SurgeTrader Review

Proprietary trading firms have become key players in the constantly changing financial market landscape, completely changing how trading is handled and carried out. Financial firms that engage in proprietary trading, also referred to as “prop trading,” trade their own funds rather than that of their customers. A symbiotic link between traders and the company itself is created by these businesses, which use their knowledge, techniques, and market insights to make profits. SurgeTrader, a dynamic proprietary trading company owned by Surge Capital Ventures, LLC, is one of these avant-garde businesses.

SurgeTrader stands out by reducing its trading rules in a sector where complexity may frequently obscure the road to success, making it a welcome option for traders seeking a basic strategy. Contrary to many other prop trading companies, SurgeTrader’s evaluation procedure is refreshingly straightforward, removing pointless barriers that can frequently obstruct development and growth.

In this comprehensive review of SurgeTrader, we will furnish pertinent insights encompassing the advantages of trading, available platforms, the meticulous evaluation procedure, distinctive trading attributes, and other critical facets pivotal to embarking on your venture with this proprietary trading firm. Furthermore, traders and investors will gain valuable insights into the potential limitations and shortcomings of the company, empowering them to make an informed decision when selecting the optimal proprietary firm that aligns with their aspirations.

What is SurgeTrader?

SurgeTrader is a proprietary trading firm established by seasoned Forex experts who aimed to uncomplicate the funding process for traders while introducing easy-to-follow trading rules. The platform provides an extensive array of trading instruments, extending beyond individual stocks, and permits traders to apply any trading strategy they deem suitable. One of SurgeTrader’s standout features is its highly competitive profit-split system, which offers up to a whopping 90%.

Recognizing that quick access to capital is a crucial ingredient for trading success, SurgeTrader employs an efficient one-step evaluation model. This approach is designed to expedite funding for proficient retail traders while fostering a nurturing and cooperative trading environment.

The process of evaluation on SurgeTrader is uncomplicated, and it presents the opportunity to manage up to $1,000,000 of capital with a rewarding profit split system that generously hands 75% to the traders. What sets SurgeTrader apart is its flexibility on trading strategies. It does not impose restrictions, whether you’re into hedging, automated or algorithmic trading, or fundamental analysis. Moreover, the platform ensures rapid payout processing with no minimum limit, and profits can be accessed once a month at any time.

Also Read: Prop Trading: What is it and How Does it Work?

Advantages and Disadvantages of Trading with SurgeTrader

Benefits of Trading with SurgeTrader

SurgeTrader offers its traders an environment marked by both reliability and transparency. The platform’s robust credibility is underlined by its affiliation with EightCap, a broker that operates under the rigorous oversight of the Australian Securities and Investments Commission (ASIC).

This relationship not only bolsters the platform’s standing but also offers traders a secure trading backdrop, instilling confidence as they engage with the financial markets. Complementing its trustworthy nature, SurgeTrader champions transparency.

All its legal stipulations and operational conditions are accessible to the public. Moreover, while it upholds stringent trading rules, SurgeTrader understands human errors, tolerating occasional trading discrepancies as long as they don’t exhibit a recurring pattern.

Moreover, SurgeTrader is characterized by its adaptability and comprehensive offerings. It provides traders the latitude to employ a spectrum of strategies—be it algorithmic techniques, hedging, scalping, or any other approach—ensuring every trader finds their fit.

This flexibility is further enhanced by a broad array of over 100 trading instruments, catering to diverse trading appetites and including notable assets like cryptocurrencies. Financial gains are also in the spotlight, with traders having the potential to pocket a whopping 75% of their profits. And while the lure of high returns is enticing, SurgeTrader ensures its community doesn’t tread on thin ice.

It has embedded a robust risk management framework, promising to cover losses if traders stay within the defined loss and drawdown thresholds. This dual promise of potential rewards and minimized risks positions SurgeTrader as a platform that truly understands and caters to the trader’s journey.

