Scandinavian Capital Markets Review

In the world of Forex trading, selecting the right broker is crucial. A Forex broker acts as a gateway to the global currency markets, providing traders with access to buy and sell foreign currencies. The choice of broker can significantly impact your trading success, influencing factors such as transaction costs, available trading pairs, and the reliability of trade executions.

When it comes to Scandinavian Capital Markets, this broker distinguishes itself in the competitive Forex landscape. Since its inception in 2011, Scandinavian Capital Markets has carved a niche for itself, offering an array of services including trading in currency pairs, cryptocurrencies, and precious metals. Located in Sweden, the broker is regulated by the Finansinspektionen (Swedish Financial Supervisory Authority), adding a layer of trust and regulatory compliance to its operations.

In this comprehensive review, we delve deep into Scandinavian Capital Markets. We aim to provide an insightful analysis of what sets this broker apart, covering aspects like account types, deposit and withdrawal procedures, commission structures, and more. Our review is a blend of expert analysis and real trader feedback, aiming to furnish you with a balanced view. This approach is designed to help you make an informed choice about whether Scandinavian Capital Markets is the right Forex broker for your trading needs.

What is Scandinavian Capital Markets?

Scandinavian Capital Markets is a financial services provider based in Sweden, specializing in Forex trading and investment solutions. The broker caters to a wide range of financial markets globally, including Forex, commodities, indices, and cryptocurrencies. This diverse offering makes it a versatile choice for traders and investors.

Functioning as an ECN broker, Scandinavian Capital Markets employs the STP (Straight Through Processing) execution model. This approach ensures direct access to various liquidity providers, which is essential for swift and transparent order execution. For traders, this means more efficient trading with potentially better pricing and faster transaction completions.

Benefits of Trading with Scandinavian Capital Markets

After trading with Scandinavian Capital Markets, I’ve identified several benefits that stand out. The broker offers a diverse array of trading instruments, which includes a wide selection of over 70 currency pairs, along with metals and an impressive range of cryptocurrencies. This variety has allowed me to diversify my trading portfolio and explore different markets, enhancing my trading experience significantly.

Another notable benefit is the broker’s adoption of popular and user-friendly trading platforms like MetaTrader 4 and cTrader. These platforms have proven to be highly reliable and efficient, providing advanced tools and features that cater to both novice and experienced traders. The ease of use and robust functionality of these platforms have greatly facilitated my trading activities.

Additionally, Scandinavian Capital Markets’ customer support has been commendable. Available 24/5, the support team is accessible through various channels including email, phone, and live chat. Their quick response times and the relevance of the information provided have been instrumental in resolving my queries efficiently. This level of customer support has added a layer of confidence and reassurance in my trading journey with them.

Scandinavian Capital Markets Regulation and Safety

understanding their regulatory framework and safety measures is crucial. The broker has its base in Sweden and is registered with the Swedish Financial Supervisory Authority. This registration is important because it signals a commitment to adhering to certain standards and regulations that protect traders.

The safety of client funds is a top priority for Scandinavian Capital Markets. The broker ensures that client capital is held in segregated accounts at major international banks. This separation from the company’s capital is a key safety feature, as it protects client funds in the event of financial difficulties within the broker.

Additionally, all agreements with clients are governed by the legal framework of Sweden, which adds another layer of security and trustworthiness. Being under the watchful eye of the Swedish Financial Supervisory Authority, also known as Finansinspektionen, means Scandinavian Capital Markets must comply with strict regulations. Furthermore, the broker aligns with the European ESMA regulation and the MiFID directive, ensuring a high standard of operation and transparency. This compliance is vital for traders like me, as it provides assurance of the broker’s integrity and reliability in the financial market.

Scandinavian Capital Markets Pros and Cons

Pros

- Low minimum deposit requirement.

- Supports automated and copy trading.

- Trading via MetaTrader 4, cTrader, and FIX API access.

- Flexible account settings for optimal trading conditions.

- Demo account available.

- Caters to both retail and professional traders.

- Partnership programs for passive income.

Cons

- Does not offer trading in stocks, futures, indices, or options.

- No cent accounts offered.

- Limited payment system options for deposits and withdrawals.

- Lacks a top-tier license.

