Position in Rating | Overall Rating | Trading Terminals |

231st  | 2.1 Overall Rating |  |

SmartFX Review

Choosing a trustworthy forex broker influences the success of your trading and security, hence being more than just convenience. Platform features, trading conditions, and regulatory compliance should all be considered while making a decision when choosing a forex broker platform. A licensed broker assists traders in accomplishing their financial goals by utilizing a range of tactics in addition to managing transactions in forex trading.

The Vanuatu Financial Services Commission (VFSC) regulates SmartFX forex trading platform, a STP (Straight Through Processing) forex broker founded in 2018. facilitating trading simpler by offering the opportunity to trade foreign currencies, stocks indices, precious metals, and energy markets through a single Standard account. SmartFX stands apart by its capacity to support a wide range of trading methods, such as copy trading, hedging, algorithmic trading, and expert advisors. This makes it a stable and versatile trading platform for both novice and seasoned traders.

This SmartFX review offers a thorough examination of this forex broker, pointing out both its advantages and disadvantages. The main characteristics of the broker will be explained to you, along with account options, deposit and withdrawal procedures, commission schedule, and other pertinent information. This assessment gives you the information you need to determine whether SmartFX is the best broker for you by fusing professional analysis with actual trading experiences.

What is SmartFX?

SmartFX is an international online trading firm offering 24/7 access to a broad range of financial instruments, including forex currency pairs, commodities, indices, stocks, and futures. SmartFX, which has integrated the widely famous MetaTrader 5 platform, offers traders advanced features such as high liquidity, competitive spreads, mobile trading, and in-depth technical analysis.

With an emphasis on establishing a safe and effective trading environment, SmartFX upholds strict operational guidelines to assist both new and seasoned traders. With resources and circumstances that encourage safe trading, the platform is made to accommodate a wide range of trading requirements.

SmartFX provides daily market analysis to provide the most recent information on trends and insights for individuals who want to stay ahead of the competition. SmartFX guarantees that its clients have the skills and information necessary to trade with assurance and efficiency by fusing education with market knowledge. SmartFX is designed to assist your trading adventure, regardless of your level of experience or desire for a trustworthy partner.

SmartFX Regulation and Safety

SmartFX’s operations were handled by the Vanuatu Financial Services Commission (VFSC), who guaranteed that it complied with strict regulations regarding financial services and investor protection of customers. The VFSC offers traders an additional level of security and assurance by regulating the company’s operations. In addition to trading smart securities, SmartFX forex platform has the capacity to offer several types of financial services to its clients.

By guaranteeing that SmartFX complies with industry standards, this legislation serves to safeguard customers’ interests and foster an open and safe marketing environment and provide risk management.

SmartFX is guaranteed to operate with the greatest levels of accountability and safety because it is certified and supervised by a reputable organization like the VFSC. This provides traders with the assurance that their money and confidential information are being managed responsibly and legally.

SmartFX Pros and Cons

Pros

- Competitive spreads

- Wide range of trading instruments

- Multiple trading platforms

- Strong regulatory oversight

- Fast execution speeds

- Excellent customer support on business day

Cons

- High minimum deposit for premium accounts

- Monthly maintenance fee for inactive accounts

Benefits of Trading with SmartFX

A variety of benefits provided by SmartFX enhance trade operations for both beginner and experienced traders. The platform being used is supported by a group of experts in the field who are committed to continuous improvement and providing that traders have access to innovative tools and features to improve their overall trade operations successfully.

A notable feature of SmartFX is the Smart Account, a single account type intended to streamline trading. With this method, traders may start investing and manage their trades more easily because it removes the complication of having various account options. As a licensed and regulated broker, SmartFX also offers a safe, open, and transparent market activity environment that complies with stringent industry requirements.

Considering SmartFX offers an instant account opening and funding process, creating an account is quick and easy. Traders can start investing right away thanks to the short registration process and speedy verification. Additionally, SmartFX guarantees no deposit fees, so traders may make the most of their resources without having to pay extra for deposits or withdrawals.

Another important advantage of SmartFX is its customer service. The platform guarantees traders receive individualized help whenever they need it by offering round-the-clock assistance, including access to a dedicated Relationship Manager. Because of these attributes, SmartFX is a dependable and easy-to-use option for anyone wishing to trade profitably in a safe setting.

