Position in Rating Overall Rating Trading Terminals 109th 3.3 Overall Rating

Sage FX Review

Choosing the right Forex broker is a critical decision for any trader. A Forex broker acts as your intermediary to the market, providing the platform, tools, and support needed to trade currencies effectively. The broker you choose can significantly impact your Forex trading experience, affecting everything from the costs of your trades to the security of your funds. Thus, it’s essential to choose a reliable and reputable broker to ensure a secure and efficient trading environment.

Sage FX stands out in the crowded field of Forex brokers for its commitment to providing a robust and user-friendly trading experience. With a variety of account options, competitive commission structures, and seamless deposit and withdrawal processes, Sage FX aims to cater to traders of all levels. This detailed review will explore Sage FX’s unique features, helping you determine if it is the right broker for your trading needs.

In this detailed review, I aim to provide a comprehensive evaluation of Sage FX, highlighting its unique selling points and potential drawbacks. My goal is to offer you essential insights into the broker, including the various account options, deposit and withdrawal processes, commission structures, and other crucial details. By combining expert analysis with actual trader experiences, I hope to equip you with the necessary information to make an informed decision about choosing Sage FX as your preferred brokerage service provider.

What is Sage FX?

Sage FX is an offshore Forex broker that has gained attention for its competitive trading environment and diverse offerings. Operating from Saint Vincent and the Grenadines, Sage FX provides access to a variety of financial instruments, including Forex, cryptocurrencies, indices, commodities, and metals. This broker uses the STP execution model, which provides traders with direct access to the interbank market, aiming for transparent and fair trading conditions.

Sage FX supports the popular MetaTrader 4 (MT4) platform, known for its advanced charting tools and technical analysis features. MT4 is available as a desktop application, web trader, and mobile app, making it convenient for traders to monitor and manage their trades from anywhere. Additionally, Sage FX is working on integrating MetaTrader 5 (MT5), which offers enhanced algorithmic trading capabilities and additional timeframes and indicators.

Benefits of Trading with Sage FX

Trading with Sage FX has several benefits that I’ve experienced firsthand. One of the standout features is the high leverage options available, going up to 1:500. This allows traders to amplify their positions significantly, which can lead to higher potential returns, although it’s crucial to manage the associated risks properly.

Another major benefit is the support for cryptocurrency transactions. Sage FX allows deposits and withdrawals using popular cryptocurrencies like Bitcoin and Ethereum. This flexibility in funding options is especially useful for those who prefer digital currencies over traditional banking methods, providing a seamless and quick transaction process.

I also found their 24/7 customer support to be highly responsive and helpful. Whenever I encountered issues or had questions, the support team was readily available through live chat, providing immediate assistance. This level of support is crucial for maintaining confidence in the platform, particularly during critical trading times.

The range of account types offered by Sage FX is another benefit worth noting. Whether you’re a beginner or an experienced trader, there are account options that cater to different levels of trading experience and financial capabilities. This variety ensures that you can find an account type that fits your specific trading needs.

Sage FX Regulation and Safety

When trading with Sage FX, it’s crucial to understand the broker’s regulatory status and safety measures. Sage FX is currently not regulated by any major financial authority, which means there is no regulatory body overseeing its operations. This can be a significant point of concern for traders, as regulated brokers typically offer more protection and transparency.

The lack of regulation allows Sage FX to offer certain features, such as high leverage up to 1:500, which might not be possible under stricter regulatory conditions. However, this high leverage can increase both potential profits and risks, making it essential to use effective risk management strategies.

Despite being unregulated, Sage FX employs several security measures to protect its clients. The broker uses segregated funds, ensuring that client money is kept separate from the company’s operating funds. Additionally, Sage FX implements two-factor authentication to add an extra layer of security to trading accounts, helping prevent unauthorized access.

