Technical indicators look for market trends. The methodology for the task at hand of finding price movement in a given asset. varies among indicators. In the case of the Traders Dynamic Index, the main goal is to scan the market when no obvious trend is apparent.

Once the trend is pinpointed the Traders Dynamic Index (TDI) determines the price movements.

TDI indicator is formed by volatility bands, relative strength index, and moving averages. Because of these parameters, most charts display three separate lines.

Each of them represents a moving average, Bollinger bands, and RSI.

Also Read: Best Technical Indicators for Day Trading

Contents

- Offers a Wide Market Perspective

- Traders Dynamic Index

- Practical Remarks about TDI

- Configuring the Traders Dynamic Index Indicator

- RSI Period and Price

- Trading Signals Generated by The Green Line

- The Best Traders Dynamic Index Strategy

- Make the TDI Indicator More Sensitive

- Conclusion

- FAQs

Offers a Wide Market Perspective

The structure of TDI makes it a potent analysis tool, that can locate entry points for investors that prefer to trade in time frames between short and medium.

If you break down the indicator and inspect the data separately, you will see that the Bollinger bans are there to locate high and low volatility. While the moving averages recognize the trend.

The RSI fills in the picture by estimating the momentum. As you can see, we are not talking about one indicator but a mix of reliable indicators that brought their strengths into one place.

With the Traders Dynamic Index (TDI), traders can prepare a trading strategy that can compensate for the drawbacks of other individual technical indicators. Effectively giving investors a broad perspective of the market.

Traders Dynamic Index

The indicator was developed by Dean Malone, his idea was to create a tool for estimating market conditions, and identifying trade signals.

The complexity of the TDI indicator has an upside, and that is the opportunity to use it as a stand-alone trading system.

With elements like the moving average, the Bollinger bands, and the RSI, it can be a reliable instrument for market diagnosis.

The Bollinger bands get utilized to estimate the size of the price and the course of the trend. And the moving averages get used to compensate and make more understandable lines produced by the relative strength index.

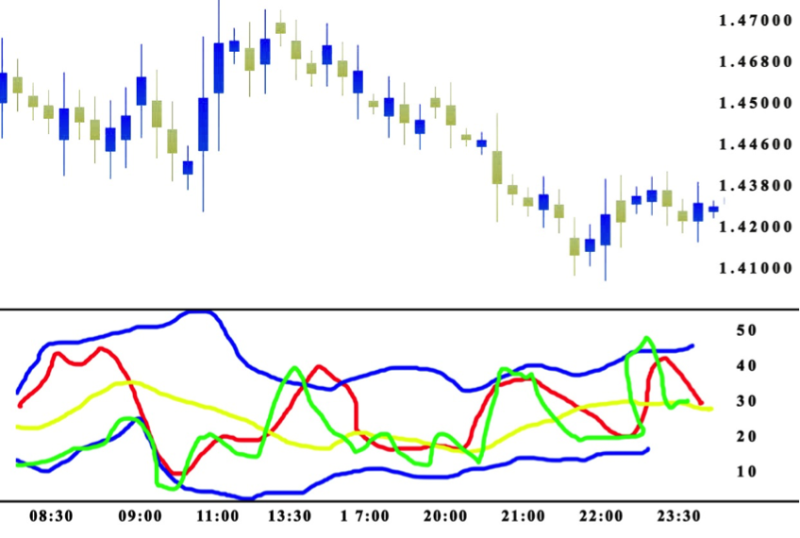

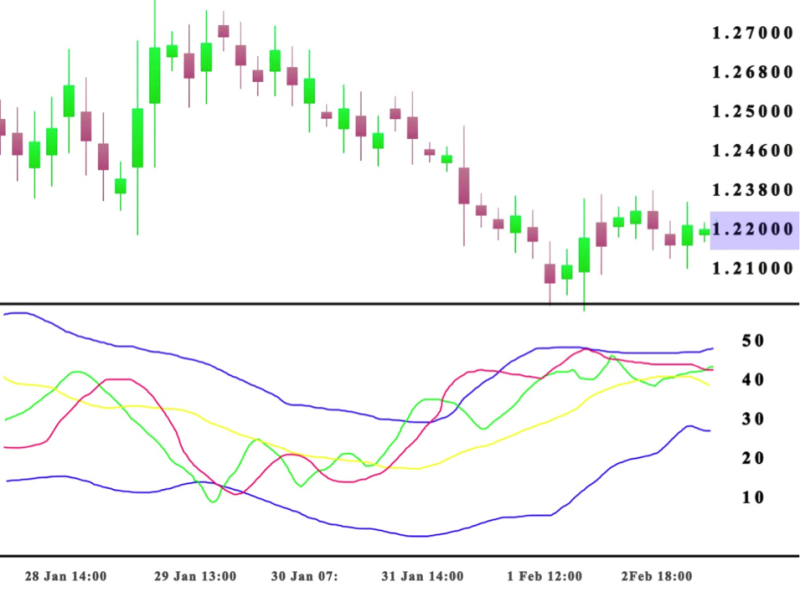

On a chart, the TDI indicator looks like a mash of five lines, three Bollinger bands, and two RSI each color code and representing a different parameter.

