Support and Resistance Forex Explained

The idea of support and resistance (SR) levels in trading is a common topic among traders when it comes to technical analysis. Similar to other indicators, knowing how to interpret these levels can help you immensely in forex. In this article, we will discuss the support and resistance forex application to help you buy low and sell high.

Contents

- Support and Resistance Forex Meaning

- Support and Resistance Trading System

- Support and Resistance Indicator

- Support and Resistance Zones

- How to Find Support and Resistance levels

- Support and Resistance Formula

- Support and Resistance Forex Trading Strategy

- How to Find Support and Resistance in Day Trading

- Conclusion

Support and Resistance Forex Meaning

Let’s start from the beginning. What are SR levels? First of all, they are not lines like the ATR, RSI forex indicator, or the simple moving average. Think of it as an area instead of a line since it is hard to pin the SR levels to a certain point. It is always moving, so it is easier to just see it as an area instead.

The Support level is a price area where the downtrend is expected to stop because of the increase in demand or buying interest. When the price goes down low enough, there will be a demand spike, therefore preventing the prices from going any lower. Think of the support level as a price floor.

On the other hand, the resistance level refers to the price area where the uptrend is expected to stop because more traders start to sell the higher the trend goes. This creates an excess in supply or selling interest, preventing the prices from going any higher. This is the price ceiling.

Support and Resistance Trading System

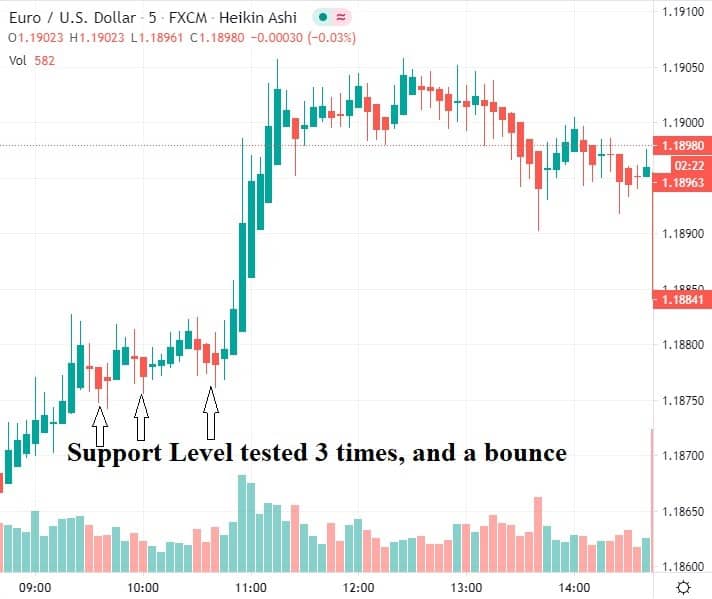

One simple application for SR levels is to identify entry and exit points. When the prices keep hitting the support or resistance level (also referred to as “testing the level”), one of two things will happen. The prices may bounce off the support or resistance level and head in the opposite direction, or it will break through that level until it hits a new support or resistance level.

Here, it is worth pointing out that the SR levels are not static. They move with the trend and price volatility. This is crucial to keep in mind as some traders base their forex trading strategy on the belief that the SR levels will remain unchanged.

Whether the levels stop the price or it breaks through, traders can “bet” on the direction and immediately discover if they are correct. If they are not, they can close their position at a small loss. However, if they are right about the direction, the move could be substantial.

Support and Resistance Indicator

Some traders prefer to eyeball the chart and mark the price points that the prices keep hitting consistently as the SR levels. But you do not have to do it. Some trading platform such as MT4 (open a trading account here ) comes with auto support and resistance indicator to help you keep track of how the SR levels are moving with the trend of the market.

Support and Resistance Zones

A fair number of traders make the mistake of treating the SR levels as a line, not areas. This is a problem. The prices may undershoot or overshoot the line, which results in either you missing the trade or your assumption of the SR is broken.

Let’s talk about undershooting first. This means that the prices drop close to your line, but not enough. What tends to happen next is that they bounce back up in the opposite direction and you missed the trade since you were waiting for them to reach the line.

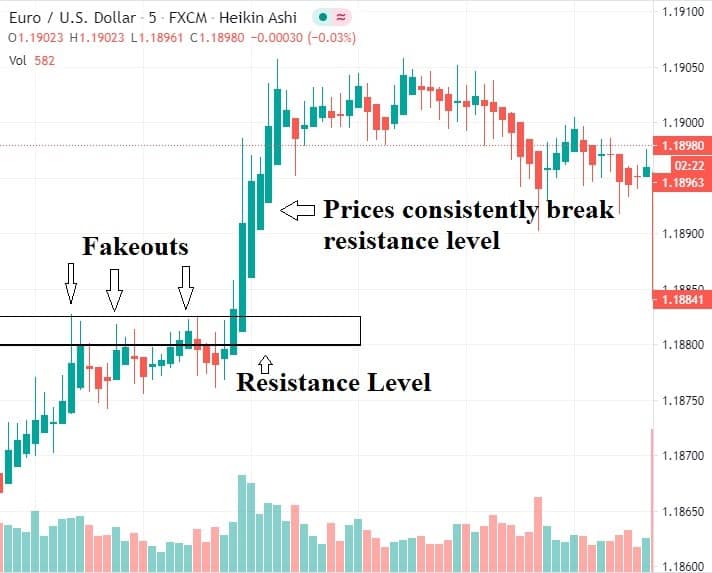

When the price overshoots and the resistance level is broken, you might assume that the price action will continue to go up until it hits a new resistance level. So, you trade the breakout, but only to realize that it is not an actual breakout, just a single overshoot.