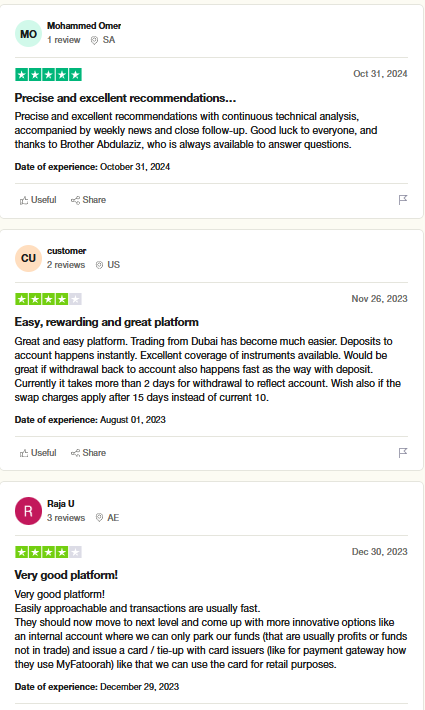

SmartFX Customer Reviews

Customers of SmartFX generally express how satisfied they’ve been with their usage of the platform, highlighting the platform’s diverse range of trading tools and ease of use. The team’s outstanding client service, which is always available for guidance and assistance, is mentioned in a number of testimonials. Customers also appreciate the platform’s competitive features, which make SmartFX a great option for traders of all skill levels. Effective bank account management and transparency about costs and processes are two examples of these traits.

SmartFX Fees and Commissions

In order to enable traders to make trades effectively and without any hidden expenses, SmartFX charges them clear and competitive rates. One of SmartFX’s primary advantages is that there are no additional deposit fees involved in trading. Traders can fund their trading accounts to maximize their trading capital without fear of incurring additional costs.

SmartFX does not charge commissions for deposits or withdrawal request. The result is that traders can manage their funds more freely and avoid the extra costs that some forex broker impose. Also, because there are no withdrawal fees, traders have additional options if they want to retrieve their money quickly and without facing penalties.

Depending on the state of the market conditions, SmartFX provides reasonable spreads for trading fees. The entire cost of trading is reduced by these low trading costs, making it an ideal option for traders who want to cut costs. Given its profound flexibility, traders may anticipate that orders will be processed quickly, which will improve their trading experience and financial transactions even further.

In general, SmartFX broker offers its pricing structure as simple and straightforward, with no additional fees, so traders can focus on their trading skills rather than worrying about excessive expenses in financial markets.

