Position in Rating | Overall Rating | Trading Terminals |

199th  | 2.7 Overall Rating |

Saracen Markets Review

Choosing the right Forex broker is crucial for any trader. Forex brokers are intermediaries that facilitate the buying and selling of currencies in the foreign exchange market. The right broker can provide you with the necessary tools, competitive spreads, and robust trading platforms to help you succeed in the volatile Forex market.

Ultima Markets distinguishes itself with a range of features designed to enhance the trading experience. Known for its advanced trading platforms and competitive spreads, Ultima Markets offers traders the tools they need to succeed in the Forex market. Additionally, their commitment to customer support and education ensures that both novice and experienced traders can trade with confidence.

In this detailed review, I aim to provide a comprehensive evaluation of Saracen Markets, highlighting its unique selling points and potential drawbacks. My goal is to give you essential insights about the broker, including the various account options available, deposit and withdrawal processes, commission structures, and other critical details. My balanced perspective combines expert analysis and actual trader experiences to equip you with the necessary information to make an informed decision about considering Saracen Markets as your preferred brokerage service provider.

What is Saracen Markets?

Saracen Markets is a Forex broker offering a variety of trading options and investment opportunities. With its MetaTrader 4 (MT4) platform available in both web and mobile versions, traders can access the financial markets anytime and anywhere. Established in 2018, Saracen Markets is based in Saint Vincent and the Grenadines, providing services to a global clientele.

One of the standout features of Saracen Markets is its high leverage, offering up to 2000:1. This allows traders to maximize their positions and potential profits, although it also increases the risk. The broker provides a wide range of trading instruments, including currencies, indices, shares, cryptocurrencies, CFDs, and commodities, catering to various trading strategies and preferences.

Benefits of Trading with Saracen Markets

Trading with Saracen Markets offers several benefits that enhance the overall trading experience. One of the primary advantages is the availability of high leverage up to 2000:1, which allows traders to control larger positions with a relatively small amount of capital. This can significantly amplify potential profits, especially for experienced traders who know how to manage leverage effectively.

Another notable benefit is the use of the MetaTrader 4 (MT4) platform, which is well-regarded for its robust features and user-friendly interface. MT4 supports advanced charting tools, technical analysis, and automated trading through Expert Advisors (EAs), making it easier for me to implement and manage my trading strategies efficiently. The platform’s availability in web, desktop, and mobile versions ensures that I can trade seamlessly across different devices.

Saracen Markets Regulation and Safety

When trading with Saracen Markets, it’s essential to be aware of its regulation and safety measures. Saracen Markets is regulated by the Financial Services Authority (FSA) of Saint Vincent and the Grenadines, which is known for having less stringent regulatory requirements compared to major financial hubs. This means traders should exercise additional caution and conduct thorough research before committing their funds.

From my trading experience with Saracen Markets, I found the platform to be user-friendly and the trading conditions favorable. However, the lack of clear regulatory oversight and detailed information on their safety protocols can be concerning for those who prioritize security in their trading activities. Traders should be particularly diligent in verifying the legitimacy and safety measures of the broker to protect their investments.