Sage FX Pros and Cons

Pros

- High leverage options

- No deposit or withdrawal fees

- Accepts cryptocurrency payments

- 24/7 customer support

- Offers demo accounts

Cons

- Not regulated

- No phone support

- No MetaTrader 5 platform

- Limited educational resources

Sage FX Customer Reviews

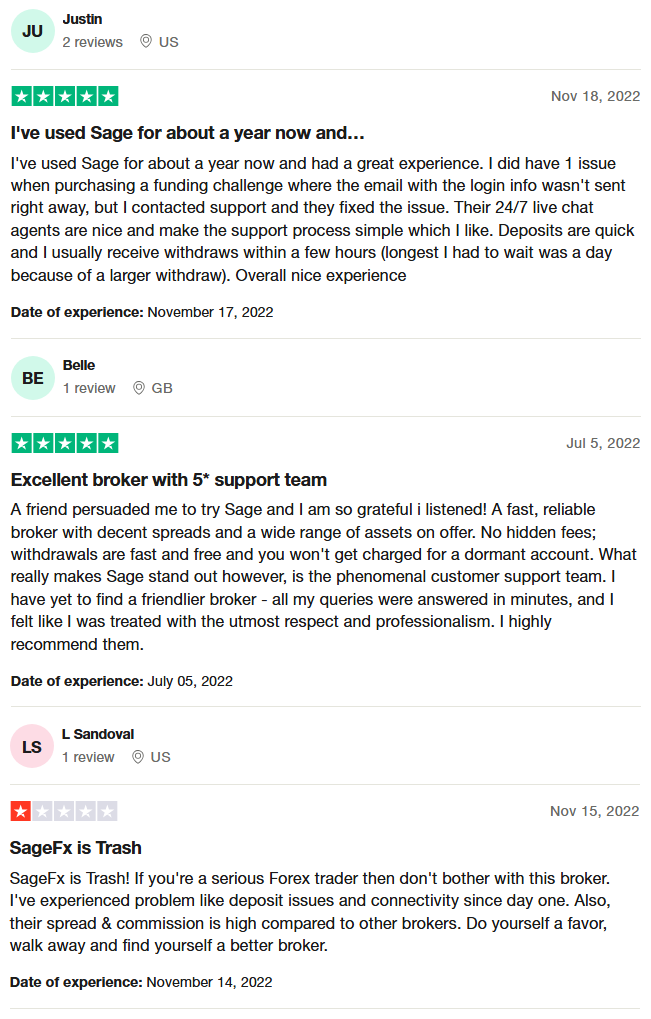

Customer reviews of Sage FX reveal a mixed bag of experiences. Many traders appreciate the broker’s fast and reliable services, highlighting quick deposits and withdrawals, and commend the 24/7 customer support for its responsiveness and professionalism. Users have noted that the support team is friendly and efficient, often resolving issues promptly.

However, some traders have reported issues with deposit processes and connectivity, and complaints about high spreads and commissions compared to other brokers. While some users highly recommend Sage FX for its reliable services and excellent customer support, others advise caution due to their negative experiences with certain aspects of the broker’s operations.

Sage FX Spreads, Fees, and Commissions

Trading with Sage FX, I’ve found that their spreads are generally competitive, starting as low as 0.8 pips for major currency pairs like EUR/USD. However, compared to some other brokers, these spreads are not the lowest, which can impact overall trading costs. For example, brokers like Tickmill offer spreads starting at 0.0 pips, but they charge commissions per lot traded.

Speaking of commissions, Sage FX keeps it simple. They offer commission-free trading on their standard accounts, which can be beneficial for those who prefer to avoid additional costs per trade. For their PRO accounts, they charge a small commission, which is typical in the industry to provide tighter spreads. This setup can appeal to both beginners and more experienced traders looking for flexibility.

One of the standout features for me has been their zero deposit and withdrawal fees. This is a significant advantage, as many brokers charge fees for these transactions, which can add up over time. Sage FX supports various payment methods, including cryptocurrencies and e-wallets, ensuring quick and cost-free transfers, which is a big plus for active traders.

