Skimming profits sounds like an illegal scheme. But in Forex trading, it is a legitimate strategy used by traders. You should take into account that some brokers and jurisdictions do not allow scalping. The concept is for investors to earn money from small price movements. The goal is in few minutes to make several small wins, instead of concentrating on bigger profits over many days. Scalping in Forex is a short-term strategy, and it is a useful tactic.

Scalpers purchase and sell a foreign currency pair, and keep the position for few minutes. Investors repeat this process during the day intending to obtain returns, by taking advantage of price fluctuations. The process is repeated several times a day. This way the profits are more frequent. In effect, they profit from the fluctuations in prices.

Contents

- Profits are Made at Days End

- Concentration is an Important Skill

- How Profitable is it?

- Factors to Consider

- How to Scalp Trade in Forex

- Scalping Forex Tools

- Forex scalping strategy

- Types of Forex Scalping Strategies

- Education Leads to Success

- Scalping the EUR/USD

- Conclusion

- FAQ

Profits are Made at Days End

The smallest price movement a currency can make in a Forex market is known as percentage in point or pip for short. Traders use it to calculate profits and losses. Scalpers try from every position they held to scalp 5 to 10 pips. The end of the day is the period when the biggest profits are made.

Scalping is perceived as a safe tactic. Because the positions are held for a short time. Compared to day traders, the risk of losses resulting from strong market moves is smaller.

Concentration is an Important Skill

When using scalping as a strategy, the trader must be fully concentrated, when compared with swing-trading.

Opening and closing dozens maybe hundreds of positions in a trading day, and the room for losses is limited, the scalper must be on the top of his game. Concentration is a quality of a successful Forex scalper. If you plan to be a scalper you need to develop attentiveness and patience.

How Profitable is it?

Forex scalpers profit of up to 20 pips per trade. They use leverage so these trades become valuable. If you hold a $10,000 position and see a ten-pip profit, you earn $10. If you leverage that position to control $100,000, you will make $100.

There are Forex strategies that don’t need a large number of pips. If your target is 50 pips per day it’s a simple strategy.

Forex needs liquid assets that you can trade quickly. It requires a decisive attitude, which is not a strong characteristic for everyone. When you are adept at Forex scalping, you can apply it to becoming a day trader.

Many brokers don’t allow scalping. They can block your funds if they spot that you are closing trades fast.

Factors to Consider

It’s important to learn currency liquidity and volatility, before forming a Forex scalping strategy.

Forex scalpers need a trading account with low commissions and small spreads. These features are offered in ECN Forex accounts. These accounts enable the trader to function as a market maker. He can buy at the bid price and sell at the offer price.

If the spread is high, or the price is restricted. The potential for success is limited.

Liquidity in Forex Scalping

Daily there are trillions of dollars in Forex transactions. This makes it globally the most liquid market. The opportunity to buy and sell without influencing the price in the market is liquidity. For scalpers high liquidity is desirable. They enter and exit positions fast.

But the liquidity of a currency is not stable, it is influenced by many factors. The time of day, and quantity traders that are active in the market. But also, inflation rates. The EUR/USD, USD/JPY, and GBP/USD are liquid Forex pairs that are frequently traded.

In Forex markets, the bid-offer spread tightens, this makes the cost of transaction affordable. Liquidity can be understanding as stability. But Forex is also volatile. Short-term price movements can accrue at any moment. This increases the value of currencies in both directions in a matter of seconds. Scalper prefers Forex because volatility opens the potential for profits.

Volatility in Forex Scalping

When trading derivatives, volatility is welcomed. The rising and falling prices enable traders to profit. This is not guaranteed. You must have a strategy to minimize losses. This is important when you use leverage to open a position. The best moment to open a position is when a session’s opens and closes.

Forex pairs like AUD/JPY, USD/MXN, and GBP/EUR have decreased liquidity and are more volatile.

Risk Management

Traders should use larger leverage because the small profits are gained from scalping Forex. This can increase profits, but it can bring a high risk of losing. Traders can lose money rapidly due to market fluctuations. If you are going to implement a higher leverage ratio, you need to manage potential losses. Never risk what you cannot afford to lose.

Traders should use the 1% rule. The concept is to on any trade they should not risk more than 1% of their account balance. If you are trading a $20,000 account, $100 is the maximum for any one position. With the 1:2 risk-reward ratio. When you risk 1% the trader is looking to close out for a 2% profit. This is would mean $400 profit on a $20,000 account balance.

Best Scalping System

It is recommended that you work within one or five minutes. That’s a good time frame to take advantage of price movement. Your trading style will define the analysis technique you use.

