The popularity of cryptocurrency is taking the world by storm. Most regular people see it as a quick-rich scheme, while economists are theorizing if the digital coin is the way of the future. Yet, no matter to which camp you subscribe, short-selling bitcoin is becoming an attractive option.

Cryptocurrency mining has been a staple in media headlines. The process of creating digital currency has created a small industry.

But in the background, there is a lot of trading going on with the final product of the so-called mining process for digital currency. Most brokers are keeping a watchful eye on Bitcoins’ price.

This past summer, the market experienced a shock after China implemented regulation on Bitcoin and other forms of crypto, resulting in a downward price trajectory on many charts.

Just to be clear most financial institutions around the world do not regulate cryptocurrency, and that includes Bitcoin. This opens an opportunity for profits, by basically being at the right place at the right time.

For some investors, the turbulent experience last summer was verification that their expectations of a future crash were justifiable. Brokers that share that belief can find shorting the currency as a solid profit-making option.

Also read: How to Day Trade Crypto

Contents

- What Are Cryptocurrencies?

- What Is Shorting?

- How Does It Work In Practice?

- Reasons For Short Selling Crypto

- Volatility Can Be Both Risky And Advantageous

- Is Shorting Different Than Margin Trading?

- Crypto Margin Trading

- Advice On How To Short Bitcoin

- Benefit From Technical Analysis

- Fundamental Analysis Can Be Used

- The Risks Of Short Sell Bitcoin?

- Conclusion

- FAQ

What Are Cryptocurrencies?

For those late to the crypto game, a clarification is in order. Cryptocurrency is a new concept, for all intense and purposes, it’s not a real currency.

Yes, certain businesses are allowing the exchange of products and services for Bitcoin. But it’s not a traditional currency, regulated by government institutions. A better perspective is to look at it as an investment opportunity.

Crypto is an assemblance of binary data created to function as money.

The concept has several practical manifestations like Bitcoin, Ethereum, Cardano, Dogecoin, and many others. But the spotlight is on Bitcoin that has become a synonym for cryptocurrency and has a large market share.

Also read: Is Cryptocurrency a Good Investment?

What Is Shorting?

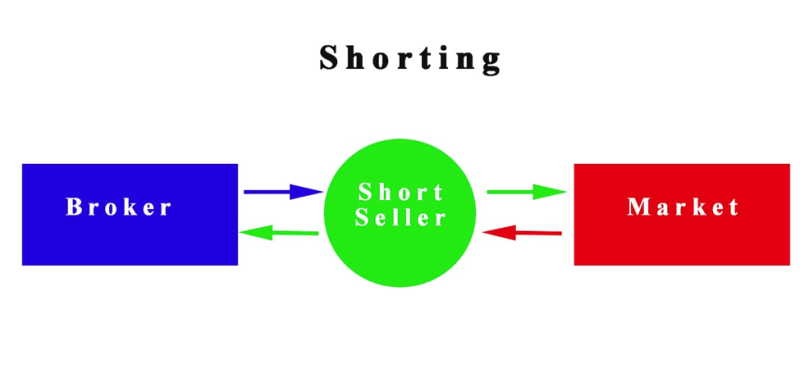

Trading depends on different tactics to accomplish the desired result, and short selling is an investment method that gets leveraged when a decline in the price of an asset gets expected.

The reason for the term shorting is that usually, traders don’t possess the funds to purchase the asset, that they sell at a profit.

Short-sell crypto is not restricted, the option is open to anybody, yet some traders don’t prefer the strategy. It can influence the value of the asset there are holding in their portfolio.

The process is not complicated, but it comes with risks. When things don’t develop as planned and the price spikes upward, you can lose more than the amount invested in the crypto.

How Does It Work In Practice?

Shorting is performed by borrowing an asset and immediately selling it for the current market price. There is the easy part, the whole strategy depends on your foresight that the price will drop by the tie you have to return the borrowed Bitcoin, which has a predetermined date of return.

If things develop as planned and the price declines, then you buy the Bitcoins you previously sold and return them to the original owner, but you get to pocket the difference between the initial selling price and the later purchasing price.

Let’s look at some of the ways to short Bitcoin :

- Start by borrowing 25 Bitcoins when the price is $2000.

- Sell the 100 Bitcoins for $2,000.

- In a few weeks, the price declines to $1,500.

- You repurchase the 100 Bitcoins and return them to the original broker.

- The profit is $50,000-$37,500 = $13,000.

