In the world of forex trading, having a reliable and trustworthy broker is crucial for success. For those interested in the Swiss market, Swiss forex brokers offer a unique advantage. Switzerland, known for its stability and financial expertise, has a long-standing history in the realm of finance.

In this comprehensive guide, we will explore the rich history of trading in Switzerland, delve into forex regulation in the country, discuss the key factors to consider when choosing a Swiss forex broker, and highlight some popular forex brokers in Switzerland. Whether you are an experienced trader or just starting out, this article will provide valuable insights into the Swiss forex market.

History of Trading in Switzerland

Switzerland boasts a rich history of trading that stretches back centuries. Situated in the heart of Europe, the country's strategic location has made it a crossroads for international commerce. Swiss cities such as Geneva and Zurich have served as vital trading hubs, attracting merchants and traders from all corners of the globe.

Over time, Switzerland's financial sector developed a reputation for reliability and discretion, with Swiss banks gaining prominence as trusted custodians of wealth. This reputation naturally extended to the forex market, making Swiss forex brokers highly sought after by traders who value Switzerland's robust financial infrastructure and expertise.

Forex Regulation in Switzerland

Switzerland is renowned for its stringent financial regulations, and the forex market is no exception. The primary regulatory authority overseeing forex brokers in Switzerland is the Swiss Financial Market Supervisory Authority (FINMA). This regulatory body ensures that Swiss forex brokers adhere to strict guidelines, safeguarding the interests of traders and maintaining the integrity of the financial system.

FINMA's regulations include requirements for capital adequacy, the segregation of client funds, transparent pricing, and risk management standards. By selecting a Swiss forex broker regulated by FINMA, traders can have confidence in the security and reliability of their chosen broker. The regulatory framework guarantees that brokers operate transparently, protecting traders from fraudulent activities and promoting fair trading practices. Swiss forex brokers are also required to maintain adequate capital reserves, ensuring they can weather market volatility and provide a secure trading environment for their clients.

How to Choose a Swiss Forex Broker

Selecting the right forex broker is pivotal to successful trading. Here are some key factors to consider when choosing a Swiss forex broker:

a. Regulation

Ensure that the broker is regulated by FINMA. Regulation provides a crucial layer of protection for traders and ensures that the broker operates in compliance with Swiss financial regulations.

b. Security

Look for brokers that prioritize the security of client funds and personal information. Robust security measures, such as data encryption and segregated client accounts, help safeguard against unauthorized access and potential cyber threats.

c. Trading Platforms

Evaluate the trading platforms offered by the broker. Look for user-friendly interfaces, advanced charting tools, and access to real-time market data. Popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely used and offer a comprehensive suite of features.

d. Trading Conditions

Consider factors such as spreads, leverage options, order execution speed, and the range of available trading instruments. Low spreads and favorable trading conditions can significantly impact trading profitability.

e. Customer Support

Opt for brokers that offer responsive and multilingual customer support. Efficient customer support can promptly address any concerns or issues that may arise during trading, ensuring a smooth trading experience.

Best Swiss Forex Brokers

#1. Libertex

What is Libertex

Libertex is a leading Swiss forex broker renowned for its user-friendly trading platform and extensive range of tradable assets. Traders gain access to forex, stocks, indices, commodities, and cryptocurrencies through this platform.

Advantages and Disadvantages of Trading with Libertex

Commissions and Fees

Libertex operates on a spread-based model, and the fees vary depending on the trading instrument. Generally, the spreads offered by Libertex are competitive when compared to other brokers in the market.

#2. Plus500

What is Plus500?

Plus500 is a leading fintech firm offering a proprietary trading platform that provides Swiss clients access to Contracts for Difference (CFDs) across various asset classes, including forex, indices, commodities, cryptocurrencies, and shares. The platform is user-friendly and available on web, desktop, and mobile devices, catering to both novice and experienced traders. While Plus500 is not regulated by Swiss authorities such as FINMA, it operates under multiple global licenses, including those from the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC).

Advantages and Disadvantages of Plus500

Plus500 Commissions and Fees

Plus500 primarily earns through the market spread, meaning it does not charge commissions on trades. However, traders should be aware of certain additional fees: an overnight funding fee is applied when positions are held open past a specified time; a currency conversion fee of up to 0.7% is charged for trades on instruments denominated in a currency different from the account's base currency; and an inactivity fee of up to USD 10 per month is levied if there is no account login activity for a period of at least three months. Notably, Plus500 does not impose deposit or withdrawal fees, but traders should be mindful of potential charges from payment providers or banks, especially in cases of international transactions or currency conversions.