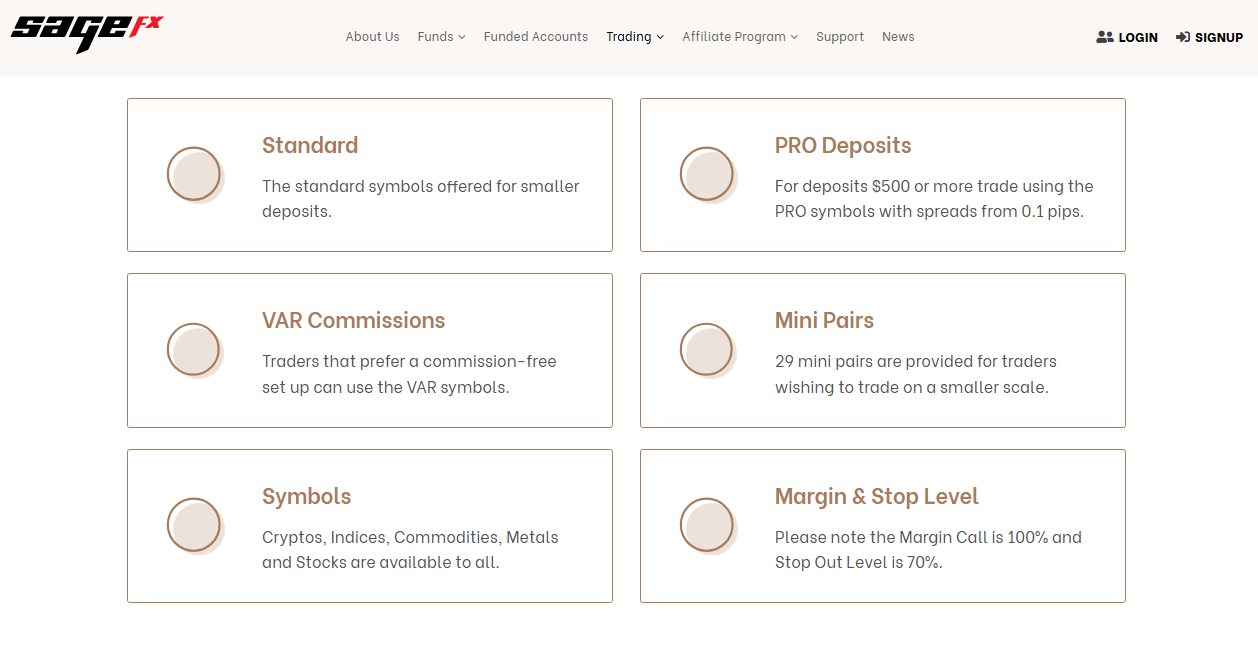

Account Types

When trading with Sage FX, you’ll find several trading account types tailored to different trading needs. Here’s a breakdown of what they offer:

Standard Account

The Standard Account is ideal for those starting with smaller deposits.

- Minimum deposit of just $10.

- Competitive spreads starting from 1.2 pips.

- Suitable for beginners looking to get a feel for trading without a significant upfront investment.

PRO Account

The PRO Account is designed for traders looking to deposit more substantial amounts.

- Minimum deposit of $500.

- Tighter spreads starting from 0.1 pips.

- This account involves a commission per trade, appealing to experienced traders seeking better pricing.

VAR Account

The VAR Account is suitable for those who prefer a commission-free environment.

- Competitive spreads similar to the Standard Account.

- Offers flexibility without additional costs.

- Good for traders who want more options without paying commissions.

Islamic Account

The Islamic Account is tailored for traders who follow Sharia law.

- Does not charge swap fees, ensuring compliance with Islamic finance principles.

- Provides interest-free trading conditions.

- Great option for traders looking for ethical trading solutions.

