TFI Markets Review

For traders who want to make money with forward contracts and currency conversion, TFI Markets is the perfect place to get started. This platform has been in the business for around 24 years and offers favorable conditions, low commissions, and reliable services.

TFI Markets works only with legitimate entities such as businesses, partnerships, business owners, and individuals, ensuring that all its services comply with international standards. This broker is also approved by CySEC and the Central Bank of Cyprus, proving its commitment to financial integrity. The company is also a proud sponsor of prestigious events such as Invest Cyprus CIPA Awards and IN Business Awards.

In this detailed review, we discuss the complete TFI markets overview and find out what is the company’s background, trading conditions, payment methods, and other important features. We will also analyze its account types, fees and commissions, the leverage offered, customer services, and more to help you make an informed decision. So let’s get started!

What is TFI Markets?

TFI has been the go-to provider of exceptional currency solutions for its esteemed corporate clients for over two decades. The organization’s success lies in the hands of its professionals and their extensive knowledge in this field. Recently, TFI Markets has opened its doors to individual traders and investors looking for a reliable and competitive broker.

Through this platform, traders can access financial products such as forex, and different currency pairs. The platform is designed for companies, corporates, and individual investors with various features and tools to assist in every step of the trading process.

For traders looking for advanced financial technology and currency solutions, TFI Markets has the perfect choice for them. With its cutting-edge technology and currency solutions for businesses, investors, and traders, TFI Markets is the all-in-one platform for a wide range of trading activities.

Moreover, TFI Markets Ltd is a licensed Payment Institution by the Central Bank of Cyprus (License No. 115.1.2.13/2018) and an Investment Firm regulated by CySEC (Licence No. 117/10). This means that traders can be assured of the highest quality of services from a regulated and licensed company.

Advantages and Disadvantages of Trading with TFI Markets

Benefits of Trading with TFI Markets

TFI Markets has been an incomparable and well-known broker for foreign currency conversion and forward contracts. It offers the best conditions for traders, with competitive spreads and low commissions. In addition, the TFI Markets broker provides comprehensive risk-management tools and the latest automated trading technologies.

TFI Markets is a reliable and secure broker, allowing its customers to select from 20 different currencies for their payments in 150 countries. Furthermore, it provides multi-currency accounts free of charge to ensure guaranteed delivery wherever you pay — but it is also fully licensed by CySEC and compliant with EU regulations.

To start trading with TFI Markets, you can start with any amount of money in your account and quickly start trading with low spreads and no commissions. Moreover, this broker is tailored specifically for active traders, meaning no avenues to passive income exist with this broker. Moreover, since there are no training materials available, it’s evident that the broker targets experienced clients only.

TFI Markets Pros and Cons

Pros

- No conversion fees

- Best for forward contracts

- The minimum deposit is just $1

- The secure and reliable trading environment

- Comprehensive risk management tools for traders

- Suitable for professional traders

- Well-regulated and licensed

Cons

- Average customer supports

- Order execution speed is slow

- It doesn’t allow EAs

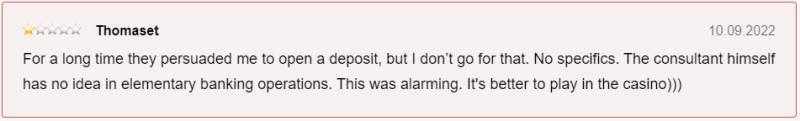

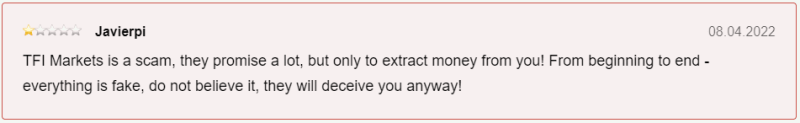

TFI Markets Customer Reviews

Our review expert team has looked up online reviews and found mixed customer reviews about the broker. Some traders have reviewed that TFI Markets is a great broker for trading peculiarities and forward contracts. The best part of this broker is the currency conversion rate they offer; it’s very economical and makes the trading process seamless.

Positive reviews help ensure your standing in the rankings, whereas negative reviews can lead to a drop in the rankings. As an EA user, you may appreciate TFI Markets’s ability to run the trading software optimally. Moreover, there need to be more maximum trading assets for investors with TFI Markets. Therefore, this broker may not be your best choice if you are a serious investor.

