TD Ameritrade Review

A few brokerage firms are suitable for beginners and advanced traders alike, and TD Ameritrade is one of them! With its low commission fees, user-friendly platform, and wide range of trading options, it’s no wonder why TD Ameritrade is one of the most popular brokers out there.

The award-winning trading platform is the go-to choice for active traders as it provides a comprehensive and user-friendly experience for retail traders and investors. With industry-leading technology, research tools, and a mobile app that lets you access the markets from anywhere, TD Ameritrade is the premier brokerage for traders with different experiences.

In this review, we will dive into the key features and benefits of TD Ameritrade and its drawbacks. We will also look at what kind of user experience you can expect, different account types, fees and commission details, and more.

What is TD Ameritrade?

Founded in 1975 as First Omaha Securities, TD Ameritrade is an award-winning American online broker for trading and investing in the OTC markets. In 1998, it transformed to become one of the leading digital brokers in the United States. With its cutting-edge technology and top-notch services, TD Ameritrade remains at the forefront of industry innovation today.

In 2020, TD Ameritrade and Charles Schwab Corp. joined forces to become an unparalleled financial powerhouse. Although integrating their online brokerage services is expected to take three years, both companies will remain separate broker-dealers until then. As such, customers can benefit from this powerful partnership with access to state-of-the-art technology and innovative investment strategies for years to come!

In 2020, Charles Schwab made a staggering $26 billion acquisition of TD Ameritrade. This highly anticipated merger is slated to be finalized by 2023. As a member of FINRA and SIPC, TD Ameritrade provides services to over 11 million clients. With its simple pricing plans, advanced trading platforms with professional analytics tools, and extensive range of markets and investment products, it is no wonder why TD Ameritrade is one of the most popular brokers out there.

Moreover, TD Ameritrade uses the most renowned platform, ThinkorSwim, which is backed by highly advanced order routing technology to ensure your orders are routed quickly and accurately. The platform also offers financial calculators, powerful research tools, backtesting features, and screening capabilities.

Advantages and Disadvantages of Trading with TD Ameritrade

Benefits of Trading with TD Ameritrade

TD Ameritrade is a top-rated and highly regulated stock broker providing its clients with great trading and investment options. With this platform, you can trade exchange-traded securities, OTC market assets, and Forex instruments – making it the perfect place for all your portfolio needs.

Investors benefit from various cash solutions from esteemed partners such as JP Morgan, State Street, Charles Schwab, and Federated. Moreover, they can invest in managed portfolios built on the modern portfolio theory principles.

TD Ameritrade is a great choice for investors who need the best tools and resources to make informed decisions. The third-party research tools include Morningstar, Federal Reserve Economic Database, the Center for Financial Research and Analysis, and more.

Moreover, traders can get an advantage from both standard and margin accounts. Cash accounts require no initial deposits so you can start immediately. With a margin account, however, traders have the potential to double their purchasing power with just a $2,000 deposit.

Those seeking a more personalized investment experience can choose managed portfolios starting at $25,000 and come with tailored services and terms. Moreover, the exclusive investments start from just $250,000, giving access to private placements and venture capital.

The other TD Ameritrade services include market heat-up, up-to-the-minute market analysis, trend reports, insights from third-party industry professionals, commentary, and guidance on stock and bond markets. Moreover, you can use tools to find options, mutual funds, ETFs, and more.

