Switch Markets Review

Switch Markets, a relatively new entrant in the over-the-counter market, has quickly carved out a reputation for itself since its inception in 2019. Standing out in the cluttered trading landscape, this dynamic broker is making waves through the development of innovative, state-of-the-art technical trading solutions. Integrating a custom-built risk management system, a host of calculators, and offering exclusive trading advisory services, Switch Markets is going the extra mile to empower its clientele. These avant-garde facilities are made available to all traders irrespective of their expertise level, ensuring that each client has an arsenal of tools at their fingertips.

This comprehensive review will delve into the various aspects of Switch Markets. We will critically examine its unique features, commission structures, types of accounts, transaction procedures, and more to provide a holistic viewpoint. This assessment will combine expert opinions with real-world trader experiences to help potential clients in making an informed choice.

What is Switch Markets?

An Australian entity, Switch Markets, is a fresh face in the trading arena, having commenced operations in 2019. Although based in Australia, the broker extends its services globally. It operates under the rigorous regulation of the Australian Securities and Investments Commission (ASIC), a financial regulator of international repute and trust.

Switch Markets International PTE Ltd oversees its global operations, acting as an authorized representative of its parent company, Royal ETP LLC. The parent company originates from St Vincent and the Grenadines. Despite being relatively new, Switch Markets has made remarkable progress in establishing a robust global footprint and a reputation for uncompromising regulatory compliance.

Advantages and Disadvantages of Trading with Switch Markets?

Benefits of Trading with Switch Markets

Switch Markets has several benefits that enhance the trading experience. Forex traders can start with a minimum deposit of $50. Leverage of up to 1:1000 enables traders to open trades on major assets within the guidelines of risk management. The platform boasts a high execution speed, averaging between 70-80 ms.

Switch Markets offers a variety of helpful trading tools such as a free Forex profit calculator, lot calculations, points, trading advisors, and a training base with practical analytical tools. It also provides a free VPS server, ensuring order execution delay to a maximum of 3-5 ms. Furthermore, the broker welcomes new clients with a bonus of up to 5,000 US dollars.

Switch Markets Pros and Cons

Pros:

- Offers zero commission accounts, allowing quick start of trading.

- Charges low commissions with tight spreads starting from 0.0 pips.

- Provides Islamic accounts for Muslim traders.

- No inactivity fees charged.

- Offers a demo account for strategy testing.

- Supports a wide variety of deposit and withdrawal methods.

Cons:

- Lacks managed account options.

- Services are not available for clients from certain countries.

- Does not support FIX API connectivity.

- Does not provide MetaTrader 5 or cTrader platforms.