OPEN AN ACCOUNT NOW WITH PLUS500 AND GET YOUR WELCOME BONUS

OPEN A DEMO ACCOUNT ON PLUS500

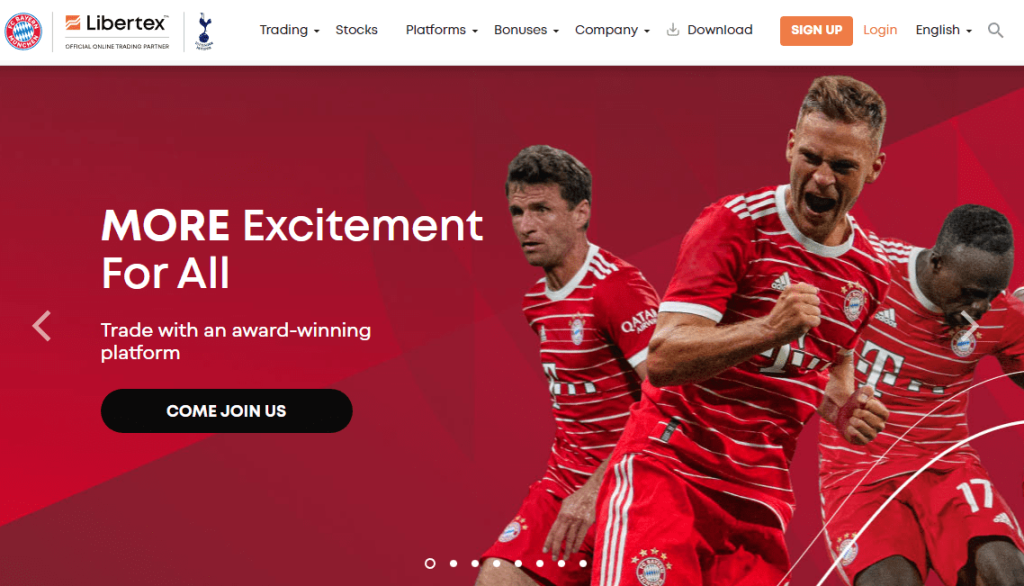

#3. Dukascopy

What is Dukascopy

Dukascopy is a well-established Swiss forex broker renowned for its advanced trading technology and robust liquidity. Traders gain access to a range of trading platforms, including the popular MetaTrader 4 and Dukascopy's proprietary JForex platform.

Advantages and Disadvantages of Trading with Dukascopy

Commissions and Fees

Dukascopy charges commissions based on the trading volume and the account type. The spreads offered by Dukascopy are generally tight, making it a suitable choice for frequent traders.

#4. Swissquote

What is Swissquote

Swissquote is one of the largest Swiss forex brokers, offering a wide range of financial services. Traders gain access to various trading platforms, including MetaTrader 4, MetaTrader 5, and Swissquote's proprietary Advanced Trader platform.

Advantages and Disadvantages of Trading with Swissquote

Commissions and Fees

Swissquote operates on a spread-based model, and the fees vary depending on the trading instrument. The spreads offered by Swissquote are generally competitive compared to other brokers.

#5. Admiral Markets

What is Admiral Markets

Admiral Markets is a well-regulated Swiss forex broker that offers a range of trading instruments and platforms suitable for both beginner and advanced traders.

Advantages and Disadvantages of Trading with Admiral Markets

Commissions and Fees

Admiral Markets operates on a spread-based model, and the fees vary depending on the account type and trading instrument. The spreads offered by Admiral Markets are generally competitive in the market.

#5. XM

What is XM?

XM is a global online broker offering access to over 1,400 tradable instruments including forex, commodities, stocks and indices via both the MetaTrader 4 and MetaTrader 5 platforms. It features a low minimum deposit, tight spreads, and high trading flexibility with leverage up to 1:1000 (where permitted). XM is multi-regulated, holding licences from reputable authorities such as the Cyprus Securities and Exchange Commission (CySEC), Financial Services Commission (Belize) (FSC), Financial Services Authority (Seychelles) (FSA), Dubai Financial Services Authority (DFSA), and the Financial Sector Conduct Authority (FSCA) in South Africa — collectively offering strong regulatory credentials. For traders in Switzerland, where high regulatory standards via the Swiss Financial Market Supervisory Authority (FINMA) are expected, XM’s global oversight, solid infrastructure and competitive trading conditions make it one of the best broker choices for Swiss-based traders seeking trust and performance.

Advantages and Disadvantages of XM

XM Commissions and Fees

XM charges no per-lot trading commission on its Micro and Standard accounts, meaning all trading costs are incorporated into the spread, which for the Standard account starts at around 1.6 pips on major currency pairs. Traders holding positions overnight may incur swap/rollover fees, and an inactivity fee typically applies if the account remains inactive for 90 days or more.

OPEN AN ACCOUNT NOW WITH XM AND GET YOUR WELCOME BONUS

Conclusion

Swiss forex brokers offer a secure and reliable trading environment for forex traders. With their strict regulation, advanced trading platforms, competitive trading conditions, and a wide selection of tradable instruments, these brokers cater to the diverse needs of traders. By considering factors such as regulation, security, trading platforms, trading conditions, and customer support, traders can make informed choices when selecting a Swiss forex broker. Whether you choose Libertex, Vantage, Dukascopy, Swissquote, Admiral Markets, or eToro, you can access the Swiss forex market with confidence.

FAQs

Are Swiss forex brokers regulated?

Yes, Swiss forex brokers are regulated by the Swiss Financial Market Supervisory Authority (FINMA). This regulatory body ensures that brokers adhere to strict guidelines and regulations to protect traders' interests.

What are the advantages of trading with Swiss forex brokers?

Trading with Swiss forex brokers offers several advantages, including a secure and regulated trading environment, competitive spreads, access to advanced trading platforms, a wide range of tradable instruments, and reliable customer support.

Can I open a demo account with Swiss forex brokers?

Yes, many Swiss forex brokers offer demo accounts, allowing traders to practice and familiarize themselves with the trading platforms and conditions before trading with real money. Demo accounts are an excellent way to gain experience and test trading strategies.

What trading platforms do Swiss forex brokers offer?

Swiss forex brokers offer a variety of trading platforms, including popular options such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Additionally, some brokers provide their proprietary trading platforms, which may offer unique features and functionalities.

How can I contact customer support at Swiss forex brokers?

Swiss forex brokers typically provide multiple channels for customer support, including phone, email, and live chat. Some brokers may also offer multilingual support to cater to traders from different regions. Contact information for customer support can usually be found on the broker's website or trading platform.