T4Trade Review

T4Trade is a global pioneer in online trading which offers both expert and novice traders’ access to a diverse range of trading instruments across global financial markets. The features of T4Trade are designed to fulfill the demands of all traders, making it an excellent alternative for potential traders seeking a dependable and versatile brokerage service.

In this article review, we’ll look at what distinguishes T4Trade, including its primary selling factors and potential drawbacks. You’ll learn about the numerous account types, deposit and withdrawal procedures, commission structures, and beneficial information. By combining expert research with actual trading experiences, we at Asia Forex Mentor aspire to give you all of the information you need to decide whether T4Trade is the appropriate broker for you and your risk.

What is T4Trade?

T4Trade is a contract-for-difference broker, or CFD, that provides commission-free trading on a variety of assets, such as currencies, commodities, indices, and equities. T4Trade is subject to regulation by the Seychelles FSA and offers platforms such as MetaTrader 4 and WebTrader with leverage of up to 1:1000 which means you can borrow up to 1000 times the money you have to trade more, and it’s based upon the account type. Educational resources are accessible to users, who may select from a variety of account options, such as Cent accounts that are suitable for beginners.

T4Trade is suitable for both novice and experienced traders as a result of its customizable options and diverse selection of assets. Nevertheless, it is imperative that a potential user such as yourself exercise proper risk management and thoroughly evaluate all factors, particularly when employing borrowed capital.

T4Trade Regulation and Safety

T4Trade operates under the regulatory oversight of the Seychelles Financial Services Authority (FSA). Since Seychelles Financial Services Authority (FSA) is considered less strict compared to other regulated broker in the U.S and Europe as part of its commitment to safeguarding client funds, T4Trade has implemented an additional layer of protection.

This includes keeping all your capital in segregated accounts, which means that your funds are held separately from the broker’s own assets. This measure provides an extra layer of security in the event of bankruptcy.Additionally, T4Trade partnered with a top-tier bank to ensure that the segregated funds are secured. T4Trade uses advanced security measures to protect your personal information and financial transactions.

This includes using encryption technology on its trading platforms. These safeguards, along with the reliable MetaTrader 4 platform, make T4Trade a relatively secure and trustworthy place to trade. However, it’s important to consider the level of regulatory oversight provided by the Seychelles Financial Services Authority (FSA) when deciding if T4Trade is right for you, especially if you have a high-risk tolerance.

T4Trade Pros and Cons

Pros

- Wide Range of Trading Instruments

- Flexible Account Types

- Mobile Trading

- MetaTrader 4 Platform

Cons

- High Leverage Risks

- Withdrawal Fees

- Regulation

Benefits of Trading with T4Trade

The MetaTrader 4 (MT4) platform is one of the most advantageous features of T4Trade, as it is user-friendly, even for novice traders. The platform includes advanced charts and the capacity to automate transactions because of the convenient trade copier interface.

Additionally, their application allows for hassle-free trading on mobile devices, eliminating the necessity to remain reliant on a computer to oversee your trading transactions. T4Trade provides access to more than 300 financial instruments, including Forex market, commodities, indices, and equities, enabling both experienced traders and potential traders to diversify their investments across various global financial markets.

T4Trader also provides flexible leverage, which enables traders to trade larger quantities even if their account balance is low. T4Trade also offers a variety of account types, such as demo account, which allows novice traders to practice and more experienced traders to transition into actual trading platform with reduced risks.