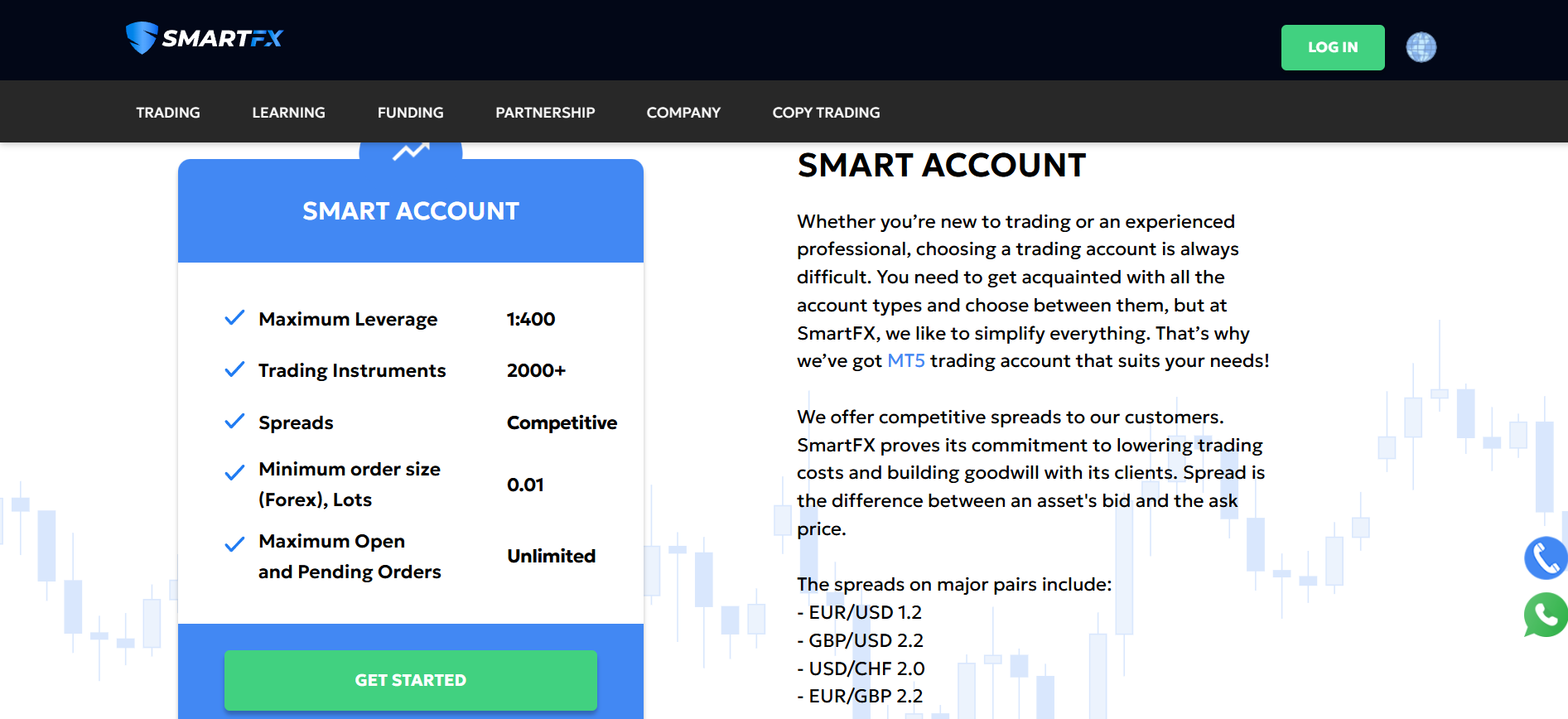

Account Types

By providing just one account type, SmartFX team keeps things straightforward. This simplified method makes it simple to get started without the hassle of selecting between several account alternatives, regardless of your level of experience or trading strategies in Forex trading. All of your trading requirements are met by SmartFX’s MT5 trading account, which offers user-friendly tools and access to a variety of markets.

