Contents

- What Is Slippage Trading

- Change in Spread and Expected Price

- Positive Slippage

- Negative Slippage

- Reducing Slippage With Market Orders

- Conclusion

- FAQ

What Is Slippage Trading

Traders know that every trading day brings new challenges. They try to overcome them with the help of technical analysis. Experts are called that, because of the long experience that has given them the instinct to feel the market and with the help of data to make correct moves. But in this fluctuating space, things don’t always go the way traders plan.

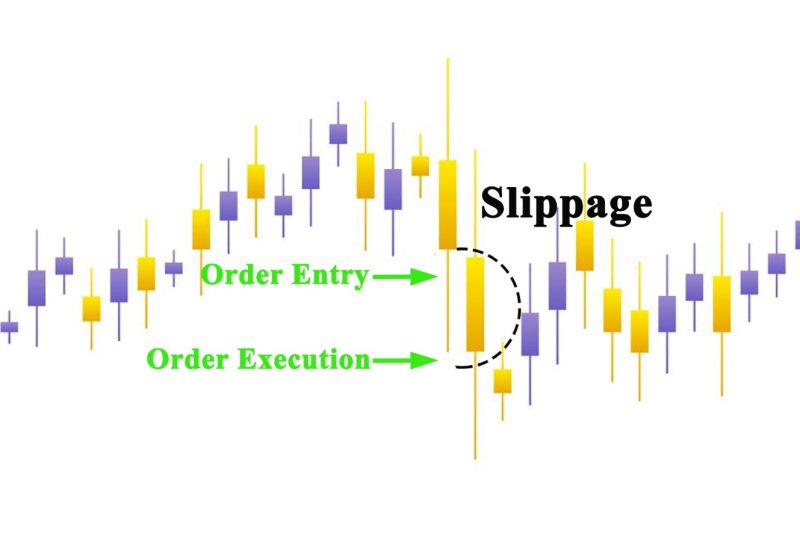

Major news events affect price changes and day traders encounter high risk. When this happens, you have encountered slippage. The phenomenon touches on the contrast between the anticipated price and the real price at which the trade is realized. The process usually happens in periods of volatility .

Also Read: Mirror Trading

Change in Spread and Expected Price

The question you may ask yourself is why is this happening? Slippage arises when a trade order is fulfilled without a matching limit order. The alternative situation is when a stop loss is placed at a less gainful rate than what was set in the original order. The phenomenon happens in times when the market is shaken by news, making it hard to execute trade orders at the expected price.

Forex traders will usually realize trades at the execution price, this can change when there is a limit order, that prevents the trade at a certain price. When this happens, slippage is caused by a change in spread. The spread is the difference between the desired price and the bid price. Traders can escape slippage along with volatile conditions in the market by not placing market orders.

Positive Slippage

The concept behind slippage is simple. Technically speaking it happens when the order that you set on the exchange is archived at a price, which is different from the price that you asked for. Slippage happens in the forex and stock markets. It can be positive or negative.

The positive slippage happens when an order is realized at a much better price than what was hoped for. For example, if you buy at EUR/GBP 1.560 but the order is executed at 1.568, you have a price that is better by 8.

Negative Slippage

The other side of the negative slippage occurs when the order is fulfilled at a lower price than what was planned for. In the case of a forex market, when trading currency pairs like for example if you purchase USA/EUR at 1.2060 but the order is realized at 1.2056. The price is reduced by 4 pips. Because of the dynamic nature of the financial markets, slippage happens because of the lag between making a market order and the time it is fulfilled.

Reducing Slippage With Market Orders

It is impossible to escape the spread between entry and exit points, there are ways to minimize slippage.

