Position in Rating | Overall Rating | Trading Terminals |

278th  | 2.0 Overall Rating |  |

SoFi Invest Review

Choosing the right Forex broker is crucial for any trader. A reliable broker like SoFi Securities LLC provides secure platforms, competitive spreads, and efficient customer support that directly impacts trading outcomes. The right choice helps manage risks, ensures smooth transactions, and supports overall trading strategies through features like advanced trading tools and access to alternative investments.

SoFi Invest differentiates itself with its user-friendly interface and straightforward approach to investing. This review covers its key benefits and limitations, from active invest account options and deposit/withdrawal processes to its commission structure. Combining expert analysis with real trader feedback, we’ll help you determine if SoFi Active Investing Account, backed by SoFi Wealth LLC, fits your trading needs. Whether you’re interested in exchange-traded funds (ETFs), IPO investing, or building a diversified brokerage account, SoFi Wealth’s advisory operations and certified financial planners are designed to support both beginner and passive investors.

What is SoFi Invest?

SoFi Invest is a digital investment platform designed for both beginner and experienced traders. Operated by SoFi Securities LLC, it offers a wide range of investment products, including stocks, exchange-traded funds (ETFs), cryptocurrency, and alternative investments. With no account minimum and commission-free transactions, it simplifies investing through an easy-to-use investing app. Whether you’re interested in IPO investing, fractional shares, or traditional brokerage accounts, SoFi Invest makes it accessible and cost-effective.

What sets SoFi Invest apart is its integration of financial tools with expert advisory services provided by SoFi Wealth LLC, an SEC-registered investment adviser. SoFi members have access to certified financial planners without paying an annual fee, supporting effective financial planning and strategy development. For those looking to diversify, the platform supports SoFi Active Investing Accounts, automated portfolios, and even opportunities in venture capital. Whether you aim to manage uninvested cash, maximize rewards points, or align with specific investment objectives, SoFi Wealth’s advisory operations offer the flexibility and guidance needed to help you succeed.

SoFi Invest Regulation and Safety

SoFi Invest, operated by SoFi Securities LLC, functions under strict regulatory guidelines to ensure the safety of its users’ funds. As a Securities LLC member of FINRA and SIPC, it protects client investments up to $500,000, including $250,000 for cash claims. This regulatory framework ensures that SoFi Invest maintains transparency and compliance across its brokerage account services, whether users are engaged in stock trading, ETF trades, or managing alternative investments.

To enhance security, SoFi Invest uses advanced encryption technology to protect both personal and financial data. The platform also employs multi-factor authentication to safeguard every SoFi account, adding an extra layer of protection against unauthorized access. Despite these robust security measures, it’s important to note that investment products, including mutual funds and exchange-traded funds, are not bank guaranteed and may lose value, highlighting the inherent risks tied to investing. However, with strong compliance protocols and secure technology, SoFi Invest offers a trustworthy environment for both beginner investors and seasoned traders.

SoFi Invest Pros and Cons

Pros:

- Commission-Free Trades

- User-Friendly Interface

- Financial Advisors

- Diverse Investments

Cons:

- Limited Research

- No Mutual Funds

- Crypto Restrictions

- Lacks Advanced Tools

Benefits of Trading with SoFi Invest

Trading with SoFi Invest comes with the added advantage of commission-free investing, allowing users to buy and sell stocks, ETFs, and cryptocurrencies without extra costs. This helps investors keep more of their returns, making it a cost-effective choice, especially for those making frequent trades.

Another essential advantage of SoFi Invest is access to professional financial advisors at no additional cost. Clients receive expert guidance tailored to their financial situations, helping them make informed investment decisions and create strategies to reach their goals. SoFi Invest also provides member-only benefits, including career coaching, financial planning tools, and loan discounts, adding extra value beyond just investing.

For those who prefer a hands-off approach, SoFi Invest’s automated investing feature offers a no-management-fee solution. It automatically adjusts the user’s portfolio based on their risk tolerance and long-term objectives, ensuring a balanced and optimized investment strategy.

SoFi Invest Customer Reviews

Customer feedback for SoFi Invest highlights positive experiences, particularly with the platform’s loan offerings. Users appreciate the fast and simple application process, where approvals and fund transfers happen within minutes to 24 hours. Many also praise the platform for its competitive interest rates, streamlined processes, and responsive customer service. Several users have reported significant improvements in their credit scores after using SoFi Invest for loan consolidation. Overall, customer reviews suggest high satisfaction with the platform’s efficiency and ease of use, making it a reliable choice for those seeking financial management solutions beyond investing.