SurgeTrader Pros and Cons

Pros:

- Topnotch regulation

- High profit percentage for traders

- Flexibility of trading strategies

- Wide array of trading instruments

Cons :

- Expensive examination fee

- Enrolling in a course before taking the challenge is recommended

Difficulties Met by the Traders Who Participated in the Brokers Challenge

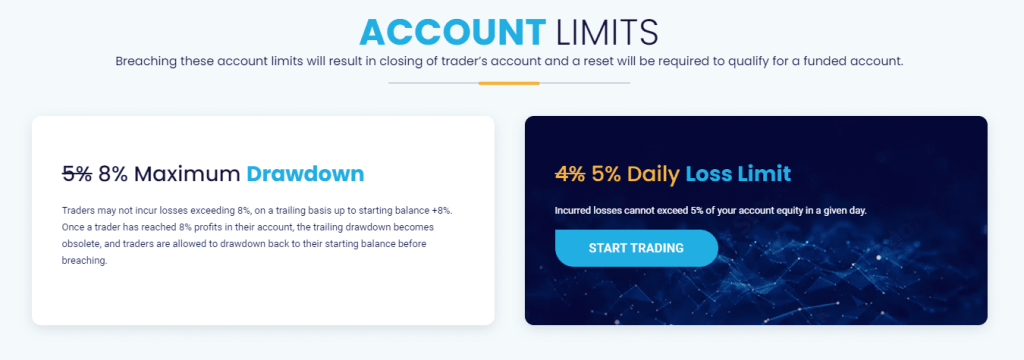

#1. Maximum Drawdown Set at 8%

This limitation requires traders to exercise extreme caution when devising their trading strategies. A substantial drop in prices could potentially deplete a large portion of their trading account. Therefore, traders must remain vigilant, constantly monitoring their trades and market conditions, and be ready to take immediate action. The 8% drawdown limit essentially imposes a maximum allowable level of risk on trading activities. Consequently, it’s critical for traders to refine their risk management approaches to prevent reaching this threshold.

How to Overcome the Difficulty

It is vital to apply strong discipline in trade management if you want to overcome this obstacle. The maximum drawdown restriction can be avoided by keeping a close eye on the market and responding quickly to developments. Trading losses can be considerably reduced by using tools like warnings and predetermined conditions for exit strategies, giving traders more control over their trading trip.

#2. Limited Maximum Open Lots

The largest number of open lots is limited to 1/10000 of the total account size. This stipulation effectively caps the amount of open trades a participant can have in relation to the size of their account.

How to Overcome the Difficulty

A smart approach to trading is required to get around this restriction. The emphasis should be switched away from pursuing a large number of trades and toward improving the quality of each trade. Further aiding in navigating this restriction is the application of a diversified strategy over a range of assets, which can maximize possible profits and distribute risk.

#3. Weekend Open Positions are Not Allowed

The potential for long-term trading methods is limited because traders are not allowed to retain open positions over the weekend. For traders who normally employ long-term tactics, such as “buy-and-hold,” which may necessitate keeping positions open for weeks or even months, this law imposes a major restriction.

How to Overcome the Difficulty

To get over this restriction, traders should concentrate more on intra-week trading techniques. Constantly monitoring market developments might yield timely information for wise decision-making. To avoid potential losses that could result from erratic weekend market moves, traders should make sure all positions are terminated before the weekend.

#4. Stop-Loss is Mandatory for Every Trade

Each trade must have a stop loss, and traders are only allowed to lose up to 5% of their account in a single day. The necessity of a stop loss for every trade emphasizes how crucial risk management is in trading. The 5% cap on daily losses acts as a safety net, preventing traders from suffering a severe loss in a single day.

How to Overcome the Difficulty

It is essential to put strict risk management techniques into place if we are to address this issue successfully. To make sure that the risk levels correspond with their comfort zones, traders should periodically review and fine-tune their trading plan. Effective risk management can also be achieved by modifying stop loss levels in accordance with market volatility and individual risk tolerance. By regularly employing such risk management strategies, traders can be shielded from big losses.