TD Ameritrade Pros and Cons

Pros

- Offers proprietary platform with built-in calendars and GainsKeeper calculator

- Access to the news and market updates

- Advanced analysis and research tools

- No account minimum and large investment selection

- Access to margin accounts, mutual funds, ETFs, and managed portfolios

Cons

- No direct crypto trading

- No fractional shares

- Enrollment for the cash sweep program is not available

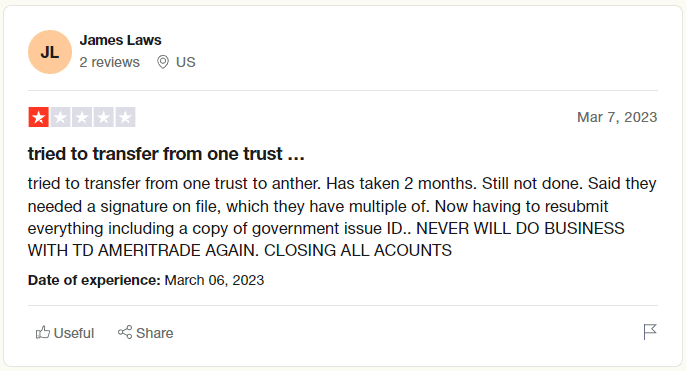

TD Ameritrade Customer Reviews

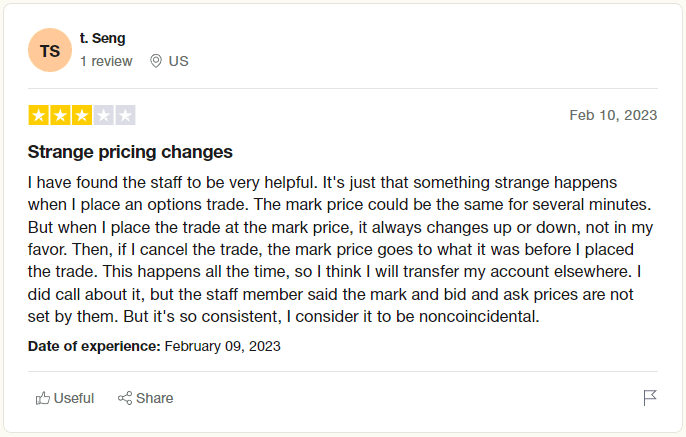

Our review team at Asia Forex Mentor found that TD Ameritrade caters to its client’s needs by providing various features and tools. Its proprietary platform has been praised for its intuitive user experience and robust analytical tools. Besides, the range of investment options is highly appreciated by customers, as it allows them to choose from various assets.

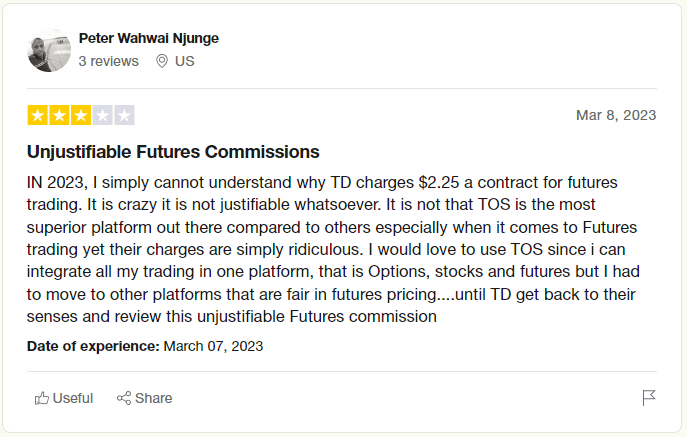

The customer support team is responsive and knowledgeable. However, a few TD Ameritrade customers complain about transfer issues, unjustifiable futures commissions, and the lack of direct crypto trading. Overall, traders are satisfied with TD Ameritrade’s offerings and have had successful experiences.

TD Ameritrade Spreads, Fees, and Commissions

Below is the detail about TD Ameritrade spreads, fees, and commissions:

TD Ameritrade Spreads

The spreads are missing from TD Ameritrade, which means you may encounter variable spreads in certain markets.

TD Ameritrade Fees

TD Ameritrade offers all clients fee-free trading in US stocks, domestic and Canadian ETFs, and options. The only exception is a small $0.65 per contract charge when trading options contracts; futures and Options Futures have slightly higher fees at $2.25 per contract (plus exchange & regulatory charges).

TD Ameritrade charges just $6.95 for each OTC trade, with no other fees included, whether to open an account or withdraw funds. In addition, the platform costs nothing and provides access to market data at no additional cost, making it even better value for money.

Furthermore, brokers often avoid sending documents through conventional mail. If an accountholder’s account is valued at less than $10,000, they will be charged a fee of $2 per paper statement. Moreover, there is no inactivity fee — a great benefit for those who may have to pause trading activities.

