StarTrader Review

Selecting the right Forex broker is essential to your success in Forex trading in the financial markets. With so many brokers to choose from, finding one that aligns with your trading goals can be challenging. A broker’s features and services impact your overall trading experience, influencing profits and the safety of your investments.

StarTrader stands out by offering clients over 200 CFDs on currency pairs, stocks, indices, metals, and commodities. In this review, I’ll give you a comprehensive look at what makes StarTrader unique. I’ll analyze its account options, commission structures, and deposit/withdrawal processes, to offer a balanced view of whether StarTrader could be your ideal Forex broker.

What is StarTrader?

StarTrader is a Forex broker providing over 200 CFDs across various asset types, including currency pairs, stocks, indices, metals, and commodities. They offer two account types, STP and ECN, each requiring a minimum deposit of $50. STP spreads start at 1.3 pips, while ECN spreads start at 0 pips but come with a $7 fee per full lot.

Clients can trade using the MetaTrader 4 and MetaTrader 5 platforms, allowing flexibility in executing strategies. Leverage options are flexible and can go up to 1:500 for most asset types, enabling traders to tailor their trading according to risk appetite. StarTrader also provides a demo account for those who want to practice before live trading.

Benefits of Trading with StarTrader

Trading with StarTrader comes with several benefits, as I discovered firsthand after trading with the broker. Their flexible leverage up to 1:500 allows me to scale my trades according to my risk appetite. This feature is especially helpful when I’m trading multiple CFDs across currencies, stocks, and commodities.

Their zero-fee policy on deposits and withdrawals ensures I don’t lose profits to unnecessary transaction charges. In addition, the rapid order execution through their MetaTrader 4 and MetaTrader 5 platforms lets me manage my trades efficiently.

Furthermore, their regulatory compliance provides peace of mind that my funds are secure. Knowing that customer support is responsive and knowledgeable adds extra assurance, making StarTrader a trustworthy platform for my trading activities.

StarTrader Regulation and Safety

StarTrader is a registered Forex broker with offices across Saint Vincent and the Grenadines, Hong Kong, Australia, Cyprus, and Seychelles. Its regulation includes oversight by recognized financial authorities like ASIC, SVGFSA, and FSA. These regulatory bodies ensure that brokers follow strict guidelines to safeguard client interests and maintain transparent business practices.

Why is this important? Regulation is essential for ensuring that a broker operates ethically and securely. From my experience trading with StarTrader, I found these regulatory measures foster a more trustworthy environment. Clients can be confident that their funds and personal information are handled with care, offering peace of mind during trading activities. Furthermore, StarTrader International PTY Limited offers negative balance protection to their traders.

StarTrader Pros and Cons

Pros

- Free 30-day demo and low $50 deposit.

- Low spreads and fees.

- Fast execution with no restrictions.

- Trade sizes from 0.01 to 100 lots.

- Knowledge Center with articles, videos, and webinars.

Cons

- CFDs only.

- Few analytical tools.

