Teletrade Review

Teletrade is a brokerage company offering access to forex, CFDs, and commodity markets, catering to both novice and experienced traders. It provides users with a range of trading tools and educational resources, aiming to support informed trading decisions. The platform is accessible through MetaTrader 4 and 5, two widely-used trading platforms known for their charting and analytical features.

Teletrade emphasizes brokerage service like customer support, available in multiple languages, which is beneficial for international users. The broker also offers different account types, allowing traders to choose an option that aligns with their experience and financial goals. Additionally, the platform includes a copy-trading feature, enabling users to mirror the trades of more experienced traders, which can be helpful for beginners seeking guidance.

In terms of regulation, Teletrade is monitored by specific authorities depending on the region, adding a layer of credibility to its offerings. However, it’s crucial for users to review these regulatory details to ensure they align with their expectations for transparency and security.

What is Teletrade?

Teletrade is a brokerage firm established in 1994, offering access to various financial markets, including forex, CFDs, and commodities. The company provides trading platforms like MetaTrader 4 and 5, known for their user-friendly interfaces and analytical tools.

Teletrade caters to both beginners and experienced traders by offering educational resources and customer support in multiple languages. The broker is regulated by the Cyprus Securities and Exchange Commission (CySEC), ensuring compliance with European financial standards.

Additionally, Teletrade provides a copy-trading feature, allowing users to replicate the trades of seasoned investors, which can be beneficial for those new to trading. Teletrade is one of the most famous in the market news, it is a good broker the provides real account with synchronous trading service.

Teletrade Regulation and Safety

Teletrade operates as a regulated brokerage firm under the oversight of the Cyprus Securities and Exchange Commission (CySEC). This regulatory framework ensures that Teletrade complies with European financial standards, providing a level of security for its users. By adhering to these regulations, the broker works to maintain transparency and trust in its operations.

To enhance safety, Teletrade implements strict protocols for client fund protection, keeping customer funds segregated from operational accounts. This practice safeguards users’ investments and aligns with industry standards for financial security. Additionally, Teletrade follows anti-money laundering policies, which add another layer of protection for its clients.

Teletrade also offers customer support in multiple languages, making it accessible to a diverse range of users. The platform’s emphasis on education and risk management tools helps traders make more informed decisions. Together, these features contribute to an environment focused on security and informed trading.

Teletrade Pros and Cons

Pros

- Regulated broker

- Diverse instruments

- User-friendly platforms

- Educational resources

Cons

- Withdrawal fees

- Limited crypto options

- High leverage risks

- Inactivity fees

Benefits of Trading with Teletrade

Teletrade offers a range of benefits for traders seeking a comprehensive trading experience. The broker provides access to over 200 financial instruments, including forex, commodities, cryptocurrencies, stocks, shares, indices, metals, energies, ETFs, and CFDs, allowing for diversified investment opportunities. Utilizing the MetaTrader 4 and MetaTrader 5 platforms, Teletrade ensures a user-friendly interface equipped with advanced charting and analytical tools.

For those new to trading or looking to enhance their strategies, Teletrade offers educational resources such as free forex webinars, tutorials, and daily market video briefings. These materials are designed to help traders make informed decisions and stay updated on market trends. Additionally, the broker provides a copy trading platform, enabling users to mirror the positions of experienced traders, which can be particularly beneficial for beginners.

Customer support is a priority for Teletrade, with services available around the clock and multilingual staff ready to assist clients from various regions. The broker also offers a loyalty program, allowing traders to earn bonus points through account deposits and trading activities. These points can be exchanged for additional funds or real money, enhancing the overall trading experience.

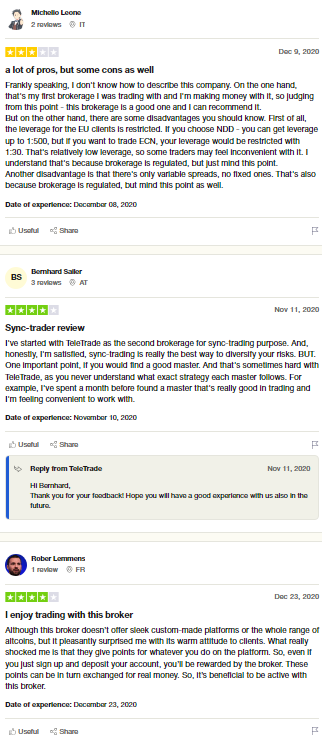

Teletrade Customer Reviews

Teletrade has garnered a range of customer reviews reflecting diverse experiences. Some traders commend the broker for its extensive educational resources and user-friendly platforms, highlighting the availability of MetaTrader 4 and 5 as advantageous for both beginners and seasoned traders. Additionally, the copy trading feature is often praised for enabling less experienced traders to follow and replicate the strategies of more seasoned investors.