SoFi Invest Spreads, Charges, and Commissions

SoFi Invest offers commission-free trading for stocks, ETFs, and cryptocurrencies, making it a cost-effective option for investors. This means users can buy and sell these assets without paying additional fees, helping them maximize returns. However, like many platforms, there may still be hidden costs due to bid-ask spreads, especially for assets with lower liquidity.

While SoFi Invest does not charge for account maintenance, certain services—such as wire transfers or paper statements—may come with additional fees. For cryptocurrency transactions, the platform applies a 1.25% markup per trade, which serves as its primary charge. Overall, SoFi Invest maintains a transparent fee structure, making it easy for users to understand their costs.

Account Types

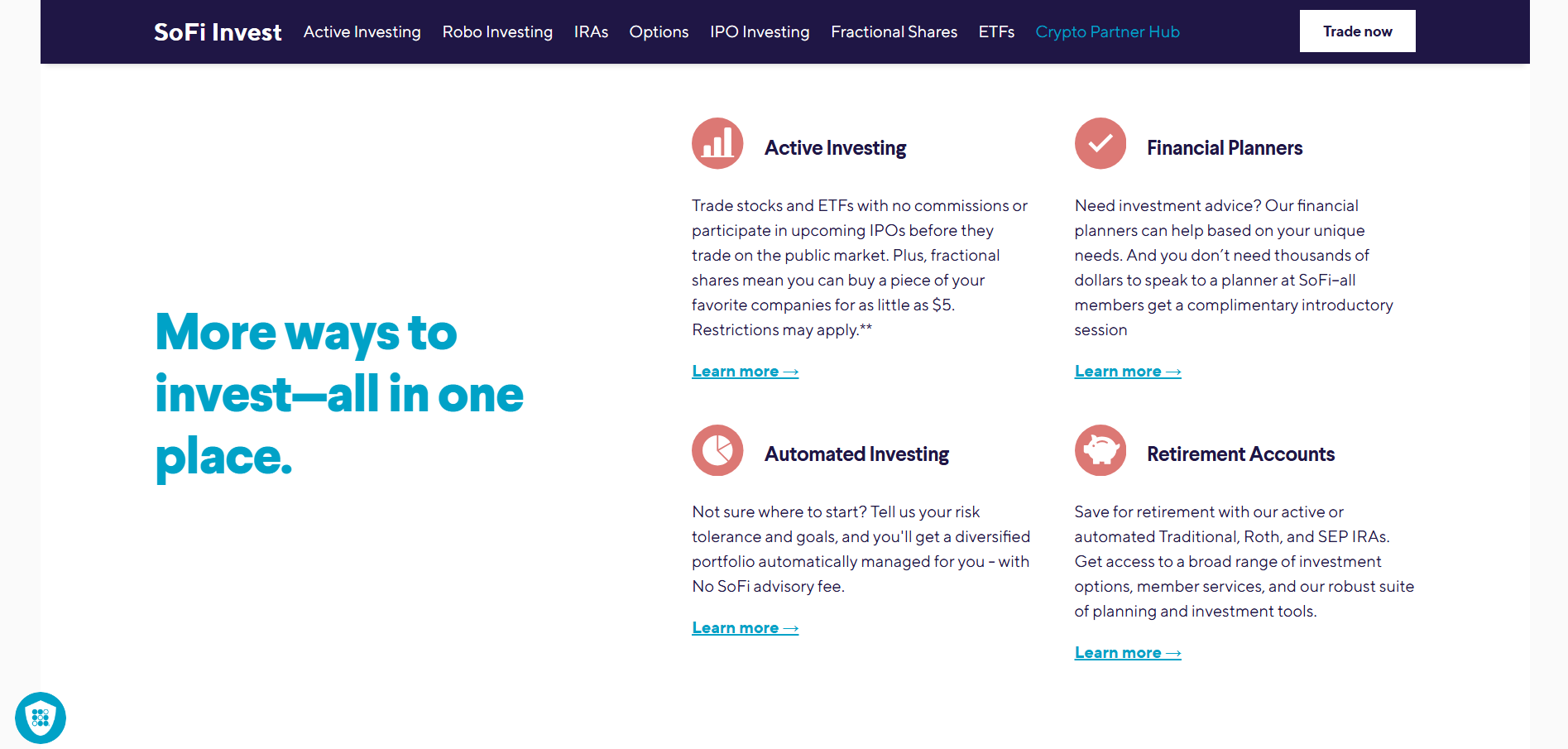

Active Investing

This account lets you trade stocks and ETFs with no commission fees. You can also buy fractional shares, allowing you to invest in companies with as little as $5. It’s designed for hands-on investors who want to manage their own portfolios.

