In the intricate world of investment and trading, precise metrics are essential tools for evaluating performance and risk. One such key metric is the Sortino Ratio.

Unlike traditional risk-assessment formulas that paint all volatility with the same brush, the Sortino Ratio specializes in quantifying the downside, or negative volatility, offering a nuanced view of investment risk. This ratio is particularly invaluable for those engaged in Forex trading and other forms of investment where risk and reward can be asymmetrically distributed.

Understanding and applying the Sortino Ratio can be a game-changer in risk assessment and investment decision-making. It enables traders and investors to objectively weigh the prospects of an investment, especially in markets prone to sudden downturns and volatility. Thus, for Forex traders and investors seeking to optimize their risk-adjusted returns, familiarizing oneself with the Sortino Ratio is not merely beneficial—it’s essential.

What is Sortino Ratio?

In the fast-paced realm of Forex trading, knowing how to manage your risk is just as crucial as identifying profitable trades. Here’s where the Sortino Ratio comes into play. The Sortino Ratio measures the risk-adjusted return of an investment, focusing specifically on the downside, or negative, volatility. In simpler terms, it tells you how much excess return you’re getting for the extra downside risk you’re taking on.

Now, you might be familiar with the Sharpe Ratio, another popular metric in trading and investment circles. While both the Sharpe and Sortino Ratios aim to quantify risk-adjusted performance, they do it in slightly different ways. The Sharpe Ratio considers both upside and downside volatility, treating them as equal.

On the other hand, the Sortino Ratio zeros in on negative volatility alone. For Forex traders, that distinction is invaluable; it means you can focus on the risks that could actually result in losses, not just general market movements.

In Forex trading, not all volatility is bad; upside volatility can lead to profits. What we’re genuinely concerned about is downside risk—the risk that the currency pair you’re trading will move against you. The Sortino Ratio is tailor-made for this. It calculates the downside deviation, which is a measure of downside volatility, and incorporates it into the ratio. This gives you a more nuanced view of your trading strategy’s performance, allowing you to make adjustments based on the risks that truly matter.

Why Use Sortino Ratio?

In the trading arena, raw returns don’t tell the whole story. You could have high returns but take on enormous risks to achieve them. That’s where the concept of risk-adjusted returns comes into play. This metric allows you to evaluate how much risk is involved in achieving a particular return. By considering risk, you get a more accurate picture of an investment’s efficiency, which is crucial for long-term success.

When it comes to risk, not all types are created equal. While upside volatility can lead to gains, downside volatility can erode your capital. Assessing downside risk is vital because it gives you a clear understanding of potential losses. Knowing the downside allows you to position your trades better and set stop-losses effectively. It also helps in evaluating whether a trading strategy is sustainable in the long run.

In Forex markets, prices can be highly volatile and move rapidly against you. The Sortino Ratio’s focus on downside risk makes it especially relevant here. By using this metric, you can pinpoint trading strategies and currency pairs that offer good returns for a lower downside risk, optimizing your investment portfolio. For traders engaged in leveraged trading or handling multiple currency pairs, understanding and minimizing downside risk through the Sortino Ratio can be a game-changer.

