Investors are constantly on the lookout for reliable technical indicators that will enable them to identify market trends. With the proper tools in a trader’s arsenal, profitability is on the horizon.

There are numerous trading strategies and professional trading platforms, that advertise a streamlined investing experience, and the squeeze momentum indicator is emerging as a useful instrument that produces results.

Also Read: How to Use the TTM Squeeze Indicator

Contents

- What Is the Squeeze Indicator?

- Good Option for Trading Strategies

- What Does TTM Do?

- Visualization of the Indicator

- Reading the Bollinger Bands and Keltner Channels

- Trading the Squeeze Indicator with Divergences

- Momentum Value

- Conclusion

- FAQs

What Is the Squeeze Indicator?

This indicator is the brainchild of John Carter. That is a product of a capable investor and not a trader that only works theoretically it is clear from his success on the futures market in 2020 when he earned 18 million dollars.

The practical application of the squeeze momentum is to reveal the situations when volatility is rising or declining. Simply said, it shows when the market moves between a trend and flat movement and the opposite.

The reality of the market is that about eighty percent of the time it will be in a consolidation phase. And only twenty percent will be moving in a given direction. And this applies to every time frame. Typically following a flat movement, there will be a breakout, this is especially true if the flat movement was present for a prolonged period.

Investors prefer to trade the breakouts, and the reason is the potential to make profits from breakouts that get frequently accompanied by a powerful and sustained trend movement.

For investors, it’s crucial to learn the present situation in the market, since various trade types of trades will perform differently in the flat and trend.

If a trader purchases on a new high in a trending market. Still, when purchasing on a new high in a flat, the investors can lose their money. It is also risky to short new highs throughout an evident bullish trend. Although the squeeze momentum is a technical indicator, it is not lagging and can produce alarms concerning reversals in price.

Good Option for Trading Strategies

It’s a solid indicator that can get implemented with various trading strategies. Investors that are active in the futures or options markets, need to get an understanding of the squeeze indicator.

At the same time, they must realize that technical indicators are not perfect tools, they must get supported with other indicators or chart patterns. By doubling down on technical analysis, investors prevent false signals that can adversely influence a trade, generating losses that potentially could have gotten prevented if the damaging information had been identified at the time.

The market is very dynamic and at times unpredictable, affected by multiple factors such as economic and political events. That’s a key reason why many analysis tools get implemented to assess the condition.

So far, research and experience have revealed that squeeze momentum is effective most of the time, but there is always risk present. Investors should remember this when making a trade. Making calculated moves that get verified from multiple indicators is the difference between a profitable strategy and big losses.

What Does TTM Do?

Traders implement the TTM Squeeze because they are confident in the indicators and their capacity to generate results most of the time. Making it an excellent option for experienced and newbie traders who can profit from the TTM Squeeze and transform small investments into significant assets.

This indicator gets frequently implemented to reduce risk factors, increase profits, and target entry and exit points. The experience of using the indicator has proven that it is a dependable instrument that enables traders to forecast significant moves and show accurate timing for investors working with options.

Investors have positive results with the TTM Squeeze, and when used adequately it can bring large profits for a trader. Because of this, it’s a staple on most trading platforms and charting software . It is a solid option for combining it with different indicators and implementing it in various trading strategies. Yet investors need to learn proper implementation of the TTM Squeeze when trading assets.

The market is a high-pace environment, that’s why different analysis tools get implemented to estimate the circumstances. Most try to forecast upcoming price movements and reveal the course of the trend, but there are disadvantages.

Data available from research indicates that TTM Squeeze is productive about 70% of the time, but investors should keep in their sights the other 30% when it will not generate the desired effect in the market. That can be the deciding moment in a profitable trade and big losses.

