Scope Markets Review

Scope Markets is a trading brokerage overseen by the International Financial Services Commission of Belize (IFSC). Its operations strictly adhere to various regulatory rules and guidelines, with particular emphasis on the principle of the segregated account. This helps ensure the client funds’ security and separation from the broker’s operational funds. Scope Markets offers an array of trading solutions complemented by multi-platform trading facilities, catering to different trader preferences.

This article provides an in-depth review of Scope Markets, delving into its advantages, shortcomings, and all the critical elements. By examining features such as the broker’s commission structure, account types, transaction processes, and more, we aim to provide a comprehensive perspective that will guide potential traders in their decision-making.

What is Scope Markets?

Scope Markets is a Forex and Contract for Difference (CFD) broker that has been in operation since 1997. For over two decades, the company has continually improved and delivered exceptional trading conditions by deeply understanding and responding to the needs of traders. The broker operates using a No Dealing Desk or Straight Through Processing (STP) execution model, which offers a trading environment that balances simplicity and sophistication. This environment is suitable for both beginners and experienced traders alike.

The company boasts more than 20 years of industry experience, providing traders with a variety of instruments, including Forex, Indices, Metals, and more. The broker has operations in Belize through the offshore entity Scope Markets Ltd and in Cyprus via SM Capital Markets Ltd. The Cyprus entity operates several domains, including scopemarkets.com/eu and sminvest.com/eu, offering similar trading services across platforms.

Advantages and Disadvantages of Trading with Scope Markets?

Benefits of Trading with Scope Markets

Trading with Scope Markets brings an array of advantages.

- Regulated by CySEC: Firstly, its regulation by the Cyprus Securities and Exchange Commission (CySEC) enhances the broker’s reputation, thereby instilling trust among traders. Over its extensive operational years, Scope Markets has been able to maintain a reputable standing in the industry, showcasing its reliability and dedication to service quality.

- Simple Account Opening Process: Another crucial benefit is the straightforward account opening process, which aids in providing a seamless onboarding experience for traders. With the ease of setting up an account, traders can quickly dive into trading activities without unnecessary delays or hassles.

- Wide Range of Trading Tools and Software: Furthermore, Scope Markets offers a wide range of user-friendly trading tools and software that cater to both novice and experienced traders. These comprehensive trading resources are designed to equip traders with the necessary tools to make informed decisions and optimize their trading strategies.

- Competitive Fees and Trading Conditions: The broker also stands out for its competitive fees and trading conditions. By offering low fees and competitive spreads, Scope Markets ensures that traders can maximize their profits while keeping trading costs to a minimum.

- Exceptional Multilingual Customer Support: Last but not least, the exceptional multilingual customer support offered by Scope Markets cannot be overlooked. With a dedicated team available to provide prompt responses and useful assistance, traders can enjoy a smooth and uninterrupted trading experience.

Scope Markets Pros and Cons

Pros:

- Scope Markets is a CySEC-regulated international broker, which underscores its commitment to adhere to stringent regulatory standards.

- The broker’s extensive global coverage and years of operation underscore its stability and wide-reaching service provision.

- Scope Markets offers a broad variety of trading platforms, accommodating the varied needs and preferences of traders.

- The broker’s competitive trading conditions ensure that traders can optimize their profits without incurring excessive costs.

- The exceptional customer support from Scope Markets, available via live chat, ensures fast responses to any trading inquiries or issues.

- Scope Markets has implemented a negative balance protection feature to safeguard traders from losing more money than they have deposited into their accounts.

Cons:

- Scope Markets operates an offshore entity in Belize, which may raise regulatory concerns for some traders.

- The broker does not offer 24/7 customer support, which may affect traders who operate in different time zones or those who prefer trading outside typical market hours.

- The company’s international regulation through offshore zones may not provide the same level of trader protection as regulators in major financial hubs.

- There may be variations in account types and offers according to jurisdiction, which may affect the consistency of service for traders in different regions.

- The broker provides limited deposit and withdrawal options for European clients, which may impact the convenience of transactions for some traders.

Scope Markets Customer Reviews

Customers have generally positive feedback about Scope Markets, appreciating its reliable services, tight spreads on indices, and efficient customer support. Users find the platform suitable for trading and appreciate the efficient resolution of their help requests. This feedback reflects the overall satisfaction of the customers with the services provided by Scope Markets.

Scope Markets Spreads, Fees, and Commissions

In terms of spreads, fees, and commissions, Scope Markets strives to ensure a cost-effective trading environment for its clientele. The broker’s trading fees fall in the lower to average range, making it an attractive choice for traders seeking to maximize their profits.

When it comes to Scope Markets fees, one of the significant advantages offered by Scope Markets is the lack of fees charged on deposits, an exemption being Bank Transfers. For these transfers, clients may encounter fees levied by the sending or correspondent banks. It is always advisable for traders to be familiar with their bank’s fee structure before opting for this method of deposit.

The minimum withdrawal amount stands at a reasonable 50 USD, EUR, or GBP, depending on the currency of the client’s account. This flexibility allows traders to manage their accounts efficiently.