Saracen Markets Pros and Cons

Pros

- High leverage up to 2000:1

- Low minimum deposit of $2

- MetaTrader 4 platform available

- Multiple deposit and withdrawal methods

- Fast processing times

Cons

- Limited trading instruments

- Unclear regulatory oversight

- Limited customer support details

- Not available in some major countries

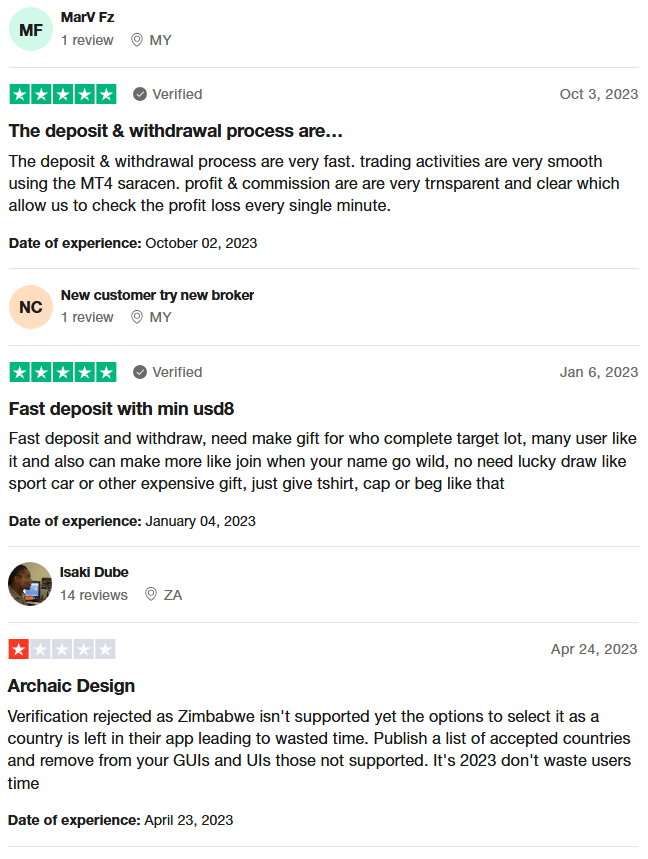

Saracen Markets Customer Reviews

Saracen Markets receives mixed customer reviews. Users appreciate the fast deposit and withdrawal processes and find the trading activities on the MT4 platform smooth and transparent, allowing them to monitor profits and commissions clearly. Some users suggest introducing rewards for achieving target lots, which could enhance user engagement without needing expensive gifts. However, there are complaints about the verification process, particularly from users in unsupported countries like Zimbabwe. Customers recommend publishing a list of accepted countries and updating the app to prevent wasted time, emphasizing the need for better user interface management.

Saracen Markets Spreads, Fees, and Commissions

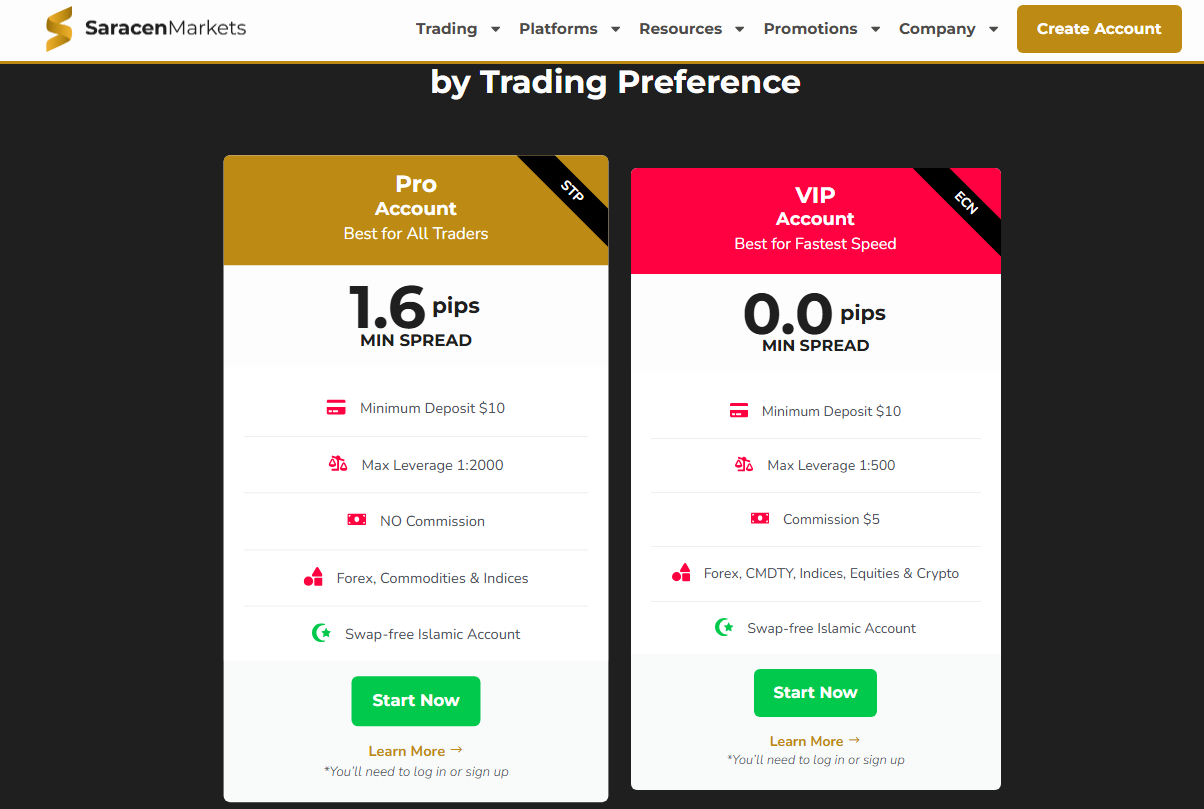

Trading with Saracen Markets offers a competitive fee structure that can appeal to various types of traders. The spreads start as low as 1.6 pips on the Pro Account, which is quite reasonable compared to many other brokers. This allows for cost-effective trading, particularly for those who engage in frequent trading activities.