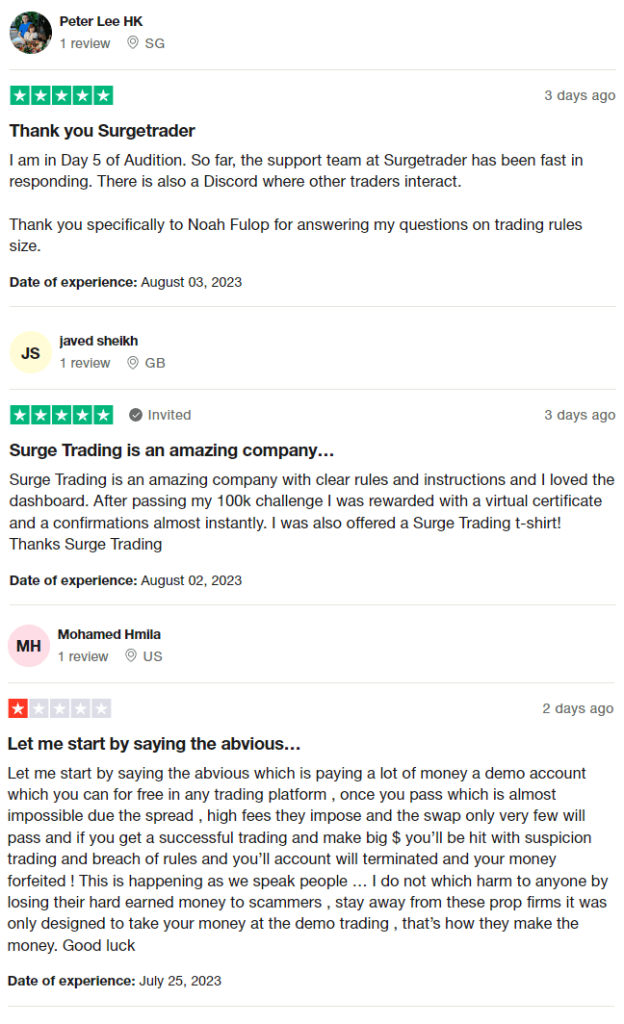

SurgeTrader Customer Reviews

The reviews left by SurgeTrader’s customers are quite diverse. Quick responses to user questions and efforts to build community through interactive tools like Discord are two of the platform’s selling points. Users are especially appreciative of the trading challenge’s clear rules and instructions, as well as the challenge’s user-friendly design.

Meanwhile, several investors have voiced concern over the high costs of the demo account, on top of the significant spreads and fees. They question the regulations’ consistency and argue that the platform’s setup may not be optimal for making a profit from trading.

Potential users should conduct their research and make an educated decision based on their preferred trading strategies and comfort level with risk, despite the fact that there are a variety of different points of view.

SurgeTrader Fees and Commissions

SurgeTrader has a distinctive revenue model in which it does not charge conventional commission fees. Instead, to connect its financial interests with the success of its traders, the company takes a quarter of the trader’s achieved gains as income. The only fee directly collected by the company is an upfront payment for the SurgeTrader Audition, relieving the traders of the burden of ongoing monthly expenses.

It’s important to keep in mind, though, that because of the payment system’s workings and the market’s intrinsic spread charges, traders can have to pay extra. The platform also imposes swap commissions, charges assessed when a trading position is carried over to the following trading day.

The business uses a zero-spread model to conduct business on the MetaTrader 5 (MT5) platform. Here, dealers pay a fixed commission of USD 3.5 per entire lot traded in place of a spread. This feature guarantees that traders can execute transactions at the exact market price, but possible gains should take the fixed commission into account.

Account Types

SurgeTrader offers an extensive range of account types, accommodating traders of varying experience levels and financial resources. Each account tier comes with a corresponding audition fee, setting the stage for traders to showcase their trading skills.