Switch Markets Customer Reviews

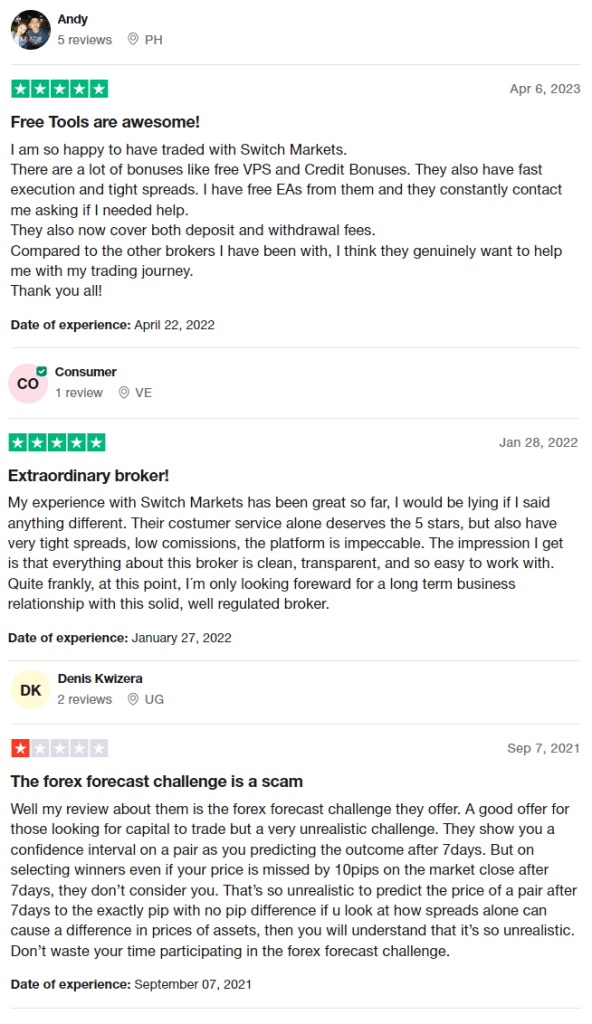

In general, clients hold positive views about Switch Markets, citing the provision of bonuses, fast execution, and tight spreads as significant benefits. Customers also appreciate their efficient customer service and transparent operations. However, some traders expressed dissatisfaction with the forex forecast challenge, finding it unrealistic in its criteria for selection.

Switch Markets Spreads, Fees, and Commissions

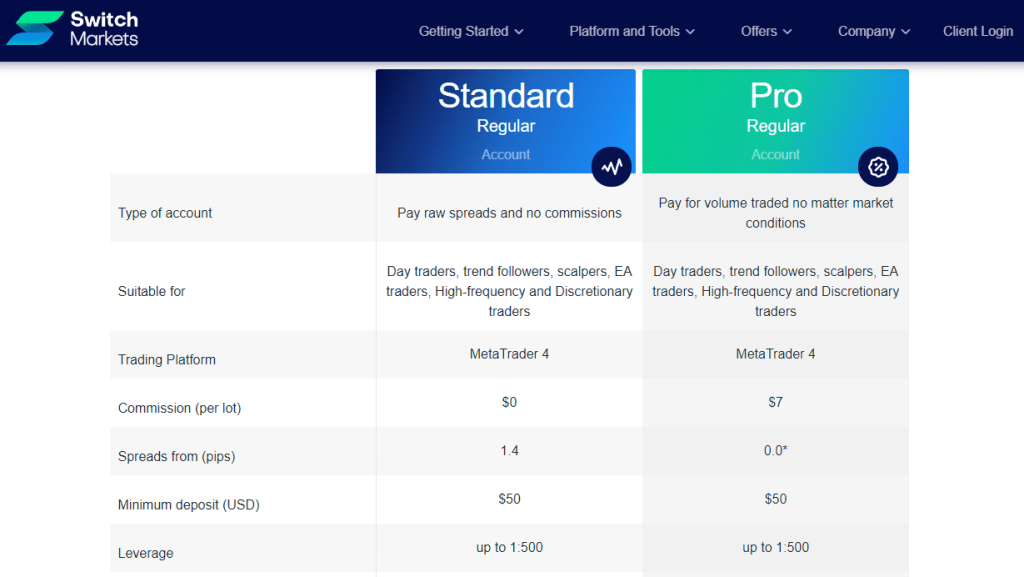

A key consideration for any trader when choosing a forex broker is the associated costs of trading, which mainly include spreads, fees, and commissions. In the case of Switch Markets, there is a clear bifurcation in these charges based on the type of account – Standard or Professional.

For Standard Account holders, the trading costs come mostly in the form of spreads. These start from 1.4 pips, with no extra commissions per lot traded. This account type can be especially appealing to novice traders as it provides a simple, predictable cost structure, allowing traders to easily calculate potential profits and losses. It’s noteworthy, though, that these spreads may widen during times of heightened market volatility or for certain “exotic” trading instruments, where the spread might range from 2.0 to 2.2 pips.

Professional Account users, conversely, encounter a dual cost structure, involving both spreads and commissions. The spreads for this account type start from as low as 0 pips, giving Pro traders access to the raw, tight spreads often seen in interbank markets. However, this comes with a fixed commission of $7 per lot traded, a cost structure preferred by experienced traders who conduct high-volume trades and are willing to pay for the precise market conditions.

It’s important to note that both types of accounts attract a commission on open trades that are held overnight, also known as a swap fee. Furthermore, while Switch Markets offers an extensive array of deposit options, withdrawal requests do incur a broker’s commission ranging from 0.5% to 2% depending on the method chosen. It’s also worth mentioning that Switch Markets covers deposit and withdrawal fees, a feature that has been appreciated by many clients.