Moreover, Scope Markets prides itself on offering competitive spreads, which commence from as low as 0.01 pips. This feature is beneficial for traders who employ strategies that are sensitive to cost fluctuations. The absence of hidden charges and commissions further underscores the broker’s transparent pricing policy.

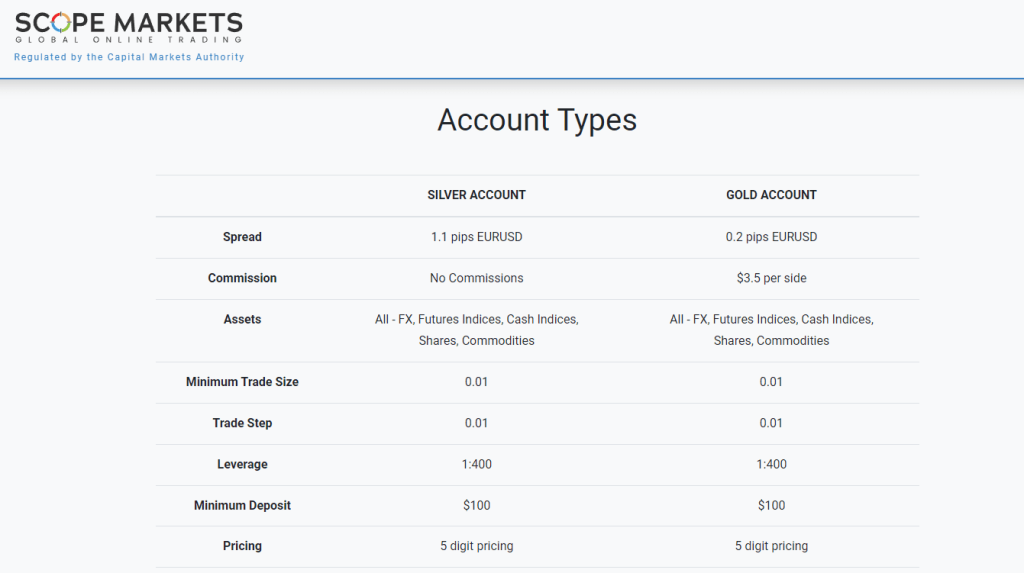

Account Types

For broker Scope Markets account type, the broker caters to a diverse clientele by offering two distinct types of accounts: the Silver Account and the Gold Account. Scope Markets minimum deposit is $100 for both Scope Markets account. Scope Markets demo account is also available. You can practice Forex trading with this free demo trading account.

Silver Account

The Silver Account is particularly suited to traders seeking a cost-efficient trading experience. It offers a spread of 1.1 pips on EUR/USD and does not charge any commissions, making it an ideal choice for traders who prefer straightforward pricing structures. The Silver Account also provides access to a broad range of tradable assets, encompassing Forex, Futures Indices, Cash Indices, Shares, and Commodities.

Gold Account

The Gold Account, by contrast, is designed for more seasoned traders who prioritize tighter spreads over commission-free trading. With this account, traders can enjoy a lower spread of 0.2 pips on EUR/USD. However, a commission of $3.5 per side is levied. Like the Silver Account, the Gold Account also provides access to a wide array of assets, enabling traders to diversify their portfolios based on their preferences and risk tolerance.

How to Open Your Account

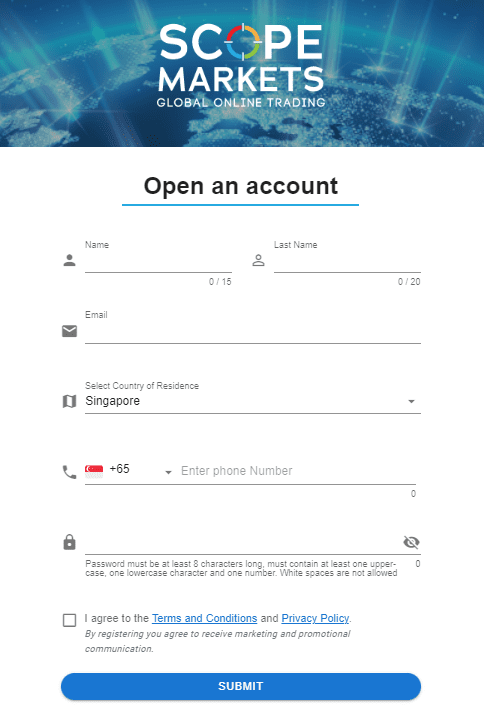

Establishing an account with Scope Markets is a straightforward, user-friendly process that can be completed in a few simple steps.

- To begin, visit the Scope Markets website and locate the “Login” button. After clicking on this button, select the “Get an Account” option to initiate the account registration process.

- During this process, you will be required to provide various personal details, including your name, email, and phone number, amongst other information. These details are crucial for setting up your trading profile and ensuring the security of your account.

- Following this, a verification process is carried out, which necessitates the submission of certain documents to confirm your identity and place of residence. Accepted documents for proof of residence typically include a utility bill or bank statement, while valid identification documents generally entail a passport or national ID card.

- Once your provided information has been verified and your account activated, the final step involves funding your account. After depositing the necessary funds, your trading journey with Scope Markets can commence.

