SuperForex Review

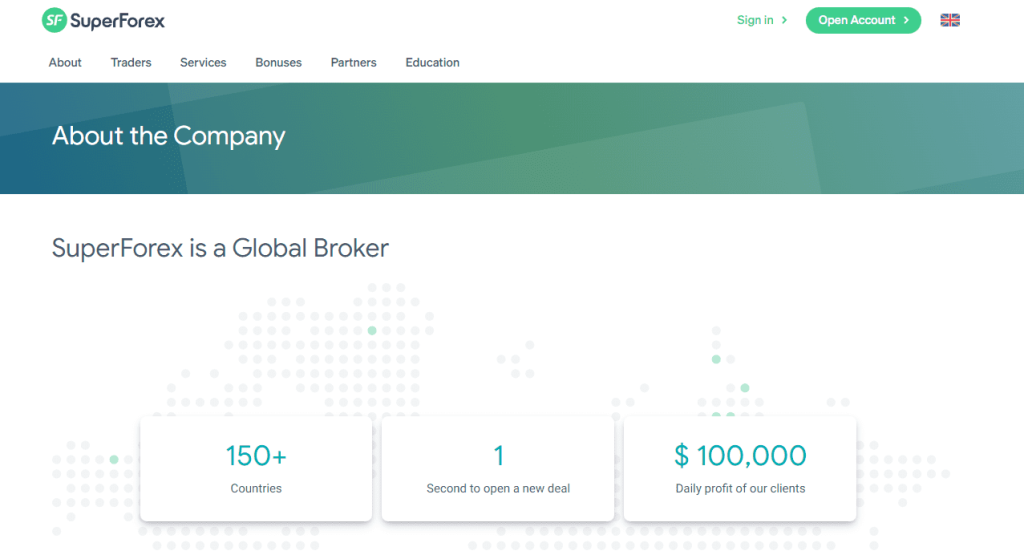

SuperForex is a reputable global brokerage firm that has been catering to clients around the world since 2013. With regulation from the International Financial Services Commission (IFSC), this broker offers a wide range of trading and investment services to individuals and businesses across 150+ countries.

An outstanding feature of SuperForex is its extensive array of financial instruments. Traders have access to a diverse selection of assets, including currencies, commodities, indices, cryptocurrencies, and more. This broad range allows for portfolio diversification and the exploration of various market opportunities.

SuperForex takes great pride in its highly professional team, which is dedicated to continuously improving the company’s products and services. This commitment to excellence is evident in their user-friendly trading platforms, educational resources, and customer support.

In this comprehensive review, our goal is to provide an in-depth assessment of SuperForex, highlighting its strengths and weaknesses. We aim to equip you with detailed information about the broker, including account options, deposit and withdrawal procedures, commission structures, and more.

By presenting a balanced perspective that incorporates expert analysis and real trader experiences, we aim to empower you to make an informed decision when considering SuperForex as your brokerage provider.

What is SuperForex?

SuperForex is a well-known and globally acclaimed broker with a track record dating back to 2013. Operating in over 150 countries, the company has gained recognition as a trustworthy and accessible platform for traders and investors worldwide. One of SuperForex’s notable strengths lies in its comprehensive range of financial instruments for trading.

Clients have access to diverse markets such as Forex, commodities, indices, cryptocurrencies, and more. This wide selection empowers traders to diversify their investment portfolios and explore various opportunities based on their individual preferences and trading strategies.

Regulatory compliance is a crucial factor when choosing a broker, and SuperForex is regulated by the International Financial Services Commission (IFSC). This regulatory oversight ensures that the broker adheres to established standards, providing clients with a sense of security and transparency in their trading activities.

Additionally, SuperForex caters to the diverse needs of its clients by offering different types of trading accounts. From beginner-friendly accounts with low minimum deposit requirements to specialized accounts tailored for professional traders, there are options available to accommodate individual preferences and specific trading strategies.

Advantages and Disadvantages of Trading with SuperForex?

Benefits of Trading with SuperForex

When it comes to trading with SuperForex, there are several notable benefits that traders can enjoy:

- Zero Broker Commission: SuperForex offers the advantage of zero broker commission on deposits and withdrawals*. This means that traders can save on transaction costs, allowing for more efficient fund management.

