Cryptocurrency have been very popular in the past decade. There is an ongoing debate if it will replace the current monetary system. Yet while experts are expressing opinions, traders are actively transacting with the available crypto assets, from which Bitcoin has a primary spot.

However, Bitcoin is a volatile asset, something obvious from the price swings that it has experienced in its short history. At one moment, it can make substantial highs, just to decline dramatically a few months later. This volatility makes Bitcoin an attractive asset for short-sellers. Yet newbie investors are advised to stay clear from short-selling tactics, considering the risk that is present.

Let’s examine how you can short bitcoin and what to look out for.

Also Read: What Are Bitcoins Backed By?

Contents

- What Is Shorting?

- Reasons to Short Sell Bitcoin

- How to Short Bitcoin

- Strategies for Short Selling Bitcoin

- Factors to Consider

- Conclusion

- FAQs

What Is Shorting?

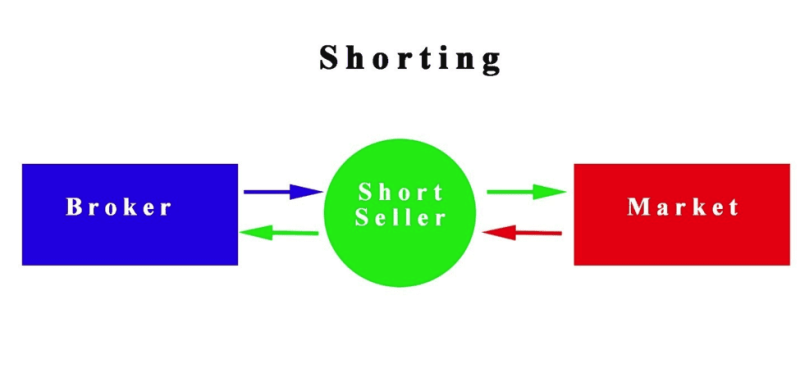

The goal of shortening as a trading strategy is to take advantage of an expected decline in a price of an asset. Traders sell the asset at a high price and wait for it to go down, after which they purchase it back at the newer lower price. This is contradictory to the conventional wisdom of purchasing low and selling high. Short sellers work the opposite way sell high and buy low.

The goal is to earn a profit from the price difference. This is a risky strategy because there are no guarantees the price will decline. Theoretically, it can increase, causing difficulties for short-sellers that originally did not owned the asset they sold. Creating pressure to purchase it back at a larger price to return it to the lender.

Short selling is a tactic that can get implemented with any financial instrument, and Bitcoin is no different, as an asset it can be sold and in turn get shorted. Yet, shorting cryptocurrency can be a more complicated process, mostly concerning on how you are shorting it, either by using a leveraged trading provider or on a cryptocurrency exchange.

Reasons to Short Sell Bitcoin

Bitcoin is an asset that has generally increased in value since its beginning. Recent policy changes in a few countries have made it a more volatile asset, but typically investors were more interested in stockpiling crypto and awaiting the price rises.

Very few have chosen to gamble on shorting Bitcoin, yet the new realities of the market offer reasons to attempt this strategy. Several reasons can motivate investors to short sell, and we are going to explore a few.

Volatility

Experience has shown that Bitcoin prices can appreciate and decline in value equally fast. Traders with a mentality of a gambler choose volatile assets that can create huge rewards, at the same time can incur losses. For seasoned traders, it’s not a gamble, but a test of knowledge about the market. It’s possible to make an educated prediction about the short-term future of the Bitcoin price.

Hedging Risk

Investors with large portfolios short assets in an attempt to hedge the risk. When a decline in the value of Bitcoin gets expected, traders will open a position to short sell bitcoin. In cases when their prediction is correct, the income generated by the short position will offset any losses in the long run.

Valuation

The market price is in large part built on speculation. The value of certain assets has been produced by circumstances. That is why there is large fluctuation, as conditions change, so do the values of the underlying asset.

Investors may estimate that Bitcoin gets overvalued, and the price bubble can burst and result in a downward trend, creating a perfect opportunity for shorting. Several metrics are used in valuation, and learning the methods offers a better understanding of the price dynamic.

Where Can You Short Bitcoin?

Investors have few methods at their disposal for shortening Bitcoin, and every one of them provides rewards but also risks and can be complex to manage. Most options for short selling are types of derivative trading of shorting through an exchange.

Bitcoin Exchanges

Market exchanges that accept shorting of Bitcoin are the most frequent method. It’s important to know that exchanges that work with the sale of Bitcoin are more complicated than purchasing and owning crypto. Bitcoin traders that plan to open a short position, because of the expectation the market will decline, have to borrow the asset from a broker.

The trader sells the Bitcoin and expects price drops, then repurchases the quantity of Bitcoin that was initially borrowed. The investor returns the crypto and earns a profit from the difference in prices. Selling on exchange relies on more liquidity than buying and creates fees and other costs. This complexity discourages some investors that going the alternative route and working with a leveraged trading provider.

Margin Trading

Cryptocurrency margin trading platforms offer the easiest way to short Bitcoin’s price. Most brokerages and exchanges permit this form of trading. Margin trades enable traders to borrow from a broker, and because it involves borrowed assets, it can increase losses. There are plenty of Bitcoin exchanges facilitating margin trading.

Leveraged Trading Provider

Leveraged trading providers offer CFDs and spread betting. The difference between exchanges and leveraged trading products is in the fact that with the latter, you are not the owner of the asset. Traders assume a position deciding if the price will rise or decline and profit if their prediction comes true.