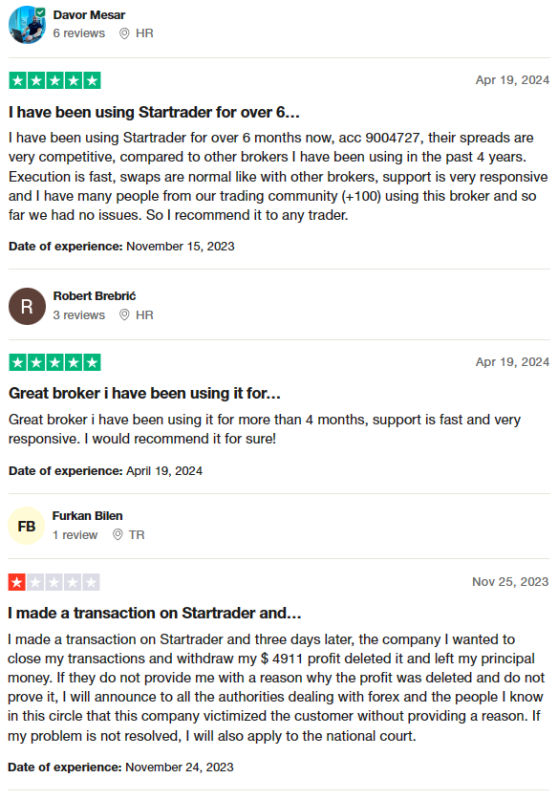

StarTrader Customer Reviews

Customer reviews of StarTrader are generally positive, with traders praising its competitive spreads, fast execution, and responsive customer support. Many traders from a particular community reported a smooth experience using StarTrader over several months, recommending it to others. However, one customer expressed frustration over a profit withdrawal issue that wasn’t resolved to their satisfaction, raising concerns about transparency in handling transactions. Overall, StarTrader garners positive feedback, but occasional negative experiences highlight the importance of careful monitoring and communication.

StarTrader Spreads, Fees, and Commissions

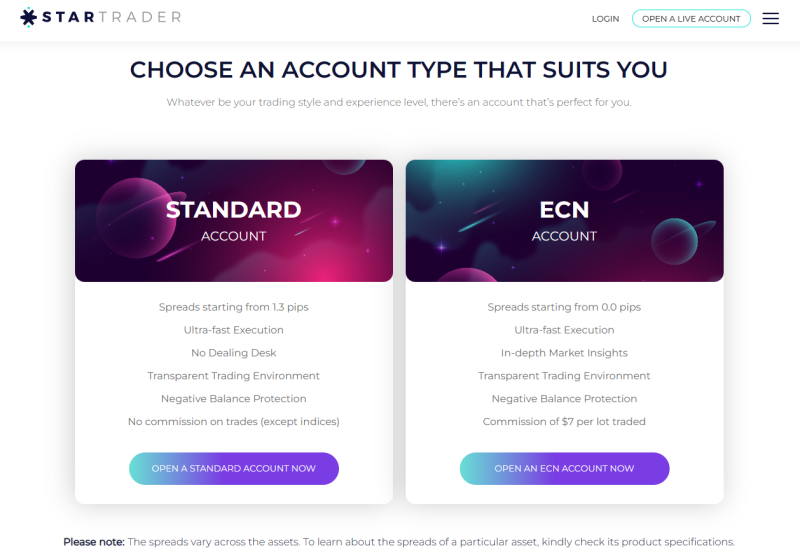

StarTrader’s spreads, fees, and commissions offer different structures depending on the account type. STP account holders get a floating spread starting from 1.3 pips, while those with an ECN account can benefit from raw spreads as low as 0 pips, though they incur a commission of $7 per lot.

In terms of deposits and withdrawals, the broker provides options like credit/debit cards, bank transfers, electronic wallets, and cryptocurrency wallets. StarTrader does not charge fees for any of these transaction methods. However, there could be third-party fees, particularly for international bank transfers that may cost up to $20. Therefore, it’s essential to be aware of these potential additional trading costs when managing your account.

Account Types

StarTrader offers three account types:

- Demo Account: The demo accounts are free to open and available for 30 days. It includes 100,000 virtual dollars for practice trading with real-time market quotes.

- Standard Account: With a minimum deposit of $50 and leverage up to 1:500, this account provides spreads starting at 1.3 pips. There are no trading fees, and clients can trade all instruments from 0.01 to 100 lots.

- ECN Account: Also starting with a minimum deposit of $50, this account features spreads starting from 0 pips and a trading commission of $7 per lot. Leverage is up to 1:500 (or 1:20 for stock CFDs). The account allows all strategies and provides 24/5 support.