How to Scalp Trade in Forex

Trading on the Forex market, means you have to follow trends. You need to know if it is expected for the dollar to decline. How global events will shape the currency market.

In a day there is fluctuation in the value of a currency. These will happen during a certain period. When you look at a stock market chart, you can find the fluctuation just by connecting a line between where the highest and lowest pair will go.

A reluctance level is the largest value a pair is reached in a certain time frame. This is the upper limit, of the fluctuations. An external event usually brings a pair higher and is caused by a policy that is aimed to strengthen a currency.

Traders need to monitor the trendlines because a pair can be trending upward or downward.

The best option is to buy an upward-trending pair. If a pair is trending downward, then when your pair finds the resistance level, you should sell.

Scalping Forex Tools

Before you learn how to do scalping strategies in Forex, some useful features can be hugely advantageous if implemented properly. Your scalping Forex trading system based on few minutes will not produce results without the help of indicators, charting features, and, automated tools.

Charting Indicators are a Guide

Forex scalping is dependent on daily chart patterns. They serve as indicators to guide the investor. This is necessary because traders need to act in small time frames and take advantage of intricate price moves. Typically, 1-minute (M1) to 15-minute (M15) charts are used.

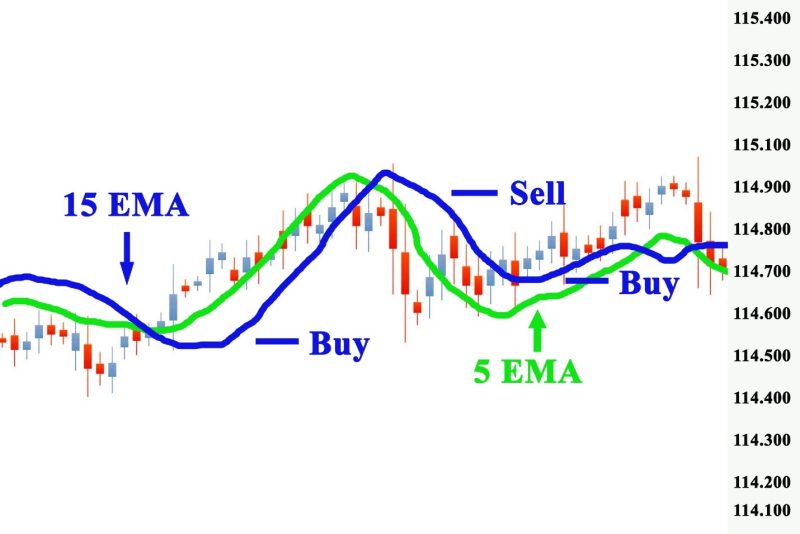

Scalping strategies involve moving averages. Other Forex indicators are envelopes, MACD, Fibonacci retracements, and Bollinger Bands.

Traders can recognize bullish and bearish zones. Research the strategies that suit your style. Learn the basics, how to read charts.

Some Forex traders prefer to perform scalping with price action analysis, which is a strategy involving no indicators. Scalpers focus only on price, using candlestick charts, support and resistance, and trendlines to identify trend continuations.

Automated Trades

Some traders benefit from scalping robots. It sounds futuristic, but Forex robots are algorithms that scan the markets. They produce buy or sell signals.

The bot is programmed to look for certain indicators in the market. Things like moving averages and Relative Strength Index (RSI). There are free versions. If you are serious about Forex trading then paid platforms offer more reliable information that will help you shape a trading strategy.

Focus on Live Charts

Forex scalpers trade quickly. That’s why updates are need and live charts provide the information. This will enable you to identify fluctuations in price and in that way you can profit.

When you need to identify buy and sell points use a one-minute chart. And a ten-minute chart can show you the market trend.

Market Timing

You need to be trading at the best times of the day. The main trading sessions are London, North-American and Asia-Pacific.

The most overlaps happen with London/New York and London/Asian sessions. They present many trading activities. If you are looking for market volatility, trade at the same times as banks and funds.

Forex scalping strategy

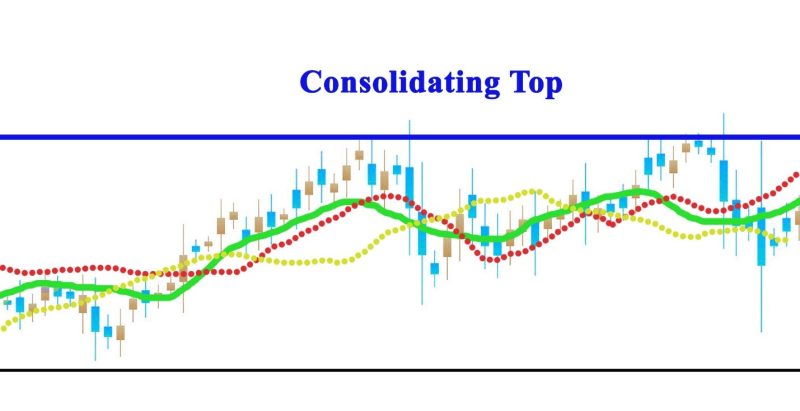

A profitable scalping strategy will be based on small gains. Trading in different periods of the day. Before opening a position, it is important to analyze the market where you plan to implement the strategy. Timeframe analyses are used to get a perspective of the price action.