What Can You Trade on Scope Markets

Scope Markets offers its clients a comprehensive and dynamic trading environment through its high-performance, low-latency solution. This innovative approach allows traders to access a wide array of trading instruments and markets, thereby providing ample opportunities for diversification.

Among the various instruments available for trading, Scope Markets includes a vast range of currency pairs, encompassing major, minor, and exotic pairs. This ensures that Forex traders of all levels can find pairs that align with their trading strategies and risk tolerance.

In addition to Forex trading, traders can also access leading shares, commodities, and binary options, which further expand the scope of trading possibilities. However, it’s important to note that Indices trading is not available on the ECN trading Account. As such, traders are always advised to consult the support center to verify the trading conditions and instrument availability pertinent to their chosen account type.

Scope Markets Customer Support

Scope Markets takes pride in its accessible and effective customer support. While they do not offer 24/7 customer support, their team is readily available during standard working hours on working days, providing timely and relevant solutions to customer concerns.

Advantages and Disadvantages of Scope Markets Customer Support

Security for Investors

Withdrawal Options and Fees

Scope Markets offers a variety of trusted deposit and withdrawal methods, including Credit Cards (Visa or Mastercard), Skrill, Neteller, Wire Transfer, and several other alternatives. While Scope Markets does not generally charge funding fees, payment providers might add some fees depending on jurisdiction or international rules. For withdrawals, Scope Markets permits two free requests per month. Any additional withdrawal request incurs a charge of $35 or its equivalent.

Scope Markets Vs Other Brokers

#1. Scope Markets vs AvaTrade

Both Scope Markets and AvaTrade are reputable, well-established Forex brokers that cater to a global clientele. They each offer a diverse selection of trading instruments and platforms, which can cater to different types of traders. Scope Markets, as a CySEC-regulated broker, has built a reputation for competitive trading conditions and strong customer support. On the other hand, AvaTrade, headquartered in Dublin, Ireland, has distinguished itself with a robust online trading experience serving a large number of customers globally.

Scope Markets may offer a more appealing choice for traders looking for low spreads and straightforward fee structures, with spreads starting from 0.01 pips. AvaTrade, however, might be a better fit for traders prioritizing a larger diversity of financial instruments, as it offers over 1,250 financial instruments to trade.

Verdict: While both are excellent choices, AvaTrade may hold a slight edge due to its greater variety of financial instruments, making it a more versatile platform for diverse trading strategies.

#2. Scope Markets vs RoboForex

RoboForex, like Scope Markets, offers strong trading conditions, driven by advanced technology and a large number of trading options. With more than 12,000 trading options across eight asset classes, RoboForex presents an extensive trading opportunity for clients. The company also offers different platforms including MetaTrader, cTrader, and RTrader, and it organizes contests on demo accounts, which could be attractive for new traders looking to gain experience and start a successful trading career.

However, Scope Markets prides itself on its competitive spreads, straightforward fee structures, and excellent customer support, making it an attractive option for many traders.

Verdict: While RoboForex offers a wide selection of trading options and platforms, Scope Markets’ competitive spreads and excellent customer support may make it a better choice for traders prioritizing cost-efficiency and service quality.

#3. Scope Markets vs Exness

Exness is a notable broker offering an extensive selection of financial instruments including CFDs for stocks, energy, metals, cryptocurrencies, and over 120 currency pairings. The company’s emphasis on low commissions, immediate order execution, and swift fund withdrawal could make it appealing to cost-conscious traders. They also offer an attractive feature of infinite leverage on small deposits up to $999.

On the other hand, Scope Markets offers competitive spreads starting from 0.01 pips, a diverse range of assets, and excellent customer support. While Exness may provide more trading instruments and features, Scope Markets maintains a simpler and more straightforward approach to trading with fewer associated costs.

Verdict: Both brokers have strong offerings, but Scope Markets may edge out Exness for traders looking for simplicity, low spreads, and excellent customer support.

Conclusion: Scope Markets Review

Overall, Scope Markets is a solid choice for traders looking for a reliable, regulated broker with competitive trading conditions. Its user-friendly platforms, range of tradable assets, low spreads, and exceptional customer support make it an attractive option for traders of all experience levels. While it might not offer the sheer variety of instruments provided by some competitors, its commitment to transparency, customer support, and straightforward fee structures set it apart in the crowded brokerage field.

Scope Markets Review: FAQs

Is Scope Markets regulated?

Yes, Scope Markets is regulated by the Cyprus Securities and Exchange Commission (CySEC). This ensures that the broker is held to a high standard of conduct and provides assurance to traders that their funds are safe.

What types of accounts does Scope Markets offer?

Scope Markets offers two main types of accounts: the Silver Account and the Gold Account. The Silver Account offers spreads of 1.1 pips on EUR/USD with no commissions, while the Gold Account offers lower spreads of 0.2 pips on EUR/USD but includes a commission of $3.5 per side. Both account types provide access to a variety of asset classes.

Does Scope Markets offer customer support?

Yes, Scope Markets offers exceptional customer support. They provide a live chat option and are known for their quick response time. However, it’s important to note that their customer support is not available 24/7.