Starter Account

The “Starter” account, ideal for beginners or those testing the waters of trading, provides an account size of 25,000 USD and requires an audition fee of 250 USD.

Intermediate Account

For those looking to step up, the “Intermediate” account offers a larger trading volume of 50,000 USD for an audition fee of 400 USD.

Seasoned Account

The “Seasoned” account, targeted at more experienced traders, provides a significant trading balance of 100,000 USD at an audition fee of 700 USD.

Advanced Account

High-volume traders can opt for the “Advanced” account, offering a hefty 250,000 USD trading balance with an audition fee of 1,800 USD.

Expert Account

The “Expert” account caters to professional traders, offering an account size of 500,000 USD, with an audition fee of 3,500 USD.

Master Account

The “Master” account, the highest tier, is tailored for elite traders, offering a staggering account size of 1,000,000 USD, with an audition fee of 6,500 USD.

Moreover, SurgeTrader offers an attractive profit-sharing scheme where traders can retain 75% of their earnings. This ratio can potentially be boosted to 90% through an additional payment, thereby enhancing the profit potential for successful traders.

How to Open Your Account

Opening a SurgeTrader account is a streamlined process designed to be user-friendly and efficient. First, a prospective trader is required to complete an application form and pay for the desired trading package. Access and account settings will then be provided to the trader. Here are the detailed steps for setting up your SurgeTrader account:

- Begin by navigating to the SurgeTrader official website at https://surgetrader.com/.

- Click on the “Start Trading” tab displayed on the website’s main page.

- You will be presented with various trading packages to choose from and asked to select a trading platform, either MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

- Proceed to confirm the purchase of your chosen trading package.

- Following the purchase, the details of your SurgeTrader account will be sent to your provided email address.

Upon receiving a funded account, you are expected to complete the SurgeTrader Audition to enhance your earnings capacity. This audition process can be reviewed free of charge. Once you have successfully navigated through the audition, you will receive an email within 24 to 48 hours with your new live account details, and your funded trading account will be set up, ready for you to start trading.

Post-audition, you will gain access to a funded trading platform with a real balance provided by the SurgeTrader proprietary firm. Note that all accounts during the SurgeTrader audition process are demo accounts with virtual funds. You can then start making real profits and withdraw your earnings at your discretion.