Investors must make a small deposit to get the full value. But the deposit is not the benchmark for the exposure, which gets based on the full trade value. This way, profit, and losses can increase concerning the exposure.

Binary Options Trading

Traders can short Bitcoin with call and put options. If planning on shorting you can execute a put order, trying to sell the crypto at the current market price even if the price declines later on.

The expanse and risk of using binary options are high. The benefit is in limiting your loss by selecting not to sell the put options.

Bitcoin Futures

Bitcoin futures are a contract that facilitated the purchase and sale of Bitcoin for a specific amount and date.

The original intent of a futures contract was to protect traders from price fluctuations in commodity markets. Futures contracts have evolved and are available for cryptocurrencies.

Bitcoin Options

Some exchanges offer bitcoin options. This is a contract that makes it possible, in other words, the investor has the right but is not under any obligation to follow through with the contract which enables the buying or selling of Bitcoin at a predetermined price and a date.

This is an investment strategy best suited for advanced traders. The advantage of short-selling Bitcoin with an options contract is that risk is limited to the paid premium.

Also Read: What Is Crypto Halving

How to Short Bitcoin

Before starting to short sell any asset, not just Bitcoin it’s crucial to educate yourself and understand the risk that comes with the trading method. Take advantage of a demo account on your preferred trading platform and experiment before investing real money.

When shorting bitcoin on a leveraged trading account , the first step is to open an account. This gets you started but to continue, you need to know what you are doing, that’s why analysis is a good option to study the bitcoin market. Learning the market is a prerequisite for locating entry and exit points.

It is crucial to implement a risk management strategy, with features such as taking profit and stop-loss orders.

When you have decided that you want to short bitcoin, and risk management is appropriately structured, place your bitcoin trade.

Strategies for Short Selling Bitcoin

Investors can implement various analytic strategies when shorting Bitcoin. These strategies work with different periods and risk appetites. However, technical or fundamental analysis tends to be the dominant option for most investors, while some prefer to combine the two.

Technical Analysis

Investors that utilize technical analysis go over historical charts relating to Bitcoin price, and examine previous trends with the help of technical indicators. The moving average indicators are a staple in this type of analysis offering insight into the strength and momentum of a trend.

Other technical analysis strategies for short-selling Bitcoin assets get based on support and resistance levels on chart patterns. Although with every strategy, there are cons and advantages.

It’s easy to locate resistance and support levels, but they tend to be more obscure when a market is rising and declining. On the other hand, chart patterns can be more difficult to identify and provide contradicting data.

Fundamental Analysis

Some investors think bitcoin has no fundamentals, and the only way to trade it is with technical analysis. Because it’s a new asset on the market without significant historical data to analyze, some investors think the fundamental analysis is not valuable in this case.

The key to using fundamental analysis on cryptocurrencies is to determine the supply and demand. Factors that influence the demand for bitcoin are transactional activity, news, and adaptation.

Supply variables are simpler because the quantity of digital coins in circulation is limited. But other elements, for example, Bitcoin halving can play a role.

Factors to Consider

Every strategy that uses shorting Bitcoin has great risk. Here are a few things to consider when shorting Bitcoin.

The Price Is Volatile

Bitcoin’s price is volatile its no secret, but it’s a fact that should not get ignored when trading. Most options to short Bitcoin depend on derivatives, based on fluctuations in the cryptocurrency’s price. Bitcoin cannot get used as a hedge for investment in actual Bitcoin. Additionally, options trading in Bitcoin can increase losses because of price volatility.

Risky Asset

Price is one of the multiple risks. There is not enough data on Bitcoin to make an educated decision about its feasibility as an asset. Several issues are not unresolved. And some trading platforms are susceptible to hacks.

Unclear Regulations

Bitcoin is a global phenomenon, but it functions in a grey zone because its regulatory status is still unclear. Many platforms are not available to American traders, and the lack of oversight means that exchanges have more freedom than they recommend under normal circumstances. The absence of clarity about regulatory status limits legal options for customers.

Learn Order Types

Before opening a short position, take a crash course and familiarize yourself with different order types. That way, you can reduce losses if the price trajectory moves on a different course. With stop-limit orders and trading derivatives, investors can control losses.

Conclusion

Shorting Bitcoin is a strategy that can be profitable but is very risky considering the lack of regulation and the volatility of the asset. Bitcoin trading implemented correctly can generate income, but it can also result in losing money rapidly.

With short selling, investors borrow Bitcoins, and sell them at a higher price, then repurchase them when there is a price decline, making a profit from the difference.

This is not a strategy recommended for novice traders, because of the risk involved. When shorting Bitcoin invest funds you can afford to lose. Follow the market for relevant events that will help you anticipate price changes.

Investors that short bitcoin foresee a short-term trend and have a bearish sentiment. They follow the latest developments in blockchain technology and are not influenced by other opinions, but guide themselves by their objectivity.

FAQs

Is shorting Bitcoin profitable?

Shorting Bitcoin can be a profitable strategy when properly done on many cryptocurrency exchanges. There are several ways to short bitcoin, and it’s crucial to select the correct trading tools. Yet it’s a risky tactic, and a lot of retail investor accounts have experienced big losses if the price of Bitcoin doesn’t move in the expected direction.

What does it mean to short a Bitcoin?

Shorting Bitcoin means selling the asset when the price is high, then waiting for a decline to buy it back and earn an income from the price difference between the two prices. Most frequently, the traded Bitcoin is borrowed from a broker, and a fee has to get paid. The asset also must be returned on a predetermine date.