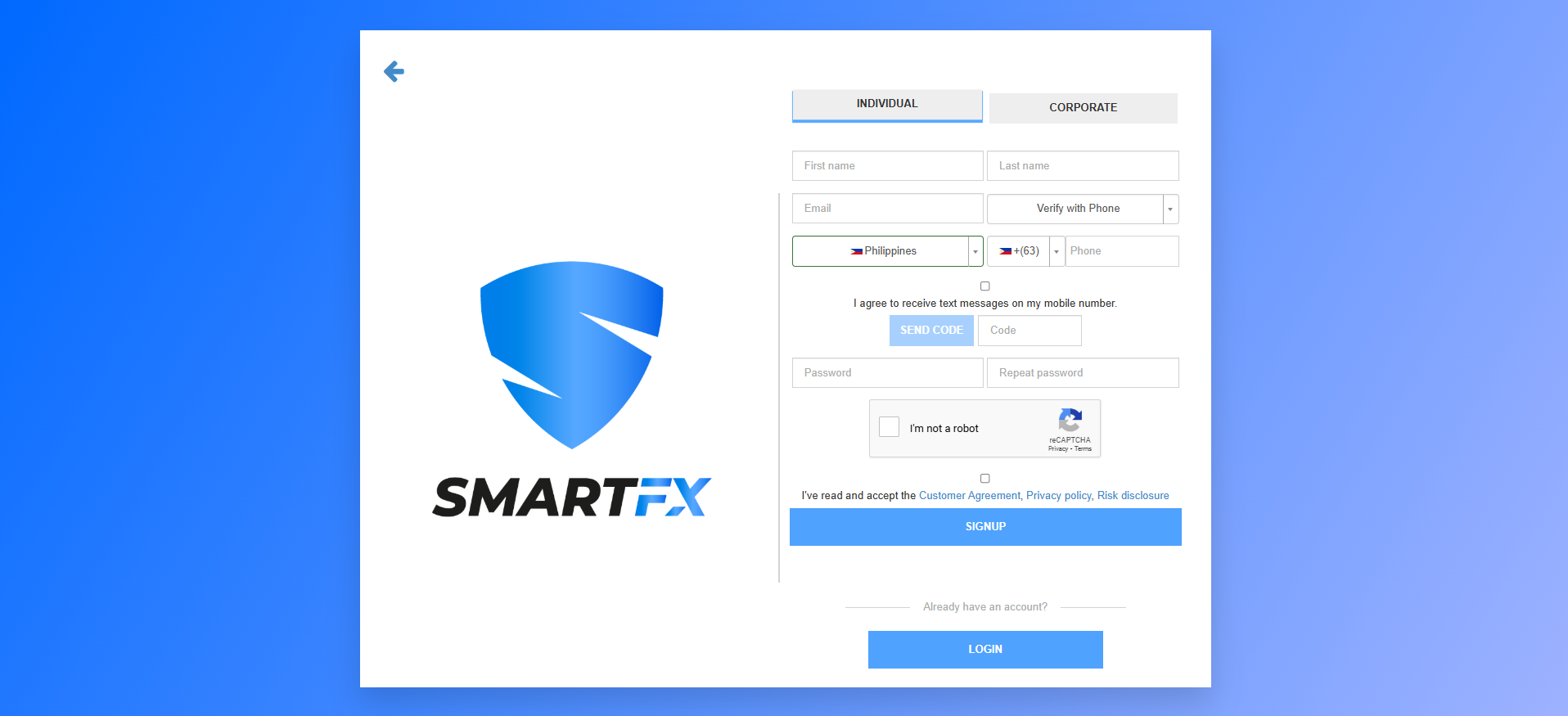

How to Open Your Account

- Go to the SmartFX website and click on the green “LOG IN” button located in the upper-right corner.

- Select “SIGNUP” in order to navigate to the registration form to start creating your account.

- Choose between Individual or Corporate accounts depending on your preference.

- Fill in the required details, including your first name, last name, email, and phone number. Verify your phone number using the verification code sent to your device.

- Create a strong password and repeat it in the corresponding field.

- Agree to the terms and conditions, including the Customer Agreement, Privacy Policy, and Risk Disclosure. Tick the necessary checkboxes.

- Complete the CAPTCHA to confirm you are not a robot.

- Click “SIGNUP” to finalize the registration process.

- Once registered, log in to your account using your email and password by clicking “LOG IN” on the main page.

SmartFX Trading Platforms

A range of trading platforms are available from SmartFX to accommodate users with different methods and strategies. With more than 80 distinct technical indicators, sophisticated charting features, and support for trading across several asset classes, MetaTrader 5 (MT5) stands out among these as a crucial platform. MT5 has greatly improved the trading experience with its powerful charting tools, real-time financial news, and an integrated economic calendar for fundamental analysis.

A range of trading platforms are available from SmartFX to accommodate users with different methods and strategies. With more than 80 distinct technical indicators, sophisticated charting features, and support for trading across several asset classes, MetaTrader 5 (MT5) stands out among these as a crucial platform. MT5 has greatly improved the trading experience with its powerful charting tools, real-time financial news, and an integrated economic calendar for fundamental analysis.

The integrated MQL5 programming environment for algorithmic trading in MT5 is another feature for traders who want to advance their trading, enabling the development and personalization of automated methods. Users can also mimic trades from seasoned traders using the forex market trading signals, which has improved strategy and allowed users to make more educated selections. SmartFX also offers a convenient mobile trading app for those who need to trade on the go.

For individuals that need to trade while on the road, SmartFX also provides a handy mobile trading app. All of the desktop version’s capabilities, including new order types and comprehensive market depth data, are accessible through the MT5 mobile app, which is compatible with both iOS and Android. The app is a great option for traders who want freedom and control from any location because of its user-friendly layout and dependable functionality.