However, certain users have raised concerns regarding withdrawal processes, noting occasional delays in fund transfers. Others have mentioned that while customer support is generally responsive, there can be instances of slower response times during peak periods. It’s also noted that the range of educational materials, though comprehensive, may not be as extensive as some competitors.

Overall, Teletrade maintains a solid broker ratings in the trading community, with many clients expressing satisfaction with its services. Prospective users are encouraged to conduct thorough research and consider both positive feedback and areas of concern to determine if Teletrade aligns with their trading needs and expectations.

Teletrade Spreads, Fees, and Commissions

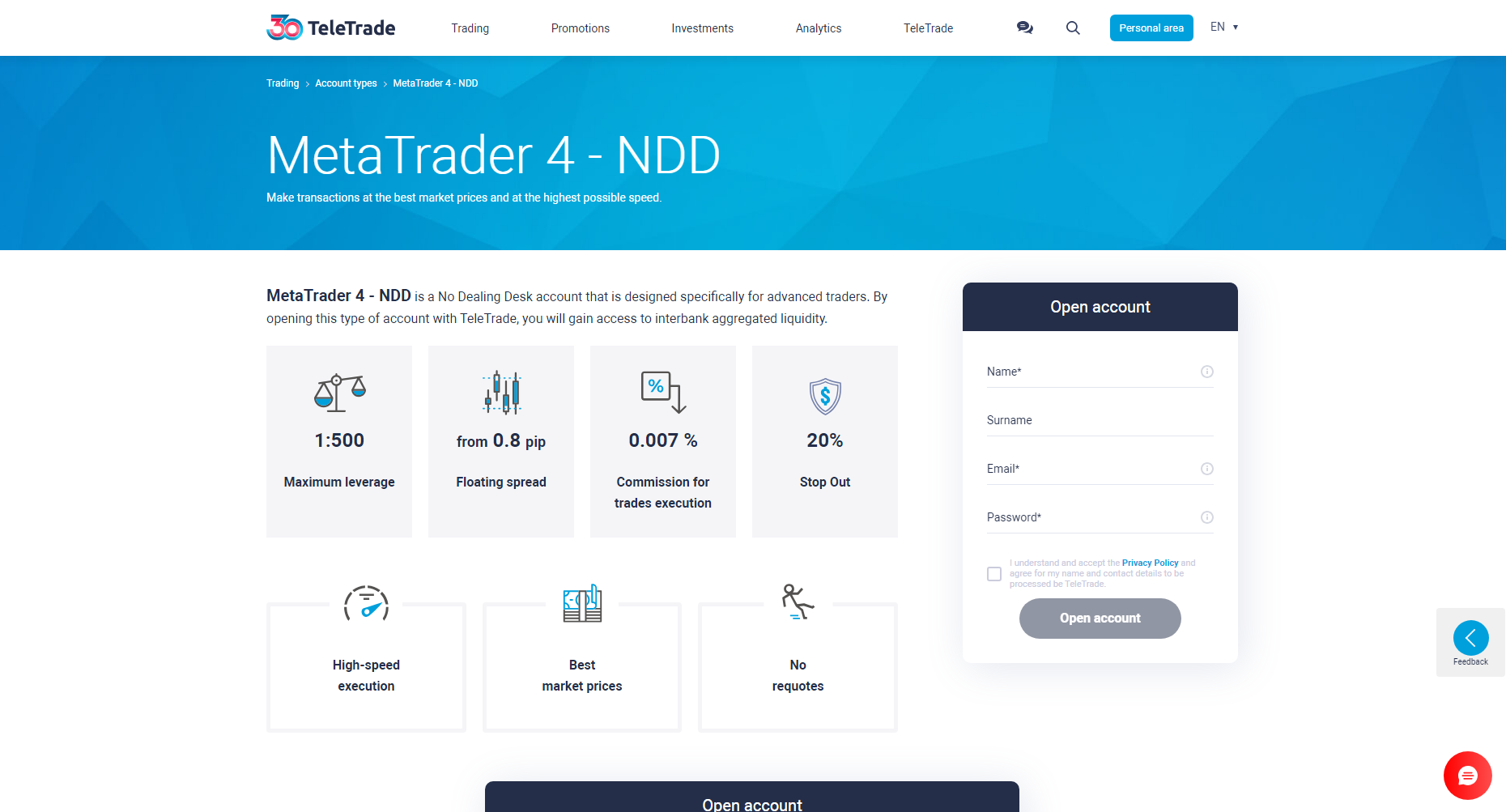

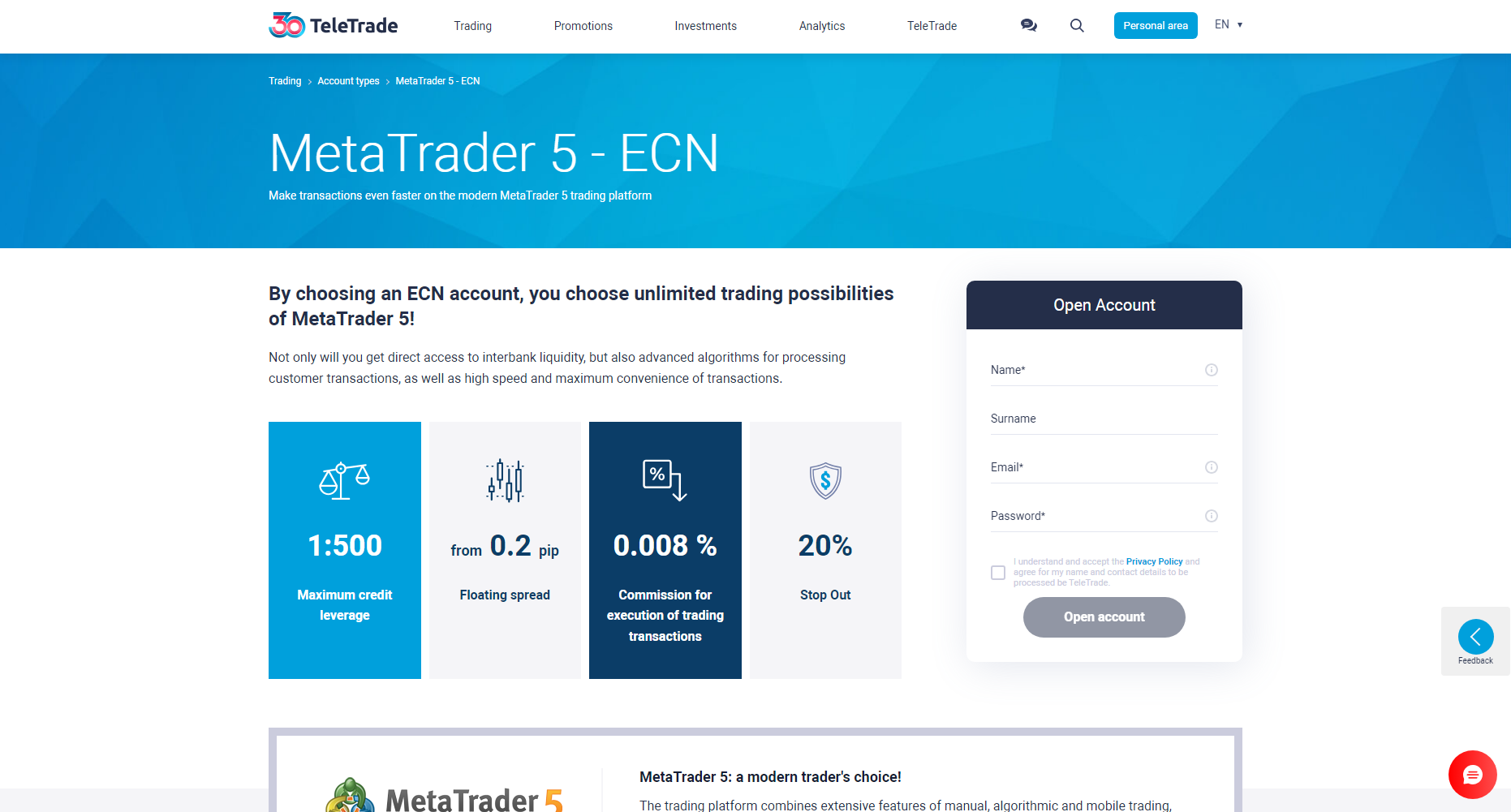

Teletrade offers various account types, each with distinct spreads and commission structures. The Standard account features spreads starting from 1.1 pips, while the NDD account offers spreads beginning at 0.8 pips. For traders seeking tighter spreads, the Sharp ECN account provides spreads as low as 0.2 pips.

In terms of commissions, the NDD account charges a fee of 0.007% per trade, and the ECN account imposes a commission of 0.008% per trade. The Standard account operates on a commission-free basis, relying solely on spreads for transaction costs. It’s important to note that Teletrade may apply swap fees for positions held overnight, which can vary based on the instrument and market conditions.

Additionally, Teletrade imposes withdrawal fees depending on the chosen payment method. For instance, bank wire transfers may incur a fee of 0.1% of the withdrawal amount, with a minimum charge of $55 and a maximum of $200. Credit/debit card withdrawals are subject to a 2.3% fee plus a fixed amount, while e-wallet services like Skrill and Neteller have their respective fees. Traders should review these costs carefully to understand the total expenses associated with their transactions.

Account Types

Teletrade offers various types trading accounts designed to meet the diverse needs of different traders, from beginners to seasoned professionals. Each account type provides specific features and trading conditions, allowing users to choose the option that aligns best with their trading goals. Here’s a closer look at each account type and what they offer.