Automated Investing

This option is ideal for those who prefer a hands-off approach. You provide your risk tolerance and financial goals, and SoFi Invest automatically manages a diversified portfolio for you, with no advisory fees.

Retirement Accounts (IRAs)

SoFi Invest offers Traditional, Roth, and SEP IRAs for long-term retirement savings. These accounts come with access to a variety of investment tools and member services to help you plan for the future.

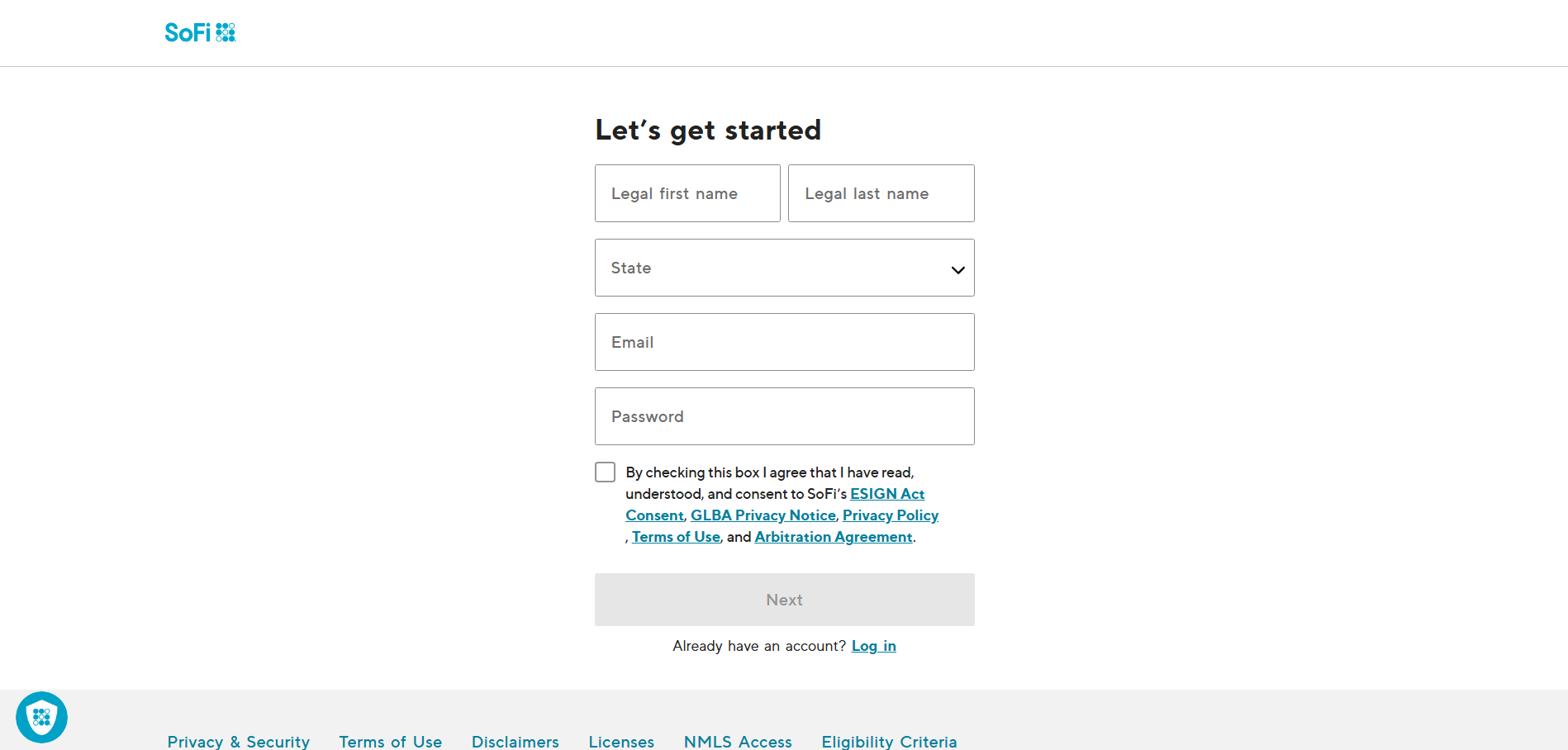

How to Open Your Account

Step 1: Visit the SoFi Invest Website

Go to the officialSoFi Investwebsite and click on the “Get Started” button. This will take you to the registration page where you can begin the account setup process.

Step 2: Enter Your Personal Information

Fill in your name, email address, and password to create your account. Ensure all information is accurate to prevent any issues during the verification process.

Step 3: Verify Your Identity

Upload a government-issued ID to confirm your identity. This step is necessary to comply with financial regulations and enhance the security of your account.

Step 4: Choose Your Account Type

Select the type of investment account you want to open. SoFi Invest offers options such as an individual investment account or an automated investing account. Review the features of each to pick the one that aligns with your financial goals.

Step 5: Link Your Bank Account and Deposit Funds

Connect your bank account to fund your SoFi Invest account. There are no minimum balance requirements, so you can start with an amount that fits your budget.

Step 6: Start Investing

Once your account is funded, you can begin trading stocks, ETFs, and cryptocurrencies. Utilize SoFi Invest’s tools to track your investments, analyze market trends, and grow your portfolio.

SoFi Invest Trading Platforms

SoFi Invest runs on a single, proprietary trading platform that aims to provide users with a smooth and user-friendly experience. Users can access it both on the desktop and on mobile devices. It is also very clean in terms of the interface, simplifying trading for beginners while still providing essential tools for monitoring portfolios and executing trades efficiently.

With support for trading on stocks, ETFs, as well as real-time updates about cryptocurrencies, its proprietary SoFi Invest platform gives users easy access to the whole market. Compared to other options, it offers minimal charting capabilities but seeks to be easier to use to make it much more accessible and convenient for simpler investment management control.

What Can You Trade on SoFi Invest

Stocks

