SabioTrade Review

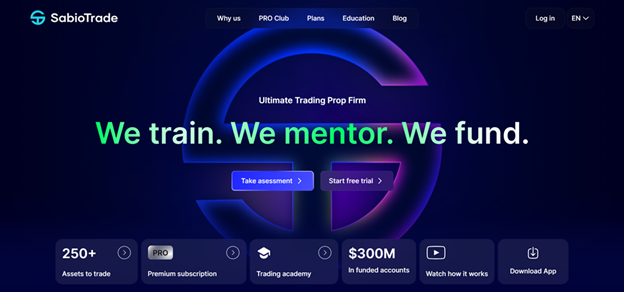

SabioTrade, a proprietary platform, also known as prop trading, provides a range of trading instrument such as forex, commodities, and cryptocurrencies. SabioTrade has an intuitive interface and a thorough educational material which are designed for enhancing the traders’ experience and trading skills. The SabioTrade’s platform has an advance tools and resources which could help both beginners and professional traders.

In this SabioTrade review, we’ll talk about what makes it unique, including its best features and possible drawbacks. This review will help you gain knowledge about SabioTrade’s different account types, how to transfer and withdraw money, SabioTrade’s payment process, fees and other useful details. Together with expert knowledge and trading experience from the real world, we aim to provide you an extensive educational content about SabioTrade and the valuable insights you need to decide if it is the right choice of broker for you and your financial goals.

What is SabioTrade?

SabioTrade is a proprietary trading platform that enables traders to participate in live trading using the company’s capital, rather than their own. This setup provides a unique opportunity for traders to hone their skills and develop strategies in a risk-controlled environment.

SabioTrade offers various account types, each tailored to different trading styles and experience levels, allowing traders to choose an account that best suits their needs. The SabioTrades’ platform is designed for supporting traders in refining their trading strategies without the fear of personal financial loss, making it an appealing choice for both novice and seasoned traders.

With structured funding programs and clear performance benchmarks, SabioTrade fosters a disciplined trading culture. Potential users are encouraged to review the platform’s account features and requirements to determine the most suitable option for their trading journey.

SabioTrade Regulation and Safety

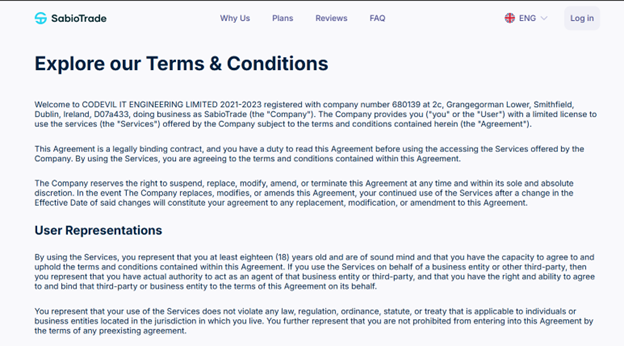

SabioTrade is operated by Codevil IT Engineering limited, a company registered in Dublin, Ireland adheres to standard trading rules that prioritize security and transparency for its users. The platform is dedicated to maintaining industry standards and offering a secure environment for the trading of a variety of financial trading instruments.

It utilizes sophisticated encryption technologies to protect the personal trading accounts and financial information of users, thereby reducing the likelihood of data breaches and unauthorized access. SabioTrade’s regulatory status is contingent upon the region in which it operates, despite the implementation of these security measures. Before establishing an account, traders are advised to confirm the platform’s regulatory credentials in their respective countries. Traders can make informed judgments about the safety and reliability of the platform by comprehending the regulatory framework.

SabioTrade also places a high value on risk management strategies by providing features such as segregated customer accounts and negative balance protection. These measures protect traders from financial losses and ensure client funds are kept separate from company accounts. Prospective users should review these safety features to confirm if SabioTrade meets their security needs.