Also Read: Best Forex Trading Platforms 2023

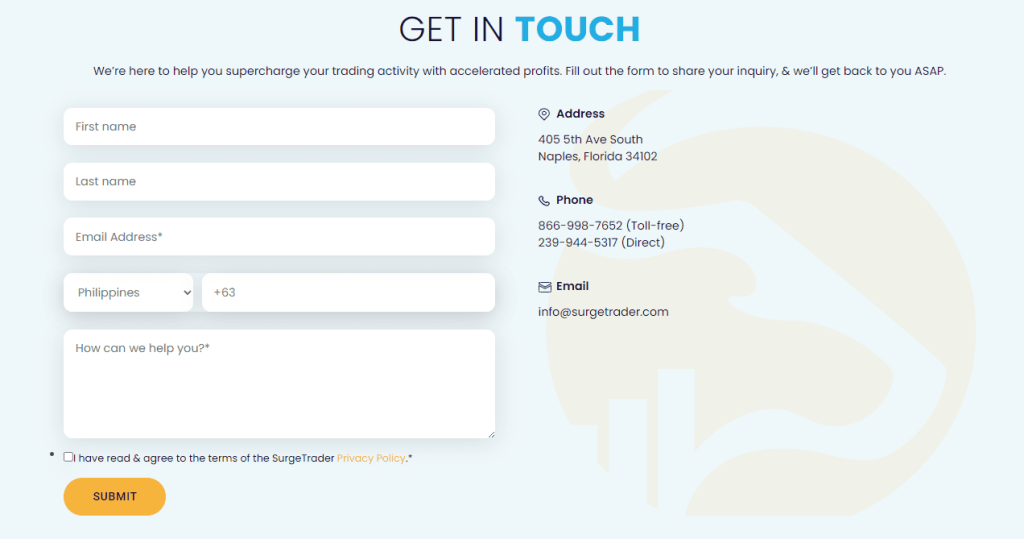

SurgeTrader Customer Support

To provide exceptional service to its traders, SurgeTrader has established multiple avenues for customer support. One of these is a dedicated feedback form that enables traders to directly convey their concerns, inquiries, or suggestions. Furthermore, email support is available, offering a medium for more in-depth queries and allowing comprehensive responses from the customer service team.

In addition to traditional communication methods, SurgeTrader leverages social media platforms, making it possible for traders to interact with the company in a familiar digital space. For immediate and real-time assistance, an on-site chat function is integrated into the company’s website, connecting traders directly with support representatives.

For those who prefer voice communication or need more extensive help, SurgeTrader provides a toll-free telephone service. Notably, accessing these support services doesn’t require separate registration, making the process seamless and convenient for traders.

Advantages and Disadvantages of SurgeTrader Customer Support

Contact Table

Security for Investors

Withdrawal Options and Fees

SurgeTrader’s withdrawal procedure is straightforward and user-friendly. Traders have the flexibility to submit their withdrawal requests at any given time, although withdrawals are processed once a month. This allows traders to manage their profits and plan their finances effectively.

Various options are available for both account replenishment and withdrawal. These include traditional banking systems and PayPal, offering convenience and catering to different trader preferences.

An important aspect to note during the withdrawal process is the recalculation that takes place, factoring in the maximum and minimum sliding drawdowns. As a result, traders may not be able to withdraw the full 75% of their profit at one time. For a more detailed understanding of this mechanism, traders are advised to refer to the FAQs section provided on the platform.

Adding to its trader-friendly approach, SurgeTrader doesn’t charge any commissions for the withdrawal of funds. This ensures that traders receive their profits without incurring any additional charges, making the entire process more attractive and beneficial.

What Makes SurgeTrader Different from Other Prop Firms

SurgeTrader stands out from other proprietary trading companies because to a special combination of features designed to enhance and cater to the trading experiences of its customers.

For instance, SurgeTrader collaborates strategically with the ASIC-licensed broker EightCap. This increases the platform’s dependability and guarantees a secure trading environment, making SurgeTrader a trustworthy choice for traders everywhere.

The company’s openness to let traders use their own trading strategies is another distinctive quality. The trading rules of SurgeTrader take algorithmic techniques, hedging, scalping, and other strategies into consideration. This flexible method encourages a diverse environment and effectively uses traders’ unique perspectives.

The income model of SurgeTrader is also quite tempting because it allows traders to keep a large 75% of their gains. A great trading experience is guaranteed by the large array of more than 100 items and the high income potential.

When traders adhere to the maximum loss and drawdown conditions, SurgeTrader covers losses, fostering a sense of security among its clients. All legal docs and terms & conditions are open to public scrutiny, and it conducts business transparently. These features, along with a lenient stance toward infrequent rule violations, illustrate SurgeTrader’s dedication to creating a trader-friendly environment.

How Can Asia Forex Mentor Help You Pass SurgeTrader’s Evaluation?

Here at Asia Forex Mentor, we’ve been guiding traders toward success since our inception in 2008, which is when our founder, Ezekiel Chew, made his first foray into the world of Forex mentoring. Starting with just a small group of friends, Ezekiel began his quest by teaching the nuances of forex trading. As his friends began to appreciate the depth of his knowledge, word spread, leading to a thriving community of traders eager to learn and improve.

The growth of the community was so rapid that it wasn’t long before Ezekiel found himself giving live, in-person lessons. His teaching prowess and deep understanding of forex trading soon caught the attention of established trading firms and banks, who sought his expertise for their own teams. Realizing the potential to help more individuals, Ezekiel consolidated all his teaching materials into a comprehensive program, the AFM Proprietary One Core Program.