With SoFi Invest, you can trade a wide range of U.S. stocks without paying commission fees. The platform also offers fractional shares, allowing you to invest in high-priced companies with as little as $5, making it accessible for all budget levels.

ETFs

SoFi Invest provides access to a variety of ETFs, which help diversify your portfolio across different sectors and industries. These funds are ideal for both beginners and experienced investors looking for low-cost, diversified investment options.

Cryptocurrencies

You can trade popular cryptocurrencies like Bitcoin, Ethereum, and others on SoFi Invest. The platform allows easy buying and selling of crypto, with real-time price tracking for a smooth trading experience.

IPO Investments

SoFi Invest lets you participate in IPOs (Initial Public Offerings) before they hit the public market. This feature allows investors to buy shares of companies at their offering price, providing early access to potential growth opportunities.

Automated Portfolios

For those who prefer hands-off investing, SoFi Invest offers automated portfolios. Based on your risk tolerance and financial goals, the platform automatically manages and rebalances your investments without charging advisory fees.

SoFi Invest Customer Support

SoFi Invest has good customer support for its users who need to clarify their investment-related queries. The support team is available by phone, chat, or email. This gives multiple channels of fast assistance when you need it. Their customer service is open during business hours for account problems, technical issues, or any questions you might have.

Besides direct assistance, SoFi Invest also includes a full online help center in their website that comprises FAQs, guides, and lengthy articles detailing specific information which the user will need to have before reaching the support. Live support combined with these self-help options makes accessing assistance convenient.

Advantages and Disadvantages of SoFi Invest Customer Support

Advantages of SoFi Invest Customer Support:

Withdrawal Options and Fees

SoFi Invest has withdrawal options as simple as transfer to a linked bank account. Users can withdraw their cash through the SoFi mobile app or site and transfer funds directly to their linked bank accounts. Generally, it takes 1-3 business days to process the transfer based on the bank’s processing.

The fees seem pretty reasonable, as SoFi Invest does not levy a fee for standard bank transfers in terms of withdrawals. Other methods like a wire transfer typically have a fee depending on the financial institution that you are working through. This particular fee-free structure means most investors can save money when withdrawing regularly.