Minimum Deposit Fee

No minimum fee is required to open an account and start trading on TD Ameritrade. However, a deposit fee of $2,000 is required for margin and certain options.

Mutual Fund Fees

TD Ameritrade offers access to more than 23,000, of which 3,600 options have no additional transaction fees. But if you don’t fall into that category of fortunate traders, commissions will range from a low of $49.95 to an outrageous $74.95 for some fund families when buying no-load funds.

When it comes to selling no-load funds, TD Ameritrade won’t put a price tag on your transaction. On the other hand, load fund sales don’t incur an extra fee from the broker, but you will most likely be charged hefty sales commissions instead.

TD Ameritrade Commissions

TD Ameritrade stands apart from the crowd by providing zero commissions on stocks and ETFs and highly competitive pricing for options trades and mutual funds. Below is the standard pricing for different types of stocks:

- Stocks and ETFs: $0

- Stock Options: $0 + $0.65 per contract

- Mutual Funds: $0, $49.99, or $74.95

However, the zero-fee stock trades are only for online transactions. Automated phone and broker-assisted trades still come with a $5 and $25 fee, so consider this when trading through TD Ameritrade.

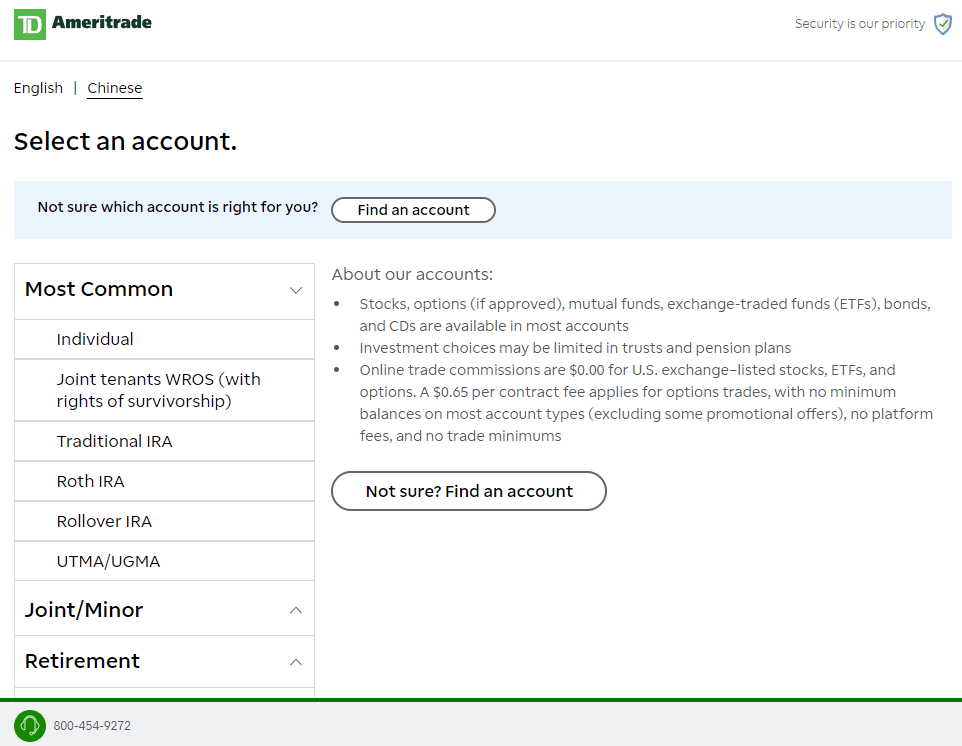

Account Types

Below are the types of account types that TD Ameritrade offers:

#1. Standard Accounts

Open a standard account to access a vast selection of investment products, comprehensive research material, plus trading platforms that grant you greater freedom. It can be opened jointly or individually; you can upgrade it for futures, options, or forex trading. No minimum funding is required for this type of account compared to margin accounts which require at least $2,000 before opening.