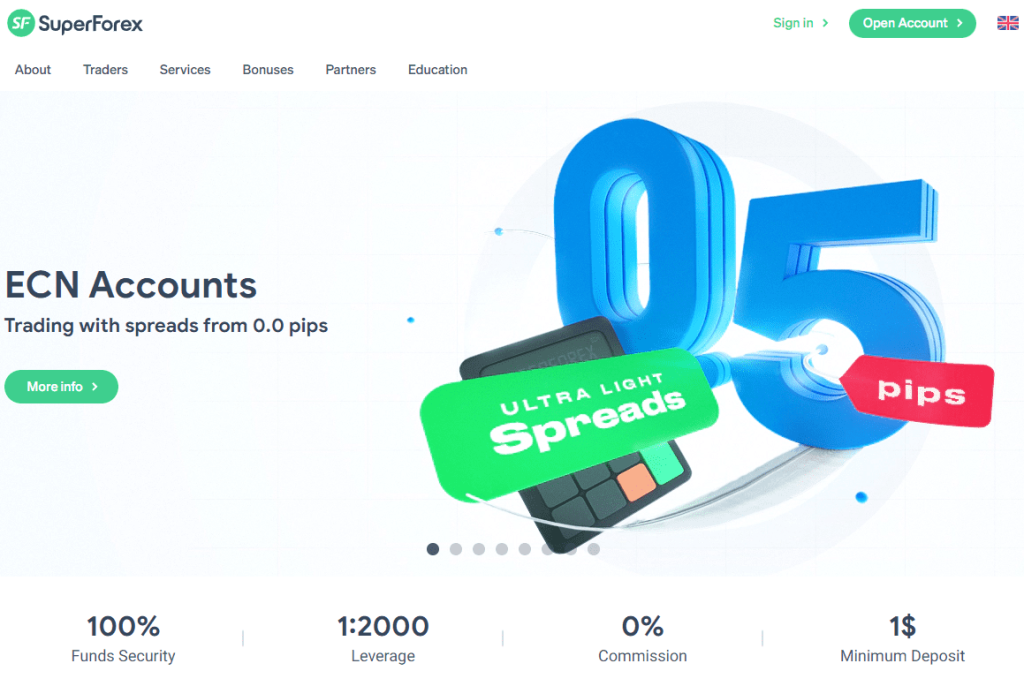

- Low Minimum Deposit: SuperForex provides a flexible and accessible trading environment by offering a minimum deposit requirement of just $1, unless otherwise specified by the chosen account type. This low entry threshold allows traders with various budget sizes to participate in the markets.

- Competitive Spreads: SuperForex offers competitive spreads starting from as low as 0.1 pips. This tight spread ensures that traders can enter and exit positions with minimal cost, maximizing their potential profits.

- Wide Range of Instruments: With SuperForex, traders have access to a diverse selection of over 250 trading instruments. These instruments encompass various asset classes, including currencies, commodities, indices, and more. Additionally, SuperForex offers the flexibility of opening an account in multiple base currencies such as JPY, USD, EUR, GBP, and others, allowing traders to choose the most suitable option for their trading needs.

Overall, the benefits of trading with SuperForex include cost-effective transactions with zero broker commission, low minimum deposits, competitive spreads, and a wide range of tradable instruments. These features contribute to a favorable trading experience and make SuperForex an attractive choice for traders seeking a reliable and accessible trading environment.

SuperForex Pros and Cons

Pros of SuperForex

- Global Presence

- Regulatory Compliance

- Wide Range of Trading Instruments

- Low Minimum Deposit

- Competitive Spreads

- Bonus Programs

- Multiple Account Types

Cons of SuperForex

- Limited Educational Resources

- Withdrawal Process Delays

- Limited Customer Support Availability

SuperForex Customer Reviews

The majority of customer reviews about SuperForex are positive. Traders appreciate the platform’s reliability and the excellent customer care provided by the support team. Some users express gratitude towards the CEO and the SuperForex team for their exceptional work. However, there is a complaint regarding high withdrawal fees. Overall, customers seem satisfied with the broker’s services, including the provision of a WhatsApp group for fundamental analysis updates.