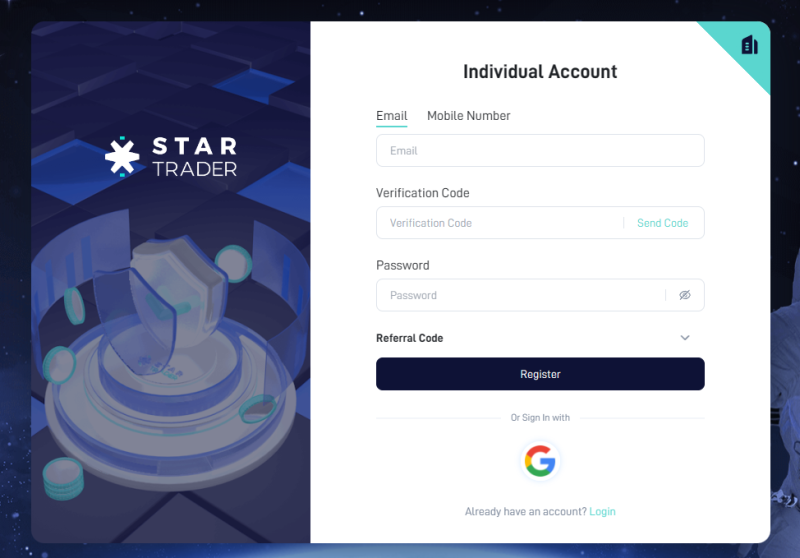

How to Open Your Account

- Visit the broker’s website and pick your preferred interface language from the top-right corner. Click on the “Open a user account” button.

- Enter your email or phone number to receive a verification code, create a password, and, if applicable, enter a promo code. Click “Register” after confirming your contact details.

- Access your user account immediately and find the demo account that’s automatically created for you. To set up a live account, choose your trading platform (MT4 or MT5), account type (STP or ECN), and specify any interest in the PAMM service. Select your account currency, set up a trading password, and click “Next.”

- Answer questions about your income sources, trading experience, and USA residency.

- Provide your personal information, including your name, gender, date of birth, and ID number. Verify this info by uploading a photo or scan of your passport or national ID.

- Go to “Payment” and then “Deposit” to add funds using your preferred method. Follow the on-screen instructions.

- Head to the “Platform” section to download the MT4 or MT5 trading platform or join a PAMM account. You can also join the copy trading service.

StarTrader Trading Platforms

StarTrader provides access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. From my experience, these platforms offer comprehensive tools suitable for both beginners and advanced traders. MT4 is a reliable choice for those who prefer a simpler, more intuitive platform with core trading features and automated trading.

MT5, on the other hand, builds on MT4’s capabilities by providing more advanced charting tools, additional order types, and a broader asset selection. For traders seeking versatility and deeper market insights, MT5 stands out. Both platforms deliver real-time market data and are user-friendly, catering to different trading strategies.

What Can You Trade on StarTrader

StarTrader offers CFDs on a range of financial instruments, including currency pairs, stocks, indices, metals, and commodities. From my experience trading with StarTrader, the platform provides access to major, minor, and exotic currency pairs, offering flexibility for traders to diversify their portfolios.

Stocks, indices, and metals CFDs also provide ample opportunities to speculate on global market movements. Commodities such as oil, gold, and agricultural products allow traders to capitalize on economic trends and market shifts. This comprehensive selection makes StarTrader suitable for implementing varied trading strategies.

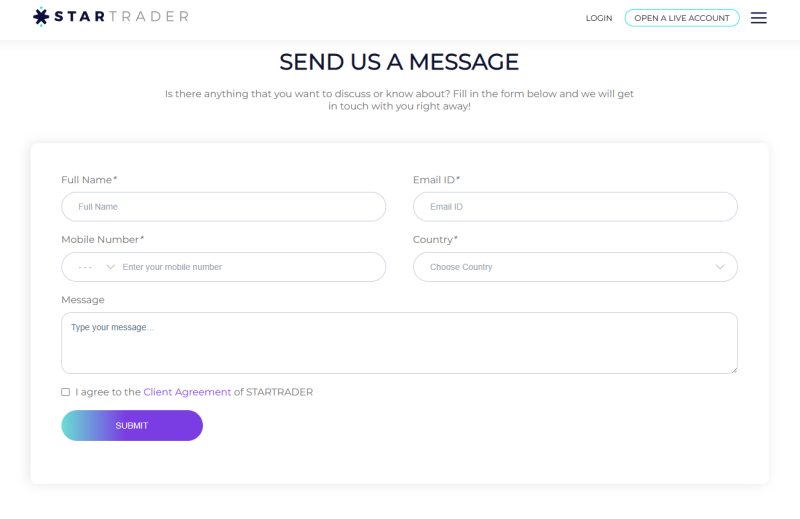

StarTrader Customer Support

StarTrader’s customer support team offers several convenient ways to get in touch with their team. Email, tickets via the website, and live chat both on-site and within your user account make it easy to resolve any queries quickly. From my experience, I found their support team responsive and knowledgeable.