Scandinavian Capital Markets Customer Reviews

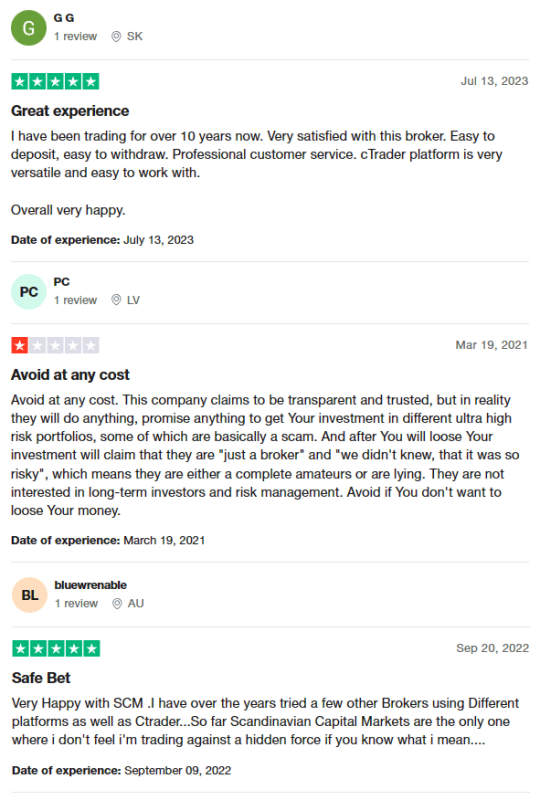

Scandinavian Capital Markets, a Forex broker, currently holds a 4.6-star rating on Trustpilot, reflecting a mixed response from its users. Some long-term traders express satisfaction with the broker, praising its easy deposit and withdrawal process, professional customer service, and the versatility of the cTrader platform. On the other hand, there are strong criticisms about the broker’s transparency and trustworthiness. Concerns are raised about their investment strategies, with some customers suggesting they promote high-risk portfolios that could lead to significant losses. Additionally, certain users have indicated a positive trading experience, feeling less manipulated compared to other brokers. This varied feedback underscores the importance of careful consideration and research when choosing a Forex broker like Scandinavian Capital Markets.

Scandinavian Capital Markets Spreads, Fees, and Commissions

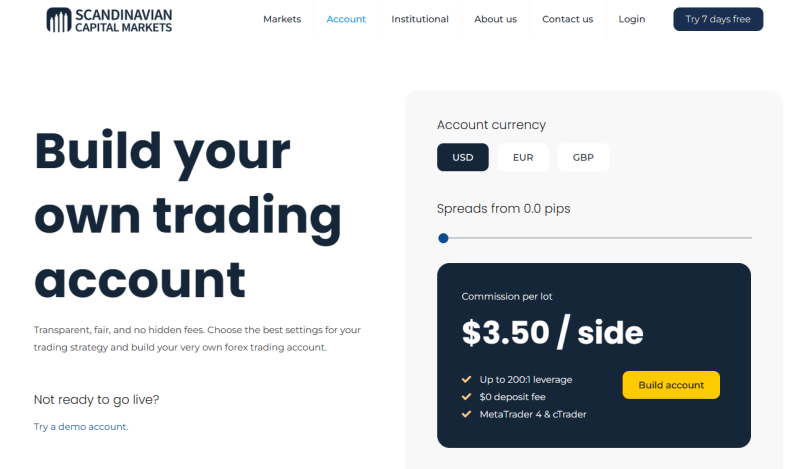

In my experience with Scandinavian Capital Markets, their spreads, fees, and commissions vary based on the account type. For a Standard account, spreads can start as low as 0.0 pips for popular pairs like EUR/USD. The Premium account offers raw interbank spreads, but it includes a commission. Specifically, it’s $10 per lot on the MT4 platform and $100 per million traded on cTrader.

Regarding fees, these depend on the account you choose and can be either based on spreads or commissions. Notably, there are no charges for deposits. However, when withdrawing funds via bank transfer, a discretionary fee of $25 is applied. Additionally, if you don’t use your account for over six months, there’s an inactivity fee, which is around $20, but this can vary depending on the account’s currency. This structure of fees and commissions is an important consideration when choosing an account type with Scandinavian Capital Markets.

Account Types

After conducting thorough research and testing at Dumb Little Man, I’ve identified the following account types at IFX Brokers:

Live Account

- Customizable to fit individual trader needs.

- Basic settings include a leverage of 1:200.

- Offers MT4 and cTrader platforms.

- No deposit fees.