TFI Markets Spreads, Fees, and Commissions

Below are the details about TFI Markets spreads, fees, and commission:

TFI Markets Spreads

TFI Markets offers floating spreads from 0.1 to 0.3 pips. This cost is quite competitive compared to other brokers in the forex market.

TF Markets Fees

When you open an account with TFI Markets, no additional fees are charged for opening or closing your account. However, the account maintenance fee of €80 is applicable if the account has been inactive for over five years. Moreover, an investigation and charge fee is determined on an individual basis.

TFI Markets Commissions

At TFI Markets, a commission fee is charged for each trade. Also, the compensation fee as a commission is also charged for executing trades on behalf of traders. Commission fees can significantly differ depending on the type of financial asset being traded and your TFI Markets trading account level. The average commission of $3 is charged per lot.

Account Types

Below are the trading accounts offered by the TFI Markets:

#1. Corporate Account

This TFI Markets account is ideal for large investors who want to benefit from the best trading conditions available. In addition, the corporate account is suitable for corporations, communities, and other registered companies and associations. You can download the zip files to get more information about each account type and account opening type.

#2. Personal Account

This trading account is perfect for those who want a more relaxed trading approach without minimum deposit requirements. Besides, this account is perfect for private customers who are incorporated as legal entities.

Demo Account

Unfortunately, due to its broker policies, TFI Markets does not offer demo accounts.

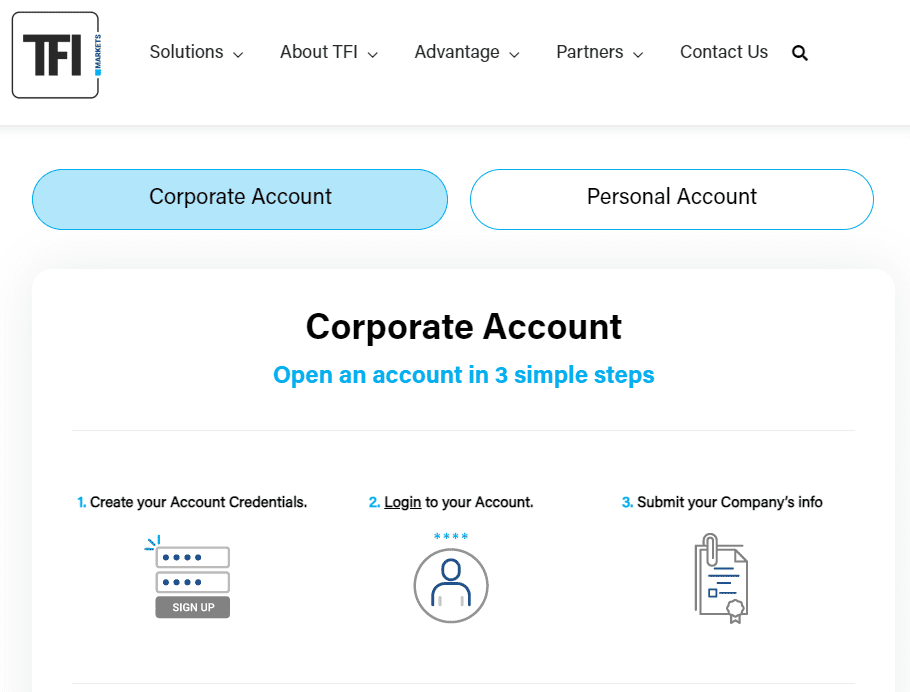

How To Open Your Account?

TFI Markets offers two types of accounts, and the account opening process is easy and straightforward. However, the account opening process varies according to the type of account you are opening. Let’s look at each type below.

#1. Corporate Account

For a corporate account, you will need to provide some basic information such as company name, address, and contact details. Below is a step-by-step guide to help you open a corporate account with TFI Markets:

- Visit the broker’s website and click the “Open Account” option.

- Select the corporate account, and the sign-up form will be displayed.

- Fill in the required details and submit the application form.

- Once your application is approved, a Corporate Account Manager will contact you to help you with the further process.

- After logging in to your account, submit your company information and documents to complete the registration process.

- Finally, you can start trading in the financial markets with your new corporate account.

#2. Personal Account

To open a personal account, you must download and submit the application forms to the brokerage firm. The forms require basic personal details such as your name, address, contact information, etc.

Once your application is approved, you will receive a login and password for accessing your personal account. After logging in to the account, you can start trading right away. But remember, it pays to research and understand the terms and conditions set by the broker before investing your money.