Account Types

Switch Markets, a classic Straight Through Processing (STP) broker, caters to traders at various stages of their trading journey, offering two distinct account types – Standard and Professional.

The Standard Account is designed for simplicity and transparency, with raw spreads and no extra commissions. Spreads start from 1.4 pips, with no commission per lot. This setup simplifies the cost structure for novice traders who prefer a clear understanding of their trading costs.

Conversely, the Pro Account is designed for seasoned traders who pay for the volume they trade, irrespective of market conditions. This account type carries a commission of $7 per lot but offers the advantage of spreads starting from $0.0. This kind of account can be beneficial for high-frequency traders who can leverage the low spreads while paying a per-lot commission.

Both Standard and Pro trading accounts are versatile and cater to various trading styles, making Switch Markets a suitable platform for traders with diverse trading strategies.

How to Open Your Account

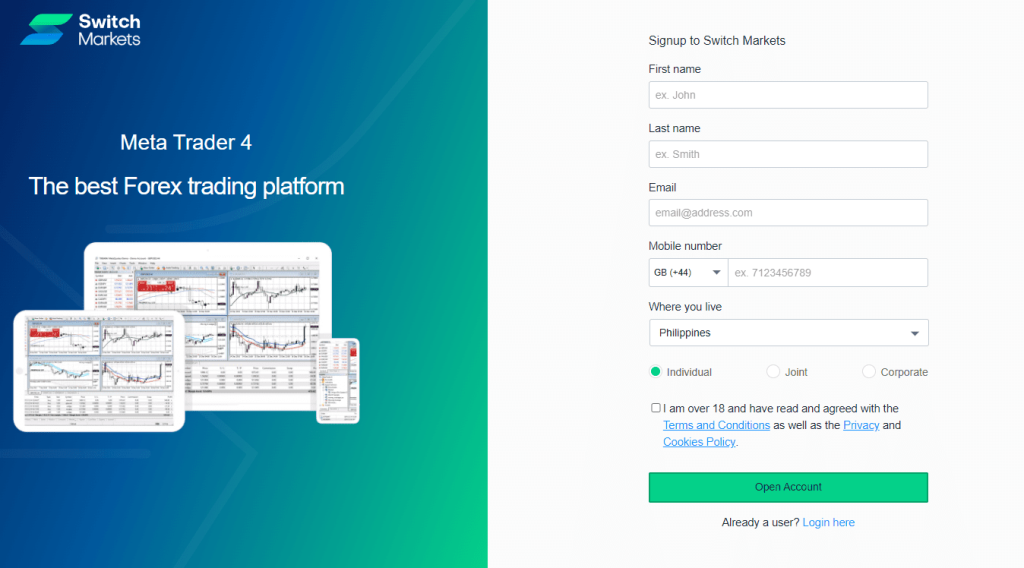

Creating an account with Switch Markets is a straightforward, user-friendly process designed to quickly onboard traders to its trading platform.

1. Visit their website.

The initial step involves navigating to the official Switch Markets website. Once there, prospective traders will find the “Create Live Account” button prominently positioned on the home page. Clicking on this initiates the account creation process.

2. Fill out their online form.

The subsequent step requires the completion of an online form, gathering basic personal and financial information. Accuracy in providing this information is paramount as it will be used for future account verification, in compliance with regulatory requirements aimed at client safety and anti-money laundering measures.

3. Verify your account and start trading.

After the form submission, Switch Markets will send an account verification email to the provided address. This email provides a detailed, step-by-step guide to completing the verification process, ensuring that the account is ready for trading. Once the verification is complete, the new account is activated, and clients can log in and begin their trading journey.

What Can You Trade on Switch Markets

One of the standout features of Switch Markets is the extensive range of tradable instruments available to its clients. This wide selection caters to diverse trading strategies and risk appetites.

Forex trading, arguably the most popular trading market worldwide, is well-represented, with over 62 currency pairs available for trading. These encompass major, minor, and exotic pairs, giving traders a broad spectrum of choices. Forex’s high liquidity, 24/5 operational hours, and volatility provide ample opportunities for speculative trading, making it a go-to choice for many traders.