Shorting is a method of profiting from the decline in an asset’s value. Investors opt for shorting when political or economic circumstances signal that a decline in market value will happen. Shorting any asset is risky, but the unpredictability of crypto makes it highly dangerous.

Reasons For Short Selling Crypto

Investors can be motivated by various factors to short sell a cryptocurrency. It all depends on the data they have from market analysis. How confident are they in the predictions and the potential for profits by making this risky move?

Asset Valuation

Technical analysts are continuously looking at a chart and trying to figure out if a given currency is overvalued and experiencing a price bubble.

Investors sense the trend and decide to make a profit by short sell their crypto and expecting its retracement to start.

Short selling crypto is not done by following instincts. The best method is to harness the potential of valuation metrics, implement analysis of the value against the present market price so you can know when to repurchase the crypto.

Hedging Risk

One of the reasons for implementing short selling is the volatility of crypto that can negatively affect a long position. If in possession of Bitcoin or other cryptocurrency and expect a price decline, then you can choose to short sell the currency.

If the prediction turns out to be accurate, the profit made from short selling can reduce the losses on the long position. Implementing a hedging strategy manages the level of losses in a bear market.

Volatility Can Be Both Risky And Advantageous

Investors that are not by nature risk-takers should be concerned because of the volatility of cryptocurrency. The data inform that the price of crypto can dramatically rise and decline at the same speed.

Traders who like to play this type of high-stakes game will be attracted by the fluctuations, in the hopes of harvesting big monetary rewards. Investors with experience in changing trends and knowledge about crypto can exploit the volatility to their advantage.

Is Shorting Different Than Margin Trading?

There are similarities but also large differences. Shorting a cryptocurrency means selling a cryptocurrency that you do not own. With margin trading, traders borrow funds from their brokers to purchase an asset. The big difference is the interest on the money that gets borrowed, it works similar to bank credit, while when shorting, a fee has to get paid to the broker.

Crypto Margin Trading

There are several crypto exchanges including Kraken make it possible to short sell Bitcoin on a margin trading account with leverage or not. In these cases, traders are borrowing crypto at the present market price and selling it.

Afterward, you repurchase it at a reduced price, the whole process is dependent on the original fee to borrow the asset.

This is possible on Kraken with certain advanced settings, where traders modify the sell and settle position something that is also an option on Poloniex, which complies with US laws, but on Bitfinex, which uses Tether, and operates outside of the U.S.

Futures Trading Contracts On Bitmex

U.S. citizens can’t use Bitmex, but with the help of a VPN, they can access it to short crypto. Bitmex provides highly leveraged short contracts settled in BTC. Investors choose the contract type and leverage, fund it, and hit go.

Futures Contracts On The Stock Market

Traders are not limited to purchases of CBOE Bitcoin futures contracts or CME Bitcoin futures contracts. If planning to short a futures contract investor need to buy a call or put options on that contract. This gets done via a broker that can use leverage.

Advice On How To Short Bitcoin

Because shorting crypto is dependent on a few factors, it’s crucial to incorporate every element when formulating your trading strategy. The risk is high if the retracement is false that is why all factors need to get used in the equation before starting to short sell cryptocurrency.

Follow The News

As previously mention, cryptocurrencies are in a state of limbo. The assets are not regulated by most government institutions around the world. And politico-economic events can affect the Bitcoin price on the market. If a government decides to implement regulations it can crash the crypto market.

Traders can benefit from shorting crypto in the bear market, yet if moving against government guidelines can produce serious consequences.

Benefit From Technical Analysis

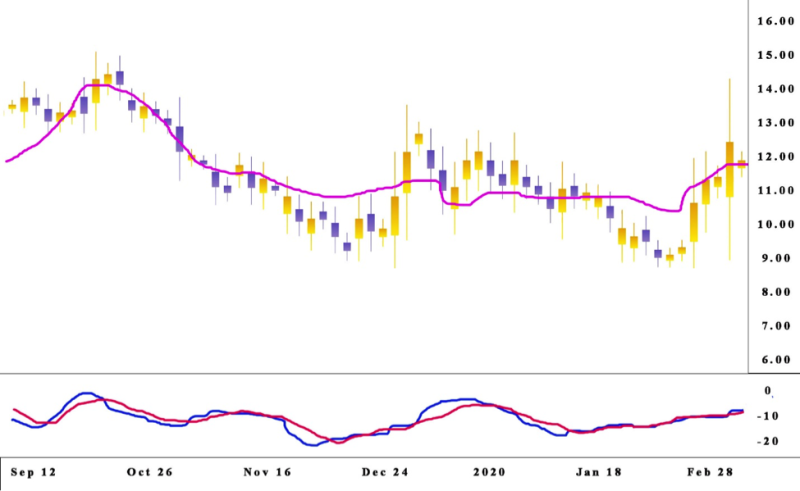

Technical analysis use information’s to forecast the future course of the crypto market and gets done by inspecting the volume and movement of the currency in the past. The core idea is that the dynamic in the crypto market is not accidental but based on a trend. Frequently the currency follows a trend, it in due course will go the way of the opposing trend.