SabioTrade Pros and Cons

Pros:

- User-friendly

- Diverse assets

- Educational resources

- Low fees

Cons:

- Limited regulation

- Withdrawal delays

- Customer support

- Region restrictions

Benefits of Trading with SabioTrade

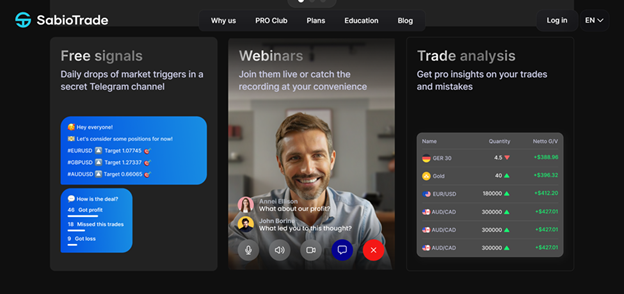

SabioTrade prioritizes trader education by offering comprehensive resources such as webinars, tutorials, and technical analysis. These materials are aimed at helping users develop their trading skills and strategies, making the platform a valuable resource for continuous learning and growth. Additionally, SabioTrade’s flexible account options cater to various trading styles and risk appetites, enabling users to choose the account type that best fits their needs. The platform’s competitive fee structure is also one of the advantages, providing cost-effective trading solutions with low spreads and commissions. Coupled with features like negative balance protection and secure fund management, SabioTrade aims to create a safe and supportive trading environment. For those looking to expand their trading opportunities while minimizing costs, SabioTrade stands as a compelling option.

SabioTrade Customer Reviews

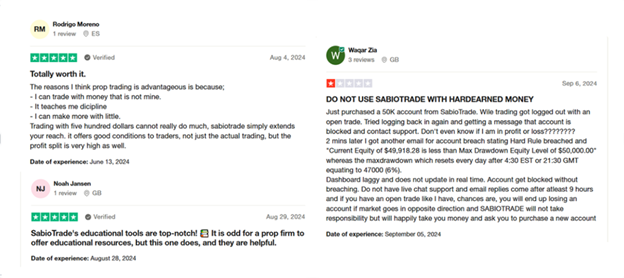

Customer reviews of SabioTrade reflect a mixed experience among users. Some traders, like Rodrigo Moreno and Noah Jansen, express satisfaction with the platform’s educational resources and trading conditions. They highlight the benefits of using company capital to trade, citing improved discipline and opportunities for greater profits. SabioTrade’s educational tools are particularly praised, as they provide valuable guidance and support for both novice and successful traders.

On the other hand, some users have voiced concerns regarding the trading platform’s reliability and support team. A review by Waqar Zia details issues with account accessibility and lack of timely support responses. He warns against using the platform, citing account blocks and insufficient customer assistance.

These contrasting reviews indicate that while SabioTrade has strengths in education and trading flexibility, potential users should be cautious and consider all aspects before committing to the platform.

SabioTrade Spreads, Fees, and Commissions

SabioTrade offers cost-effective trading with no commissions, which means users don’t have to worry about extra charges when making trades.

The online trading platform of SabioTrade has a flexible leverage option, which allows traders to control how much they want to risk based on the asset classes they choose. This setup is great for both beginners and experienced traders looking to save on fees while trading more efficiently.

For funded accounts, SabioTrade offers plans starting from $20,000 up to $200,000. Traders can keep up to 80% of their profits, and it increases to 90% for higher account tiers. The platform’s simple fee structure and no trading commissions make it a good choice for those who want to understand their costs clearly and trade with more confidence.