What Can You Trade on TFI Markets

No matter which account you choose and how much you invest, you can always access to the 20 currency pairs as your trading instruments. With TFI Markets, you can access Forex currency pairs such as EUR/USD, USD/JPY, GBP/USD, AUD/USD, and many more.

TFI Markets is the perfect broker for those looking to profit from trading currencies. For those traders looking to independently manage their funds and leverage currency conversions for amazing returns, TFI Markets is the best choice. Through offering comfortable conditions, personal managers who are there to assist you throughout your journey, various convenient ways of transferring funds, and safe transactions, it all comes together perfectly.

TFI Markets Customer Support

TFI Markets provides friendly customer service available every Monday through Friday. In addition, those seeking assistance can use the 24/5 support team to answer any questions or queries you might have. Whether it regards your account, trading, or technical issues — they can help you out.

Whether a simple question or a more complex query, the TFI Markets Support Team is ready to assist you. And that’s not all — they can also help you with account registration and portfolio management and provide advice on making the most of your trading experience.

However, live chat support is not available during weekends. Also, it is quite slow, and the agents are only sometimes as helpful as one would like. But if you need assistance in a hurry, then leave an email for a quick response. Moreover, you can visit their offline offices in case of a more serious problem.

Contact Details

- Phone nos: Greece: (+30 210 710 20 10) Cyprus: (+357 22 749 800)

- Email: support@tfimarkets.com

- Address: 178 Athalassas Ave, 1st Floor, Irene Tower, 2025, Nicosia, Cyprus

Advantages and Disadvantages of TFI Markets Customer Support

Security for Investors

At TFI Markets, the investor security is assured by Cyprus Securities and Exchange Commission (CySEC) with license no. 117/10, in addition to authorization from The Central Bank of Cyprus granting it license number 115.1.2.13/2018, enabling them to provide financial services according to regulatory agency standards.

In accordance with the regulations of the European Union, TFI Markets strictly separates clients’ funds from their company’s by using segregated accounts that can only be accessed through customers. Therefore, TFI Markets cannot use personal funds since they are not accessible.

The broker has ensured to safeguard of clients’ data by incorporating various authentication methods. Furthermore, the transactions are guaranteed secure with SWIFT — a global institution that supervises payments across all corners of the globe. Thus, rest assured knowing your funds will reach their destination safely and securely.

Withdrawal Options and Fees

You can use payment methods like bank transfer, SEPA, and SWIFT to withdraw and deposit funds. Also, the payments are processed within one business day.

SWIFT deposits and withdrawals are free, but SHR and OUR transfers incur a small fee of €10 and €30. Nevertheless, if the transfer exceeds an incredible amount of €100,000, all SHR transactions become costless. Moreover, you must verify your personal information to withdraw money from TFI Markets.

TFI Markets Vs. Other Brokers

Below is the in-depth comparison of TFI Markets with other well-reputed brokers:

#1. TFI Markets vs. AvaTrade

AvaTrade is one of the most well-reputed brokers in the global market, with over 200 financial assets. With over 300 thousand registered users and 2 million transactions monthly, it is no surprise that AvaTrade is one of the top choices for brokers.

The best thing about AvaTrade is that several top-tier authorities regulate it, including DSCA, FSA, ASIC, and more. Moreover, with a minimum deposit of $100, the broker offers competitive spreads and more than 1200 trading tools. Also, the leverage of AvaTrade is up to 1:30 for retail investor accounts and up to 1:400 for professional traders.

On the other hand, TFI Markets is a Cyprus-based broker offering over 20 financial instruments to its clients. CySEC regulates it and offers MiFID-compliant services. This broker has no minimum deposit; however, it is only suitable for forward contracts and currency conversions. Moreover, it is not as famous and reliable as AvaTrade when it comes to global trading.

The main difference between TFI Markets and AvaTrade is that the former offers limited products while the latter provides a wider selection of financial instruments. AvaTrade has also been around for a much longer period and is more trusted in the industry. In addition, AvaTrade has gained more trust and reliability due to its high level of security.

Overall, AvaTrade is the ideal option for traders who are looking for a reliable broker with a wide variety of assets and competitive spreads. In addition, it is suitable for novice and seasoned traders as it offers excellent customer service and automated trading services. Compared to TFI Markets, AvaTrade is the clear winner as it offers more features and security.