SuperForex Spreads, Fees, and Commissions

SuperForex provides competitive trading conditions in terms of spreads, fees, commissions, leverage, and stop-out levels. Let’s delve into each aspect in more detail:

Spread

SuperForex offers tight spreads across a wide range of financial instruments. With starting spreads as low as 0 pips, traders can benefit from highly competitive pricing. This allows for more cost-effective trading, potentially maximizing profits.

Fees

When trading with SuperForex, fees are involved, starting as low as $0.2 USD. The specific fee amount may vary depending on the chosen trading instrument and account type. It’s essential for traders to carefully review the fee structure to gain a clear understanding of the costs associated with their trades.

Commissions

SuperForex provides commission-free trading on select account types. This means that traders can execute trades without incurring additional commission charges. However, it’s important to note that certain account types, like the No Spread Account, may have fixed commission fees instead of spreads. Traders should thoroughly review the commission structure associated with their chosen account type to fully grasp the costs involved.

Account Types

SuperForex presents a diverse range of account types to meet the specific requirements and preferences of traders. Each account type is tailored to offer unique features and benefits, ensuring traders can find an account that aligns with their trading style and goals. Here is an overview of the different SuperForex account types:

Standard Account

Ideal for Forex beginners, the Standard Account offers flexible trading conditions and a low minimum deposit of $1. Traders can choose leverage between 1:1 and 1:1000, enjoy attractive bonuses, and trade with swaps and fixed spreads.

Swap-Free Account

The Swap-Free Account is designed for traders who want to avoid swaps, making it suitable for religious or interest rate avoidance reasons. This account type eliminates swaps and associated fees and can be customized to meet individual needs for long-term trading strategies.

No Spread Account

The No Spread Account allows traders to open new deals without paying any spreads, opting for fixed commission fees instead. It is applicable to all trading instruments and offers no spreads, up to 25% lower commission rates, and transparent fees that can be calculated in advance.

Micro Cent Account

Perfect for traders working with small investments, the Micro Cent Account allows trading with as little as $1. It removes concerns about volume and free margin requirements, making it an ideal choice for low-risk trading and providing an optimal learning environment for beginners.

Profi STP Account

Catering to traders with larger deposits, the Profi STP Account facilitates high-stakes trading with large volumes. It grants access to superior liquidity, specialized customer service, leverage of up to 1:3000, and low-margin requirements, empowering traders to maximize their trading potential.

Crypto Account

Tailored for traders interested in Forex trading with cryptocurrencies, the Crypto Account provides access to popular digital currencies. Traders can execute trades using the widely recognized MetaTrader 4 platform, utilize various trading strategies, and incorporate expert advisors and other trading software.