Visualization of the Indicator

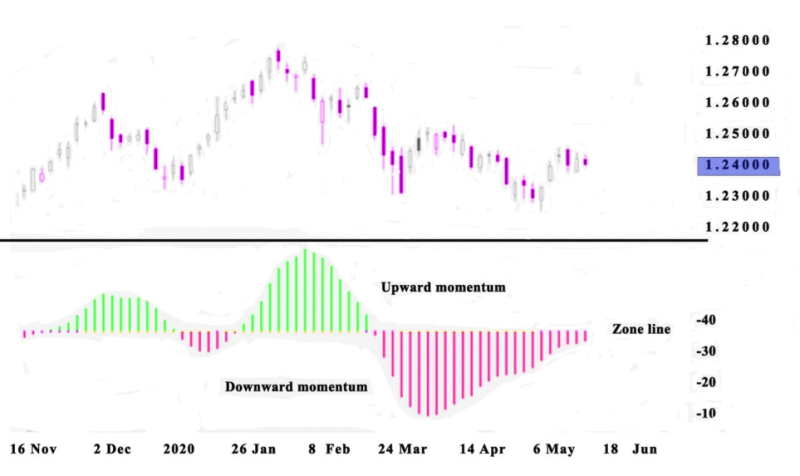

There are two types of visualization for the squeeze momentum. Movement in price gets displayed with green and red histograms. In a situation of decline in the price, the tone of the colors gets dark green. But if the price begins to rise, then a more favorable bright tone of color gets displayed.

With the grey and black dot, the point is to show when Bollinger Bands are within the channel and it signals low volatility. This is done with the black dots, and the gray crosses signify a break in the Keltner Channel, or a squeeze release and the squeeze fires.

Reading the Bollinger Bands and Keltner Channels

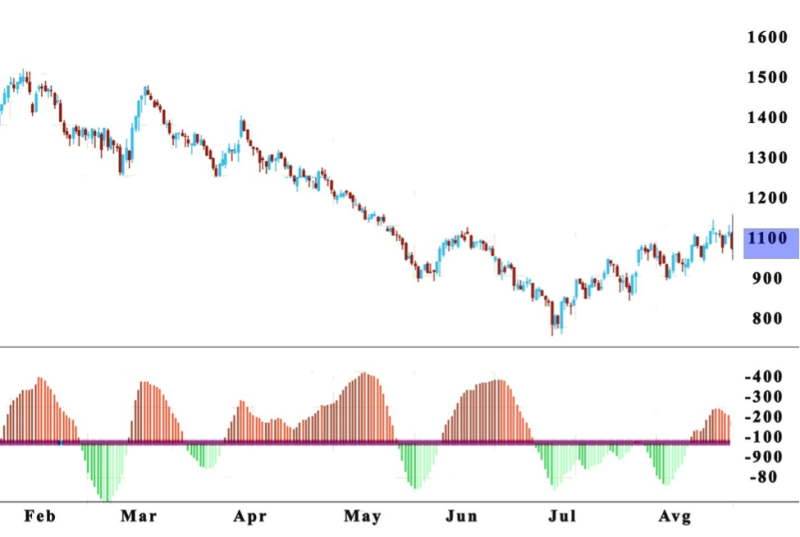

The squeeze momentum is a combination of two indicators Bollinger Bands and Keltner Channels that work to locate periods of consolidation, following a breakout that may occur and can imitate the start in a trend price movement.

The Bollinger Bands estimates the basic price deviation from the average value. And it will calculate the market volatility. When it shrinks, it signals that there is no activity in the market. When they expand, this is a signal that a breakout has happened and there will be a rise in volatility.

While the Keltner Channel estimates Average True Range (ATR). The squeeze momentum searches for locations where Bollinger Bands moves away from the ATR. When this happens the bands expand.

Also Read: What Is The Keltner Channel?