#2. Retirement Accounts

You can open an IRA with TD Ameritrade to start investing for your retirement with no account minimums. So whether you’re looking for tax-deferred growth in a Roth IRA or want to invest pre-tax funds in a traditional IRA, TD Ameritrade can help you get started. The retirement accounts include Traditional IRA, Roth IRA, Rollover IRA, SEP IRA, Solo 401k, SIMPLE IRA, and Pension or Profit Plan.

#3. Education Accounts

If you’re a college student looking to invest in the future, TD Ameritrade can help. You can open an Education Account with no account minimums and get access to the same features as a standard account. The education accounts include Coverdell ESA, 529 College Savings Plan, and UGMA/UTMA Custodial Accounts.

#4. Specialty Accounts

Specialty-tailored accounts are available for high-net-worth individuals, trusts, and foundations. These accounts have exclusive access to private placements, trusts, small businesses, charitable accounts, investment clubs, and other high-end investments. Specialty accounts don’t have an account minimum and have the same features as a standard account.

#5. Margin Trading Account

You can open a margin account with TD Ameritrade to access higher trading limits and capital. A minimum funding of $2,000 is required to open a margin account, and the account comes with trading privileges by providing access to advanced features such as options and futures. With a margin trading account, you can take your trading to the next level, as this account allows you to borrow money and increase your buyer power by 50%.

How To Open Your Account?

Below is the step-by-step guide on how to open an account on TD Ameritrade:

Step 1: Go to the official website of TD Ameritrade and click on ‘Open account.’

Step 2: In the next window, choose the type of account you want to open. For example, if you want to open an individual account, click ‘Open an individual account.’

Step 3: Fill in your details contact information like name, email, country, and phone number, and click on ‘Continue to personal information

Step 4: Add your personal and financial information in the given fields.

Step 5: Choose your funding method and click ‘Agree & Submit.’

Step 6: Finally, verify your account via email or mobile number and submit your application for review.

Step 7: Add your ID, Passport, and other required documents to verify your profile completely.

Your application is now processed, and you can start investing/trading with TD Ameritrade.

What Can You Trade on TD Ameritrade?

TD Ameritrade offers different types of accounts, each offering different investment options. Depending on your account type, you can check the investment choices. For example, using a standard account, you can use several investment choices like futures, forex, mutual funds, etc. At the same time, you may have limited investment choices for a pension and 529 educational accounts.

Below are the types of investments you can use with TD Ameritrade:

#1. Stocks

With TD Ameritrade, you can trade stocks from various exchanges worldwide.

#2. Options

Options are a popular form of trading as they offer investors and traders greater flexibility. You can trade options on TD Ameritrade with no minimum balance. Moreover, using the ThinkorSwim platform, you can easily execute multi-legged options strategies.

#3. Futures

TD Ameritrade offers futures trading with competitive commissions and margin rates. You can also use the futures calculator to check your margins and estimate your potential profits.

#4. ETFs

You can trade exchange-traded funds (ETFs) on TD Ameritrade. It offers a wide selection of ETFs with no commissions from leading providers like Morningstar.

#5. Mutual Funds

TD Ameritrade also offers mutual funds for investors who want to diversify their portfolios. You can browse thousands of no-load, no-transaction-fee funds from Vanguard, Fidelity, and other providers.

#6. Forex

Forex trading is another popular type of investment you can do through TD Ameritrade. Again, you can access the currency market without commission and competitive spreads.

#7. Cash Management

With TD Ameritrade, you can manage your cash more easily. You can open a Cash Management Account (CMA) to streamline your cash flow and access banking services like free checks and online bill pay.

#8. Bonds and CDs

TD Ameritrade also allows you to buy, sell, or trade bonds and certificates of deposit (CDs). As a result, you can easily access the fixed-income securities market and purchase instruments with competitive rates.

TD Ameritrade Customer Support

TD Ameritrade offers the unique benefit of direct in-person customer support. With hundreds of branches across the US, you are always close to a physical location to address any questions or concerns regarding your account. This convenient and personal service can be invaluable as you manage your investments.

Not only is customer support available 24/7 by phone and email, but it can also be sought through Twitter or Facebook Messenger — even stock trades can be completed via a chatbot in the latter. Moreover, it offers a convenient chat support option through ThinkorSwim mobile, so traders can get the help they need without leaving their app.

