If you are looking to improve your indices and equities trading game, it is time to consider learning how to use different types of technical indicators. More specifically learn what momentum indicators are and how you can use them to speculate the strength or weakness of the price action of an underlying asset.

Momentum indicators are technical tools that help traders evaluate the overbought and oversold price levels and hence predict price movement but not price direction. One such momentum indicator is the McClellan Oscillator.

In this article, we will take you through what the McClellan Oscillator is and how to use it to improve your future results and make more profit. As a bonus, we have compared the McClellan Oscillator to other technical indicators to better help you grasp the idea behind this oscillator.

Also Read: What Is A Market Order?

Contents

- What is a Stock Order?

- What is a Market Price Order?

- What is a Limit Price order?

- Market and Limit Order Costs

- What are Price Gaps?

- Other Stock Order Types

- Conclusion

- FAQs

What is a Stock Order?

A stock order is a buy or sell instruction for a security or asset. The type of stock order or asset determines how the order will be executed.

Traders have different strategies, and their expectations and investment strategy determine the types of stock orders they will place. Other factors that can influence stock order types preference includes market volatility and slippage.

There are two major stock order types. They are Market Orders and limit orders.

What is a Market Price Order?

This is the most common of trade executions. It is an order issued by traders or investors, to buy or sell a security or asset instantly at the current price. A market order means immediate trade execution, which is suitable when the current market price is a favourable execution price.

A Market Order may sometimes have a different execution price from the price seen before execution. This could be caused by spread or volatility. Only when the bid/ask price is precisely the same as the previous transacted price will the execution price remain stable.

Individual investors who wish to acquire or sell stock quickly use market orders. The benefit of utilizing market orders is that the transaction is assured to be filled. It will be done as quickly as feasible. Even though traders do not know the precise price at which the asset will be purchased or sold, market orders on equities that trade in the thousands or even millions of shares each day are likely to be filled near the bid/ask values.

What is a limit Price order?

A limit order is also known as a pending order. Limit orders investors or traders to buy or sell stocks and assets at a specified price or limit price if the asset comes to that price in the future.

A limit order is used to initiate a transaction if the price reaches a specified level. The request will not be completed if the price does not reach the specified level, and there is no guarantee that the price would reach that level. A limit order, in essence, specifies the maximum or lowest price at which you are ready to purchase or sell.

There are 4 types of limit price orders. There are:

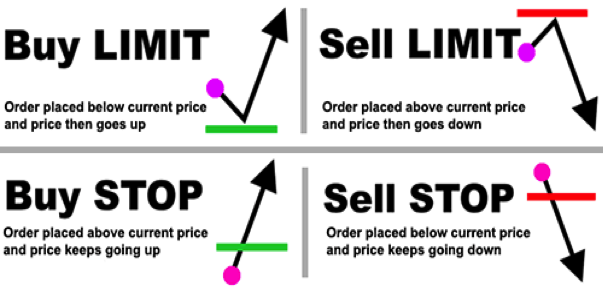

Buy Limit order

This is a buy order for security at a specified price or below a certain price. Buy limit orders must be positioned on the proper side of the market in order to achieve their goal of price improvement. This refers to placing a purchase limit order at or below the current market price.

Sell Limit order

A sell order for a security at a limit price or above a certain market price. The order must be made at or above the current market ask to assure a better stock price.

Buy Stop order

This is a purchase order for a security at a price higher than the prevailing market quote. Once a certain price level is reached (the stop price), a purchase stop order becomes active. Orders put above the market are known as buy stop orders, while orders placed below the market are known as sell stop orders (a buy stop order is the opposite of a sell stop order). When a stop level is achieved, the order is changed to a market or limit order right away.

Sell Stop Order

A sell stop is an order to sell a security for less than the current market price. A sell stop order, like a purchase stop, becomes active only when a certain price level is achieved.

Also Read: What Is a Buy Stop Order, and Why Is It Important for any Trader?

Market and Limit Order Costs

Investors should be mindful of the additional fees when selecting between a market order or limit order. Market orders, on average, have lower commissions than limit orders. The variation in commission might range from a few pennies to more than 50 dollars. For Instance, When you put a specified limit price on a market order, a $2 commission might be increased to $5. Make sure your limit order is profitable before you put it.

Let's assume a market order costs $10 and a limit order costs $15 at your broker. You wish to acquire stock XYZ at $99.90 per share, which is now trading at $100 per share. You pay $1000 (10 shares x $100 a share) plus a $10 fee on a market order to buy 10 shares, for a total of $1010. You would spend $999 + $15 fees for a total of $1014 if you placed a limit order for 10 shares at $99.90.