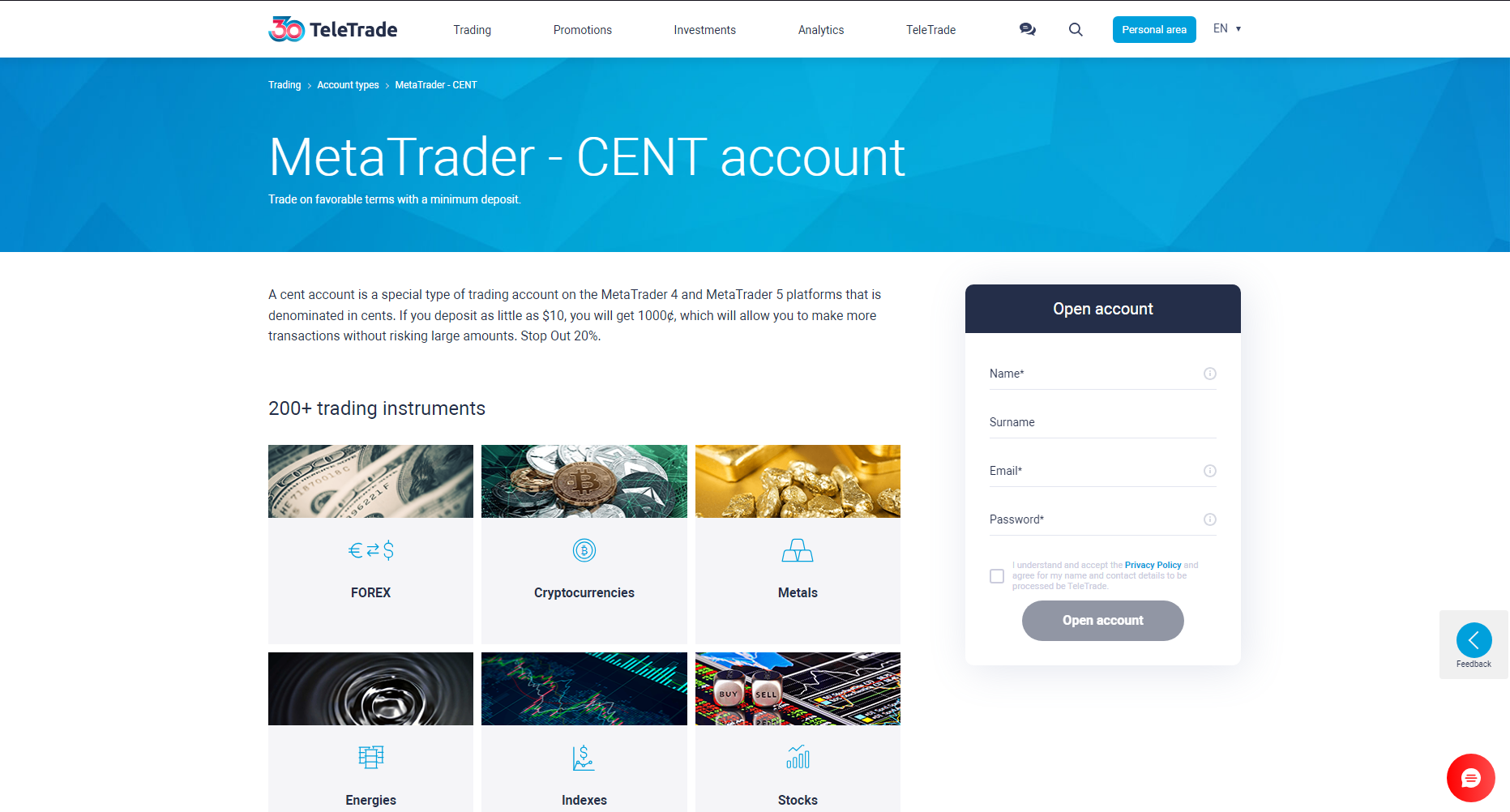

Cent Account

The Cent Account is ideal for beginners or those seeking a straightforward trading experience. It operates on a commission-free basis, with costs embedded in the spreads, which start from 1.1 pips. This account provides access to major forex pairs, commodities, and CFDs, making it suitable for basic trading strategies.

NDD (No Dealing Desk) Account

The NDD Account is tailored for traders who prefer tighter spreads and faster execution speeds. Spreads begin at 0.8 pips, and there’s a small commission fee of 0.007% per trade. This account is beneficial for those who prioritize reduced spreads over commission-free trading.

ECN Account

The ECN Account is designed for advanced traders who require the tightest spreads, starting as low as 0.2 pips. This account comes with a commission of 0.008% per trade, which caters to traders focused on high-frequency or scalping strategies. open an ECN account and even open an Investor account and automatically copy trades. It really expands the possibilities of making money in the forex market.