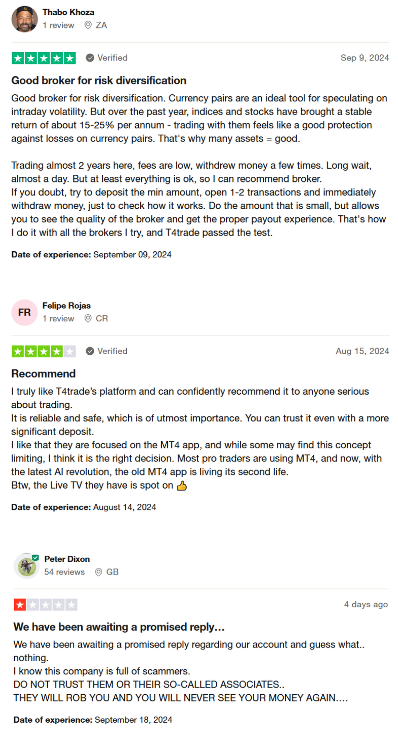

T4Trade Customer Reviews

T4Trade has received a lot of mixed comments, let’s start with the positive feedbacks; firstly we have gathered such as the following: wide variety of tradable assets by the platform, user-friendly interface and smooth deposit and withdrawal, Many users also appreciated the educational resource and responsive customer support of T4Trade, but despite the good feedbacks received by T4Trade, it also received negative reviews, some of which are as follows: delay in withdrawing large amounts of money , and some customer service issues.

T4Trade Spreads, Fees, and Commissions

T4Trade charges floating spreads, which means that the cost of trades changes based on market conditions. For popular currency pairs like EUR/USD, the spread is usually 1.8 to 2.1 pips, which is a bit higher than average.

They don’t charge fees for deposits or withdrawals, but some third-party fees might apply. However, there’s a 3% inactivity fee if you deposit money and don’t trade.

T4Trades’ structure is well-suited for professional traders who prefer commission-free transactions, but its higher spreads might not be great for everyone, especially to those focused on minimizing trading costs, particularly in the forex market.

Account Types

T4Trade provides multiple account types to suit the needs of different traders. The following are:

Standard Account

This is suitable for most traders, with floating spreads starting at 1.8 pips, making it a good option for those looking for flexibility in market conditions.

Premium Account

Offering tighter spreads from 1.6 pips, this account is ideal for traders seeking a bit more competitive pricing.

Privilege Account

This account offers even lower spreads, starting at 1.1 pips, catering to experienced traders who require finer spreads for their trading strategies.

Cent Account

Designed for beginners, the Cent account allows trading with smaller capital by converting deposits into cents. This means you can start with minimal risk while practicing or developing your trading strategies.

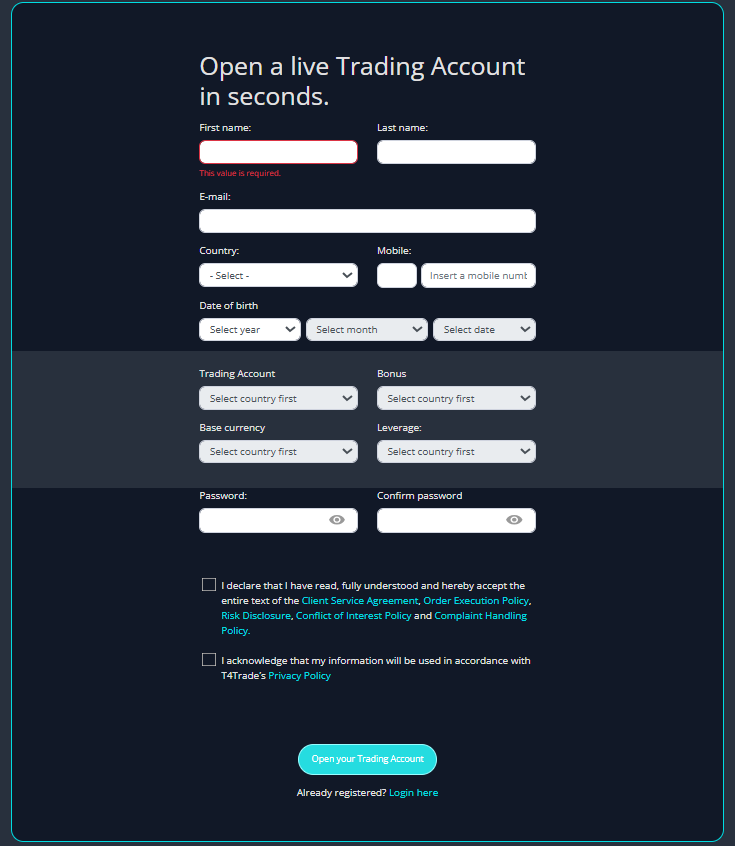

How to Open Your Account

Step 1: Visit the T4Trade Website

Go to the Official T4Trade website and click the “Open Account” or “Sign Up” button on the homepage.