However, there is no live chat option available and no trading support outside of regular market hours.

Contact Details

- Phone no: 800-454-9272

- Address: 200 S 108th Ave, Omaha, NE, USA

Advantages and Disadvantages of TD Ameritrade Customer Support

Security for Investors

TD Ameritrade, operated under the parent company Charles Schwab Corporation, is a registered trademark of TD Ameritrade, Inc., and all transactions are overseen by FINRA (US Financial Services Regulatory Authority).

This brokerage company is also a member of the SIPC that protects investors against any financial losses due to fraudulent activities or insolvency on the part of TD Ameritrade. It holds up to $500,000 for each account holder in the event of bankruptcy and an additional $250,000 for cash claims.

Moreover, this broker keeps the client’s funds in a segregated account, ensuring they are not used to cover the company’s losses or expenses. TD Ameritrade also offers two-factor authentication, data encryption, and other advanced security protocols to keep customer assets safe.

Withdrawal Options and Fees

The broker’s deposit and withdrawal solutions are diverse, allowing customers to transfer funds electronically via Automated Clearing House (ACH) or wire transfer, move assets from another brokerage company, and submit checks through a mobile application or email address well as present physical stock certificates.

Withdrawals made through ACH are commission-free, while wire transfers have a fee of $25. In addition, there are additional commissions that certain banks charge for completing the transfer. Moreover, traders need to verify their accounts to make withdrawals.

TD Ameritrade Vs. Other Brokers

Below is the in-depth comparison of TD Ameritrade with other well-reputed and established brokers:

#1. TD Ameritrade vs. Avatrade

AvaTrade is a larger broker with over two million active accounts and over 250 trading instruments. Its average spread on EUR/USD pair is 0.7 pips, while TD Ameritrade offers 0.3 pips on the same pair. This broker also offers several analytical tools and assets for automated trading, including three different trading platforms.

Not to mention the brokerage’s added advantages of minimal commission, low spread, and prompt order execution — all confirmed by hundreds of satisfied customers. AvaTrade has established itself as a dependable partner that consistently delivers for its customers.

On the other hand, TD Ameritrade is the ideal platform for beginner to advanced investors, fund investors, and binary options traders. Its easy-to-navigate platform, low minimum deposit requirement, and customer service make it the perfect choice for those looking to start their trading journey or simply test out the waters.

When it comes to which broker is better, it depends on the investor’s preferences and needs. AvaTrade is more suitable for experienced traders that demand a high level of technical analysis tools, while TD Ameritrade is ideal for beginners. Ultimately, both are excellent options for investors looking to get the most out of their trading experience.

#2. TD Ameritrade vs. Roboforex

RoboForex ensures clients the best trading conditions: minimal spreads from 0 pips, instant executions at optimal speed, and micro-accounts with minuscule lot sizes of 0.01. In addition, many expert traders love RoboForex because of its instant withdrawals, operational support, and availability of copy-trading and API solutions.

Besides that, RoboForex is a renowned partner for those working in the financial market, having been distinguished by numerous awards. Not only does it possess licenses from FSC Belize and CySEC (license No. 191/13 Robomarkets Ltd), but it also provides outstanding services worldwide — making them an international leader in this field.

On the other hand, TD Ameritrade has its advantages for investors, including a wide range of asset classes and products, advanced trading tools, free educational resources and seminars, and a friendly customer service team. The broker also offers low minimum deposits and no withdrawal fees, making it a great choice for those looking to get started in the financial markets.

Both brokers offer comprehensive services and cater to different needs. RoboForex is more suited for experienced traders, whereas TD Ameritrade provides the ideal platform for beginner investors and fund managers. Compared to TD Ameritrade, RoboForex has a slight edge as it provides leverage of 1:3000 and does not restrict its services to US customers.

Overall, it comes down to the individual needs of a trader – both brokers offer great value, and it’s simply a matter of finding the right one for you. So, whether you choose RoboForex or TD Ameritrade, you can rest assured that you’ll be in good hands. You’ll get an excellent trading experience with either broker and take your investment game to the next level.