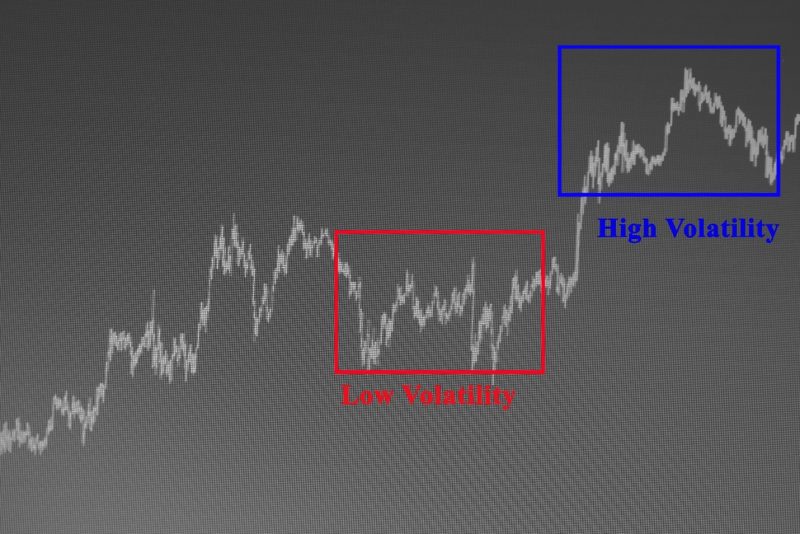

Investors can reduce the risk of slippage by doing business in liquid and low-volatility markets. Smooth price action is a trademark of markets with low volatility markets. The other positive aspect of this strategy is by using liquid markets you interact with many brokers and that multiplies the chances of an order being realized at the requested price. Liquidity in forex markets is when major markets overlap.

Traders need to abstain from holding positions in times of low liquidity. In times of weekends or overnight. This is why prices of underlying assets are affected by events that occur when the markets were closed.

Slippage happens because investors use market orders to enter or exit trading positions. One possible option to escape the problems of slippage is to reduce orders. The reason for this is limit order are realized at a hoped price.

Limit order reduces slippage when brokers start a trade to earn returns. When a limit order is started it will be realized at the stated or hoped price. The sell order takes place at the wanted price, but the buy order at the lower or specified price.

Slippages happen most often during news events that affect the market. Follow media reports related to assets you trade and avoid trading at this time. The information can be a signal of the course the asset can take. Stay passive in volatile times. Important financial events bring turbulence to the market. Many traders fell into the trap of seeing a good opportunity just to be derailed. When traders assume a position in periods of important news coming to light, then slippage will happen at greater risk the planned. Guaranteed stops for a specific price are recommended.

Conclusion

For market participants, slippage occurs at any time. The most frequent circumstances for slippage are volatile and less liquid markets. Take precursor measures to prevent the biggest slippage. Stay away from volatile markets where slippage can occur. Take a break from trading when the market is affected by major events that influence market directions and assets value. When trading use limit orders instead of market orders. This way your order will be filled at the requested price. You can reduce negative slippage by doing this in your trades.

It is hard to avoid slippage. It is the price of doing business. When you execute trades, you look for a favorable price, but that's not always the actual price on a trading day. Brokers use complex instruments to avoid slippage. That said it’s wise to implement steps to reduce slippage costs. Every day trader has experience slippage. If you are in a trade and funds are at risk, you feel you are losing control of the trade. Focus on using market orders to escape the position. Limit orders can help you leave the position in favorable conditions.

In summary slippage for a market maker in forex trading can be a beneficial method. The chartered market technician can calculate the slippage at the executed price. Use guaranteed stop because slippage occurs in the forex market and when trading currency pairs.

Also Read: Lightspeed Trading

FAQ

How can we stop slippage trading?

Investors that want to minimize slippage, prefer to use limit orders. The reason for this is that a limit order only fills at the price you want. In contrast with a market order, it will not fill at a worse price. Slippage can be evaded by using a limit order.

How is slippage trading calculated?

The slippage is calculated by measuring the range from the theoretical entry price to the day's highest price.

Does slippage make you lose money?

Negative slippage causes traders to lose money. The slippage risk can be reduced by trading in periods of high activity and low volatility markets.

What is broker slippage?

Broker slippage refers to how good a broker is at reducing slippage. This is done by routing orders to markets that offer better pricing or move fast to prevent price moves.