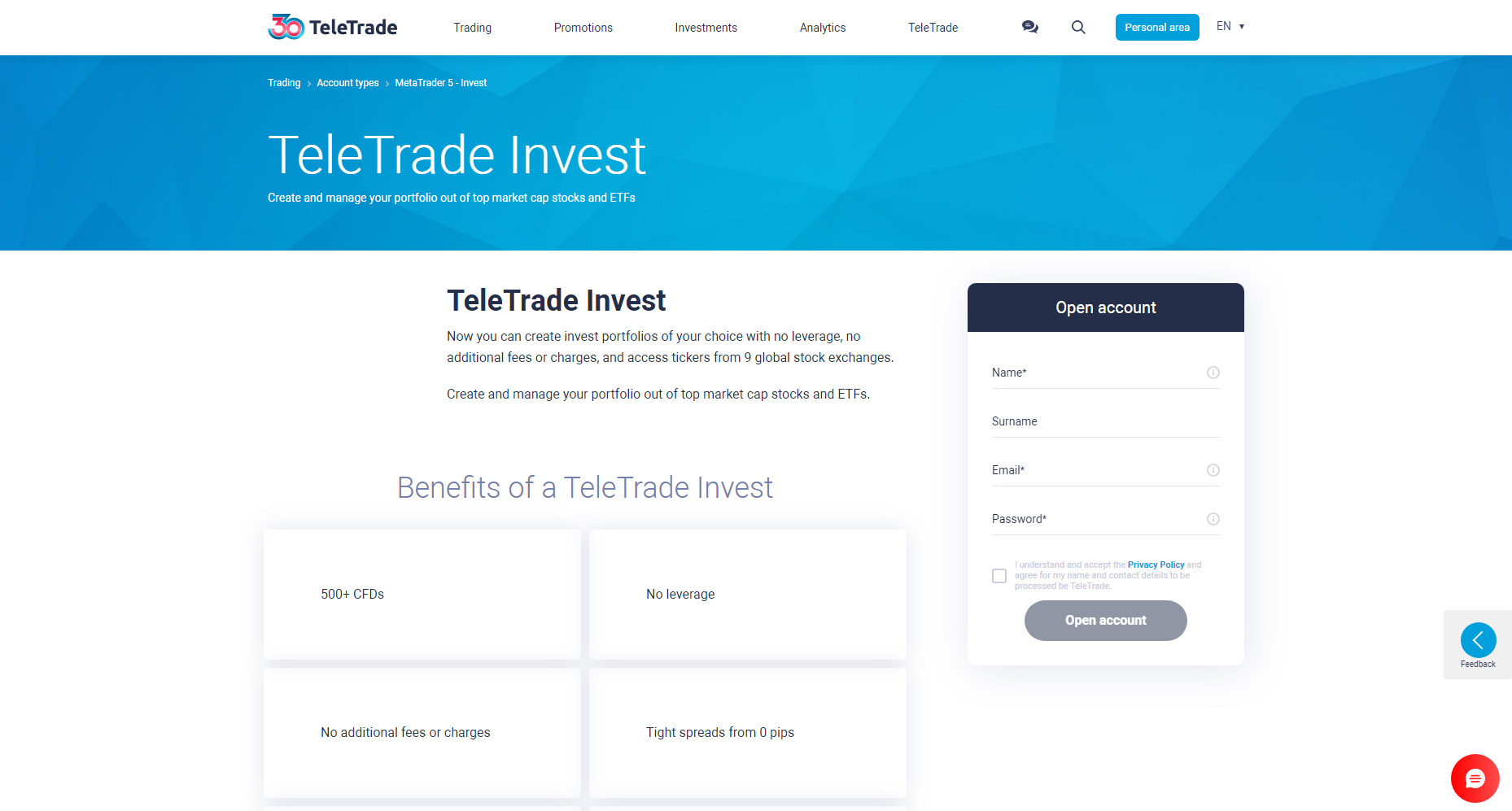

Invest Account

Traders can create investment portfolios of their choice without using leverage, without incurring any additional fees or penalties, and with access to tickers from nine different stock exchanges across the world. Users can trade forex using the invest account with 500+ CFDs no leverage and additional fees required, tight spreads from 0 pips and 0.3% of total commission free trading.

Demo Account

Teletrade’s demo account lets customers practice trading with virtual funds and over 200 trading instruments. This tool lets traders test strategies and learn the platform’s features risk-free. The demo account simulates live trading with real-time quotations and complete trading terminal capabilities.

All of these accounts has required amount of minimum deposit depending on which account the trader is going to avail. The trading process according to the used trading platform will determine on how much the trader is going to get in the financial market. Teletrade is also offering sync trading. Sync trading let the traders trade simultaneously without worrying about the other accounts.

How to Open Your Account

Opening an account with Teletrade is a straightforward process designed to accommodate both novice and experienced traders. The following steps outline how to initiate and complete the account registration:

Step 1. Visit the Teletrade Website

Navigate to the official Teletrade website. Locate and click on the “Open Account” button, typically found on the homepage.

Step 2. Complete the Registration Form

Fill out the online registration form with personal details, including name, email address, and phone number. Create a secure password for account access.

Step 3. Verify Your Email Address

After submitting the registration form, Teletrade will send a verification email to the provided address. Click on the verification link within the email to confirm and activate the account.

Step 4. Submit Identification Documents

Log in to the newly created account and upload the required identification documents, such as a valid passport or driver’s license, and a recent utility bill or bank statement to verify residency.

Step 5. Fund Your Account

Once the documents are approved, proceed to deposit funds into the trading account using one of the supported payment methods, which may include bank transfers, credit/debit cards, or e-wallets.

Step 6. Start Trading

With the account funded, download and install the MetaTrader 4 or MetaTrader 5 platform, as preferred. Log in using the provided credentials to begin trading across various financial instruments offered by Teletrade.

By following these steps, traders can efficiently set up their Teletrade accounts and commence trading activities.