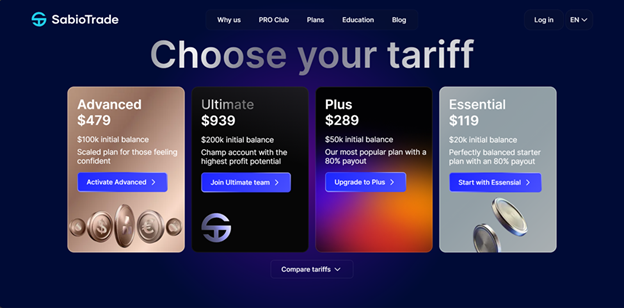

Account Types

Standard Account

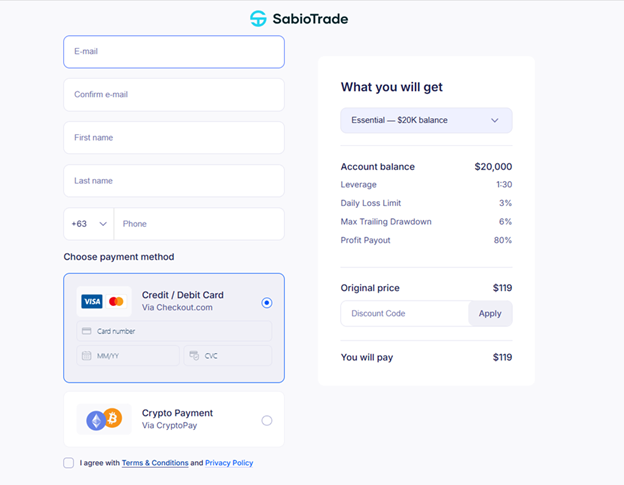

This account is ideal for traders looking to start with a $20,000 initial balance and an 80% profit share. With a one-time fee of $119, it provides flexibility and access to essential trading tools, making it suitable for those exploring professional trading without a large upfront investment.

Premium Account

For traders seeking more capital, the Premium Account offers a $50,000 balance and an 80% profit payout. Priced at $289, it includes tighter spreads and access to more educational resources, making it a great choice for those looking to enhance their trading skills and profitability.

Advanced Account

Catering to experienced traders, this account provides a $100,000 balance and a 90% profit share. With a fee of $479, it features advanced trading tools, mentorship, and weekly payouts. This account is perfect for those aiming to scale their trading activities with more capital and support.

Ultimate Account

The Ultimate Account is designed for professional traders, offering a $200,000 balance and a 90% profit share. For a fee of $939, it provides comprehensive access to all premium resources, including mentorship and strategic trading analysis, making it the best option for maximizing profit potential.

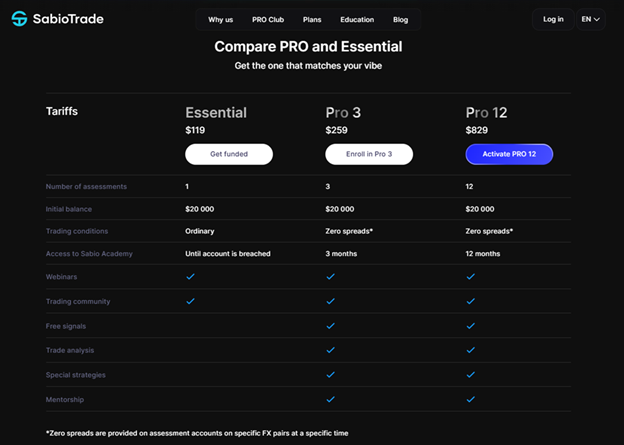

The accounts in the image (Essential, Pro 3, Pro 12) are likely training or assessment accounts designed to help traders qualify for real funded accounts by demonstrating their trading skills and discipline.

Actual Funded Accounts in SabioTrade typically include levels like Standard, Premium, Advanced, and Ultimate, with varying amounts of trading capital ranging from $20,000 to $200,000 and profit-sharing percentages up to 90%.

To gain access to these actual funded accounts, traders must successfully complete an assessment based on the plans shown in the image.

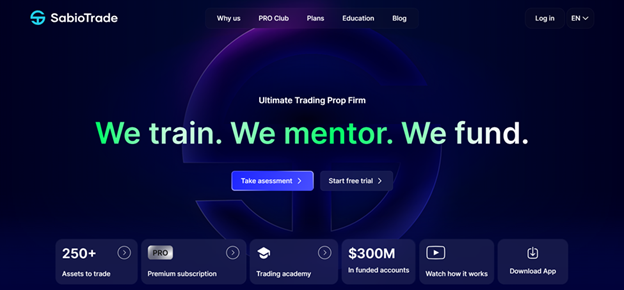

How to Open Your Account

Step 1: Visit the SabioTrade Website

Go to the official SabioTrade website and click Click on the “Take Assessment” button displayed on the main page. This is your starting point to get evaluated and qualify for a funded account.