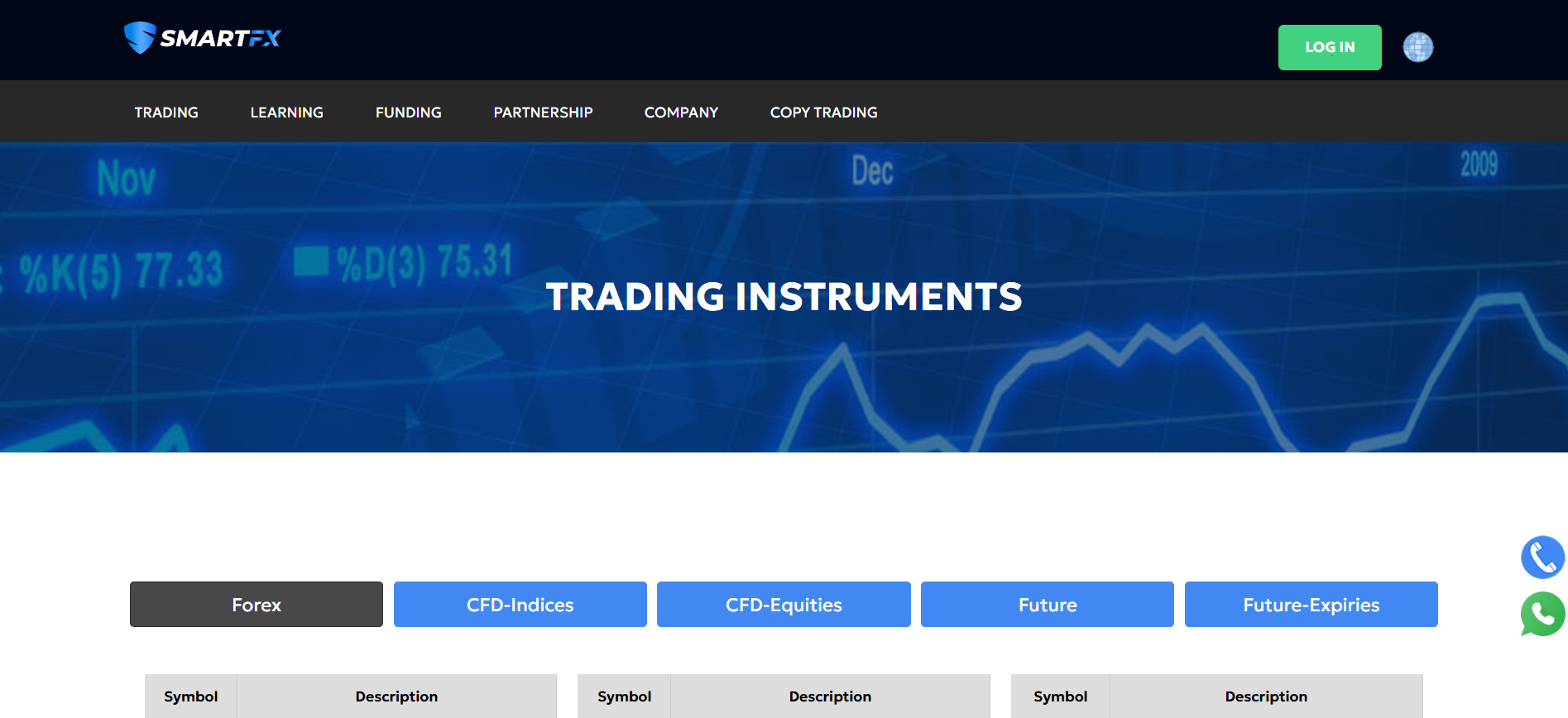

What Can You Trade on SmartFX

You can trade a range of financial assets with SmartFX trading instruments, beginning with currency. Using their proprietary MetaTrader 5 platform, you may trade major, minor, and exotic currency pairings on the forex market around-the-clock with minimal spreads and strong liquidity. With over $5 trillion USD being exchanged every day, the FX trading market provides traders of all skill levels with unparalleled opportunity.

Access to commodities like US crude oil, UK Brent oil, natural gas, gold, and silver is made possible by SmartFX for diversification. Trade these well-liked assets according to changes in price brought up by supply, demand, and worldwide economic patterns. Hedging and leveraging techniques across uncorrelated assets are also made possible by the availability of index trading, which provides real-time access to 14 major stock markets.

Stocks is also one of the trading instruments of SmartFX, allowing traders to capitalize on price fluctuations or long-term investors to benefit from market growth. With real-time data from global stock exchanges, SmartFX ensures seamless trading across various asset classes, catering to both novice and experienced traders.

SmartFX Customer Support

This forex offers multiple customer support options, ensuring a smooth user experience. Their support channels include email, phone, and live chat, catering to immediate and non-immediate inquiries. Available from 10 AM to 7 PM, their office hours are suitable for most users, although weekends are excluded, which might limit accessibility for some clients.

SmartFX maintains two offices for customer assistance—a representative office in Dubai and a head office in Vanuatu—each with a dedicated phone line. The Dubai office is conveniently located in Business Bay, with a clear map provided for directions, while the Vanuatu head office ensures global support coverage. These options demonstrate SmartFX’s commitment to providing accessible and responsive customer care.