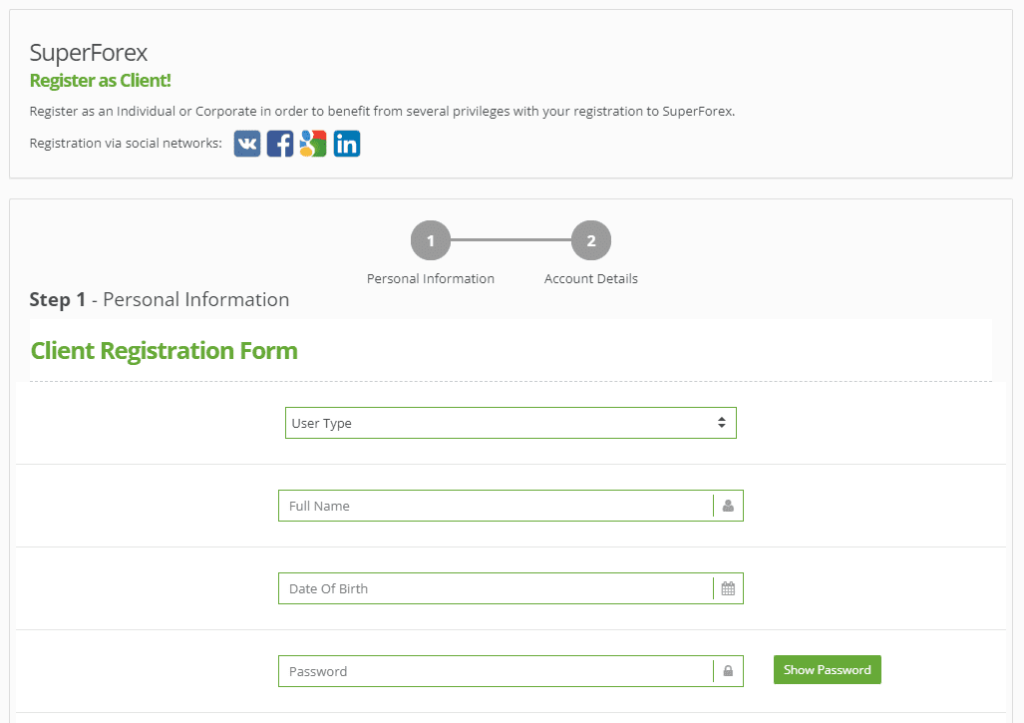

How to Open Your Account

To begin your journey with SuperForex and open a trading account, follow these simple steps:

- Go to the SuperForex website.

- Locate and click on the “Open Account” or “Register” button.

- Select the account type that aligns with your trading requirements.

- Provide accurate information in the registration form.

- Carefully read and agree to the terms and conditions.

- Proceed with the verification process, which typically involves verifying your email, identification documents, address, and phone number.

- Once verified, deposit funds into your account using the available deposit methods.

- Download and install the SuperForex trading platform, which offers powerful tools and features for seamless trading.

- Log in to your newly created account and start trading in the financial markets.

By following these steps, you can easily open a SuperForex trading account and begin your trading journey with a reputable broker.

What Can You Trade on SuperForex

On SuperForex, traders have access to a diverse range of financial instruments, providing ample opportunities to explore and engage in various trading markets. Here are some of the key assets that you can trade on SuperForex:

Forex (Foreign Exchange)

As a global broker, SuperForex offers a wide selection of currency pairs, allowing traders to participate in the largest financial market in the world. Major currency pairs such as EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs, are available for trading.

Commodities

SuperForex provides access to the commodities market, enabling traders to trade popular commodities such as gold, silver, oil, natural gas, and more. These assets allow traders to diversify their portfolios and take advantage of price fluctuations in the commodity markets.

Indices

SuperForex allows traders to trade major stock indices from around the world. Indices represent a basket of stocks, providing a way to speculate on the overall performance of a specific stock market. Popular indices such as the S&P 500, NASDAQ, FTSE 100, DAX, and Nikkei are available for trading.

Cryptocurrencies

SuperForex recognizes the growing popularity of cryptocurrencies and offers a range of digital currencies for trading. Traders can access major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and more. Trading cryptocurrencies allows traders to capitalize on the volatility and potential profit opportunities in this emerging asset class.

Stocks

SuperForex provides access to a selection of global stocks from various exchanges. Traders can trade shares of well-known companies like Apple, Amazon, Microsoft, Google, and others. Stock trading allows investors to take positions based on their analysis of company performance and market trends.

CFDs

SuperForex also offers Contracts for Difference (CFDs) on a range of assets, including stocks, commodities, indices, and cryptocurrencies. CFDs enable traders to speculate on price movements without owning the underlying asset, providing flexibility and potential profit opportunities.