In addition, Switch Markets offers 82 stock CFDs, enabling clients to speculate on the price movements of popular stocks without needing to own the underlying asset. This is particularly useful for traders who wish to diversify their portfolios or take advantage of short-term price movements in equity markets.

For those interested in trading market indices, Switch Markets provides access to 21 global indices. These instruments allow traders to take positions on entire sectors or economies, offering a different risk/reward balance compared to individual stocks or currency pairs.

Commodities and cryptocurrencies are also available for trading at Switch Markets. With 8 commodities, including precious metals and energy products, and 6 cryptocurrencies, traders can further diversify their portfolios and potentially profit from different market cycles.

Switch Markets Customer Support

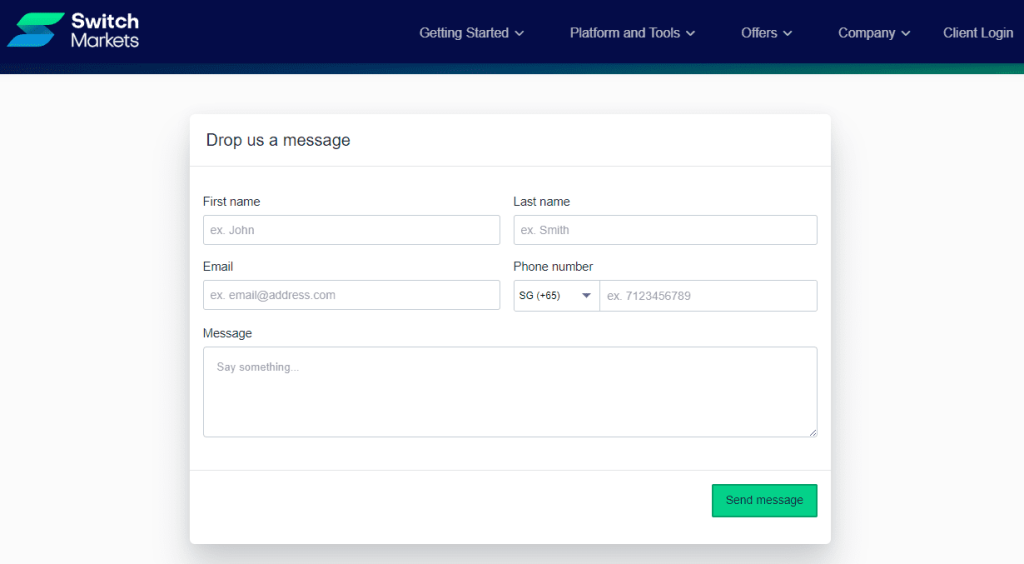

Switch Markets values the importance of responsive customer support. The support team is available five days a week during business hours to assist clients. Traders can reach the customer support team through various channels, including a feedback form on the broker’s website, an online chat function, traditional email, and various social networks. One standout feature of their customer service is that registration is not a prerequisite for answering queries, making it easier for potential clients to obtain necessary information.

Advantages and Disadvantages of Switch Markets Customer Support

Security for Investors

Withdrawal Options and Fees

Switch Markets supports over ten types of payment methods, including bank payment systems and virtual electronic wallets. The broker is planning to add cryptocurrency payment functionality in the future. The receipt of funds varies between 1 to 3 business days depending on the chosen method, with bank system withdrawals taking the longest and e-wallet withdrawals processing within a few hours.

Payment methods and systems include Visa/MasterCard, bank transfer, Neteller, Skrill, FasaPay, UnionPay, Perfect Money, PayTrast, Globe Pay, NganLuong.vn, Interac, and wire transfer. The accepted currencies for deposits and withdrawals are USD, EUR, AUD, GBP, CAD, NZD, SGD, CHF, and PLN.

In addition to the payment system’s commissions for money withdrawal, there are broker’s commissions ranging from 0.5%-2%. There are no restrictions on the withdrawal amount or the number of withdrawal requests.