#3. TD Ameritrade vs. Alpari

For 21 years, Alpari has been a dependable partner in the Forex market, providing traders with favorable trading conditions. Offering both an account for beginners and classic accounts for pros alike, as well as ECN accounts that promise low spreads to more experienced investors.

Alpari also offers low commission, the MetaTrader 4 platform, a range of trading instruments such as binary options and currencies, and an impressive selection of educational materials for traders. The company also provides excellent customer service that is available 24/7. Moreover, Alpari broker vigilantly evaluates its managers’ scores to reduce investors’ risk when selecting a PAMM account or portfolio that aligns with their objectives.

In comparison, TD Ameritrade also offers many advantages, including robust trading tools and research, comprehensive educational resources and seminars, and a large selection of asset classes and products such as futures, mutual funds, and bonds. The broker also features low minimum deposits and no withdrawal fees, making it ideal for novice investors.

Alpari and TD Ameritrade offer a wealth of benefits, making them great options if you want to begin trading. However, Alpari is the better choice for competitive spreads and a wide range of tools. At the same time, TD Ameritrade is more suited for beginner traders who want an easy-to-use platform and comprehensive educational resources.

Alpari has a slight edge regarding leverage and the ability to trade in a wide range of markets, but TD Ameritrade is more focused on novice investors. So, depending on your wants and needs, either broker is a great choice for your financial endeavors. With Alpari or TD Ameritrade, you can rest assured that you’ll have the best trading experience and make smart investments.

Conclusion: TD Ameritrade Review

TD is an industry leader in the US as far as online brokers go, and they offer all trades with no commission on stocks and ETFs. In addition, their research, education, and ThinkorSwim desktop platform give traders access to various tools, and their in-person customer support offers an invaluable asset for traders.

On top of that, the broker enforces the highest security measures with their segregated accounts and two-factor authentication. TD Ameritrade has limited withdrawal options. However, there is no commission fee on ACH transfers.

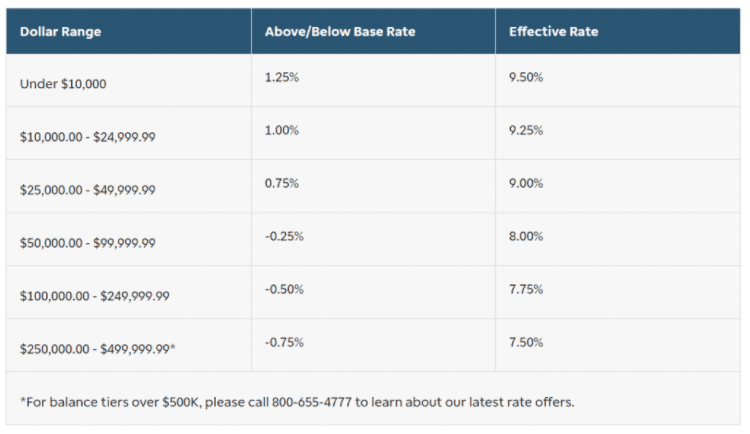

There are a few downsides, such as the high financing (margin) rates and lack of acceptance for credit/debit cards or electronic wallets in money transfers. Also, the product portfolio is just available in US equities and ETFs, unlike other brokers, which offer access to a wider range of financial markets.

Overall, TD Ameritrade is a great choice for US traders who need access to the stock, ETF, and options markets. The broker provides an excellent platform with plenty of features, tools for traders of all levels, and great customer service.

TD Ameritrade Review FAQs

Is TD Ameritrade regulated?

TD Ameritrade is regulated by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC). This means that the broker must abide by all laws and regulations set forth by these organizations, which help protect traders and investors from unfair business practices or fraud.

What is TD Ameritrade’s minimum deposit?

Depending on the type of account, TD Ameritrade has a minimum deposit requirement of $0 for cash accounts and $2,000 for margin accounts.

Does TD Ameritrade charge withdrawal fees?

TD Ameritrade does not charge any withdrawal fees for ACH transfers. However, there is a $25 fee associated with wire transfers.