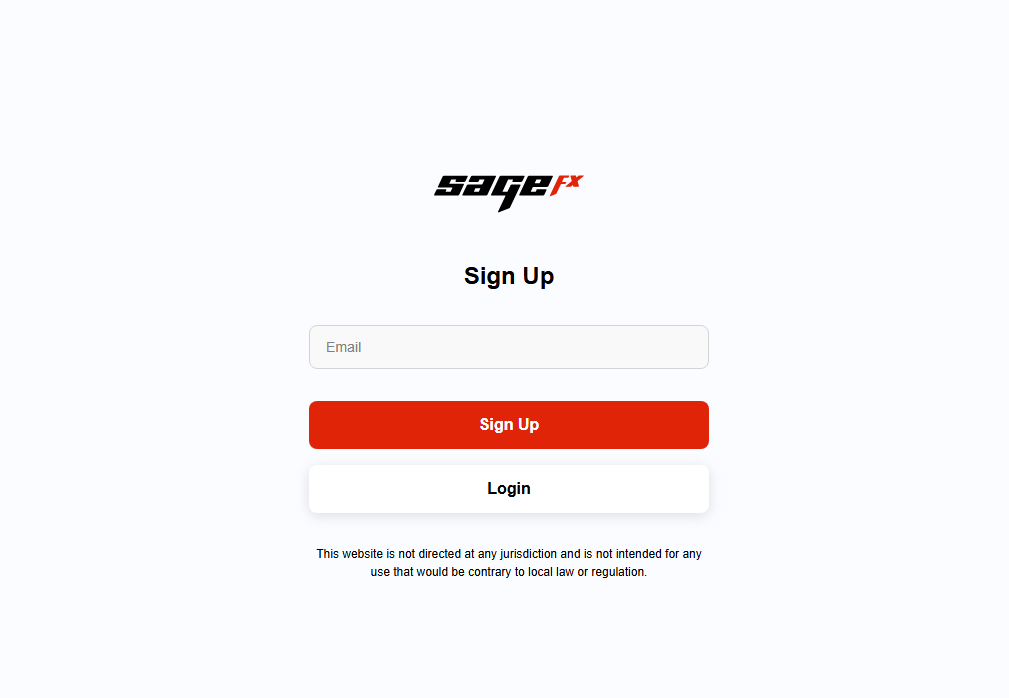

How to Open Your Account

- Visit the official Sage FX website and locate the registration form.

- Enter your basic contact details such as name, email, and phone number.

- Click the “Sign Up” button to proceed with the registration process.

- The system will prompt you to fill out a more detailed form with additional information like your address and postal code.

- Create a secure password for your account to ensure your information is protected.

- Verify your email address by clicking on the confirmation link sent to your inbox.

- Provide any necessary identification documents to complete the KYC (Know Your Customer) process.

- Once your documents are verified, log in to your new account and start trading with Sage FX.

