Options trading strategies easily qualify as some of the most complicated in the realm of financial markets. But that's only because they offer traders great flexibility so they can best determine their profit potential and limited risk ranges to their specific needs and requirements.

A great example of these interesting strategies is the straddle options strategy, which helps traders make money on their trades as long as the price of the underlying stock makes a large move in either direction.

With that in mind, in today's detailed guide, you're going to learn everything there is to learn about the straddle strategy, how you can best use it, where it makes the most sense, and more. We'll even take a detailed look at examples of the straddle options strategy in action.

Also Read: Options Trading Books

Contents

- What Is a Straddle Strategy?

- How Does Straddle Trades Work?

- Types of Straddle Trades (Long Straddles vs. Short Straddles)

- Example Of the Straddle Strategy and How They Make You Money

- What Is A Strangle?

- Conclusion

What Is a Straddle Strategy?

The straddle strategy is a neutral options trading strategy in which a trader or investor simultaneously buys a put option and a call option on the same underlying security with the same expiration date and the same strike price.

A trader joins these kinds of neutral trading mixes when they're not sure the direction the market will take. The trader only decides whether or not they think the market is about to increase in volatility.

While trying to learn everything you can about a straddle strategy, you must've also come across the term Strangle. It's related to the straddle strategy, but not quite. More on this later.

How Does Straddle Trades Work?

Here is an in-depth guide into how a straddle strategy should work in a real market condition. To make a straddle trade work, the trader buys a call option and a put option on the same underlying asset, each with the same strike price and expiration date.

If their prediction is right and the same security they straddled on changes its price significantly, one of the two contracts loses its value as it moves out of the money, while the other one gains value as it keeps moving into the money.

Remember, the only total cost to the trader here is the premium paid for both option contracts. So essentially, straddle traders bet that the price of the underlying stock will significantly change to either render an “in the money call option” or an “in the money put option” more valuable at the expiry date than the premium paid for both contracts put together.

Types of Straddle Trades (Long Straddles vs. Short Straddles)

There are two distinct ways in which a trader or investor can use a straddle strategy. These are a short straddle and a long straddle.

Long Straddles

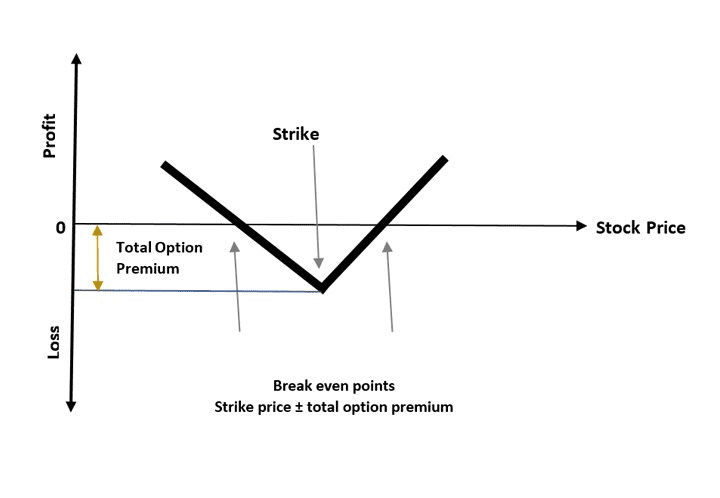

As we just described, long straddles involve purchasing both call options and put options with the hope of closing both for a profit once the stock price moves significantly in the direction of one strike price. With this kind of straddle, the maximum loss the trader is faced with is the limited premium they paid for the call options and put options.

The profit potential, on the other hand, is virtually unlimited (theoretically). The further the stock's price moves from the strike price, the more profit the trader will make once they decide to resale or exercise their “in the money contract.”

Short Straddles

Short Straddles aren't as common as long straddle trades. Also, they're only typically attempted by the most experienced traders because they carry way more risk while their profit potential is capped.

To make short straddle trades, traders would sell (write) call options and put options for the same underlying asset with the same expiration date and strike price. This implies speculating that the underlying security won't change in price significantly before the expiry date.

If the traders are right, the contracts are unlikely to get exercised, which implies they'll pocket the premium charged as profit. Note that this premium charged is the maximum profit possible for short straddle trades.

Example Of the Straddle Strategy and How They Make You Money

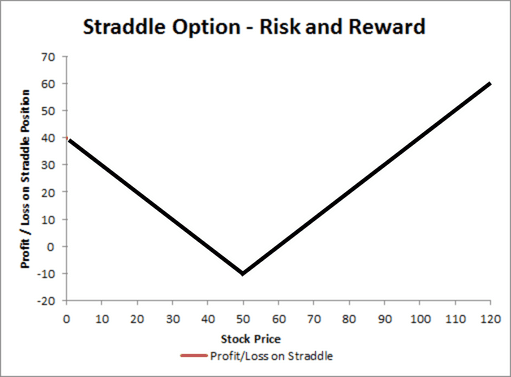

In the image above, the trade example shows one buying a long straddle option with a $50 strike price and a total premium paid of $10 for both options trades.

In this example case, the worst-case scenario is that the underlying asset does not move and remains at its $50 strike price at the expiration date. If that happens, then both the call and put option expire worthless, and the only thing you will lose is the $10 total premium paid.

Conversely, if the stock price makes a large move in any of the two directions, you make a profit. For example, let us say the stock price falls to $20 by the trade's expiry date. Then the call option the investor placed expires worthless. On the other hand, the put option won't expire worthless and will actually have a $30 value at the expiration date. If you net out the $10 premium paid while placing the trade, you're left with a $20 net profit on the straddle option position.

And in case the stock price shoots to $80, then the end result is the same. Here, the put option will expire worthless, while the call option has a value of $30 at the expiry date. When you deduct the premium received, the profit is the same, $20.

This straddle strategy example proves that these trades thrive best in markets with high volatility because the more the stock price moves your chosen strike price, the greater the total value of both options.

Also, as the example demonstrates, from how the straddle strategy is set, only the put option or call option will have some intrinsic value by the expiry date. The trader believes the option's value will be huge enough to earn a profit on the entire position.

What Is A Strangle?

Remember we said we'd discuss the difference between a strangle and straddle options strategy? Well, here is everything you need to know.

A Strangle strategy is similar to straddle trades since it involves purchasing put options and call options with similar expiration dates and for the same underlying security. It varies from the straddle options strategy in that instead of making a purchase of put and call contracts with similar strike prices, the trader buys contracts with distinct strike price points.

Another key difference between the two is the price movement needed before one earns a profit and the cost of implementing each trade strategy. The strangle options strategy typically needs a bigger price movement in the underlying stock before you can start turning a profit..

What’s more? As we highlighted, however, they're also way riskier than straddle strategies. That's because, as we’ve seen, the underlying security’s price would need to make a significant move to turn a profit.

Conclusion

The main issue with the straddle options strategy is that most traders and investors try using it when it's too apparent that volatility is about to spike on the financial asset. For instance, you'll hear a trader or investor talking about the option prices of straddles when a certain, trusted stock is heading toward its earnings results announcements.

During these periods, the stock price will almost certainly move significantly in a specific direction. Unfortunately, for that same reason, straddle options are often at their most expensive shortly before significant market-moving moments.

Alternatively, the smartest time to employ a straddle strategy depends on when one expects volatility to spike in the underlying asset but not most other people expect the “spike.” During these times, you get the opportunity to open a straddle position during a quieter market time, which implies you'll pay way less for the position.

The only enemy of a straddle options strategy is a stagnant stock price. But as long as the share price rises or falls significantly, you can rest assured that your straddle position will make you money in both bear and bull markets.