ROinvesting Review

ROInvesting is a Cyprus-based broker, operated under the company Royal Forex Ltd. The platform offers a range of financial instruments, including forex, CFDs, stocks, cryptocurrencies, and commodities. It is regulated by CySEC, which provides a level of legitimacy for its European operations. The broker is also known for using popular trading platforms like MetaTrader 4 and WebTrader, providing various tools and resources for both beginner and professional traders.

However, despite its regulatory status, ROInvesting has been flagged for some troubling practices. Numerous users report issues with high withdrawal fees, ranging from $50 for basic withdrawals to even higher fees for smaller transactions. Inactivity fees have also been a major concern, with some accounts being charged up to $500 per month after a prolonged period of inactivity. These excessive fees, coupled with complaints about difficulty in withdrawing funds and aggressive marketing tactics, have raised concerns about the broker’s overall reliability.

What is ROinvesting?

ROInvesting is a Cyprus-based broker owned by Royal Forex Ltd, a company registered in Cyprus. The broker is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 269/15. Despite its claims of offering reliable services since 2015, ROInvesting’s operations only began in 2018, raising concerns about inconsistencies in its registration information. This discrepancy has led to suspicions about the broker's transparency, further fueled by its aggressive fee structure and problematic client fund access.

Additionally, while ROInvesting holds a CySEC license, there have been serious compliance issues, resulting in a €120,000 fine imposed by the Cypriot regulator due to non-compliance with transparency requirements and other operational deficiencies. The company's voluntary renunciation of its license in 2021 has also raised red flags, suggesting ongoing regulatory concerns. Given these inconsistencies and compliance issues, ROInvesting’s credibility is questionable, and traders are advised to proceed with caution.

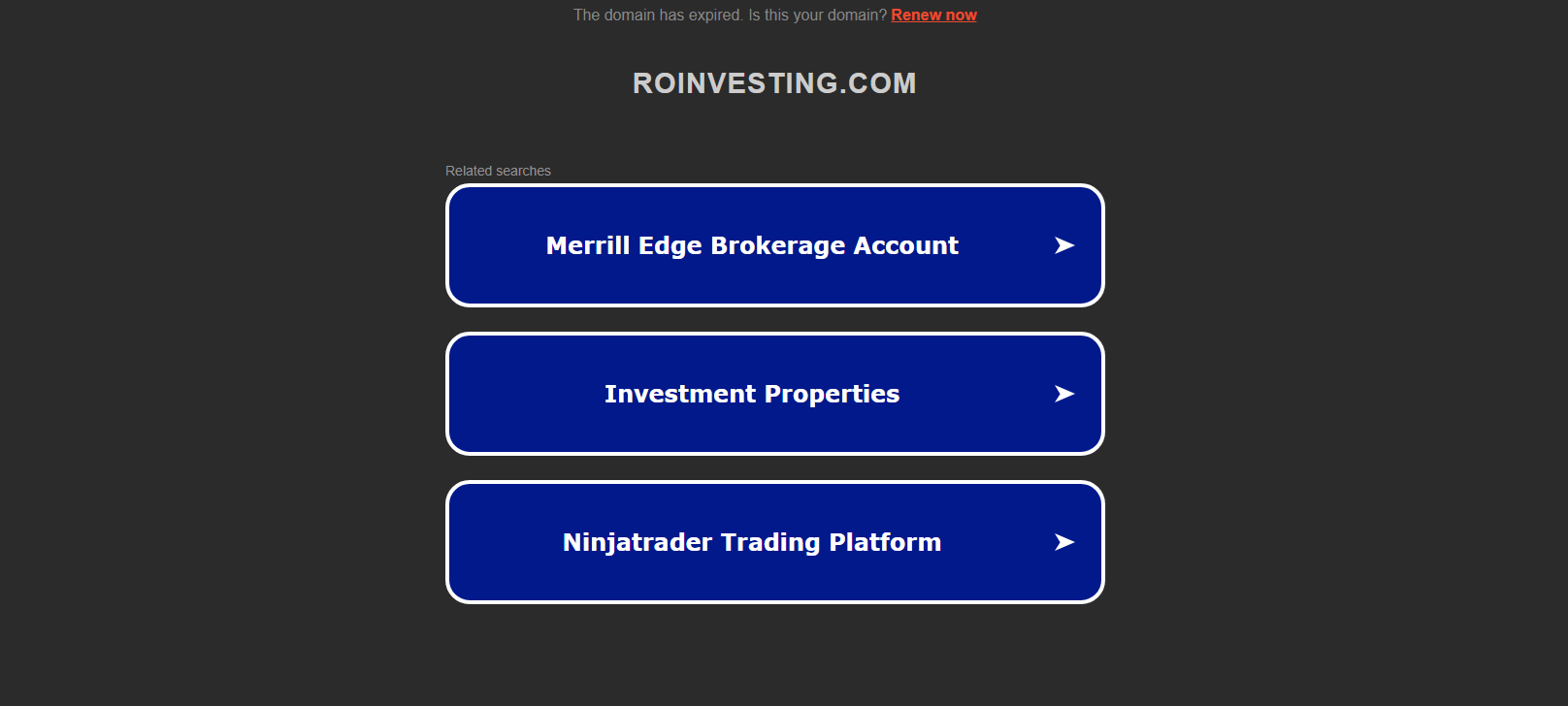

ROinvesting Website Status

The current status of ROInvesting’s website shows that the domain has expired and is pending renewal, raising concerns about the company’s operations. When a domain expires, it can enter a grace period, during which the original owner can still renew it. If the domain is not renewed, it could be auctioned or released to the public. This situation suggests potential operational issues, as an expired domain indicates a lack of attention to critical business aspects like maintaining a web presence.