For those looking for tighter spreads, the VIP Account offers spreads starting from 0.0 pips. This account type is designed for high-volume traders and carries a commission of $5 per lot. Although the commission may add to the cost, the lower spreads can offset this, making it an attractive option for more experienced traders.

Saracen Markets does not charge any additional fees for deposits or withdrawals, which is a significant advantage. The absence of fees on transactions means that traders can deposit and withdraw funds without worrying about extra costs, ensuring that more of their money remains in their trading account. Fast processing times for these transactions further enhance the trading experience, making it efficient to manage funds.

Account Types

Saracen Markets offers a variety of account types tailored to meet the needs of different traders. Here is an overview of the available account types:

Pro Account

- Minimum Deposit: $10

- Spreads: From 1.6 pips

- Leverage: Up to 1:2000

- Commission: None

- Trading Instruments: Forex, Commodities, Indices

- Execution Type: Market Execution

- Minimum Order Volume: 0.01

- Stop Out Level: 20%

VIP Account

- Minimum Deposit: $50

- Spreads: From 0.0 pips

- Leverage: Up to 1:500

- Commission: $5 per lot

- Trading Instruments: Forex, Commodities, Indices, Equities, Cryptocurrencies

- Execution Type: Market Execution

- Minimum Order Volume: 0.01

- Stop Out Level: 30%

Islamic Account

- Swap-Free: Yes

- Available for Pro and VIP Accounts

- Follows Islamic principles with no swaps or interest on overnight positions

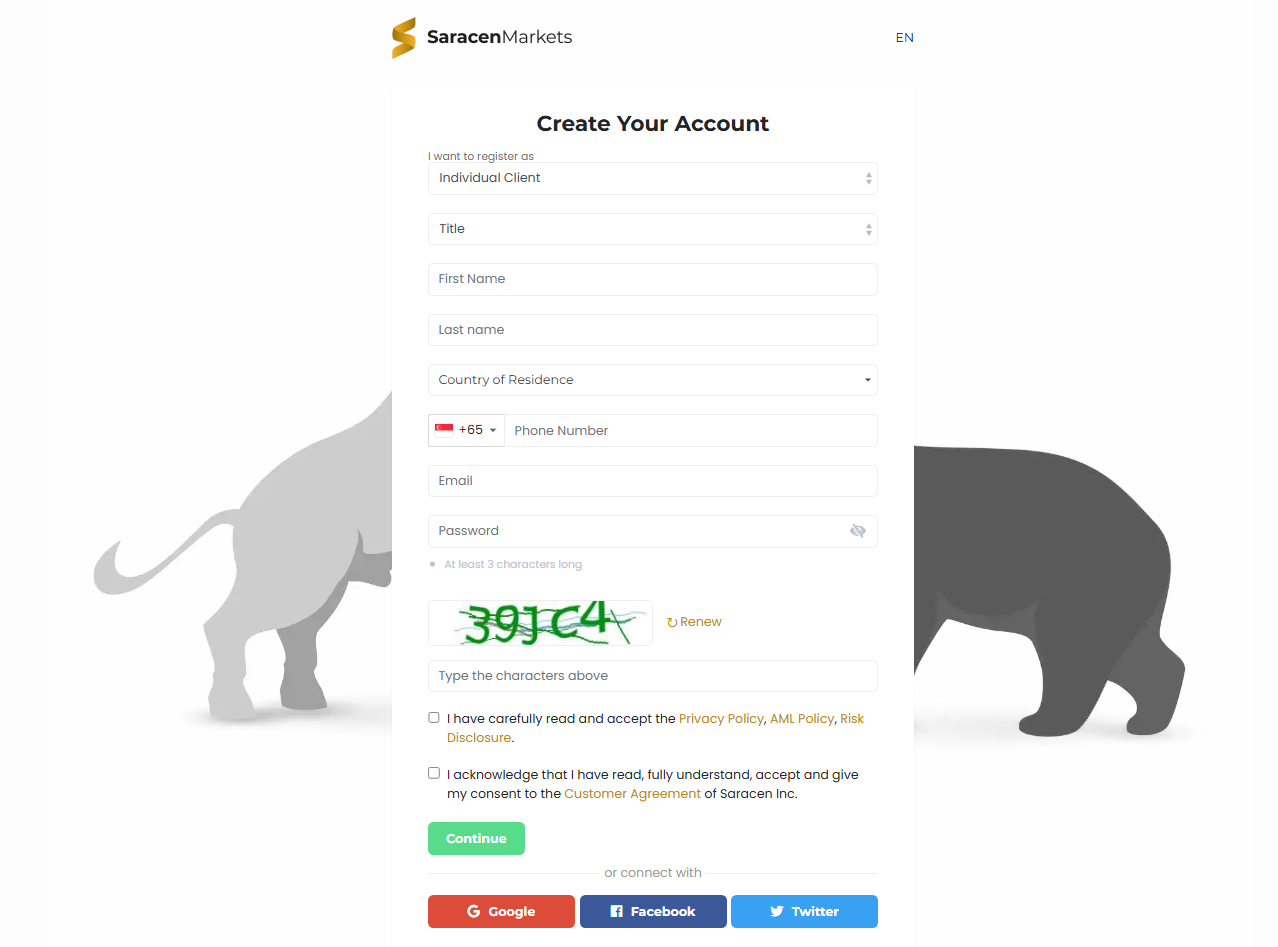

How to Open Your Account

- Visit the Saracen Markets website and click on the “Create Account” button located at the top right corner of the homepage.

- Fill in your personal details, including your name, country, phone number, email, and set a secure password.

- Enter the confirmation PIN sent to your email and phone number to verify your contact details.

- Verify your profile by uploading the necessary documents for KYC (Know Your Customer) compliance, such as a government-issued ID and proof of address.

- Choose the type of account you wish to open, whether it’s an individual or corporate account, and select the appropriate trading account type (Pro, VIP).

- Agree to the Privacy Policy, AML Policy, Risk Disclosures, and the Customer Agreement.

- Complete the account creation by confirming your details and finalizing the setup.

- Make your first deposit to start trading; various funding methods are available, including bank transfers, e-wallets, and cryptocurrency options.