In the case of the RSI, the lines represent market volatility and strength. While the Bollinger bands create a trading channel.

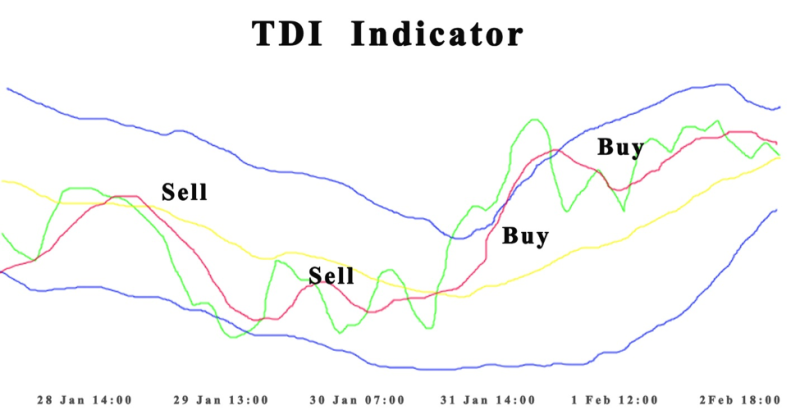

The green RSI line gets called fast, and the red one is a signal for estimating the longer averaging period. When they cross a short-term Traders Dynamic Index signals.

Both Bollinger bands are blue, forming a trading channel while the yellow line is the middle line.

Also read: Bollinger bands trading strategy (with divergence)

Practical Remarks about TDI

It is a complex set of lines, but that should not scare traders from using the indicator because every signal gets read in the standard way, making it useful for beginners.

It is advisable to use the indicator on stocks with durable volatility.

The Traders Dynamic Index indicator is productive when used separately for market analysis and can get used in combination with other technical indicators creating a reliable trading system.

Configuring the Traders Dynamic Index Indicator

The TDI indicator has a lot of settings. Making it open to optimization, helping traders to create their parameters or use the default settings in the trading platform.

The volatility band setting determines the Bollinger band settings. This parameter can get modified, and the selected value depends on your competence level with the indicator.

If the volatility band is at the lower level, it can become more responsive.

The standard deviation is a crucial element. It determines how much deviation you should use.

In some trading platforms, the TDI indicator has a default setting of 1.618, using the Fibonacci level, it is possible to change this and set it as you would when using the Bollinger band indicator.

RSI Period and Price

With the period the preset option can be configured. It gets used to identify the preceding sessions or candlesticks. If you use a larger value the result would be a lagging RSI.

Yet with a small setting, you get more awareness of market swings.

The advisable method to locate the best setting is to go with the parameter that you would be using with a standalone RSI indicator .

Investors can use opening, closing, high or low prices. The close price is the default setting and chooses what price to calculate for the RSI.

Remember that the type of price will influence the performance of the indicator. Traditionally the closing price is perceived as the curious element in a price chart.

RSI trade signal type is a advisable mode for the trade signal type stay identical to the value that you selected for the price type.

Traders are free to experiment with the moving average types to suit the best need for the market that they are trading.

Still, the SMA is known to be lagging as related to the EMA and because of that, the EMA can be a more suitable choice.

Trading Signals Generated by The Green Line

The short-term trend gets determined by the relative arrangement of the green line concerning the red line.

The trend gets treated as climbing while the green line goes over the red line, while the market is declining if the green line is under the red line.

The yellow line shows the long-term trend, and most often the trading time is in the range between 32 and 68, the line produced will decide an important change in the trend.