Step 2: Fill Out the Registration Form

Once you’ve clicked on ‘Sign Up’ Button you’ll be redirected into another form where in you should input the following:

- Personal details: such as name, email, phone number, and country of residence.

- You will also need to create a username and password for your account.

- You have to tick out the box in order to create your account.

Step 3: Select Account Type

Choose the account type that fits your needs, such as Standard Account, Premium Account, Privilege Account, or Cent account. Decide whether you want fixed or floating spreads based on your trading strategy.

Step 4: Complete KYC Verification

You will need to submit documents for Know Your Customer (KYC) verification:

- Proof of Identity (passport or government-issued ID).

- Proof of Address (utility bill, bank statement).

Step 5: Deposit Funds

After your account is verified, proceed to the deposit section and select your preferred funding method (bank transfer, credit/debit card, e-wallet, etc.). Choose the base currency of your account (USD, EUR, or GBP).

Step 6: Start Trading

Once the deposit is confirmed, you can begin trading on MetaTrader 4 (MT4), WebTrader, or the mobile app. By following these steps, you’ll successfully open and fund your account on T4Trade, allowing you to start trading across their wide range of assets.

T4Trade Trading Platforms

T4Trade offers a variety of trading platforms designed to meet the needs of traders with different preferences. Here are the key platforms that T4Trade provides:

- MetaTrader 4 (MT4): It is widely used and well-known for its user-friendly interface, making it suitable for both beginners and experienced traders. It offers advanced charting tools, technical analysis indicators, and automated trading through Expert Advisors (EAs). It is also available on desktop, web, and mobile versions, allowing traders to access their accounts from anywhere.

- MetaTrader5 (MT5): An upgraded version of MT4, offering more advanced features such as additional timeframes, order types, and technical indicators. MT5 Provides a more comprehensive range of analytical tools, making it ideal for professional traders. It supports both hedging and netting and includes an economic calendar for fundamental analysis.

- Web Trader: A browser-based platform that allows traders to access their accounts without needing to download any software. Offers real-time market access, charting tools, and easy trade execution similar to MT4 and MT5. Ideal for traders who want quick access from different devices, as long as there’s an internet connection.

- Mobile-Trading Apps: T4Trade provides mobile apps for both iOS and Android devices, ensuring traders can manage their accounts on the go. These apps are usually linked to the MT4 and MT5 platforms, offering many of the same features including real-time charts, market news, and the ability to execute trades quickly.

What can you trade on T4Trade

On T4Trade, you can trade a wide range of financial instruments using Contracts for Difference (CFDs). This includes:

- Forex: Major, minor, and exotic currency pairs.

- Metals: Precious metals like gold (XAU/USD) and silver (XAG/USD).

- Indices: Global indices such as the Aussie 200, German DAX, and more.

- Commodities: Products like crude oil and other commodities.

- Futures: CFDs on futures for various assets including commodities and indices.

- Shares: Stocks from major markets like the US, UK, and Germany.

T4Trade offers over 300 trading instruments across these asset classes, providing traders with extensive opportunities to diversify their portfolios.

T4Trade Customer Support

T4Trade provides 24/5 multilingual customer support to address the questions and concerns of merchants. The support team is available through a variety of channels, such as live chat, email, and phone, to ensure that you have the option that best suits your preferences and urgency. Their objective is to offer professional and timely support, thereby facilitating the effective resolution of trading or account-related issues.

Live chat is accessible directly from their website, making it the perfect choice for obtaining immediate assistance or answering quick inquiries. Responses are typically provided within one business day, and email support is also available for more detailed inquiries. Phone support is available during their operating hours and provides direct and personalized assistance for more urgent matters.

Furthermore, T4Trade provides a comprehensive FAQ section on their website that addresses frequently asked concerns regarding account management, trading platforms, and technical issues. This resource frequently offers solutions without necessitating direct communication with support. Additionally, they offer webinars, trading podcasts, and on-demand videos for educational purposes, which aid traders in enhancing their skills and knowledge.