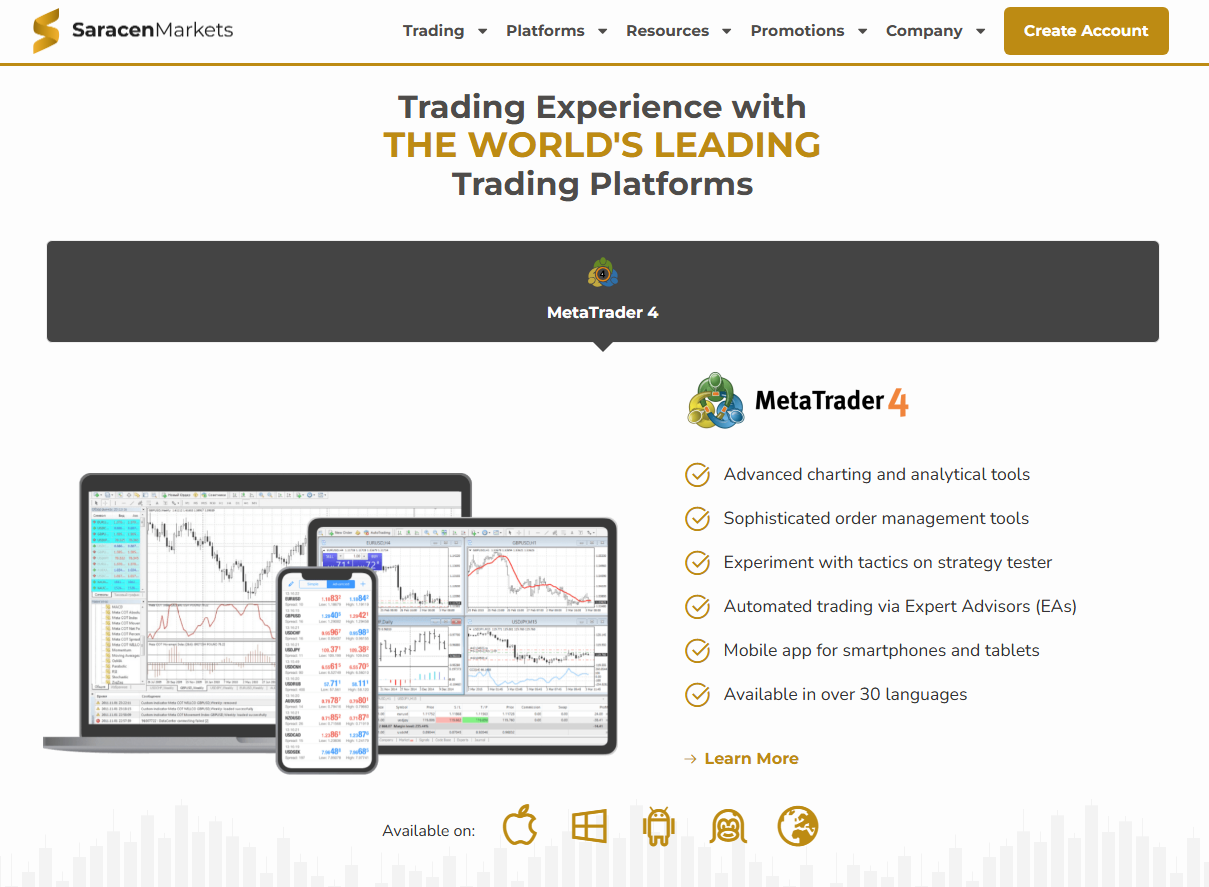

Saracen Markets Trading Platforms

Trading with Saracen Markets, I found their platform options to be quite efficient and user-friendly. The primary trading platform offered is MetaTrader 4 (MT4), which is available in web, desktop, and mobile versions. This flexibility allows traders to access the market from anywhere and on any device, providing a seamless trading experience.

The MT4 platform is known for its advanced charting tools and automated trading capabilities. I particularly appreciated the ability to use Expert Advisors (EAs) to automate trading strategies, which helps in managing trades even when I am not actively monitoring the market. The comprehensive suite of technical analysis tools provided by MT4 enhances my ability to make informed trading decisions.

What Can You Trade on Saracen Markets

Trading on Saracen Markets provides access to a diverse range of instruments, catering to various trading preferences and strategies. Forex trading is a significant part of the offerings, with over 35 currency pairs available, including major, minor, and exotic pairs. This variety allows for extensive opportunities in the foreign exchange market, enabling traders to diversify their portfolios and capitalize on different market conditions.

In addition to forex, Saracen Markets offers trading in commodities such as gold, silver, and oil. These commodities provide a hedge against inflation and market volatility, making them attractive options for both new and experienced traders. The ability to trade these assets alongside currencies enhances the flexibility and depth of my trading strategy.

Saracen Markets also includes indices and equities in their trading instruments. Indices like the S&P 500 and FTSE 100 allow traders to speculate on the performance of entire market segments, rather than individual stocks. This can be particularly beneficial during times of economic uncertainty, offering a broader view of market trends and reducing the risk associated with single-stock investments.