Teletrade Trading Platforms

Teletrade provides traders with access to the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, both renowned for their comprehensive trading tools and user-friendly interfaces. These platforms are available on Windows, macOS, and Linux, ensuring compatibility across various operating systems. Additionally, Teletrade offers web-based versions of MT4 and MT5, allowing users to trade directly from their browsers without the need for software installation.

For traders who prefer mobile access, Teletrade supports MT4 and MT5 mobile applications compatible with iOS and Android devices. These mobile platforms provide real-time quotes, interactive charts, and a full set of trading orders, enabling users to manage their accounts and execute trades on the go. The mobile apps also include technical analysis tools and customizable indicators, facilitating informed decision-making while away from a desktop.

In addition to standard trading features, Teletrade integrates copy trading capabilities within the MT4 and MT5 platforms. This feature allows users to replicate the trades of experienced investors, which can be particularly beneficial for those new to trading or looking to diversify their strategies. By offering a range of platform options and functionalities, Teletrade aims to accommodate the diverse needs of its clientele.

What Can You Trade on Teletrade

Teletrade offers a diverse range of financial instruments, enabling traders to build a varied investment portfolio. The following categories outline the primary assets available for trading:

Forex

Teletrade provides access to over 70 currency pairs, including major, minor, and exotic pairs in forex trading. This variety allows traders to engage in the global foreign exchange market, capitalizing on currency fluctuations.

Cryptocurrencies

Traders can invest in 16 cryptocurrency pairs, featuring popular digital assets such as Bitcoin, Ethereum, and Ripple. This selection enables participation in the dynamic and rapidly evolving crypto market.

Indices

Teletrade offers 9 index CFDs based on baskets of blue-chip stocks. These indices represent major global markets, providing insights into overall market performance.

Metals

Investors have the option to trade 12 metal spot CFDs, including precious metals like gold, silver, platinum, and palladium. These assets are often considered safe-haven investments during market volatility.

Energies

The platform includes 3 energy futures, covering commodities such as crude oil (WTI, Brent) and natural gas. Trading in energy markets allows for exposure to commodities essential to the global economy.

Stocks

Teletrade provides access to over 110 stock CFDs based on shares of U.S. and German companies. This selection enables traders to invest in individual companies across various sectors.

ETFs

The platform offers more than 10 ETF CFDs, representing exchange-traded funds containing various tradable assets. ETFs provide a way to invest in a diversified portfolio through a single instrument.

By offering this extensive array of trading options, Teletrade caters to the diverse preferences and strategies of its clients.

Teletrade Customer Support

Teletrade offers customer support through multiple channels to assist traders effectively. Clients can reach out via live chat for immediate assistance, email for detailed inquiries, or phone for direct communication. The support team is available 24 hours a day, five days a week, ensuring timely responses during trading hours.

The broker provides multilingual support, catering to a diverse international clientele. This approach helps bridge language barriers and enhances the overall user experience. Additionally, Teletrade maintains a comprehensive FAQ section on its website, addressing common questions and providing self-help resources.

For more personalized assistance, Teletrade offers the option to request a callback at a convenient time. This feature allows clients to schedule discussions with support representatives, ensuring their concerns are addressed promptly. Overall, Teletrade‘s customer support framework is designed to provide reliable and accessible assistance to its users.

Advantages and Disadvantages of Teletrade Customer Support

Withdrawal Options and Fees

Teletrade provides multiple withdrawal options to accommodate the diverse needs of its clients. Each method has specific processing times and associated fees, which traders should consider when planning fund withdrawals.

Bank Wire Transfer

Clients can withdraw funds via bank wire transfers, suitable for larger amounts. Processing typically takes 1-2 business days. For SEPA EUR payments, a fee of €1 plus the beneficiary bank’s commission applies; non-SEPA payments incur a 0.1% fee of the total amount, with a minimum of $55 and a maximum of $200.

Credit/Debit Cards

Withdrawals to Visa and MasterCard are available, with processing times of 1-2 business days. A fee of 2.35% plus €1/$1.30 is charged per transaction. This option is convenient for those who prefer funds returned to their cards.

E-Wallets

Teletrade supports e-wallet services such as Skrill and Neteller. Skrill withdrawals are subject to a 1% fee, while Neteller charges 2%. Processing times for e-wallet withdrawals are typically faster, often completed within 1 business day.