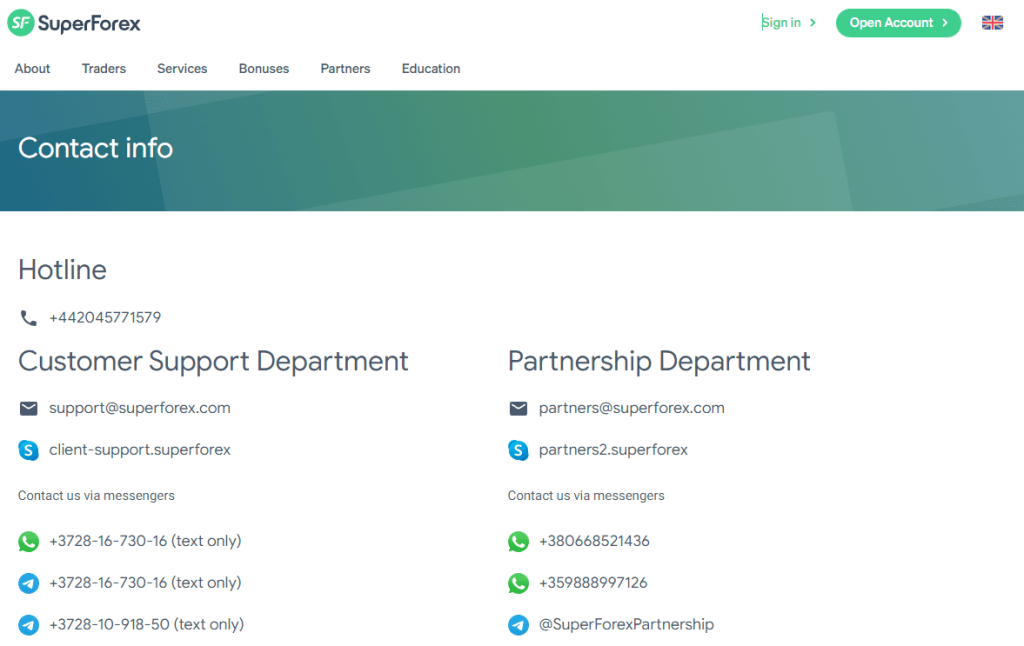

SuperForex Customer Support

SuperForex prioritizes exceptional customer support to ensure a positive trading experience for its clients. They offer a variety of contact methods, including phone calls, emails, Skype, WhatsApp, and Telegram, allowing traders to choose their preferred communication channel. The support team is available from 7:00 AM to 5:00 PM (GMT+0), ensuring accessibility during active trading hours. They strive to provide prompt responses and efficient assistance to address client inquiries and concerns.

SuperForex’s customer support is multilingual, catering to traders from diverse backgrounds. The team is proficient in various languages, enabling them to communicate effectively in the native language of the clients. This multilingual approach enhances communication and understanding, ensuring that clients receive support in a language they are comfortable with.

In addition to traditional contact methods, SuperForex maintains an active presence on social media platforms such as Instagram, Facebook, YouTube, Twitter, LinkedIn, and Pinterest. Traders can follow their official accounts to stay updated with the latest information, market insights, and company announcements. Engaging with SuperForex’s social media channels provides an additional avenue for obtaining information and staying connected with the company’s updates.

Advantages and Disadvantages of SuperForex Customer Support

Security for Investors

Withdrawal Options and Fees

SuperForex offers a variety of withdrawal options to facilitate the process for their clients. Some of the available withdrawal methods include:

Bank Wire Transfer

Withdrawals can be made directly to your bank account through wire transfer. However, it’s important to note that bank fees may apply.

Electronic Payments

SuperForex supports popular electronic payment systems like Skrill, Neteller, and Perfect Money, allowing for convenient and fast withdrawals.

Cryptocurrencies

If you prefer using cryptocurrencies, SuperForex also allows withdrawals through digital currencies such as Bitcoin, Ethereum, and Litecoin.

It’s worth noting that the withdrawal fees may vary depending on the chosen withdrawal method. It is recommended to review SuperForex’s official website or contact their customer support for detailed information on the withdrawal fees associated with each method.

SuperForex Vs Other Brokers

#1. SuperForex vs AvaTrade

SuperForex and AvaTrade are two reputable brokers in the financial industry, each with its own strengths and features. SuperForex is a global broker serving clients in over 150 countries. They offer a diverse range of financial instruments, including currencies, commodities, indices, and cryptocurrencies. With low minimum deposits starting from $1 and competitive spreads from 0.1 pips, SuperForex provides attractive trading conditions for traders. They also offer various account types to cater to different trading preferences, such as no spread accounts and swap-free accounts. SuperForex is regulated by the International Financial Services Commission (IFSC), which adds a level of security and trust for clients.

