If you’re looking for a better way to profit in the market without engaging in traditional trading, then spread betting would be a great option to look at.

Spread betting simply refers to trading financial markets without the need to own a share for a particular stock or asset. It uses cash-settled products which enables a user to assume price movements of a particular asset.

Furthermore, spread betting makes use of leveraging a product – which means you don’t need to deposit a full amount for a particular position.

While leveraging enables one to have greater profits as compared to traditional trading, it also amplifies losses in case the market goes against the anticipated direction.

Spread bets cover betting on movement for shares, forex, commodities, as well as indices . Instead of owning shares, you get to buy points which has particular value or stake. Gains as well as losses on spread betting will be defined by the points that are lost or gained.

Likewise, tax treatment for spread bets are more lose or comfortable compared to traditional trading. Also, depending on the country, spread betting may have no tax at all.

Also Read: How To Swing Trade and Make Money From It?

Contents

- How Spread Betting Works

- Example of Point Spread Betting

- How to Manage the Risks

- What are the Kind of Stop Losses

- Our Final Thoughts

- FAQs

How Spread Betting Works

Just like trading, spread betting starts from monitoring the value of a particular asset. You would want to carefully assess the flow of the market prior to making any decision.

If you think that the market has a potential to move at an uptrend then a good decision to take would be to go long, or buy products.

On the other hand, if you want to take advantage of a market that is about to go down, a short or selling strategy would be a great avenue to pursue.

When aiming to go long, simply place the number of point orders or point spread or spread bet that you want to buy on the ‘buy’ section or box of the spread bet platform.

For short orders, simply place the number of points that you want to order from the ‘sell’ section or box of the spread bet platform.

Example of Point Spread Betting

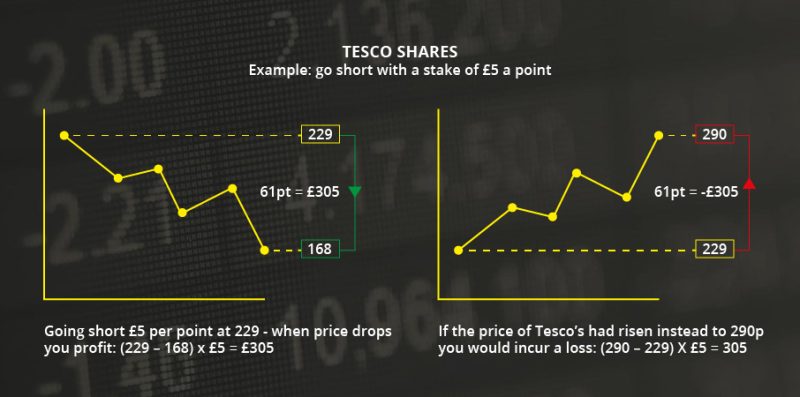

Here’s a quick example of how a spread bet is done with actual assets like Tesco.

Referring to the left side of the image, let’s say Tesco has a current price that is set at 229, and you have a good assumption that the price is going to move at a downtrend – or the price will go down in the future. This future movement of the market is assumed by evaluating news, events, and current announcements of the company.

Your aim will be to go short with spread bets set at £5 per point from the 229 current price. If the price really moves downward until the price hits 168, you will get a total profit of 61 points from the current price of 229. The 61-point profit will be equal to £305 – which is taken from 61 points x £5.

However, there is also a possibility that the market will go against your expected or assumed movement in the future.

For this case, refer to the right chart in the image. The price starts at 229 and the market moved upwards until the price reached 290. Should you have gone short in this regard, you would have lost 61 points which is equal to £305 from the computation – 61 points x £5.

So, we can see from this example that spread bets are quite easy to do and have potential for great profits however can also leave you with great losses.

However, losses and risks can also be averted and minimized by having stop losses.

Stop losses are price levels on the chart where you pull out your investment to avoid further losses.

How to Manage the Risks

As mentioned earlier, spread bets offer you the chance to have high gains but also has the dangers of high losses. Not surprisingly, stop losses are one of the most effective ways to manage risks in stop losses – and there a few kinds of stop losses to be familiar of.

What are the Kinds of Stop Losses

The standard stop loss order – this is the traditional way of designating a stop loss on a chart. This kind of stop loss closes all trades at the best price available that is close to a particular set stop price level. This is the most basic and easiest way to set a stop loss to avoid further damage to your portfolio.

Unfortunately, this type of stop loss order is not advisable when trading highly volatile stocks or assets since the stop loss value can be lower or far from the designated stop loss value.

The guaranteed stop loss order – this type of stop loss on the other hand ensures that all trades will be closed at the exact value that has been designated to close.

The only downside of this kind of stop loss is that it comes with corresponding fees from the broker.

Our Final Thoughts

While spread betting is definitely a great avenue to take than traditional trading due to its high profit potential. However, while there are a lot to gain if you win the market, there are also a lot of losing bet if the market goes the other way.

The good thing is that there are always ways to go around the risks – and that is by designating stop losses.

Furthermore, one should always be warry of the opportunities as well as risks in a chart by going through the assets’ technical as well as fundamental analyses.

Being able to see the opportunities and risks of an asset before actually betting or making trades is one thing that trader should always possess. Having this kind of skill and technique can enable you to have better chances of a winning bet.

In addition, Spread betting can become a better choice instead of Forex trading for the reason that it offers higher leveraging and a trader can invest without having to deposit the full amount of a particular asset. Spread betting also doesn’t impose tax on every bet or trade unlike traditional trading over some countries such as the UK.

Also Read: The Best Forex Trading Tips

FAQs

What is leveraging?

Leveraging refers to the investing on certain asset to increase exposure to the market. This allows the trader to pay a much lesser amount than the actual amount for an asset.

In other words, traders use the leveraging feature of a trading platform to acquire good number of positions without having to pay the full amount of a stock – this also means that the trader can only purchase a small portion or percentage of the actual value.

What are the Chances in winning a trade through spread betting?

As mentioned earlier, spread betting can give high potential profits when executed correctly. To ensure a great percentage of win on every spread, make sure to use a systematic trading plan that you are comfortable with.

Make sure that the trading system is tried and tested using your preferences and requirements.

What is Spread Betting Margin?

Whenever you perform a spread bet, you’re going to set an initial deposit. This initial deposit is called the margin. And the margin will be used to secure the position whenever engaged in spread betting.

What is a bet size?

The bet size simply refers to the amount which you want to bet on every unit of the market. The bet size can come in any magnitude provided that it complies with the minimum that is required by the market.

Profit computation from your bet size will be assumed by subtracting the opening price with the closing price, then multiplied by the bet value. Your perfectly optimized content goes here!

Is Spread Betting the same as Forex Trading?

They’re not the same. While both deals with assets, indices, as well as commodities, spread betting offers greater leveraging opportunities.

Furthermore, spread betting is tax-free in some countries such as UK. And lastly, spread betting covers a wide array of markets to choose from.