Suppose traders have a specific strategy to enter the trade but want to avoid analyzing multiple currencies manually. They turn this strategy into an indicator by simple programming in the MetaEditor space. Or, to avoid step-by-step entry into transactions, traders can turn the system into an Expert. How reliable is a new strategy or trading robot or a newly programmed indicator or Expert to be used in the real market?

Also Read: What is the Bear Call Spread Strategy and How to Apply It?

Contents

- What Are the Advantages of Using Strategy Tester?

- How Can the Strategy Tester Improve Trading Strategies?

- Reasons to Use Strategy Tester

- How to Use Strategy Tester in MetaTrader?

- Conclusion

- FAQs

What Are the Advantages of Using Strategy Tester?

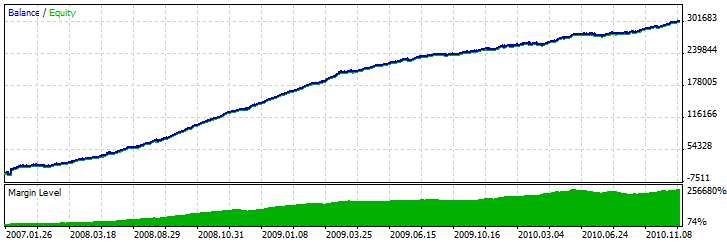

Using the Strategy Tester, we determine how the trading strategy worked in the past. In this regard, there is no guarantee, but the strategy that has brought good results in recent months will usually be profitable in the future. In any case, they need to test the strategy using robot performance prior to trading. But why is it necessary to use a trading strategy tester test?

- Prevention of loss

The first reason to test a strategy is to avoid losses.

- Having confidence in transactions

If they know that the Strategy Tester has tested your trading strategy and the result is error-free, you are in a good position and can trade with high confidence. This is something every trader should have.

- Distinguish good trades from bad trades

Traders are only expected to participate in some trading opportunities. Not all trades are profitable, but they can be difficult to spot. Each strategy tested provides traders with information on which indicators, trading environments, currency pairs, and timeframes are risky.

- Strengthening the transactions

Using the Strategy Tester is the only way to show whether your trading strategy needs to be adjusted. For example, after some time, traders must change their strategy to fit their needs.

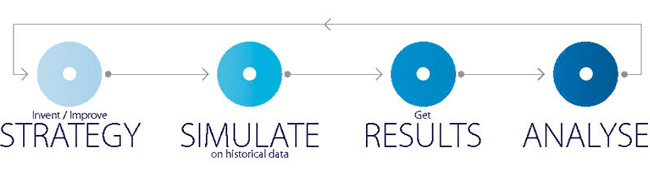

How Can the Strategy Tester Improve Trading Strategies?

This tool can improve the trading results of traders in several ways, among which the following can be mentioned:

- Testing and reviewing the trading robots allows traders to determine which is more profitable.

- Using this software, traders learn how to reduce losses without wasting time, check their strategy when the market is down, and record their conclusions about risk management. In general, trading robots help traders better understand the market performance in less time.

- In Strategy Tester, you can define spreads and swaps for each currency pair. On the other hand, this tool provides very realistic results because any broker can be simulated.

- The advanced data section includes different brokers’ historical data, allowing traders to train and test their strategy more flexibly.

- Traders can adjust the parameters of the strategy without stopping the simulation.

Reasons to Use Strategy Tester

There are many reasons to use the Strategy Tester tool, including the following:

- Test and check Experts

Before you use an Expert, you need to take a test from that Expert. You need to use this tool to know what reaction the market would have shown if the Expert had been active for you in the past.

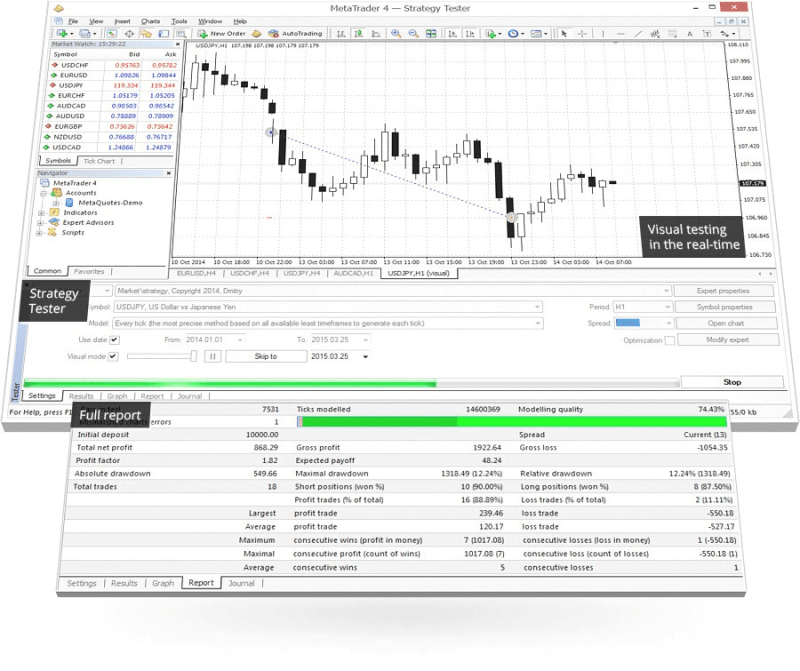

Of course, for Expert backtesting in MetaTrader4, you must be able to perform a strong without any errors and with the highest accuracy backtesting. To have an error-free backtest, we must enter the historical data correctly in MetaTrader.