Also Read: Understanding Risk Appetite

How to Calculate Sortino Ratio

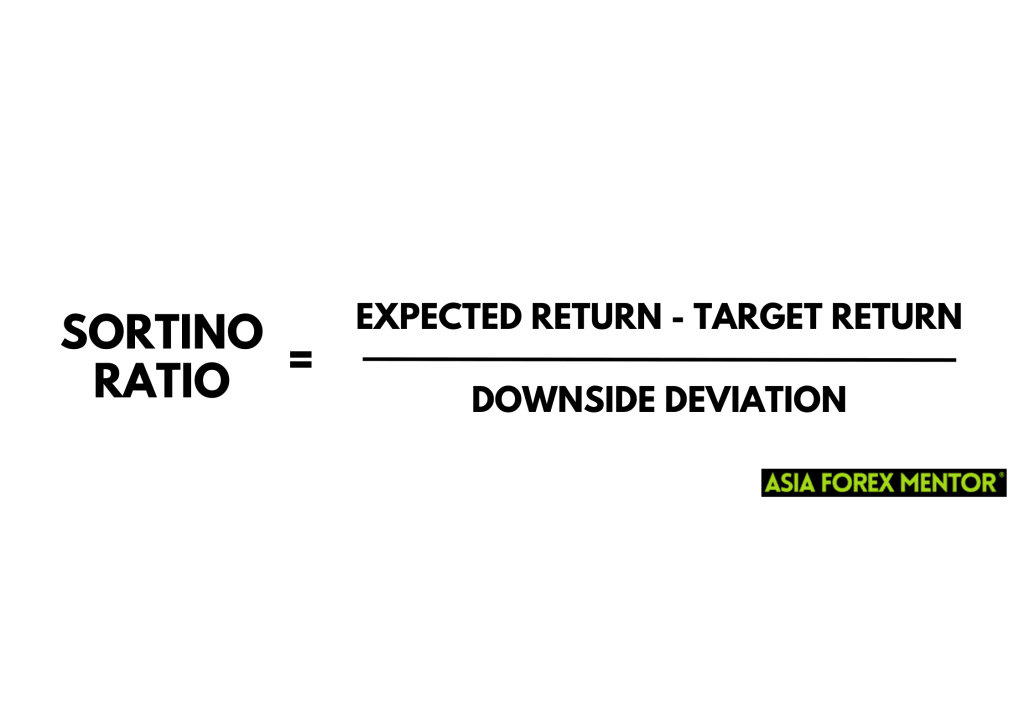

To get the most out of the Sortino Ratio, you need to understand how it’s calculated. The formula for the Sortino Ratio is:

- Expected Return: This is the average return you anticipate from the investment or trading strategy. In Forex, this could be calculated over various time frames, such as daily, monthly, or annually.

- Target Return: Also known as the minimum acceptable return, this is the return level below which all outcomes are considered undesirable. It’s often set to zero for strategies where the aim is to at least preserve capital.

- Downside Deviation: This measures the volatility of the negative returns below the target return. It’s crucial for capturing the downside risk associated with an investment or trading strategy.

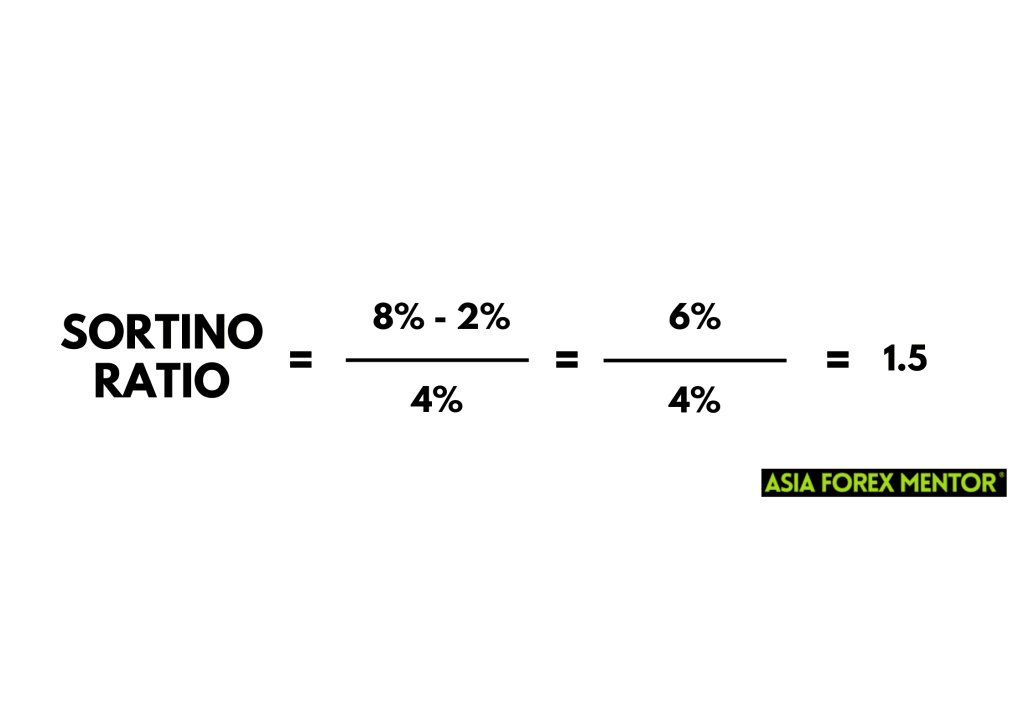

Let’s say you’re trading a particular currency pair. Over a set period, your expected return is 8%. You set your target return at 2%, aiming for at least some profit. The downside deviation for that same period, calculated from your trading data, is 4%.

Using the formula:

A Sortino Ratio of 1.5 indicates that for each unit of downside risk, you can expect a return of 1.5 units above your target return. The higher the Sortino Ratio, the better the investment’s risk-adjusted performance.