An example in the case of Bitcoin would be to look at the present trading volume and how it compares to a few months back.

The concept behind technical analysis is that history is cyclical, and prices and trends repeat over time. By researching the regulations, present demand, and past interest as well as the trader’s experience.

Some indicators used in technical analysis to forecast retracements include:

- The strength of the trend gets estimated with the Average Directional Index

- The Relative Strength Index signals momentum, and for price changes, this indicator shows the magnitude.

- Standard deviation gets used to the yearly rate of return on investment.

- Bollinger Bands reveal if the price is low or high.

The indicators help find possibilities for profits. When shorting Bitcoin traders must learn moving averages, that show the price over a given period.

Short Crypto During Rallies

Rallies are the best opportunity to short any cryptocurrency. In rallies, the assets are overbought because there is panic among investors and regular people that are seduced by the hype and are scared about not being big a part of the big payout. The interest drives the price, and this is an extra benefit because the potential profit increases by selling at an inflated price.

When the excitement subsides, a lot of people will be in a position of an asset that they don’t really need and will be interested in selling it, which in turn makes it possible for a return of the lower price, and there is the opportunity for profits.

Fundamental Analysis Can Be Used

The short history makes most traders skeptical of the value of fundamental analysis when trading crypto. The fundamental analysis gets implemented by investors to create the value of a crypto asset and improve the possibilities for correct investment decisions.

With the analysis, investors can locate factors that influence the supply and demand of cryptocurrency. It’s crucial to inspect internal and external factors to see if a cryptocurrency is undervalued or overvalued.

Because cryptocurrency’s fundamental analysis is not similar to standard markets, different metrics get implemented.

The Number Of Transactions

The amount of transactions realized is a good indication of the activity that is happening in the market. Moving averages and plotting periods are a good approach to find out, how the interest for a cryptocurrency fluctuates over time.

Still, nothing is guaranteed, and a spike in a transaction can be the result of transfers amid different wallets by the same owners.

Transaction Value

The value of transactions reveals the number of transactions done in a period. If five people transfer a Bitcoin, the transaction count is five. If the worth of Bitcoin is let’s say $20.000, the total transaction value will be $100.000.

The Risks Of Short Sell Bitcoin?

There are two key liabilities when short-selling Bitcoin assets. The biggest one is to lose money because of price volatility. It’s hard to precisely forecast the price movement of an underlying asset.

The second danger is the non-existing regulatory framework that is standard for most other assets. Most futures trading venues for crypto are not regulated. This limits options for traders if the plan doesn’t go in the expected course.

Conclusion

The concept of crypto trading is not hard to understand, investors borrow crypto from other brokers at a specific price, then sell it on the market for the current price and wait for price drops. When this happens, they can buy it back and pocket the difference between the selling and buying price.

It’s a sound financial strategy at face value, yet nothing is guaranteed. The problem in this scheme is if the price moves upward and not downward as expected, what is borrowed has to be returned, and investors will have to repurchase the crypto at a new higher price, effectively incurring losses.

Shorting Bitcoin can be risky that’s why it is not recommended for beginners. The biggest trap is the fact that investors have to borrow the cryptocurrency, and effectively are putting themselves at the mercy of the market if things don’t develop as originally forecasted.

When choosing to short Bitcoin be sure that you are risking cash you can afford to lose. Check on the date of relevant events so you can predict changes in the direction of the price.

FAQ

Can You Short Crypto?

Yes, crypto is an asset that can get shorted, but it’s a highly volatile asset making for a large risk. So be careful if attempting to short sell crypto because of the potential for losses.

Where Can You Short Crypto?

The usual method of shorting crypto is through a market exchange that allows the activity. There Are plenty of exchanges like Kraken, Bitfinex, and Bitmex, that support the shorting of cryptocurrency.

Can I Short Crypto On Coinbase?

On Coinbase the option for margin trading is no longer offered. The alternative is to use futures contracts to begin short selling without leverage. After you sign up for an account and locate a downward trend for the chosen coin you can open a position.