Furthermore, technical issues have been a recurring problem for ROInvesting users, with frequent complaints about platform shutdowns and a lack of responsibility from customer support. These factors, combined with the website's domain expiration, add to the growing doubts about the broker’s reliability and its ability to provide a stable and secure trading environment.

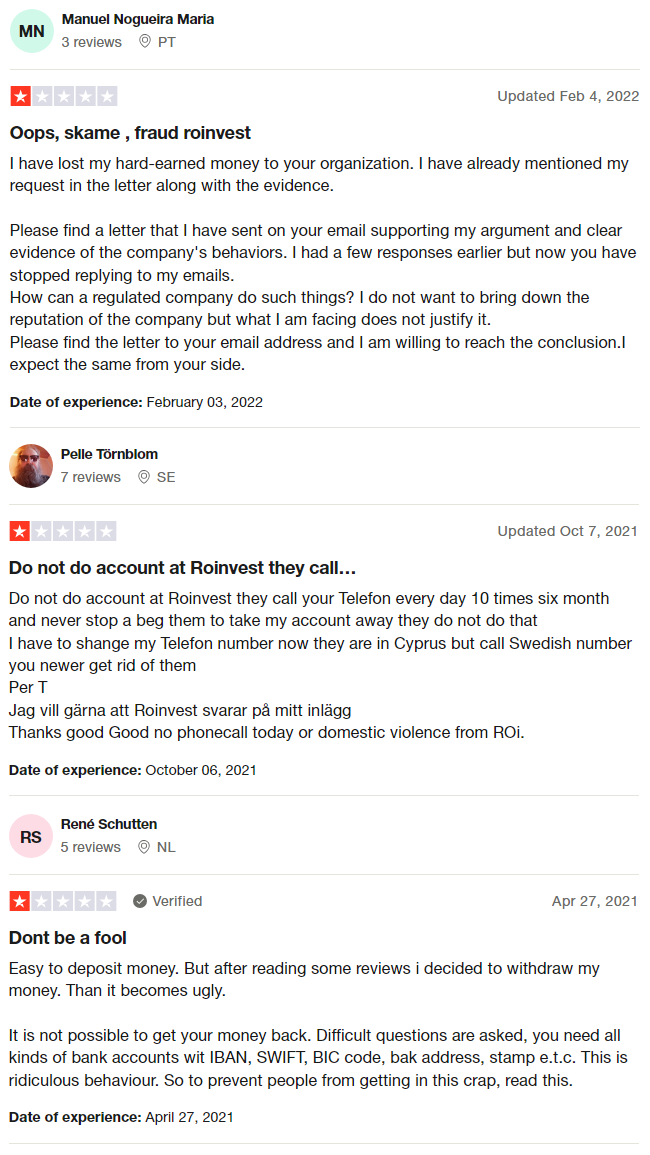

ROinvesting Customer Reviews

ROInvesting customer reviews highlight several recurring issues. Users report that while it is easy to deposit money, attempting to withdraw funds becomes highly problematic. Many customers face delays and difficulties when requesting withdrawals, with the company demanding excessive documentation like bank details, IBAN, SWIFT codes, and even physical stamps from banks. These hurdles seem designed to prevent easy fund retrieval. Another reviewer shared their frustration, claiming they lost their hard-earned money and, despite initially receiving responses, the company stopped replying to further inquiries. These experiences suggest that ROInvesting's practices make it difficult for users to access their own funds, leading to widespread dissatisfaction.

ROinvesting Regulatory Status

ROInvesting claims to be regulated by CySEC, which should provide a certain level of trust and transparency for traders. However, issues arise when examining the broker’s actual operations. Many users report that the company hides crucial fee information and only reveals unexpected charges and penalties when clients attempt to withdraw funds. This lack of transparency, despite its regulatory claims, raises doubts about how strictly the broker adheres to CySEC’s guidelines. Furthermore, the use of multiple domains by the company is a tactic often seen in fraudulent schemes, making it harder for traders to trace and recover their investments.

The risks associated with unregulated or poorly regulated brokers like ROInvesting become apparent when users face withdrawal issues. Many traders state that everything seems legitimate until they try to access their money. At this point, ROInvesting allegedly introduces a series of invented fees and barriers, such as insurances and penalties, to release only a minimal amount or, in some cases, no funds at all. This pattern of behavior puts traders at high risk of losing their investments, making it crucial to exercise extreme caution when dealing with such brokers.