On the other hand, AvaTrade is a well-established broker known for its strong reputation in the industry. They offer a wide selection of financial instruments, including Forex, stocks, commodities, and cryptocurrencies. AvaTrade provides traders with multiple trading platforms, including their proprietary platform and the popular MetaTrader 4 and 5. They are regulated by respected authorities such as the Central Bank of Ireland and ASIC. In addition to their trading services, AvaTrade provides educational resources and research tools to assist traders in making informed decisions.

The choice between SuperForex and AvaTrade depends on individual preferences and trading needs. If low minimum deposits and tight spreads are important, SuperForex may be the preferred option. On the other hand, if traders are looking for a broader range of financial instruments and additional research tools, AvaTrade may be more suitable. It is recommended that traders carefully consider their specific requirements, compare the features and services offered by each broker, and make an informed decision based on their preferences and trading goals.

#2. SuperForex vs Roboforex

SuperForex and Roboforex are renowned brokers in the financial industry, each with their own unique features. SuperForex serves clients globally, offering a wide range of instruments and competitive trading conditions. They have low minimum deposits, attractive spreads, and diverse account types. SuperForex’s regulation by the IFSC enhances their credibility.

On the other hand, RoboForex is a reputable broker providing comprehensive instruments and trading platforms. They grant access to various markets, including Forex, stocks, commodities, and cryptocurrencies. RoboForex offers different account types, advanced tools, and educational resources.

Choosing between SuperForex and RoboForex depends on individual preferences and trading requirements. Traders should consider factors such as trading conditions, available instruments, account types, and additional services. It is recommended to compare their features, regulations, and overall reputation before deciding on the broker that aligns best with one’s trading goals.

#3. SuperForex vs Alpari

SuperForex and Alpari are both well-known brokers in the financial industry, each with its own strengths and features. SuperForex is a global broker serving clients in over 150 countries, offering a diverse range of financial instruments, competitive trading conditions, and various account types. They are regulated by the International Financial Services Commission (IFSC), providing a level of security and trust for clients.

On the other hand, Alpari is a reputable broker with a long history and global presence. They provide a wide range of financial instruments, multiple trading platforms, and educational resources. Alpari is regulated by respected authorities such as the Financial Conduct Authority (FCA), adding to their credibility.

The verdict on which broker is better, SuperForex or Alpari, depends on individual preferences and trading needs. Traders should consider factors such as trading conditions, available instruments, regulation, and additional services offered by each broker. It is recommended to thoroughly compare the features and reputation of both brokers to make an informed decision based on personal requirements and trading objectives.

Conclusion: SuperForex Review

In conclusion, SuperForex is a well-established global broker that offers a wide range of financial instruments and competitive trading conditions. With its low minimum deposits, attractive spreads, and various account types, SuperForex aims to cater to the diverse needs and preferences of traders. The company is regulated by the International Financial Services Commission (IFSC), ensuring a level of security and trust for clients. While individual experiences may vary, overall customer reviews indicate positive feedback regarding the trading platform, customer support, and educational resources provided by SuperForex. Traders considering SuperForex as their broker should carefully evaluate their specific requirements and compare the features and services offered to make an informed decision.

SuperForex Review FAQs

Can I trade with SuperForex if I have limited trading experience?

Yes, SuperForex offers account types suitable for both beginners and experienced traders. Their Standard Account is designed for beginners, offering flexible trading conditions and a low minimum deposit requirement. Additionally, they provide educational resources and customer support to assist traders in their learning journey.

How can I deposit funds into my SuperForex trading account?

SuperForex provides various deposit methods for convenience. You can fund your account through bank transfers, credit/debit cards, electronic payment systems, and cryptocurrencies. Simply log in to your SuperForex account, navigate to the deposit section, choose your preferred payment method, and follow the instructions to complete the deposit process.

Is my personal and financial information safe with SuperForex?

SuperForex takes the security of their clients’ information seriously. They employ robust security measures, including encryption technology, to safeguard personal and financial data. Additionally, as a regulated broker, SuperForex adheres to strict compliance standards to ensure the protection of client information. It is always advisable to use secure internet connections and keep your login credentials confidential for enhanced security.