Advantages of Sortino Ratio

Better Risk Insights

One of the key advantages of using the Sortino Ratio is its ability to provide better risk insights. While traditional measures like the Sharpe Ratio give you a general idea of total risk, the Sortino Ratio drills down to what really matters: the downside. This sharper focus allows you to evaluate how well your trading strategy or investment performs when things don’t go as planned.

Specific Focus on Negative Volatility

The Sortino Ratio sets itself apart by concentrating solely on negative volatility. In trading environments like Forex, where volatility can be your friend or foe, knowing your downside is invaluable. You can gauge how much of the overall volatility is harmful and adjust your strategies accordingly, rather than reacting to total volatility, which can be misleading.

Usefulness in Asymmetrical Distributions

Forex returns often exhibit asymmetrical distributions, meaning that gains and losses don’t follow a normal distribution curve. The Sortino Ratio shines in such scenarios. By focusing exclusively on the downside risk, it provides a more accurate risk-adjusted performance measure for strategies and assets that have skewed or fat-tailed distributions.

Limitations of Sortino Ratio

Data Sensitivity

While the Sortino Ratio offers valuable risk insights, it’s important to note its data sensitivity. The metric is only as accurate as the data used for its calculations. Inaccurate or incomplete data, especially for downside deviation, can result in misleading Sortino Ratios. This is particularly crucial in fast-moving markets like Forex, where data needs to be up-to-date and precise.

Reliance on Target Return

The Sortino Ratio also heavily depends on the target return, which can be subjective. Different traders may have varying expectations or minimum acceptable returns, which impacts the Sortino Ratio calculation. If the target return is set too high or too low, it may distort the perception of an investment’s downside risk, potentially leading to poor decision-making.

Potential Misinterpretation When Comparing Different Investments

Lastly, care should be taken when using the Sortino Ratio to compare different investments. If the investments have diverse risk profiles or are in distinct asset classes, a direct comparison using the Sortino Ratio can be misleading. The metric is best used to evaluate similar types of investments or to assess the same investment over different time periods.

Real-World Applications of Sortino Ratio

One practical example that comes to mind is a friend who is also a Forex trader. He initially struggled with managing downside risks until he started using the Sortino Ratio. By focusing on this metric, he could fine-tune his trading strategies to minimize losses during downturns, while maximizing profits during favorable market conditions. His case underscores how the Sortino Ratio can be a pivotal component for assessing and improving trading strategies.

In the volatile Forex markets, understanding risk is paramount. The Sortino Ratio offers Forex traders a way to evaluate their strategies through the lens of downside risk, making it easier to discard or adjust strategies that expose them to unnecessary losses. The metric helps in distinguishing between ‘good’ and ‘bad’ volatility, allowing traders to make changes that improve risk-adjusted returns.

The Sortino Ratio also plays a crucial role in asset allocation, especially for traders and investors managing a diverse portfolio that includes Forex among other assets. By using the Sortino Ratio, you can gauge how much of your portfolio should be allocated to specific currency pairs or trading strategies to optimize risk-adjusted returns. It aids in making informed decisions on diversification, thereby helping to build a more resilient investment portfolio.

Conclusion

As a Forex trader and investor, it is essential that you comprehend and manage risk for long-term success. With the help of the Sortino Ratio, you can estimate a downside risk. Unlike the other metrics, Sortino Ratio does not take total volatility into account. Instead, it quantifies negative volatility. This alone makes it a more relevant risk assessment tool.

The Sortino Ratio has numerous real-world applications, ranging from enhancing trading methods to assisting in effective asset allocation. Despite its drawbacks, such as data sensitivity and the possibility of misinterpretation, it is still used in modern investment techniques to estimate risk-adjusted performance.

Also Read: How Do You Trade With a Volatility Indicator?

FAQs

What is the Sortino Ratio?

The Sortino Ratio is a risk-adjusted performance metric that focuses specifically on downside, or negative, volatility. It allows traders and investors to evaluate the risk-adjusted returns of an investment or trading strategy, paying attention solely to the risk of loss, not just general market movements.

How is the Sortino Ratio different from the Sharpe Ratio?

While both the Sortino and Sharpe Ratios aim to measure risk-adjusted performance, they differ in their approach to volatility. The Sharpe Ratio considers both upside and downside volatility, whereas the Sortino Ratio focuses only on negative volatility. This makes the Sortino Ratio a more accurate measure for assessing the downside risks associated with an investment or trading strategy.

Why is the Sortino Ratio important in Forex trading?

In the volatile Forex markets, understanding your downside risk is essential. The Sortino Ratio is significant in this context because it allows traders to measure risk-adjusted returns while considering only the downside risk. This focus makes it easier to evaluate and adapt trading strategies, contributing to more effective risk management and asset allocation decisions.