- Allows traders to choose their account currency and spread, which influences the trading fee.

Demo Account

- A risk-free training account with virtual currency.

- Ideal for novice traders to experiment with various trading strategies.

- Set up according to standard principles.

- Conditions and quotes may differ as the primary purpose is for platform testing and applying theoretical knowledge in practice.

These accounts provide a range of options, from customizability in the Live account to the safe, practice environment of the Demo account, catering to different stages of a trader’s journey.

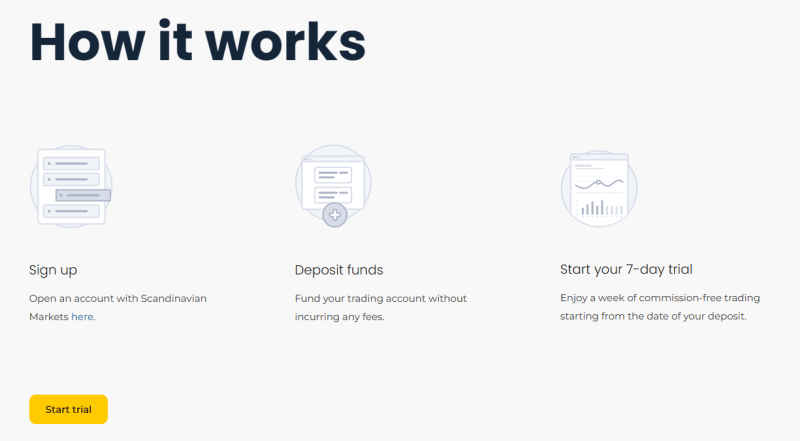

How to Open Your Account

- Visit the official Scandinavian Capital Markets website and find the “Open an account” button.

- Start the registration process for a Scandinavian Capital Markets User Account.

- Fill in your personal details including first and last names, date of birth, phone number, country, and email address.

- Choose between a personal or corporate user account, and select either a trading or managed account type.

- Complete a detailed questionnaire including your address, jurisdiction, identification number, and profession.

- Provide financial information such as your income, select a currency for the account, decide on your deposit amount, preferred leverage, trading volume per trade, and the trading platform.

- Include additional personal details like marital status, and social, legal, and political status.

- Agree to the terms, rules, and privacy policy, and click the “Complete and verify account” button to finalize the process.

Scandinavian Capital Markets Trading Platforms

Scandinavian Capital Markets offers a variety of trading platforms, each catering to different trading needs and styles. One of their primary offerings is MetaTrader 4 (MT4), a popular choice among traders worldwide. MT4 is known for its user-friendly interface, advanced charting tools, and a wide range of technical indicators, making it suitable for both beginners and experienced traders.

Another platform provided by Scandinavian Capital Markets is cTrader, a more recent addition to the trading software landscape. cTrader is recognized for its intuitive design and sophisticated trading capabilities, including detailed charting, one-click trading, and level II pricing. This makes it a great option for traders looking for a more modern trading experience.

What Can You Trade on Scandinavian Capital Markets

Based on my personal experience, Scandinavian Capital Markets offers a diverse range of trading instruments, catering to different preferences and strategies. The platform provides access to over 70 currency pairs, which includes major, minor, and exotic pairs. This extensive selection is ideal for those who focus on Forex trading, offering ample opportunities for both short-term and long-term trading strategies.

In addition to currencies, traders can also engage in trading with metals and cryptocurrencies. Scandinavian Capital Markets lists 4 types of metals, which typically include popular choices like gold and silver. These are often preferred by traders looking for safe-haven assets or diversification options. Furthermore, the platform also offers more than 30 cryptocurrencies, catering to the growing interest in digital currency trading. This selection allows traders to tap into the dynamic and potentially lucrative crypto market.

Scandinavian Capital Markets Customer Support

Scandinavian Capital Markets’ Customer Support stands out for its accessibility and proficiency. The support team is available 24/5, offering assistance through various communication channels like Email, Phone, Live Chat, and WhatsApp. This flexibility ensures that clients can reach out via the most convenient method for their needs, be it a quick chat or a detailed email.

During my interactions with their support team, I found them to be highly skilled in handling a wide range of inquiries. Whether it was technical issues, analysis recommendations, general questions, or operational concerns, the team responded with efficiency and effectiveness. Their ability to adeptly address different types of queries showcases their commitment to providing excellent customer service. This aspect of Scandinavian Capital Markets is particularly reassuring, as it reflects their dedication to supporting and catering to the diverse needs of their clients.