Cryptocurrencies are another key component of the trading options at Saracen Markets. Popular digital currencies such as Bitcoin and Ethereum are available for trading, providing exposure to the rapidly growing and volatile crypto market. Trading cryptocurrencies can be highly lucrative due to their price movements, adding another dimension to my trading activities.

Saracen Markets Customer Support

From my experience trading with Saracen Markets, their customer support is both responsive and efficient. Their support team is available 24/7, which is crucial for handling any issues that might arise at any time. This around-the-clock availability ensures that I can get assistance whenever I need it, making my trading experience smoother and more reliable.

I found multiple ways to contact their customer support, including live chat, email, and phone support. The live chat feature is particularly useful for quick resolutions, as it connects me directly with a support agent in real-time. Email support is also prompt, with responses typically received within a few hours, which is great for less urgent inquiries or more detailed questions.

The Saracen Markets website also offers a comprehensive FAQ section. This resource is very helpful for finding answers to common questions, without needing to contact support directly. The FAQ covers a wide range of topics, from account setup and verification to trading platforms and instruments, providing detailed information that enhances the overall user experience.

Advantages and Disadvantages of Saracen Markets Customer Support

Withdrawal Options and Fees

Saracen Markets offers a variety of withdrawal options to cater to traders from different regions. The available methods include B2BinPay, local bank deposits, Neteller, Payment Asia, PayTrust88, SurePay, and WalaoPay. These multiple options ensure that I can choose the most convenient and cost-effective method for my needs. Having various withdrawal methods available is crucial for flexibility and ease of access to my funds.