Switch Markets Vs Other Brokers

#1. Switch Markets vs AvaTrade

AvaTrade and Switch Markets are both commendable forex brokers with their own strengths. AvaTrade is globally recognized and has been in the market since 2006, with a robust presence in over 150 countries. AvaTrade’s trading portfolio is more extensive, offering over 1,250 financial instruments for trading compared to Switch Market’s more modest selection. This means AvaTrade may appeal more to traders seeking broad market exposure and diversification opportunities. Furthermore, AvaTrade’s presence in four major jurisdictions and its numerous regulatory licenses provide an additional level of trust and security for traders.

On the other hand, Switch Markets stands out with its dual account structure catering to both novice and professional traders. Its simple cost structure in the standard account and more competitive spreads in the professional account can make it more appealing for certain types of traders. Furthermore, Switch Markets covers deposit and withdrawal fees, which is a distinct advantage over many brokers, including AvaTrade.

Verdict: Both brokers have their unique strengths, but if cost-effectiveness and a more personalized account structure are your top priorities, Switch Markets may be the more suitable option. However, if you’re seeking a broad range of tradable instruments and the added security of multiple global licenses, AvaTrade may be the better choice.

Also Read: AvaTrade Review 2023 – Expert Trader Insights

#2. Switch Markets vs RoboForex

RoboForex is a veteran broker with an expansive range of over 12,000 trading options, dwarfing Switch Markets’ offering. They’re known for their cutting-edge technologies and wide selection of trading platforms, including MetaTrader, cTrader, and RTrader. RoboForex’s unique ContestFX adds an additional layer of incentive and excitement to the trading process.

In contrast, Switch Markets, while having a more limited range of tradable instruments, excels in its straightforward and competitive cost structures. Traders on Switch Markets can also enjoy benefits like coverage of deposit and withdrawal fees.

Verdict: If you’re a trader who values a vast range of trading options and a variety of platforms, RoboForex may be the better option for you. However, if cost-effectiveness and transparent pricing are your priorities, Switch Markets could be a better choice.

#3. Switch Markets vs Exness

Exness is a well-regarded broker known for its beneficial trading conditions, including low commissions, immediate order execution, and prompt withdrawal. It’s particularly known for its infinite leverage on small deposits, which can appeal to traders looking for high-leverage opportunities. Furthermore, the broad range of instruments, including CFDs for stocks, energy, metals, and more than 120 currency pairings, makes it a solid choice for traders wanting to diversify their portfolios.

However, Switch Markets shines with its tailored account types and cost structure, appealing to both new and professional traders. Also, the coverage of deposit and withdrawal fees is a distinct advantage for Switch Markets.

Verdict: If you’re a trader who values high leverage and broad trading options, Exness may be the better choice for you. But if you value cost-effectiveness, transparent pricing, and tailored account types, Switch Markets might be a more suitable choice.

Conclusion: Switch Markets Review

Switch Markets is a broker that stands out for its distinct account types, transparent and competitive pricing structures, and client-friendly policies like coverage of deposit and withdrawal fees. While it may not offer the extensive range of trading instruments that some of its competitors provide, its clear focus on providing cost-effective trading conditions and tailored solutions for both new and experienced traders is commendable.

The broker has built a reputation for excellent customer service and user-friendly platforms. Its commitment to client satisfaction is evident in the range of support and educational resources available to traders. Therefore, Switch Markets makes a strong case for itself for traders who prioritize low-cost trading, transparency, and an intuitive trading experience.

Switch Markets Review: FAQs with Answers

Is Switch Markets regulated?

Yes, Switch Markets is regulated by the Australian Securities and Investments Commission (ASIC).

What types of accounts does Switch Markets offer?

Switch Markets offers two types of accounts: a Standard account and a Pro account. The Standard account is designed for newer traders and offers zero commissions but slightly higher spreads. The Pro account, on the other hand, is designed for experienced traders and offers lower spreads but includes a commission fee.

Does Switch Markets offer demo accounts?

Yes, Switch Markets offers demo accounts. This allows traders to familiarize themselves with the platform and try out trading strategies without risking real money. The demo accounts mimic live trading conditions, providing a realistic trading experience.