#2. TFI Markets vs. RoboForex

RoboForex is a multi-asset broker with more than ten years of experience in the industry. The broker offers thousands of instruments, including stocks, commodities, cryptocurrencies, and indices. It also offers several trading platforms, such as the MetaTrader 4/5 and Web Trader, for quick access.

RoboForex is regulated by CySEC and FCA, making it a reliable broker for traders around the globe. The minimum deposit requirement is just $10, perfect for novice traders. The leverage offered by the broker is up to 1:3000 with tight spreads starting from 0.0 pips and a commission of $6 per lot.

TFI Markets is another reliable broker regulated by CySEC with no minimum deposit requirements. The broker offers forex currency pairs and 20 financial instruments, which is much fewer than RoboForex.

When compared, both brokers have their unique advantages and disadvantages. While TFI Markets is more accessible as it does not have minimum deposit requirements, RoboForex offers a wider selection of trading instruments and platforms. Moreover, RoboForex also has better leverage of up to 1:3000 compared to TFI Markets, which only offers maximum leverage of 1:100.

Overall, RoboForex is the ideal choice when it comes to trading instruments and platforms. The broker offers a much wider selection of products and platforms, making it more suitable for seasoned traders. Moreover, RoboForex has a slight edge regarding leverage, making it a better option for risk-takers.

#3. TFI Markets vs. Alpari

Alpari is an international forex broker offering a wide selection of instruments along with several trading platforms. With over two decades of experience, Alpari has been a leader in providing financial services to the international foreign exchange market. The company’s offerings range from active Forex trading opportunities to CFDs commodities, indices, and more.

In addition, Alpari is suitable for both beginners and expert traders. For those starting out on their journey, they offer cent accounts. Meanwhile, more advanced traders can use classic and ECN accounts with lower spreads.

On top of it, the broker proactively monitors its managers’ ratings, ensuring investors have minimum risk when selecting a PAMM account or PAMM portfolio that fits in line with their objectives. Besides, the spreads start from 0.2 pips, and traders can use trading signals and automatic trading services.

TFI Markets, on the other hand, is primarily a forex broker. It offers 20 instruments, is regulated by CySEC, and provides its traders access to the popular MetaTrader 4 platform. When compared, Alpari has more to offer when it comes to the selection of trading instruments and platforms.

Overall, Alpari has the edge over TFI Markets when it comes to trading instruments, platforms, and account types. With a minimum deposit of just $1 and leverage of 1:3000, Alpari offers more options for traders of all levels. Moreover, the broker provides additional services, such as PAMM accounts and portfolios, perfect for experienced traders. Thus, Alpari is the ideal choice for those looking for a comprehensive trading experience in the forex market.

Conclusion: TFI Markets Review

That’s all for the TFI Markets review. To conclude, TFI Markets is a reliable forex broker regulated by CySEC with a minimum deposit requirement of 0. In addition, the broker offers 20 financial instruments with leverage of up to 1:100.

However, TFI Markets offers fewer trading instruments compared to other brokers like RoboForex and Alpari. Moreover, it is only suitable for forward contracts and does not offer any other services, such as PAMM accounts or portfolios.

This broker is not well-reputed as per reviews of its clients, like the delayed customer support, slow order execution, high fees and commissions on profits, and a lack of educational materials. Also, it is more suitable for companies and entrepreneurs and offers no demo account to practice on.

Therefore, TFI Markets is not the ideal choice for those looking for a comprehensive trading experience in the forex market. As such, if you are looking for a broker with competitive spreads and more trading options, we recommend trying out some of the better-rated brokers like RoboForex and Alpari because of their comprehensive trading features. However, TFI Markets may be the right choice for those looking to execute forward contracts with tight spreads.

TFI Markets Review FAQs

Is TFI Markets regulated?

TFI Markets is fully regulated by Cyprus Securities Exchange Commission (CySEC) with License No. 115.1. 2.13/2018, an Investment Firm overseen by CySEC’s standards under its Licence No 117/10 for extra security measures to protect our customers’ investments & profits.

What is TFI Market’s minimum deposit?

There is no minimum deposit requirement on TFI Markets; you can start trading with even $1.

Do TFI Markets charge withdrawal fees?

TFI Markets charges €10 and €30 for SEPA and SHR transfers, respectively. However, SWIFT transfers are free of charge, and all SHR transfers are free for amounts over €100,000.