluating trading hours, mobile devices compatibility, and support for day trading is essential. Chinese traders and international investors alike should focus on regulated brokers overseen by the China Securities Regulatory Commission to ensure client funds protection.

FAQs

What is the best stock broker in China for low fees?

eToro offers competitive fees and is ideal for cost-conscious traders.

Which stock broker in China is best for beginners?

Interactive Brokers provides user-friendly platforms and educational tools for new investors.

Are stock brokers in China regulated?

Yes, most brokers are regulated by the China Securities Regulatory Commission (CSRC) to ensure investor protection.