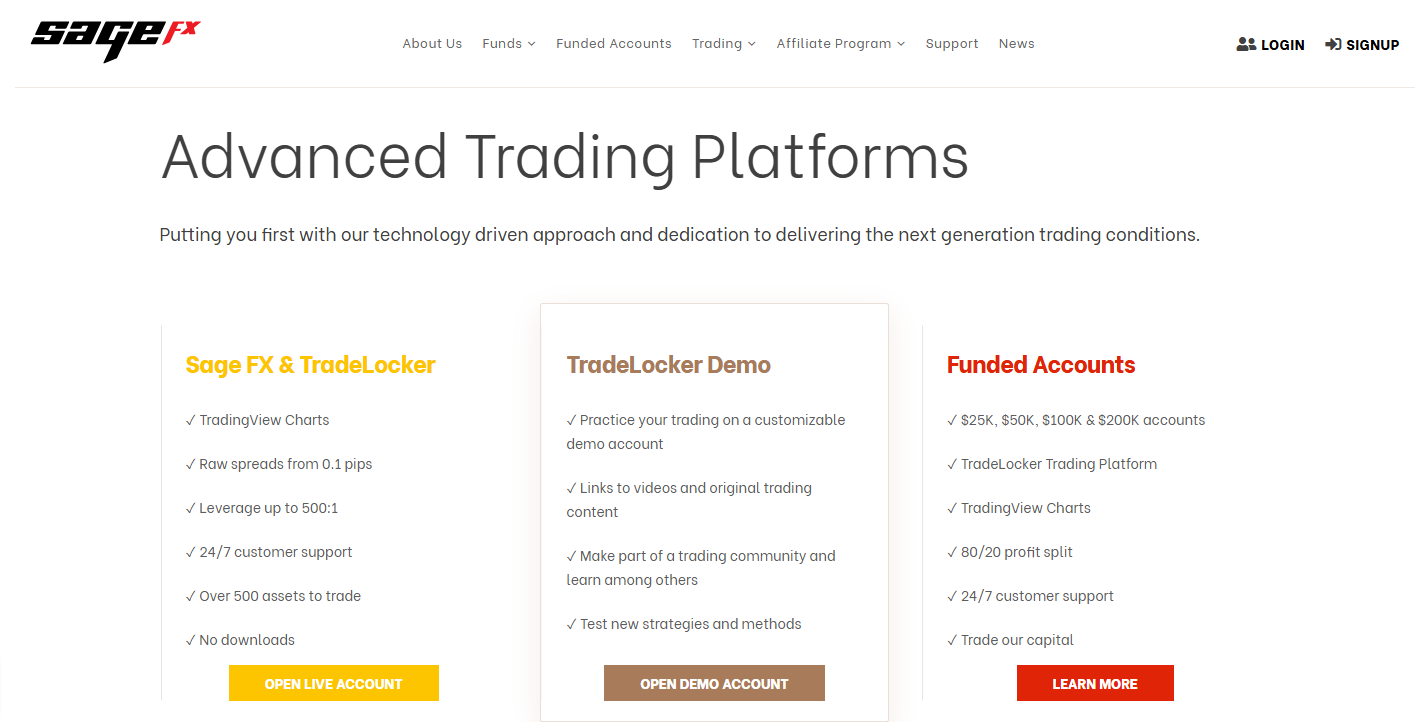

Sage FX Trading Platforms

From my experience with Sage FX, they offer two main trading platforms, MetaTrader 4 (MT4) and TradeLocker Beta. MT4 is a well-known platform in the trading community, providing a robust set of tools for both beginners and experienced traders. I found the technical analysis capabilities and customizable interface particularly useful for tracking and executing trades.

TradeLocker Beta, on the other hand, is Sage FX’s proprietary platform. While it’s still in development, it shows promise with its intuitive design and user-friendly interface. It’s accessible on both desktop and mobile devices, allowing me to trade conveniently wherever I am. The platform supports a wide range of assets, ensuring flexibility in my trading strategy.

Using MT4 with Sage FX, I benefited from its comprehensive charting tools and automated trading options. The platform’s support for Expert Advisors (EAs) allowed me to automate my trades, which was a significant advantage. Moreover, the real-time market data and one-click trading made executing trades quick and efficient.

What Can You Trade on Sage FX

In my experience with Sage FX, the platform offers a diverse range of trading instruments that cater to various trading preferences. You can trade major and minor forex pairs, which include popular pairs like EUR/USD, GBP/USD, and USD/JPY. The forex market is available 24/5, allowing you to trade currencies with high liquidity and tight spreads, which is ideal for both day traders and swing traders.

Sage FX also provides access to a wide range of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. Trading cryptocurrencies on Sage FX is straightforward, with the platform offering competitive spreads and the ability to trade 24/7. This flexibility is particularly beneficial for traders looking to capitalize on the volatile nature of the crypto market.

For those interested in trading indices, commodities, and metals, Sage FX has a variety of options available. You can trade major indices like the FTSE 100, DAX 30, and US 30, which can help diversify your trading portfolio. Additionally, the platform offers commodities such as oil and natural gas, as well as metals like gold and silver, providing ample opportunities to trade in different market conditions.

Another notable aspect is the availability of stocks on Sage FX. You can trade shares of major companies, including tech giants like Amazon, Apple, and Google. This allows for direct exposure to the stock market and the ability to trade based on individual company performance, which can be a significant advantage for those who prefer stock trading.

Sage FX Customer Support

Based on my experience with Sage FX, their customer support is highly responsive and available 24/7. This round-the-clock availability means I can get help anytime I need it, whether I’m facing issues during trading hours or outside of them. The live chat feature is particularly efficient, providing immediate assistance and resolving my queries swiftly.

I found the customer support team to be professional and knowledgeable, which significantly enhances the overall trading experience. Whenever I had questions or encountered problems, the support agents were quick to provide solutions and detailed explanations. This level of service is essential for maintaining confidence in the platform, especially during critical trading moments.

In addition to live chat, Sage FX offers support through email and an online ticket system, which ensures that all issues are tracked and addressed systematically. I appreciate the multiple channels available for support, making it convenient to reach out in different ways. The FAQ section on their website is also quite helpful, covering a wide range of common questions and providing instant answers.