SoFi Invest Vs Other Brokers

#1. SoFi Invest vs AvaTrade

SoFi Invest emphasizes commission-free trading with a user-friendly platform, which makes it ideal for both beginners and long-term investors, offering stocks, ETFs, and cryptocurrencies coupled with access to financial advisors but does not provide advanced trading tools or asset classes. In contrast, AvaTrade serves seasoned traders by offering a diverse selection of assets such as forex, commodities, and CFDs, in addition to strong trading platforms like MetaTrader 4 and 5. AvaTrade accommodates intricate trading strategies; however, it imposes spreads and inactivity fees that can increase trading expenses.

Verdict: SoFi Invest is more appropriate for novices wanting an uncomplicated, budget-friendly investing experience, whereas AvaTrade is perfect for experienced traders seeking a variety of assets and advanced trading tools.

#2. SoFi Invest vs RoboForex

SoFi Invest caters to novice and long-term investors, providing commission-free trading for stocks, ETFs, and cryptocurrencies via an easy-to-use platform. It offers access to financial advisors and automated investing with no management fees, yet it does not feature advanced trading tools or a variety of assets. RoboForex is geared towards active traders, with a wide variety of assets offered, including forex, commodities, CFDs, and cryptocurrencies, supported by advanced platforms like MetaTrader 4/5 and cTrader. While it offers high leverage and competitive spreads, it has complex fee structures and may not be as friendly to beginners.

Verdict: SoFi Invest is one of the best investment platforms for a simple, low-cost investment experience. On the other hand, RoboForex is more suitable for advanced traders who need more flexible instruments and assets.

#3. SoFi Invest vs Exness

SoFi Invest emphasizes commission-free trading for stocks, ETFs, and cryptocurrencies, providing an easy-to-use platform that includes access to financial advisors and automated investing with no management fees. It is meant for novice traders and long-term investors, offering few choices for advanced trading features. Conversely, Exness serves professional traders by focusing on forex and CFD trading, offering high leverage, narrow spreads, and sophisticated trading platforms such as MetaTrader 4 and 5. Although Exness provides increased trading flexibility and a wider range of assets, it has intricate fee arrangements and might not be ideal for beginner traders.

Verdict: SoFi Invest is optimal for novices and long-term investors looking for an easy, affordable platform, whereas Exness suits seasoned traders requiring sophisticated tools and a variety of trading choices.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH SOFI INVEST MARKETS

Conclusion: SoFi Invest Review

SoFi Invest is a great option for new and long-term investors seeking an easy, affordable platform. Its no-commission trading, availability of financial advisors, and automated investment choices make it attractive for individuals looking to expand their portfolios without incurring significant fees. The interface is user-friendly, so even new traders find it easy to manage their investments.

However, the tools might not be so sought after by the advanced traders as they are limited to fewer assets and less developed trading tools. SoFi Invest provides only some of the stock, ETF, and cryptocurrencies trading functionalities, which may lack in complexity for the people who are trying to operate complex strategies with vast market analysis. However, it serves well as a great starting option for those looking for hassle-free long-term investing.

SoFi Invest Review: FAQs

How are cryptocurrencies taxed? (Crypto Investing)

For federal tax purposes, cryptocurrencies are generally treated with the same tax rules as other property transactions, like buying and selling stocks. We recommend consulting the IRS for existing guidelines, or working with a tax professional for more information.

SoFi provides a downloadable CSV of all your 2021 crypto transactions in the Taxes section of your documents in your crypto account.

How do I upgrade my SoFi Money Account to SoFi Checking & Savings?

You are invited to upgrade to SoFi Checking & Savings so you can begin earning a higher APY while still enjoying no account fees, overdraft protection, two-day early paycheck and fee-free access to 55,000 Allpoint ATMs. You can upgrade in less than 60 seconds by checking the SoFi app or searching your email for a note from SoFi about your invitation to upgrade.

Can I sign up for just a checking or just a savings account?

When you sign up for SoFi Checking and Savings, you will receive both a checking account and a savings account. Once you set up direct deposit (or deposit at least $5,000 every 30 days), you can earn up to 3.80% APY on your savings account and 0.50% on checking account! We do not currently offer standalone checking or savings accounts.

OPEN AN ACCOUNT NOW WITH SOFI INVEST AND GET YOUR BONUS