Advantages and Disadvantages of SmartFX Customer Support

Withdrawal Options and Fees

Customers of SmartFX can use a variety of payment options, such as bank wire transfers, Visa, Skrill, and Neteller, to access automatic withdrawal services. With support for many currencies like USD, EUR, GBP, JPY, and RUB, these alternatives guarantee worldwide accessibility. All transactions are processed without any commission fees, providing cost-efficient fund withdrawals for traders.

The processing time for most methods, including Visa, Skrill, and Neteller, is 1-3 hours for approval and transfer. Wire transfers, however, may take 2-3 business days for funds to arrive. Withdrawals are processed during business hours from Sunday to Friday, 10 am to 7 pm (GMT+4). Additional fees may apply if no trading activity has occurred prior to withdrawal, particularly for banking-related charges.

To ensure effective fund management, SmartFX has a minimum withdrawal threshold that varies based on the payment method employed. Furthermore, processing costs of up to 3% of the withdrawal amount or banking-related charges may be levied if there has been no trading activity before the withdrawal.

SmartFX Vs Other Brokers

#1. SmartFX vs XM

XM and SmartFX serve distinct trading requirements. With commission-free trading and access to a wide range of asset classes, SmartFX stands out and attracts traders looking for inexpensive investments. However, XM is excellent at providing tight spreads and a variety of account types, which makes it suitable for both novice and experienced traders. Basic trading tools are offered by SmartFX, but those seeking skill development will benefit from XM’s advanced resources, which include market research and instructional materials. Furthermore, compared to SmartFX’s narrow regulatory reach, XM offers more rigorous compliance due to its global recognition and regulation.

Verdict: For traders looking for extensive trading resources and a wide variety of account options, XM is a superior option. SmartFX, on the other hand, might be appropriate for people who value commission-free trading with simple features.

Also Read: XM Review 2024 – Expert Trader Insights

#2. SmartFX vs RoboForex

With commission-free trading and an easy-to-use platform, SmartFX prioritizes simplicity and is the best option for traders on a budget. On the other hand, RoboForex provides a wide variety of account kinds, such as Cent and ECN accounts, to accommodate traders with different degrees of expertise. RoboForex distinguishes itself by offering flexibility and innovation with its sophisticated trading tools, automated solutions, and copy trading choices. RoboForex provides access to a wider number of markets, bolstered by robust regulatory monitoring and competitive trading conditions, whilst SmartFX concentrates on a more restricted asset range.

Verdict: For traders looking for sophisticated tools, a variety of account kinds, and broad market access, RoboForex is the best choice. SmartFX is ideal for people who value simplicity in trading and cost effectiveness.

Also Read: RoboForex Review 2024 – Expert Trader Insights

#3. SmartFX vs Exness

Targeting traders who value ease of use and financial savings, SmartFX offers commission-free trading on an uncomplicated platform. However, with its wide range of trading instruments, including cryptocurrencies, flexible leverage options, and tight spreads, Exness offers a wider appeal. Exness is a technological leader as well, providing cutting-edge trading tools, a mobile-friendly platform, and quick execution times. Exness is regulated by several authorities, guaranteeing a higher level of security and transparency for its clients, whereas SmartFX has a narrow regulatory reach.

Verdict: With its better trading tools, greater selection of assets, and robust regulatory environment, Exness outperforms SmartFX. For individuals who prefer simplicity and commission-free trading, SmartFX is still a fundamental choice.

Also Read: Exness Review 2024 – Expert Trader Insights

Conclusion: SmartFX Review

SmartFX excels in simplicity and efficiency, offering a single account type with competitive spreads and access to diverse financial instruments. It supports both beginners and experienced traders through the MetaTrader 5 platform, zero deposit fees, and robust customer support.

Regulated by VFSC, SmartFX ensures transparency and security, though it lacks weekend support and custom account options. Overall, it is a reliable and user-friendly platform, ideal for traders prioritizing ease of use and streamlined tools.

SmartFX Review: FAQs

Is SmartFX regulated?

SmartFX is regulated by the Vanuatu Financial Services Commission (VFSC), ensuring compliance with industry standards and offering a secure trading environment.

What account types does SmartFX offer?

SmartFX provides a single account called Smart Trading Account, designed to simplify the trading process for both beginners and experienced traders.

What trading platforms does SmartFX support?

SmartFX operates on MetaTrader 5, which offers advanced tools, technical analysis, algorithmic trading, and mobile access for flexible trading.

OPEN AN ACCOUNT NOW WITH SMARTFX AND GET YOUR BONUS