Advantages and Disadvantages of Sage FX Customer Support

Withdrawal Options and Fees

When it comes to withdrawing funds from Sage FX, there are several convenient options available. You can withdraw using cryptocurrencies like Bitcoin, Ethereum, and Ripple, which are processed almost instantly. This feature is particularly useful if you prefer using digital currencies for speed and flexibility.

In addition to cryptocurrencies, Sage FX supports withdrawals through credit and debit cards, as well as VLoad, a popular e-wallet service. Withdrawals via credit or debit cards can take up to 3-5 business days, which is standard across most brokers. However, VLoad withdrawals are processed instantly, making it a quick alternative.

One of the best aspects of Sage FX is that they do not charge any withdrawal fees. This is a significant advantage compared to many brokers who often impose fees on withdrawals, potentially eating into your profits. However, it’s important to note that third-party fees, like those from your bank or payment provider, may still apply.

Sage FX Vs Other Brokers

#1. Sage FX vs AvaTrade

Sage FX and AvaTrade both offer diverse trading instruments, but there are notable differences. Sage FX is known for its high leverage options up to 1:500 and accepts cryptocurrency deposits and withdrawals, making it appealing for traders looking for flexible funding methods. However, it is not regulated by any major financial authority, which can be a concern for some traders. On the other hand, AvaTrade is a well-regulated broker across multiple jurisdictions, including ASIC and CySEC. It offers a robust selection of over 1,250 instruments and provides platforms like MT4, MT5, and its proprietary AvaTradeGO. AvaTrade also has no deposit or withdrawal fees and offers strong customer support.

Verdict: AvaTrade is the better choice due to its comprehensive regulation, broad range of trading instruments, and strong customer support. Its regulatory status provides an added layer of security that Sage FX lacks.

#2. Sage FX vs RoboForex

Sage FX provides high leverage up to 1:500 and supports cryptocurrency transactions, which is beneficial for traders seeking flexibility and high-risk opportunities. However, its lack of regulation might be a drawback. RoboForex, in contrast, offers a variety of account types, including ECN and Prime accounts, with leverage up to 1:2000 for certain accounts. RoboForex is regulated by the IFSC, providing more security for traders. Additionally, RoboForex offers a broader range of trading tools and platforms, including MT4, MT5, and cTrader, catering to different trading styles and preferences.

Verdict: RoboForex stands out due to its regulatory oversight, higher leverage options, and a wider array of trading platforms and tools, making it a more versatile and secure choice for traders.

#3. Sage FX vs Exness

Sage FX offers high leverage, up to 1:500, and cryptocurrency funding options, which can be attractive for certain traders. However, its unregulated status is a significant concern. Exness, on the other hand, is a well-regulated broker with licenses from the FCA and CySEC, among others. Exness provides leverage up to 1:2000, depending on the account type, and has a reputation for excellent execution speeds and robust customer support. Additionally, Exness offers a wider range of account types and supports various payment methods, including local bank transfers and cryptocurrencies.

Verdict: Exness is the superior option due to its stringent regulatory compliance, higher leverage, and reliable customer support. Its extensive range of account types and payment options also adds to its appeal.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: Sage FX Review

Based on my insights and user feedback, Sage FX offers several appealing features for traders. Their high leverage options and support for cryptocurrency transactions provide flexibility and potential for significant returns. Additionally, the 24/7 customer support and variety of account types cater to different trading needs and experience levels.

However, it’s important to be cautious due to Sage FX’s lack of regulation. This absence of oversight can pose risks to traders, particularly when compared to regulated brokers. Additionally, while they offer a robust trading environment, some users have reported issues with deposit processes and connectivity, which can be frustrating during critical trading periods.

Also Read: Nash Markets Review 2024 – Expert Trader Insights

Sage FX Review: FAQs

Is Sage FX regulated?

No, Sage FX is not regulated by any major financial authority, which means there is no regulatory body overseeing its operations.

What trading platforms does Sage FX offer?

Sage FX offers MetaTrader 4 (MT4) and its proprietary platform, TradeLocker Beta, both providing a range of tools and features for traders.

Are there any fees for withdrawals on Sage FX?

Sage FX does not charge any withdrawal fees, though third-party fees from banks or payment providers may still apply.

OPEN AN ACCOUNT NOW WITH SAGE FX AND GET YOUR BONUS