One of the key advantages of Saracen Markets is the absence of withdrawal fees for most methods. Most withdrawal methods do not incur any fees, which is a significant benefit for maintaining profitability. This fee-free structure applies to options like local bank deposits and e-wallets, making it economical to transfer funds out of the trading account.

The processing time for withdrawals is generally efficient, with most methods offering a processing time of up to 24 hours. Quick processing times mean that I can access my funds promptly when needed. This efficiency in processing ensures that my trading activities are not hindered by delays in fund availability.

Saracen Markets Vs Other Brokers

#1. Saracen Markets vs AvaTrade

Saracen Markets and AvaTrade differ significantly in their offerings and regulatory status. Saracen Markets offers high leverage up to 2000:1, appealing to aggressive traders, and provides a variety of trading instruments including forex, commodities, indices, and cryptocurrencies. However, it lacks comprehensive regulatory oversight, being only registered in Saint Vincent and the Grenadines. On the other hand, AvaTrade is a well-established broker regulated in multiple jurisdictions, including Europe, Australia, and Japan, providing a more secure trading environment. AvaTrade also offers a wide range of trading platforms, including MetaTrader 4 and 5, and its proprietary platform AvaTradeGO.

Verdict: AvaTrade is a better option due to its extensive regulatory oversight and diverse platform offerings, providing a safer and more versatile trading environment compared to Saracen Markets.

#2. Saracen Markets vs RoboForex

When comparing Saracen Markets with RoboForex, several differences stand out. Saracen Markets is known for its high leverage and straightforward account types, catering to traders who need significant margin flexibility. In contrast, RoboForex offers a broader range of account types, including Cent accounts for beginners and ECN accounts for professionals, with leverage up to 2000:1 as well. RoboForex is regulated by the IFSC in Belize, providing a degree of oversight that Saracen Markets lacks. Additionally, RoboForex offers more advanced trading tools, including the R Trader platform and various bonuses and promotions.

Verdict: RoboForex emerges as the better choice due to its regulatory framework, diverse account options, and advanced trading tools, offering a more robust trading environment than Saracen Markets.

#3. Saracen Markets vs Exness

Saracen Markets and Exness offer different benefits to traders. Saracen Markets excels with its high leverage and user-friendly MT4 platform, making it attractive for those looking for simple, high-risk trading options. Exness, however, is a highly reputable broker with robust regulatory oversight from multiple authorities, including the FCA and CySEC. Exness provides unlimited leverage for smaller accounts and offers a variety of platforms, including MT4, MT5, and their proprietary platform. Exness also supports numerous deposit and withdrawal options with no fees and near-instant processing times.

Verdict: Exness is superior due to its strong regulatory compliance, diverse platform options, and better financial transaction conditions, making it a safer and more flexible broker compared to Saracen Markets.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH SARACEN MARKETS

Conclusion: Saracen Markets Review

In conclusion, Saracen Markets offers a broad range of trading instruments, including forex, commodities, indices, and cryptocurrencies, which provide traders with diverse opportunities. The high leverage up to 2000:1 and user-friendly MetaTrader 4 platform are standout features that appeal to both novice and experienced traders looking for flexible and accessible trading options. The absence of withdrawal fees and the variety of deposit and withdrawal methods add to the convenience of trading with Saracen Markets.

However, it is important to be cautious about the lack of comprehensive regulatory oversight, as Saracen Markets is only registered in Saint Vincent and the Grenadines. This lack of strong regulation could pose risks, especially for traders who prioritize security and transparency. Additionally, while the customer support is available 24/7 and offers multiple contact methods, some users have reported inconsistent service quality during peak times.

Also Read: Ultima Markets Review 2024 – Expert Trader Insights

Saracen Markets Review: FAQs

Is Saracen Markets regulated?

Saracen Markets is registered in Saint Vincent and the Grenadines, but it lacks comprehensive regulatory oversight from major financial authorities. This means traders should exercise caution and conduct thorough research before investing.

What trading platforms does Saracen Markets offer?

Saracen Markets provides the MetaTrader 4 (MT4) platform, which is available in web, desktop, and mobile versions. This platform is known for its advanced charting tools and automated trading capabilities, making it a popular choice among traders.

Are there any fees for withdrawals at Saracen Markets?

Most withdrawal methods at Saracen Markets do not incur any fees. This includes options like local bank deposits and e-wallets, ensuring that traders can access their funds without additional costs.

OPEN AN ACCOUNT NOW WITH SARACEN MARKETS AND GET YOUR BONUS