Even if you save some money by buying the stock at a cheaper price, you'll lose it in the operation's additional fees. Additionally, if you use a limit order, it's likely that the stock may not fall to your entry price. As a result, if it keeps going up, you may miss out on the chance to buy.

What are Price Gaps?

A price gap emerges when the price of a stock moves quickly increasing or decreasing with no trade-in between. Earnings releases, a modification in an analyst's prognosis, or a news release might all be influencing factors. When data or occurrences outside of market hours cause an imbalance in supply and demand, gaps are common at the open of trading platforms.

Stop orders and price gaps

There are several differences between a stop order and a limit order, but the main difference is that a limit order will only be executed at a specific price or better price. A stop order, on the other hand, will be executed at the market's current price once it initiates at the stated price—which implies it might be filled at a price much different from the stop price.

Other Stock Order Types

Now that we've covered the two primary orders, let's look at some of the additional limits and unique commands that many brokerages enable on their orders.

Stop Loss Order

One of the most helpful orders is a stop-loss order, which is also known as a stop market, on-stop buy, or on-stop sell. Contractive to limit and market orders, which become activated as soon as they are placed, this order remains inactive until a specific price is reached, at which point it is triggered as a market order.

This type of order is ideal for exiting the market in an unfavourable market situation.

Stop Limit Order

Stop limit orders similar to stop-loss orders, but they have a limit on the pricing at which they will activate. A stop-limit order specifies two prices: the stop price, which converts the request to a sell order, and the limit price. Rather than being a market order to sell, the sell order turms to a limit order that will only activate if the price is equal to or better than the limit price. Stop-loss orders, which could be executed during a selloff when prices plunge but then rebound, may be mitigated as a result of this.

Trailing stop order

A trailing stop order is comparable to a stop order in terms of functionality. A trailing stop order, on the other hand, is dependent on the relative change in market price rather than a set target price. A trailing stop order is most commonly linked with long positions, although it may also be utilized with short positions. The stock will be acquired or sold in this situation if it rises or falls by a certain proportion.

All or None (AON)

This sort of order is very significant for penny stock investors . If you place an all-or-none order, you'll either get the whole quantity of products you demanded or none at all. When a stock is particularly illiquid or a limit is set on the order, this is usually an issue.

Immediate Execution or Cancel (IOC)

An IOC order requires that the portion of an order which can be completed in the market in a very brief span of time, frequently only a few seconds or less, be filled first, followed by the cancellation of the remainder of the order. If no assets are exchanged within that “immediate” time frame, the order is totally cancelled.

Fill or Kill (FOK)

This order combines an AON with an IOC specification, It requires the full order size to be exchanged in a very brief span of time, usually a few seconds or less. The order is cancelled if neither requirement is satisfied.

Good ‘Til Canceled (GTC)

This is a time limit that you may set for certain orders. A GTC order will be in effect unless you cancel it. Brokerages usually limit the amount of time an order can be active to 90 days.

Day

If you don't use the GTC command to define an expiry time period, the order will normally be established as a day order. This signifies that the order will expire at the conclusion of the trading day. You'll have to re-enter it the next trading day if it was not processed.

Take Profit

When a trade reaches a specified level, a take profit order (TP) is used to close it out the trade at a profit. When a take profit order is executed, the trading position is closed. This sort of order is always linked to a pending order's open trade position.

Conclusion

Individual investing requires understanding the difference between a market order and a limit. There are lots of instances when one will be more suitable than the other, and your investment strategy will also determine the order type.

An investor with long term goals is more likely to utilize a market order because it is less expensive, and the financial decision is based on factors that will play out over years and decades, so the present market price is less important. A trader, on the other hand, is aiming to act on a relatively short trend in the charts and is thus much more aware of the market price. In this situation, a limit order to enter in with a stop-loss order to sell is often the basic minimum for establishing a trade.

FAQs

What is the best order type when buying stock?

When the major purpose of the trade is an immediate order, market orders are ideal. When you are certain that you have to fill your transaction and require immediate results, market orders are frequently used.

How do you categorize shares?

Shares of a publicly listed firm with distinct share classes, commonly marked by Class A and Class B, are known as classified shares.

The most common distinction between categorized shares is the number of votes imparted by ownership, or the absence thereof.

How do you categorize stocks?

The types of organizations in which the companies operate can be used to categorize stocks. Energy, technology, consumer staples, telecommunications, health care, and financials are among the ten primary groups divided by Standard & Poors. Under the major categories, there may be sub-categories.

What is a blue-chip stock?

A blue-chip stock is a large corporation with a good reputation. These are generally large, well-established, and financially sound businesses that have been in operation for a long time and have consistent earnings, generally providing dividends to shareholders.