- Checking the accuracy of the indicator

You may have an indicator with a specific application; in this case, you can set the relevant part on the indicator. By calling the indicator, select the desired indicator from the drop-down menu and check the indicator performance.

- Defect personal strategy

After entering the market’s historical data in your MetaTrader, you can follow the market in the period you want and follow your strategy. One of the most important benefits of the Strategy Tester is the problem-solving of the strategy.

- Helping trainers

If you want to teach the strategy to someone, you can teach that strategy in the past of the market than teaching through the Strategy Tester. This work has two features:

- First, to see the result, you can go through the movement of the market at a higher speed

- Second, you can have training classes every time

How to Use Strategy Tester in MetaTrader?

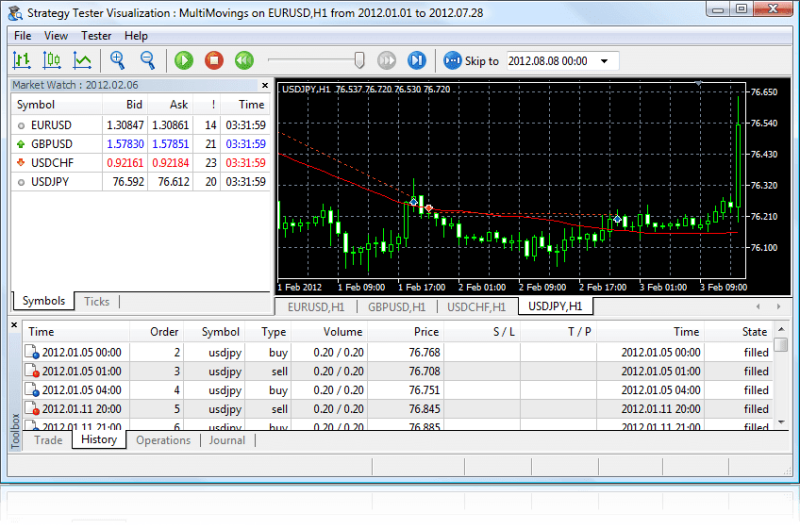

Expert Advisor is a program written in MQL5 language implemented in response to some external events. Expert Advisor has a predefined event handler for each event. The new tick event (price change) is the Expert Advisor’s main event; therefore, we need to generate a tick sequence to test the Expert Advisor. There are 3 modes of tick generation implemented in MetaTrader5 Strategy Tester:

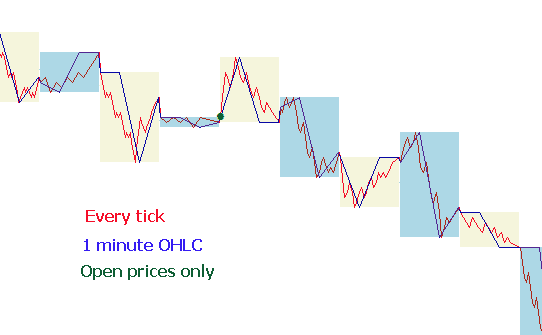

- Every Tick

- 1 Minute OHLC

- Open Prices Only (OPO)

The basic and most accurate mode is the “Every tick” mode. The other two modes are simplifications and are described in comparison to the “Every tick” mode.

“Every tick” in Trading Strategy Tester Test

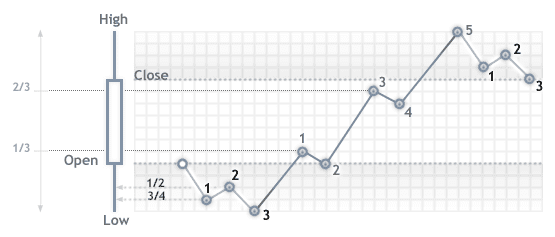

Historical market data for financial instruments are transferred from the trading server to MetaTrader 5 in packed minute bars. To test the trading strategy, we need a sequence of ticks in which the work of the Expert Advisor will be simulated.

1 Minute OHLC in Historical Data

In MetaTrader 5, the “Every tick” mode is the most accurate but slowest among the three available modes. The execution of the OnTick handler occurs every tick, while the tick size can be very large. For a strategy where the price movement of the tick sequence across the load is not important, there is a faster simulation mode.

In this mode, the tick sequence is made only with OHLC prices, and the number of generated control points is significantly reduced.

Open Prices Only

In this case, the traders can generate ticks based on OHLC prices from the time frame. The OnTick function of the Expert Advisor is executed only at the beginning of the load. Due to this, stop, and pending levels may occur at a price that differs from the specified price (especially on higher time frames). Instead, we can quickly run an Expert Advisor evaluation test.

Also Read: Bear Trap – The Best Technical Strategy to Profit from Short Squeezes

Conclusion

A strategy Tester is used to test trading strategies. Through this tool, the effectiveness of the strategy is determined before the actual transaction. Using this method, traders can test their strategy before implementing it or designing their trading strategy.

This article discusses the advantages of using the Strategy Tester, how to improve trading results, and the reasons and how to use the Strategy Tester in MetaTrader.

FAQs

What Are the Advantages of Using Strategy Tester?

- Prevention of loss

- Having confidence in transactions

- Distinguish good trades from bad trades

- Strengthening transactions

How Can the Strategy Tester Improve Trading Results?

- Identifying which trading system is more profitable for traders.

- Traders learn to cut losses without wasting time and review their strategy when the market is bearish.

- Definition of spreads and swaps for each currency pair

- Greater flexibility in strategy training and testing

- The possibility of setting strategy parameters without stopping the simulation

What Are the Main Reasons to Use Strategy Tester?

- Test and check Experts

- Checking the accuracy of the indicator

- Defect personal strategy

- Helping trainers