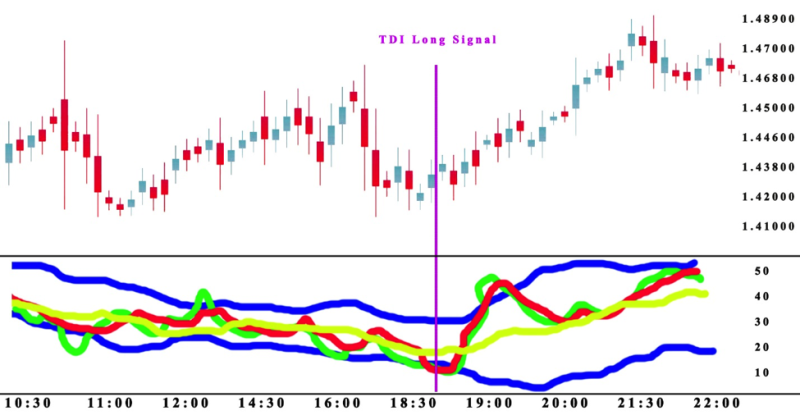

They are two modes for producing a signal that can influence a trading strategy. The long and short signals are the building blocks in trading with the TDI indicator.

A long signal is generated depending on the momentum’s potential, traders can wait for the crossover to happen when the three lines are over the 50-level of the indicator.

Typically, on a chart, the vertical line will show the entry of the trade, and the horizontal line shows the price at entry. The intersection of the red and yellow lines gives a confident long-term signal.

Parallel to this the bands expand implying that the market momentum is increasing together with the volatility.

Traders can observe that following the trigger of the signal, the price climbs to a profitable level in the long position.

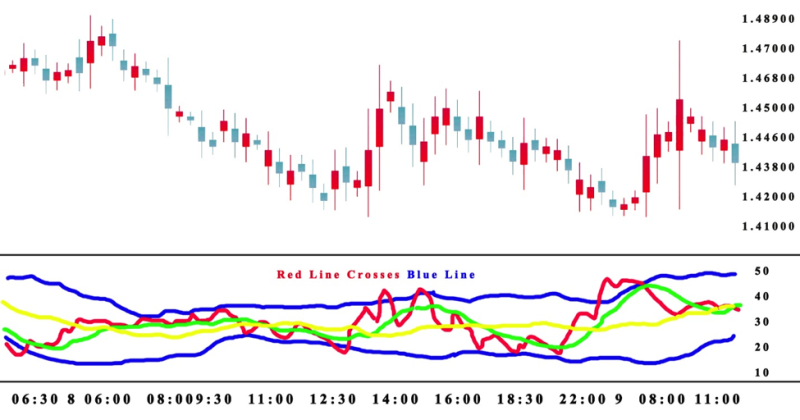

What you want to avoid is a scenario where the red line crosses over the upper blue band.

The Best Traders Dynamic Index Strategy

The best Traders Dynamic Index strategy offers a comprehensive change in your trading helping to locate scalping opportunities in real-time.

The TDI is a new toll joining the pool of technical indicators in 2005 and offering a 3-in-1 package, revealing the momentum, and market volatility.

Make the TDI Indicator more Sensitive

For scalpers, the signals get divided into buying and selling categories. For purchase, the signal is the green line intersects the red line from the bottom up.

The intersection point has to be over the balance line 50. The yellow line must support an uptrend. While for sale the green line crosses the red from top to bottom.

The point of intersection is under the 50 level, and the yellow line supports a downtrend.

Making the TDI indicator more sensitive to the current market circumstances. If you have problems with the analysis techniques, it’s crucial to make things simpler for implementation when trading.

Conclusion

The TDI indicator is a comprehensive trading system that can improve your trading strategies.

It makes no difference if you are swing trading or scalping in the Forex markets, the TDI indicator provides a total picture of the circumstances in the markets.

Because the Traders Dynamic Index indicator incorporates three different trading indicators, each of them calculating three separate elements the price, momentum, and volatility, it speeds up the process of market analysis.

Making it a versatile tool, especially basically it removes the necessity of using different tools to confirm the data received from the previous technical indicator. Saving time for other trades.

The opportunity to modify the settings gives room for experimentation or adjustment to the trader’s preferences.

Enabling the indicator to be configured to analyze the assets volatility and other market conditions.

FAQs

How do You Read a TDI Indicator?

The TDI indicator is formed under the price chart and incorporates five lines, from which three represent Bollinger Bands and two RSI lines, that show the market strength and volatility.

Is TDI a Momentum Indicator?

The Traders Dynamic Index is a momentum indicator, and its complexity makes it also a volatility indicator.

How do I Add a TDI Indicator to MT4 PC?

Accuses the platform, opens the custom section, and installs the indicator.

How do I Install a TDI Indicator?

Find and copy the MT4 custom indicator file, then past it into the indicator folder of the platform and restart.