Our One Core Program is designed with the sole aim of helping you ace your SurgeTrader evaluation process. The program equips you with the tools to construct your own trading system, enables you to dissect the forex market with surgical precision, and instills you with the skills to manage your trading account efficiently. With our comprehensive approach, we help you delve deep into the world of trading and emerge with a sound understanding of the landscape.

The One Core Program is a vast reservoir of knowledge, containing 26 elaborate lessons subdivided into over 60 precise subtopics. Every subtopic comes with a studio-quality video lesson available online, making the learning process seamless and convenient. What sets our program apart is the personal touch Ezekiel brings to every lecture, incorporating hand-selected examples and in-depth explanations that simplify complex concepts. With its beginner-friendly approach and low-risk strategy, our One Core Program is the ideal stepping stone for anyone keen to navigate the forex trading landscape successfully.

Our Journey at Asia Forex Mentor

At Asia Forex Mentor, we are proud to say that our founder, Ezekiel Chew, has left a profound impact on the lives of thousands of traders. His influence extends from retail traders to those working at esteemed banks and investment firms. Under Ezekiel’s mentorship, many of our students, who began their journey as complete novices, have transitioned into full-time forex traders. Some have even ascended to the position of fund managers, a testament to the quality of the guidance they received here at Asia Forex Mentor.

Our AFM Proprietary One Core Program has been thoughtfully designed to cover the gamut of forex trading knowledge. The concluding chapters delve into the merits of bar-by-bar backtesting, shedding light on various facets of trading psychology. Ezekiel shares his insights on the importance of maintaining trading diaries and concludes the program by demystifying his approach to successful forex trading.

In this segment of the One Core Program, we unravel concepts such as the ‘set-and-forget’ strategy, which has proven to be a game-changer for many traders. We also introduce our proprietary auto stop-loss tool and delve deeper into the ‘free trade’ idea. A thorough exploration of the differences between large and small stop-loss levels is also undertaken, which aids in fine-tuning your trading strategies.

Our goal at Asia Forex Mentor is to ensure you have the confidence and the know-how to navigate the world of forex trading. To this end, we offer a seven-day free trial of the One Core Program, post which there’s a one-time participation fee of $997. For those who are ready to dive right in, you have the option to bypass the trial and purchase the course at a discounted rate of $940. Embark on your journey with us, and watch as your forex trading skills reach new heights.

Conclusion: SurgeTrader Review

It’s easy to understand why SurgeTrader appeals to so many traders after taking an in-depth review of the platform. The platform offers advantages for both novice and experienced traders, including a clear and straightforward approach, fair costs, and a transparent structure. Impressive are the company’s service levels and its application of technology to enhance the trading experience. SurgeTrader appears to be a platform that is committed to creating an environment where its users can prosper, making it one that anyone interested in prop trading should give careful consideration to.

Also Read: FTMO Review 2023

SurgeTrader Review FAQs

Is SurgeTrader legit?

SurgeTrader is a reputable platform, so that much is true. It offers traders a just and open environment in which to engage in prop trading. The business is renowned for its strict yet simple standards, prompt customer service, and simple processes. The platform’s legitimacy is also boosted by the testimonies and reviews of its current users.

Is SurgeTrader Challenge Worth It?

Individual trading objectives and experience are ultimately what determine the SurgeTrader Challenge’s worth. The Challenge can give those who want to enter the prop trading market a systematic, risk-managed trading method. Additionally, it gives one the chance to reach bigger financial levels than they otherwise may have.

What are the fees associated with SurgeTrader?

SurgeTrader does not charge commissions. Their income comes from 25% of the profit earned by the trader. The only one-time fee incurred is the SurgeTrader Audition fee, with no recurring monthly fees. However, there are commissions on payment systems and on spreads, as well as swap commissions.