The next step will depend on if the market is trending, or is going to break out.

When a market moves in a certain direction, a trend can be located. A downtrend will have several lows and lower highs, while an uptrend will see the opposite. The larger trend can be an indicator of price action on a shorter scalping timeframe.

There are plenty of Forex scalping methods. The most common time intervals used: 1-minute (M1) and 5-minutes (M5).

These strategies are characterized by contrasting levels of sustainable profit or loss. But also, on how many pips you can gain for each scalping trade.

For beginners, the 1-minute strategy works great because it’s easy to use. It will require a level of concentration. You will be aiming for 5 pips per trade. Quantity is key, you may find yourself making over 100 trades per day.

Types of Forex Scalping Strategies

There are numerous trading strategies, but we can select a few.

- For scalpers Countertrend trading is problematic because it means taking a position in the opposite direction. These trades are done when the trader thinks that there will be a pullback or reversal in the trend.

- Trend trading strategies is following the direction of the trend with the intent to profit if the trend continues on its course.

- Range strategies locate support and resistance areas. The trader tries to buy near support and sell at resistance. The oscillating price action is what helps the trader to profit.

- Statistical traders look for patterns in specific conditions. This includes buying or selling. Keeping a position for five minutes if a certain chart pattern. Statistical Forex scalping strategies are based on price, time, and day of the week.

Education Leads to Success

Scalping Forex strategy is something you can learn. Training resources are available online, but you can also consult your broker, who has access to educational material, he can share with you. Forex academy is the best approach for a comprehensive understanding of the topic.

You can use webinars and blogs where articles offer a wealth of knowledge. Forums are a good option for the exchange of experiences and advice. They are updated frequently with analysis from professional traders. You can borrow ideas from other successful Forex scalping strategies.

Starting with a demo account will give you the practical training you need. You can test your strategy with technical analysis.

Scalping the EUR/USD

There are several major currency pairs that are traded. A Forex scalper identifies a new trend and decides to trade the EUR/USD. The strategy is to wait for a pullback. When the price starts going back in the trending direction, he buys it.

The trader will risk four pips and make a profit at eight pips. In this case the reward is double what the risk is. But if volatility is higher, the investor will risk more pips. This way he will attempt to increase his profit. But the position size will be smaller, than with the four pip stop loss.

Let’s take a trader who has a $20,000 account and is prepared to risk 0.4% per trade. He can lose $80 per trade. If he traders six pips on standard lots ($100.000), he will lose $60. But the profit is double. He can make $120 if he trades 12 pips.

Conclusion

If you are going to start scalping Forex you should be aware of the potential risks of losing money. It's never a good sign when investors' accounts lose money. If you want to scalp Forex you need the discipline that is necessary to have success.

Otherwise, you face the risk of losing money. Beginners may have a difficult to initially getting oriented with the fast pace of trades.

Trading Forex means looking for technical indicators throughout the day. Currency trading is a buy or sell strategy that has several trading systems. But when they master the 1-minute or 5-minute Forex charts, all the other pieces will come together.

The opportunity for profit doesn’t mean that you will automatically have gains. You need to implement a risk management strategy to be safe.

FAQ

Is scalping Forex profitable?

There is potential for profit with Forex scalping. Scalpers usually aim to make five to ten pips per trade. Investors must be aware that some of the trades will be lost. The balance between the wins a trader makes and the losses will define the profit. Not every trade will be profitable, traders must factor in losses. There will be several bad trades and scalpers need to be concentrated to avowed losses.

What is scalping in the Forex?

Scalping is the buying or selling of currency pairs, that are kept for a short time. The idea is to make profits from the fluctuations in the market. The Forex scalper will make a lot of trades, benefiting from the small price movements, that happen every day. Scalping is a tactic that brings in small profits. But this can be multiplied by increasing the position size.

Why scalping is not allowed in Forex?

Some brokers do not allow scalping. Forex accounts are discouraging as a trading practice.

Is scalping good for beginners?

It's widely regarded by professional traders as one of the best trading strategies. And a great strategy for beginners. They can master it with ease. The process of starting a position, gaining pips, and quickly closing the position.