Advantages and Disadvantages of Scandinavian Capital Markets Customer Support

Withdrawal Options and Fees

In my experience with Scandinavian Capital Markets, their withdrawal process is efficient and user-friendly. The broker typically processes withdrawal requests within one day, which is quite prompt compared to many others in the industry. This quick turnaround is beneficial for traders who need timely access to their funds.

Regarding withdrawal methods, you have options like bank cards, bank transfers, and Skrill. It’s great to see a variety of choices, allowing you to select the method that best suits your needs. Interestingly, Scandinavian Capital Markets does not levy any fees for withdrawals made to a bank card or through Skrill. However, for withdrawals via wire transfers, they may impose a discretionary fee of $25. This fee structure is something to consider when planning your withdrawals.

Before withdrawing, you must complete a verification process, ensuring security and compliance with financial regulations. To initiate a withdrawal, simply log into your user account and navigate to the “Withdraw funds” tab. Here, you can easily complete and submit your withdrawal request. The process is straightforward and designed for a hassle-free experience.

Scandinavian Capital Markets Vs Other Brokers

#1. Scandinavian Capital Markets vs AvaTrade

Scandinavian Capital Markets and AvaTrade are both prominent players in the Forex and CFD trading space. While Scandinavian Capital Markets, founded in 2011 and based in Sweden, offers a more focused approach with a variety of currencies, metals, and cryptocurrencies, AvaTrade, established in 2006 and headquartered in Dublin, Ireland, provides a broader range of over 1,250 financial instruments. AvaTrade’s global reach, with over 300,000 registered customers, and heavy regulation across multiple jurisdictions, including Australia and Japan, give it an edge in terms of diversity and regulatory assurance.

Verdict: AvaTrade might be a better choice for traders seeking a wider range of trading instruments and more robust regulatory oversight.

#2. Scandinavian Capital Markets vs RoboForex

Comparing Scandinavian Capital Markets with RoboForex, the latter, established in 2009 and regulated by FSC, offers a vast array of over 12,000 trading options across eight asset classes. RoboForex is known for its cutting-edge technologies and personalized trading terms, catering to various trading styles and volumes. In contrast, Scandinavian Capital Markets, though offering a robust platform, seems more limited in its trading options.

Verdict: RoboForex may be preferable for traders looking for a broader range of trading options and more customized trading conditions.

#3. Scandinavian Capital Markets vs Exness

Exness, a Cyprus broker established in 2008, offers a significant monthly trading volume and a wide range of more than 120 currency pairings, including CFDs for stocks, metals, and cryptocurrencies. Its offering of infinite leverage on small deposits up to $999 and various account types tailored to trader needs makes it a strong competitor. In comparison, Scandinavian Capital Markets provides a reliable, albeit more narrow, range of trading instruments.

Verdict: Exness seems to be the better option for traders seeking high leverage and a wider variety of trading instruments, especially in the realm of currency pairings.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: Scandinavian Capital Markets Review

In conclusion, Scandinavian Capital Markets emerges as a competent Forex broker with certain strengths but also some limitations. The broker offers a range of trading instruments, including a substantial variety of currency pairs, metals, and cryptocurrencies. This diversity caters well to traders with different investment interests, particularly those focusing on Forex and metals trading.

However, it’s important to be aware of some drawbacks. The broker’s limited payment options for deposits and withdrawals, along with the absence of trading in stocks, futures, indices, and options, may restrict traders looking for a more comprehensive trading experience. Additionally, the lack of a top-tier license could be a concern for those prioritizing regulatory oversight.

Scandinavian Capital Markets Review: FAQs

What trading platforms does Scandinavian Capital Markets offer?

Scandinavian Capital Markets provides traders with MetaTrader 4 and cTrader platforms. These platforms are known for their user-friendly interfaces and advanced trading features.

Are there any fees for withdrawals at Scandinavian Capital Markets?

Withdrawals to bank cards and through Skrill are free of charge. However, for wire transfers, the broker may charge a discretionary fee of $25.

What types of trading instruments are available with Scandinavian Capital Markets?

Traders can access a wide range of instruments including over 70 currency pairs, several metals, and a diverse selection of cryptocurrencies.

OPEN AN ACCOUNT NOW WITH SCM AND GET YOUR BONUS