StarTrader is also active on Facebook, X, LinkedIn, Instagram, YouTube, and TikTok. You can reach support specialists through these channels and get updated on the broker’s latest news. I recommend subscribing to these accounts to stay informed about market trends and platform updates.

Advantages and Disadvantages of StarTrader Customer Support

Withdrawal Options and Fees

When I trade on a demo account, I’m working with virtual money, meaning there’s no real profit involved. Once I switch to a live trading account, I’m able to make actual trades and, if my forecasts are accurate, earn real profits.

To withdraw my earnings, I simply submit a request on the broker’s website, where it’s processed promptly. Withdrawal options include bank transfers, Mastercard, Visa, electronic payment systems, and cryptocurrency wallets using USDT stablecoin.

There are no fees for these transactions. Most withdrawal methods deliver funds to my account within a day, though international bank transfers may take 3-5 days.

StarTrader Vs Other Brokers

#1. StarTrader vs AvaTrade

AvaTrade has been a prominent broker since 2006, offering over 1,250 instruments to a global client base. They provide four well-regulated trading platforms, with headquarters in Ireland and offices in Australia, Japan, and the British Virgin Islands. However, they don’t accept U.S. traders. StarTrader, a newer broker, focuses on CFDs across 200 instruments with two primary account types. With leverage up to 1:500 and zero fees on deposits/withdrawals, it provides rapid trade execution.

Verdict: StarTrader is better for lower fees and higher leverage, while AvaTrade appeals to traders seeking broader market access.

#2. StarTrader vs RoboForex

RoboForex boasts over 12,000 trading options across eight asset classes, offering tools like ContestFX to help traders build their careers. They are FSC-regulated and use MetaTrader, cTrader, and RTrader platforms. StarTrader simplifies its offering with over 200 CFDs on the MetaTrader 4 and 5 platforms. They provide straightforward fee structures, tight spreads, and high leverage.

Verdict: StarTrader is better for simplicity and higher leverage, while RoboForex is ideal for those needing extensive trading instruments and platforms.

#3. StarTrader vs Exness

Exness offers 120 currency pairs, energy, and metals with leverage up to infinity. Their platforms cater to varying trading strategies and account types. Exness is known for immediate fund withdrawals and reliable brokerage services. StarTrader has a narrower focus, emphasizing currency pairs, indices, and commodities while offering leverage up to 1:500. They have zero withdrawal fees and provide comprehensive support.

Verdict: StarTrader is better for low fees and simplicity, while Exness excels with a broader asset selection and infinite leverage.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH STARTRADER

Conclusion: StarTrader Review

StarTrader distinguishes itself with over 200 CFDs and two flexible account types, appealing to traders who prioritize high leverage, zero fees on deposits/withdrawals, and fast trade execution. The platforms, MetaTrader 4 and 5, offer reliable tools for traders to implement various strategies.

The broker’s strong regulation provides confidence in fund security, while customer support receives praise for responsiveness. However, users should note that StarTrader exclusively offers CFDs and lacks robust analytical tools, potentially limiting advanced trading strategies.

Also Read: LonghornFX Review 2024 – Expert Trader Insights

StarTrader Review: FAQs

What trading platforms does StarTrader offer?

StarTrader provides both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, offering traders flexibility and a range of tools.

Are there withdrawal fees on StarTrader?

No, StarTrader does not charge fees for withdrawals, though third-party banking fees may apply.

What assets can I trade on StarTrader?

StarTrader offers over 200 CFDs, including currency pairs, stocks, indices, metals, and commodities.

OPEN AN ACCOUNT NOW WITH STARTRADER AND GET YOUR BONUS