Step 2: Start Free Trial

If you’re new and want to explore the platform before committing, click on the “Start Free Trial” button. This will likely provide you with temporary access to the platform’s features, such as demo trading or educational content.

Step 3: Follow the On-Screen Instructions

After clicking either option, follow the on-screen instructions to complete the necessary steps, such as providing your contact information or agreeing to the platform’s terms and conditions.

Step 4: Complete the Registration Process

You may need to create an account by entering your personal details, selecting an assessment plan, and uploading required documents for verification.

Step 5: Access Your Trading Dashboard

Once you’ve completed the registration and assessment selection, you’ll gain access to your personal trading dashboard, where you can monitor your progress and start the trading journey. If you have difficulty finding specific navigation options, you can also reach out to their support team for assistance or check the “Education” section for guides on how to get started.

SabioTrade Trading Platform

SabioTrade does not employ the traditional MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platforms. Rather, it functions on a proprietary trading platform that is integrated with the QuadCode system. The Sabio Dashboard provides direct access to this platform, enabling traders to conduct transactions, monitor account statistics and market movements, and access educational resources all in one location.

The QuadCode system is intended to provide a seamless and integrated trading experience. It is equipped with a variety of financial instruments and sophisticated features, including real-time data, customizable charts, and more than 100 built-in indicators.Prop trading firms such as SabioTrade are particularly fond of this platform for its user-friendly interface and comprehensive risk management tools.

What can you trade on SabioTrade

On SabioTrade, you can trade a wide variety of financial instruments. This includes:

- Forex: Major, minor, and exotic currency pairs for global forex trading.

- Stocks: Shares from major international markets, including the US and Europe.

- Commodities: Products such as crude oil and precious metals like gold and silver.

- Indices: Global indices, including popular ones like the S&P 500 and DAX.

- Cryptocurrencies: Digital assets such as Bitcoin, Ethereum, and more.

SabioTrade offers over 250 tradable instruments across these asset classes, providing traders with extensive opportunities to diversify their portfolios and capitalize on market movements.

SabioTrade Customer Support

SabioTrade offers multilingual customer support that is available 24/7 to address any questions or concerns that users may have. The support team is accessible through a variety of channels, such as live chat, email, and phone, to guarantee that traders can select the method that is most beneficial to their requirements. Their objective is to provide prompt and professional support, thereby simplifying the resolution of any trading or account-related issues.

SabioTrade’s website provides immediate assistance for brief inquiries through live messaging. Responses are generally delivered within one business day. Email support is available for more detailed issues, while phone support provides direct and personalized assistance during operating hours. This multi-channel approach guarantees that traders receive the assistance they require, regardless of whether it is for imperative matters or general inquiries.

Furthermore, SabioTrade provides an exhaustive FAQ section on their website that addresses common concerns regarding account management, trading platforms, and technical issues. This resource frequently offers solutions without the necessity of direct support interaction. Furthermore, SabioTrade provides webinars, trading recordings, and on-demand videos to assist traders in enhancing their skills and knowledge.

In general, SabioTrade endeavors to establish a reliable trading environment by providing comprehensive educational resources and robust support. Their customer support and training resources are intended to help traders make informed decisions and promptly resolve any issues, irrespective of their level of experience.

Advantages and Disadvantages of SabioTrade Customer Support

Withdrawal Options and Fees

Withdrawal options:

SabioTrade offers traders a variety of withdrawal options, including cryptocurrency and bank transfers. While there are no specific minimum withdrawal amounts, it’s recommended to account for potential bank fees on smaller transactions. This setup provides traders with easy access to their earnings at any time.

