Contents

- Staking Crypto

- How Staking Crypto Works

- Staking Crypto Benefits

- Staking Crypto Risks

- When To Avoid Staking Crypto

- Frequently Asked Questions

Staking Crypto

Staking crypto is a popular term among crypto investors. It describes numerous approaches cryptocurrencies verify transactions, enabling traders to earn profits on their crypto holdings. In other words, it refers to the process of committing crypto assets to confirm transactions and support a blockchain network.

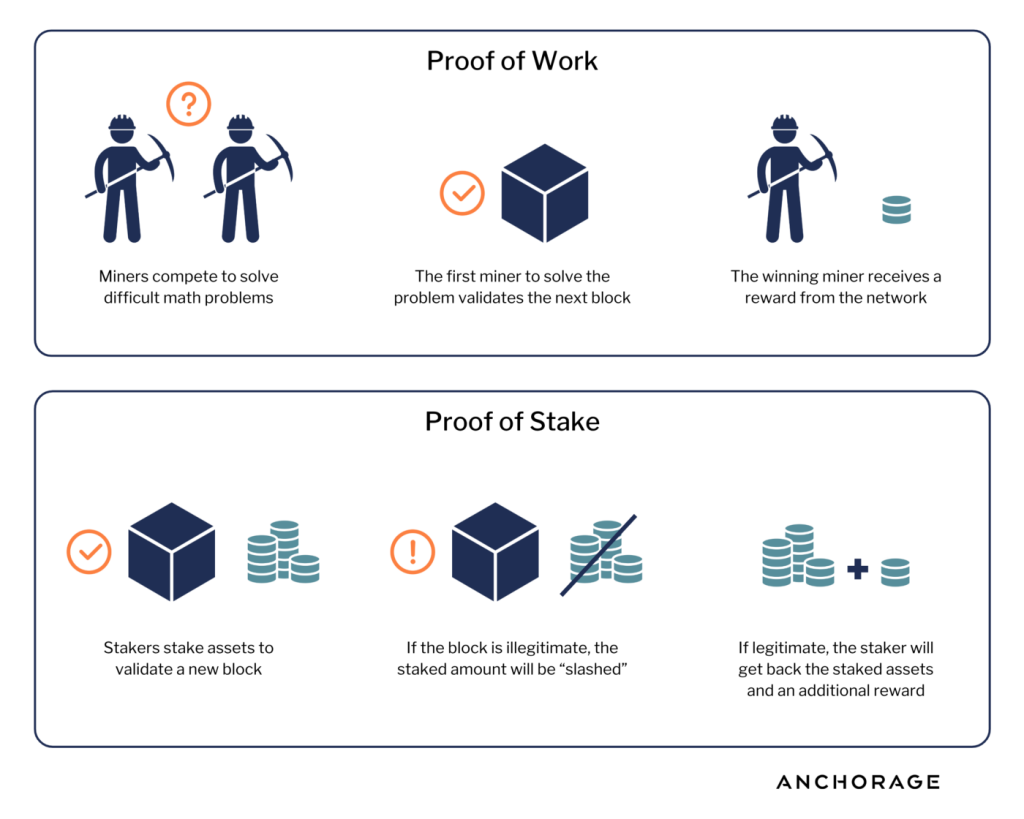

The concept is compatible with cryptocurrencies that apply the proof-of-stake approach to process their payments. In any case, it is an advanced and more energy-efficient system than the proof-of-work approach that requires mining devices that utilize computing power to calculate mathematical equations.

Staking crypto can be an excellent option to generate a passive income from your crypto investments. The best part is that some cryptos offer high staking interest rates. Nevertheless, it would be best to understand how staking crypto works before you get started. Here is the guide to help you.

Also Read: Short Selling

How Staking Crypto Works

Staking refers to the approach that proof-of-stake cryptos use to add transactions to the blockchain. Generally, traders pledge their coins against the hard-to-predict crypto protocol. The protocols select validators from the traders to confirm transaction blocks. Traders who engage more coins get noticed faster.

Once the blockchain updates a block, the protocol mints and distributes new crypto coins as the staking rewards to the block validator. The tips match the value of the trader’s stake, but some blockchains can use different rewards options. It would be best to mention that you ought to purchase proof-of-stake crypto to participate in staking. Hence, cryptocurrency exchanges will allow you to stake the amount you would like to trade.

The trader will still possess the crypto coins after staking. Staking implies that you are trading with the currencies, but you can unstake them later to sell or trade-in other markets. Unstaking can be somewhat complicated and can take time. Besides, some crypto provides the minimum timeframe to stake.

Yet, staking crypto may not work for all crypto types. Most cryptocurrencies utilize the proof-of-work approach to update blocks in their blockchains. Nevertheless, the proof-of-work method may require reliable computing power. Hence, proof-of-work cryptos need significant energy usage.

Staking Crypto Benefits

Several benefits may result from staking crypto. Here are the top benefits:

- It is environmentally friendly if you compare it to crypto mining.

- Traders help to maintain the efficiency and security of the blockchain.

- Unlike how it works for crypto mining, you do not need equipment for staking crypto.

- It provides a straightforward approach to make a profit from your crypto holdings.

The most remarkable benefit you will reap from staking crypto is that it earns more crypto since its interest rates are somewhat generous. Some traders make more than 20% profit yearly. In simple terms, it provides a potentially profitable platform to invest and make a profit from your money. Above all, it also provides a means to support the blockchain that your crypto invests in. In other words, cryptos depend on the traders staking to run smoothly and verify transactions.

Staking Crypto Risks

It would be best to note these three risks of staking cryptocurrencies. They include:

- You might wait for seven days or more to un-stake your crypto.

- Staking crypto may require you to lock up your cryptos for a specific timeframe. Thus, you cannot access or trade with the assets you staked until the end of that period.

- Cryptocurrencies prices feature high volatility and can drop rapidly. Therefore, the loss can outweigh the interest if the value of the assets you staked drops quickly.

The most considerable risk you can meet in staking crypto would be the rapid price fluctuations. Thus, it would be best to avoid cryptos that offer a very high-interest rate. Such cryptocurrency risk entice traders, but they can result in a loss if their value crushes indefinitely. You can opt for crypto stocks instead of adding a cryptocurrency to your portfolio with unpredictable and higher interest rates.

It would be best to mention that you ought to unstake crypto first before you can trade it again. Thus, you must check on the minimum lockup timeframe. Also, ensure that you confirm the period it takes to process and un-stake the request.

Also Read: Inspire Brand Stocks

When To Avoid Staking Crypto

Staking crypto is the most appropriate option for traders with crypto that they don’t intend to stake in an extended period. The good thing is that it can generate interest without taking much time. Yet, you must purchase and invest in a stable crypto that will generate profit over that period.

Frequently Asked Questions

1. What is the Downside to Staking Crypto?

The biggest crypto staking risk is price fluctuations and high volatility. For instance, the loss can outweigh the profit in a situation where you might be earning 20 percent profit, and the profits drop indefinitely by 50 percent. Thus, it would be best to conduct extensive research before taking any position in the stock market.

2. Can you Lose Crypto by Staking?

Some crypto staking systems may require traders to hold their tokens on exchanges or wallets. Yet, some users get worried about losing tickets access if they lose the keys. This statement implies that staking crypto can make traders lose staked assets reward rate access.

3. Does Staking Crypto Increase Price?

Staking crypto can increase the price over a long-term trading period, but it may not work for short-term trading. Where there is minimal demand, there is a negligible impact on the crypto prices. It would be best to check on personal data and chances of earning rewards.