In general, T4Trade’s objective is to offer a dependable trading platform and improve the user experience by implementing a robust support system. Their customer support and educational resources are intended to assist you in making well-informed trading decisions and promptly resolving any issues, regardless of whether you are a novice or seasoned trader.

Advantages and Disadvantages of T4Trade Customer Support

Withdrawal Options and Fees

Withdrawal Options:

T4Trade offers several withdrawal methods, including Credit/Debit Cards (minimum $50), Bank Transfers (minimum $100), and E-wallets like Neteller and Skrill (minimum $10). The platform also supports withdrawals via Digital Assets, providing flexibility for users based on their preferred payment method.

Fees:

T4Trade does not charge platform fees for withdrawals, but additional fees may be imposed by banks or e-wallet providers. An inactivity fee of $50 is applied if the account remains inactive for more than 30 days. Additionally, a 3% administration fee may be charged if there is no or minimal trading activity in the account.

T4Trade Vs Other Brokers

#1. T4Trade Vs AvaTrade

T4Trade and AvaTrade are very different when it comes to how they’re regulated and what they offer. T4Trade is regulated by a less strict authority, while AvaTrade is regulated by many different ones, which means it’s safer for investors. AvaTrade also has more choices for trading platforms, while T4Trade is simpler.

T4Trade has lower fees and lets you borrow a lot more money to trade, which can be good if you want to make a lot of money with a small investment. But AvaTrade has even lower fees and doesn’t let you borrow as much, because it’s regulated more strictly. So, AvaTrade is safer and has more options, while T4Trade is good for people who want to borrow more and keep it simple.

#2. T4Trade vs RoboForex

T4Trade and RoboForex offer MetaTrader 4 support and high leverage options, with T4Trade offering up to 1:1000 leverage. RoboForex supports MetaTrader 5 and cTrader, offering a wider range of platform options. T4Trade offers commission-free models with variable spreads, while RoboForex provides commission-free accounts and 24/7 customer support.

#3. T4Trade vs Exness

T4Trade, regulated by the Seychelles Financial Services Authority (FSA), provides a more relaxed trading environment with higher leverage options. This can appeal to risk-tolerant traders seeking greater potential returns. However, the FSA’s oversight may be less stringent than top-tier regulators. Exness, on the other hand, is regulated by the FCA and CySEC, offering a more secure and robust trading platform. With leverage options up to 1:2000, it caters to a wider range of trading strategies. Exness also boasts tighter spreads, starting from 0.0 pips, and a variety of trading tools, including its own WebTerminal and MetaTrader 4 and 5.

In essence, T4Trade is a good choice for traders seeking high leverage and a simpler trading experience. Exness, on the other hand, is better suited for those prioritizing security, a wider range of trading tools, and tighter spreads.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: T4Trade Review

In summary, T4Trade is a trading platform that is multifaceted, providing a variety of trading instruments, competitive spreads, and high leverage, which makes it appealing to both novice and expert traders. It distinguishes itself by offering replicate trading capabilities through ‘TradeCopier’ and is compatible with popular platforms such as MetaTrader 4 and WebTrader. Nevertheless, the FSA Seychelles’ Tier-3 regulation may not provide the same level of security as brokers that are more severely regulated. In general, T4Trade is a reliable option for traders who are interested in high leverage and flexible trading options. However, traders should be aware of the regulatory environment and potential risks.

T4Trade Review: FAQs

What trading platforms are available on T4Trade?

T4Trade offers various account types, including Standard, Premium, Premium, Premium, Premium, and Cent, catering to different trading needs and volume levels.

What Educational Resources Are Available?

T4Trade offers educational resources like webinars, podcasts, videos, and ebooks to enhance traders’ skills in trading strategies, market analysis, and trading psychology.

What is Leverage and Margin?

Leverage enables traders to manage larger positions with a reduced quantity of capital. For instance, a 1:1000 leverage ratio enables traders to manage $1,000,000 with a mere $1,000. Margin is the sum of money that is necessary to establish and sustain a leveraged transaction, serving as collateral for the broker to mitigate potential losses.

OPEN AN ACCOUNT NOW WITH T4TRADE AND GET YOUR BONUS