For this reason, you should think of the SR levels as areas or zones, not lines. If you are wondering why overshoot and undershoot happens, you have two groups of traders to thank. They are the traders with the fear of missing out and those who want the best possible price, who are generally referred to as FOMO and Cheapo respectively.

The FOMO traders are the ones causing the undershoot in prices. They enter the trades the moment the price drops close to the support level. With enough buying pressure, the market would reverse a bit above the support line, which means you are losing out on the trade if you’re waiting for the price to come down that low.

The Cheapo traders are those who lie in wait so they could get the best possible price. As such, they often place orders at the low of the support level. With enough traders, the market will reverse at that location, which may result in a false breakout.

With these two groups of traders at play and without the knowledge of who is in charge at any particular moment, it is best to look at the SR levels as areas on the chart, not lines.

How to Find Support and Resistance levels

Here is a quick example. Suppose that you are looking to get into the EUR/USD market. Let’s say that you notice that the price level has gotten very close to 1.255 throughout the days and weeks that you have been watching, but never above that. In such a case, 1.255 is your resistance level.

As you can see from the chart above, the resistance level is the price ceiling since prices never break through that point. That said, you should never assume a price point is the resistance level just because it has been tested a few times in a highly volatile market. In fact, some traders say that the more the resistance or support level is tested, the weaker they become. In other words, the more frequently the price keeps hitting a certain price point, the more likely it is to break through that level.

On the flip side, the support level is the price floor that stops prices from going any lower. As you can see, being able to effectively identify SR levels can help you identify crucial entry and exit points. Given that the whole idea of making a profit is to buy low and sell high, you can see why SR levels are discussed so frequently.

Support and Resistance Formula

Although identifying SR levels is little more than eyeballing the chart, there is a little bit of math involved in other aspects such as pivot points. Pivot points work similar to your SR levels and help identify the levels in which the sentiment of the market may change from bullish to bearish or vice versa.

For this, you need to calculate the pivot point as well as 3 SR levels. The formulas are as follows:

Pivot point (PP) = (High + Low + Close)/3

First resistance (R1) = (PP x 2) – Low

First support (S1) = (PP x 2) – High

Second resistance (R2) = PP + (High + Low)

Second support (S2) = PP – (High + Low)

Third resistance (R3) = High + 2(PP – Low)

Third support (S3) = Low – 2(High – PP)

Of course, with such a simple calculation, you can be sure that this process would be automated in most charting software. All you need to do is to configure your settings properly so that the program uses the right closing time and price and it will handle everything from there.

Support and Resistance Forex Trading Strategy

Many trading strategies such as swing trading strategies or Bollinger bands forex strategies utilize SR levels, but we will discuss two basic trading strategies that make use of the basic principles of SR levels: The bounce and the break.

1. The Bounce Strategy

The name says it all. You make the trade right after the bounce. Many forex traders make the mistake of setting their orders right on the SR levels and wait for that eventuality. Sure, it might happen now and again, but their trading strategy relies on the fact that SR levels will hold. This isn’t the case.

You might be tempted to set your entry point right on the support line so that you get the best possible price. But what if the support line does not hold and the price dips lower than that level? Then you wouldn’t get the best possible price. To counter this problem, you wait for the confirmation. That is, you wait for the price to bounce off the support level first before setting an entry order if you want to go short.

2. The Break Strategy

The truth is that SR levels break very frequently. So, you should have another ace up your sleeves for when the trendline hits and the price breaks through the SR levels. There are two ways to go about this: aggressively or conservatively.

The aggressive way is to buy or sell when the price breaks through the SR levels, with a confirmation. You want to know if this isn’t a fakeout or a false breakout. Identifying it is easy since you just need to see whether the prices pass through these levels consistently.

The conservative way, as the name suggests, requires patience. Suppose that you decided to go long on EUR/USD and you hoped that the prices would go up after hitting the support level. Unfortunately, it breaks and the price dips and you are at a losing position and your balance is falling slowly.

What do you do? Do you accept defeat, bail, and liquidate before losses mount? Or do you hold onto it and hope the price goes up again?

The conservative trading strategy is the second option. When you close out a position, you are taking the opposite side of the trade. If you close your EUR/USD long trade near or at breakeven, that means you need to short the EUR/USD by the same amount.

If enough traders bail out at the now broken support level, the price will start falling. This is how a broken support level becomes a resistance level. So the idea here is to take advantage of this event by being patient.

In other words, instead of making an entry right when the support level breaks, wait for the pullback of prices to the broken support level (now resistance level), wait for the prices to bounce from that, and then make an entry.

How to Find Support and Resistance in Day Trading

While SR levels work better in larger time frames, they can be used in your intraday trading activities.

First, you need to identify key SR levels. Just zoom out of your chart and look at a daily or weekly timeline. Then, it’s just a matter of eyeballing it to identify the SR levels. Since we are doing intraday trading, these levels do not matter much but they help measure the price direction.

Next, identify event levels in the daily or 4-hourly charts. These levels used to be the SR levels until they are broken. After that, a support level can become a resistance level and vice versa. Then, identify intraday near-term levels on a 15-minute chart. Near-term levels are the levels that are close to the current price. You have already done most of the work at this point.

Now is the time to make a move. Double-check the previous steps to ensure that the key levels, event levels, and near-term levels are indicating the same price direction before you decide. If the prices move below the key levels, you would want to sell. The incentive to sell is higher if the price dip below any event levels and ejecting buyers at the near-term levels.

Making an entry is simple. You just wait for the candlesticks to form a pinbar, a simple indecision candle, or an engulfing bar.

Conclusion

And that is the basic of support and resistance forex application. There are many more trading strategies out there so we recommend you look around and see what works for you. To prevent massive losses, never put more than 1 or 2 percent of your account. Good luck with your endeavors and remember: buy low and sell high.