Fees:

SabioTrade has no monthly trading fees, creating a cost-effective trading environment. However, there are overnight fees for maintaining positions, which are deducted from the account balance. This clear and transparent fee structure allows traders to focus on their trading without worrying about hidden costs.

SabioTrade Vs Other Brokers

#1. SabioTrade vs AvaTrade

SabioTrade focuses on prop trading with funded accounts for traders who can pass their assessment process. It provides various account options with different capital levels, allowing traders to start with as low as $20,000 and go up to $400,000. SabioTrade’s unique one-step evaluation process is designed to test a trader’s skill and risk management, making it ideal for those seeking to trade with company capital and structured performance metrics

AvaTrade, however, is a globally recognized broker offering a wide range of trading platforms like MetaTrader 4, MetaTrader 5, AvaTradeGO, and AvaOptions. It supports trading across forex, CFDs, cryptocurrencies, and options. With a minimum deposit of $100. AvaTrade is known for its educational resources, advanced trading tools, and competitive spreads. It caters to a broad audience, from beginners to advanced traders, with extensive support and research tools, making it a preferred choice for those seeking a diverse and flexible trading environment.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

#2. SabioTrade vs RoboForex

SabioTrade is a proprietary trading firm offering funded accounts from $20,000 to $400,000 to traders who pass an assessment. It uses a profit-sharing model of up to 90% and a proprietary trading system that supports forex, stocks, commodities, and cryptocurrencies. This makes it a good option for traders looking to leverage company funds with a structured evaluation process focused on risk management and growth.

RoboForex is a traditional broker with various account types, including ProCent, Pro, ECN, and R StocksTrader. It supports platforms like MetaTrader 4, MetaTrader 5, and cTrader, with leverage up to 1:2000. RoboForex offers a wide range of instruments and a low minimum deposit of $10, suitable for both beginners and experienced traders. It also provides bonus programs and competitive spreads, making it accessible for those testing strategies with smaller capital.

Also Read: RoboForex Review 2024 – Expert Trader Insights

#3. SabioTrade vs Exness

SabioTrade is a prop trading firm that provides traders with company capital ranging from $10,000 to $200,000 after a simple one-step evaluation. It features a profit-sharing model of up to 90% and uses its proprietary platform with built-in indicators and an intuitive interface, ideal for traders who want to leverage company funds with structured rules and risk management.

Exness is a global broker offering multiple account types like Standard, Pro, Raw Spread, and Zero. It supports MT4 and MT5 platforms, with competitive spreads starting from 0.3 pips and leverage up to 1:2000. Exness provides broad market access, including forex, commodities, cryptocurrencies, and indices, making it a versatile option for traders seeking flexible conditions without a prop firm evaluation.

Also Read: Exness Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH SABIOTRADE

Conclusion: SabioTrade Review

In summary, SabioTrade is a distinctive proprietary trading platform that provides traders with the opportunity to access funded accounts with capital spanning from $10,000 to $200,000 after completing a simple evaluation process.The platform operates on its proprietary trading system, which is incorporated with the SabioDashboard, and offers up to 90% profit-sharing. This configuration is optimal for traders who desire to trade with company capital while simultaneously gaining access to a transparent trading environment and a structured risk management framework.

SabioTrade’s limited asset selection and absence of conventional trading platforms such as MT4 and MT5 may not be appealing to all traders, despite the fact that it provides an appealing alternative for experienced traders. SabioTrade is an appealing option for traders who are in search of a prop trading experience that is user-friendly and characterized by clear guidelines and objectives.

SabioTrade Review: FAQs

What are the available withdrawal options?

Traders can withdraw profits via bank transfers or cryptocurrencies. There are no monthly trading fees, but overnight fees apply for holding positions.

How does SabioTrade compare to other prop firms?

SabioTrade offers a simpler assessment process with fixed rules, while competitors like FundedNext have more complex structures but offer different account options

What trading platforms does SabioTrade use?

It uses its proprietary platform integrated with SabioDashboard, not supporting MT4 or MT5.

OPEN AN ACCOUNT NOW WITH SABIOTRADE AND GET YOUR BONUS