Trading the Squeeze Indicator with Divergences

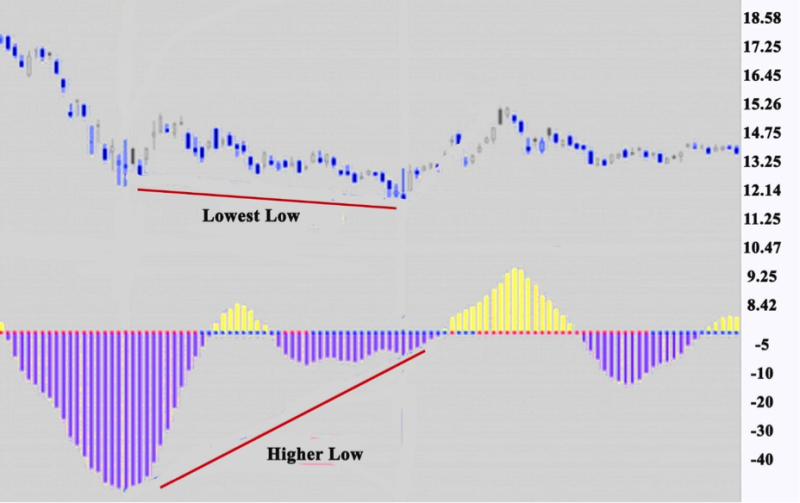

There is an option for trading the squeeze indicator by implementing divergence. This is the period when the momentum begins to decline from the zero line. At the same time, the price moves in the opposite direction. If the price is high, and the histogram angles on the squeeze create a lower high on the other side of the zero line can generate a bearish divergence. For bullish divergence the opposite is true.

When using a trading strategy, investors have to implement risk management. There are two philosophies concerning trading the squeeze divergences.

The normal method is to uses divergences with the angles of price and momentum. The other option is that traders can use the histograms slopes when trading divergences with the squeeze momentum.

Momentum Value

The squeeze occurs quickly but not frequently. The energy in the market is the objective of investors that use indicators to identify changes in the price of the asset they are trading. Estimating the potential of the asset is a reliable signal for upcoming activities.

The squeeze indicator measures the momentum to locate opportunities for trading alternatively the momentum identifies the possible direction of the breakout and provides exit points. Traders frequently implement the squeeze indicator on larger timeframes that why they can confirm a trend more easily. The larger periods form larger chunks of space on a chart, providing investors with metrics that can confirm the forecasted direction of the asset.

Investors that have been active on the market have learned that there are no technical indicators that guarantying precision. Every indicator has a certain margin of error in the information they offer. It’s not recommended to accept the data at face value, especially if the signals are looking too good, they should be always verified and the best approach is to balance the trading strategy. It is useful not to miss good entry points and the momentum value will show when volatility rises and declines.

Conclusion

Traders are known to have said that from all my indicators the squeeze is one of the most consistent. The indicator can be a solid trading options trading, and looking at the histogram bars is not sufficient for the correct squeeze setup, traders need to verify with other technical tools so they can receive a credible squeeze.

Traders can find a book mastering the trade and learn how to interpret green and red arrows and other signals. It’s crucial to implement a reliable squeeze strategy to get the accurate price trend in all financial markets.

FAQs

What Is a Squeeze Momentum Indicator?

Squeeze Momentum reveals periods when volatility rises or declines, basically showing when the market moves from a trend in flat movement and the opposite.

Does the Squeeze Momentum Indicator Work?

Yes, the squeeze momentum is effective in locating moments in time when you can expect a great move in the market. It’s also practical for combining with other trading tools.

How do You Trade with Squeeze Momentum Indicator?

When trading the indicator marks the breakout, which can coincide with a bullish trend. The breakout shows squeeze momentum when the dots on the histogram get replaced by other colored dots. The price course gets verified additionally with the ADX, and the indicator produces a breakout signal.

How does Squeeze Indicator Work?

The indicator gets presented as histogram bars over and under a horizontal axis. The dots along with the horizontal axis show if the asset is squeezing out the last stage of consolidation during the period of sideways price action. After that, it begins accumulating energy to change to a trending market.