Traders should review these options and associated fees to select the most suitable method for their needs. It’s also advisable to consult Teletrade‘s official resources or contact customer support for the most current information on withdrawal procedures and fees.

Teletrade Vs Other Brokers

#1. Teletrade vs AvaTrade

Teletrade and AvaTrade both provide access to forex, CFDs, and commodities markets, though AvaTrade offers a broader range of platforms, including its proprietary AvaTradeGO and options trading features, alongside MetaTrader 4 and 5. AvaTrade is regulated in multiple jurisdictions, including Ireland, Australia, and South Africa, giving it a wider regulatory footprint compared to Teletrade, which is primarily regulated by the Cyprus Securities and Exchange Commission (CySEC). On the other hand, Teletrade has a strong focus on educational resources and multilingual support, making it accessible to a range of trading experience levels.

Verdict: AvaTrade stands out for its extensive global regulation and diverse platform offerings, which may appeal to traders seeking extra options and security. However, Teletrade’s focus on education and simplicity makes it an attractive choice for beginner to intermediate traders.

#2. Teletrade vs RoboForex

Teletrade and RoboForex both offer trading across forex, CFDs, and commodities, though RoboForex provides a broader selection of platforms, including MetaTrader 4, MetaTrader 5, cTrader, and its proprietary R StocksTrader. RoboForex is regulated by the International Financial Services Commission (IFSC) in Belize, while Teletrade is regulated by the Cyprus Securities and Exchange Commission (CySEC), giving it a presence within European regulatory standards. Additionally, RoboForex offers unique features like CopyFX for social trading and more extensive cryptocurrency options, while Teletrade focuses on education and multilingual support, suiting a range of trader experience levels.

Verdict: RoboForex stands out for its varied platform options and cryptocurrency offerings, which may be appealing to advanced traders. In contrast, Teletrade provides a strong foundation in education and European regulation, making it a solid choice for those prioritizing these aspects.

#3. Teletrade vs Exness

Teletrade and Exness are both well-established brokers providing access to forex, CFDs, and commodities markets. Teletrade, founded in 1994, offers MetaTrader 4 and 5, focusing on education and multilingual support, and is regulated by CySEC. Exness, on the other hand, launched in 2008, is regulated in multiple jurisdictions, including the FCA in the UK and CySEC, and offers a wider range of trading instruments and higher leverage options, appealing to traders looking for more flexibility and risk options.

Verdict: Exness stands out for its extensive regulatory coverage and broader offerings, making it suitable for advanced traders. However, Teletrade provides a strong educational focus and solid European regulation, making it a sound choice for those who prioritize these elements.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH TELETRADE

Conclusion: Teletrade Review

Teletrade is a well-established brokerage offering a variety of trading options, including forex, CFDs, and commodities. With user-friendly platforms like MetaTrader 4 and 5, it caters to both beginners and experienced traders, making it a versatile choice. Additionally, the broker’s educational resources and copy-trading feature add value for those looking to enhance their trading skills or follow expert strategies.

When it comes to security, Teletrade is regulated by the Cyprus Securities and Exchange Commission (CySEC), providing a layer of trust for its users. The broker also prioritizes fund safety with segregated accounts and compliance with anti-money laundering regulations. However, potential traders should consider associated costs like spreads, commissions, and withdrawal fees to fully understand the expenses involved.

In summary, Teletrade offers a solid range of features and support for traders at various levels. With a commitment to customer service and multiple platform options, it provides a reliable trading experience. Prospective users should weigh both the advantages and any limitations to determine if Teletrade aligns with their trading goals and preferences.

Teletrade Review: FAQs

What is Teletrade?

Teletrade is a brokerage firm established in 1994, providing access to markets like forex, CFDs, and commodities.

What platforms does Teletrade offer?

Teletrade provides MetaTrader 4 and MetaTrader 5, known for their user-friendly design and extensive analytical tools.

Is Teletrade regulated?

Yes, Teletrade is regulated by the Cyprus Securities and Exchange Commission (CySEC), ensuring it meets European financial standards.

OPEN AN ACCOUNT NOW WITH TELETRADE AND GET YOUR BONUS