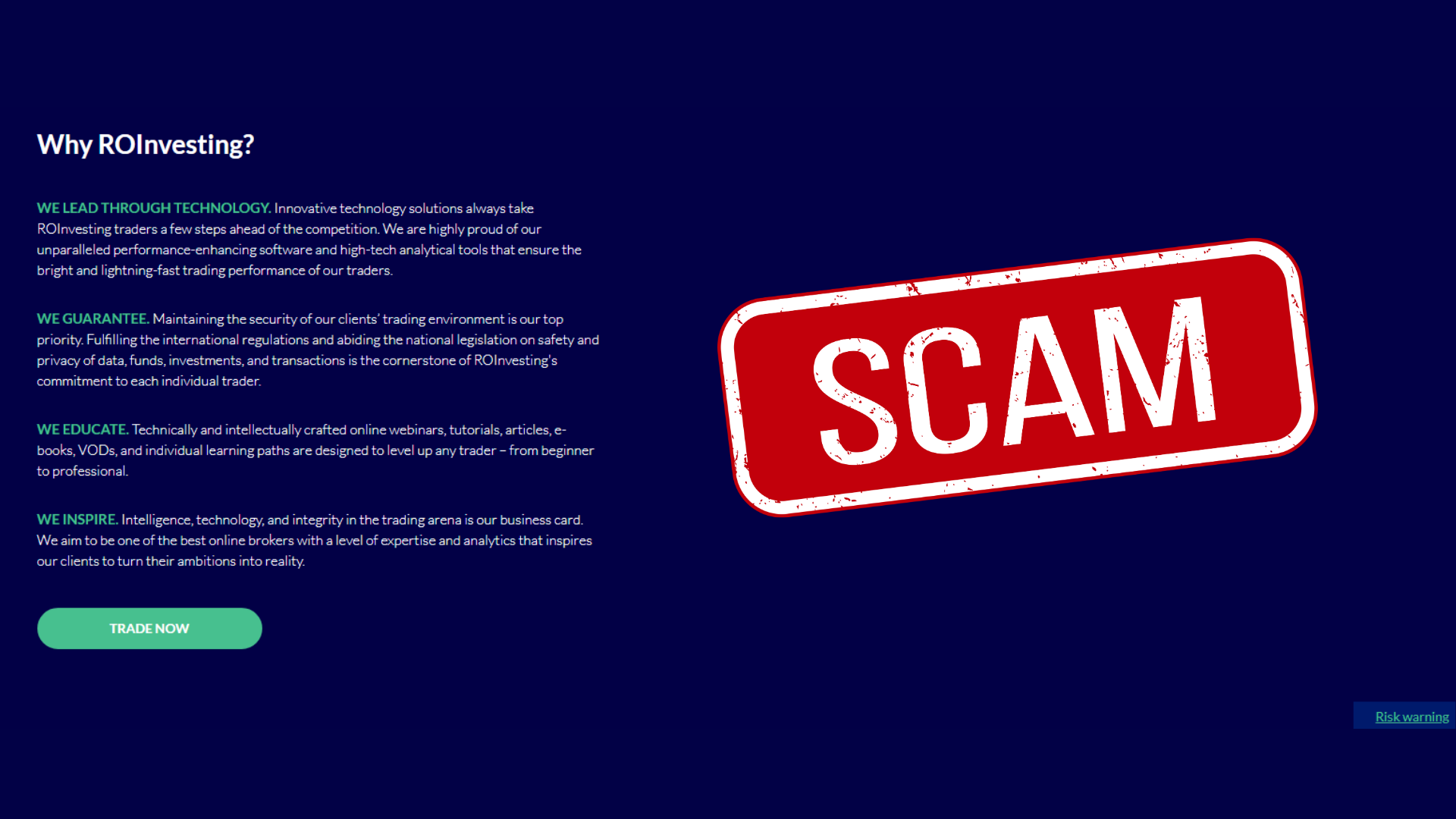

Conclusion: Is ROinvesting a Scam?

Yes, ROinvesting is a scam.

Despite its claims of being regulated by CySEC, the broker’s actions contradict this regulatory status. Users report numerous issues when trying to withdraw their funds, with the company introducing unexpected fees, insurances, and penalties to block or minimize withdrawals. Additionally, the use of multiple domains suggests deceptive practices, which are common in fraudulent schemes. These patterns make it clear that ROInvesting operates in a manner that consistently disadvantages its clients.

Given the overwhelming evidence of fraudulent behavior and client dissatisfaction, it is strongly advised to avoid using ROInvesting. The risk of losing investments due to hidden fees, poor transparency, and withdrawal issues is too high. Traders should look for more trustworthy and regulated brokers that provide transparency and fair access to funds.

Asia Forex Mentor Reminds You

Asia Forex Mentor is committed to uncovering and exposing fraudulent brokers to help safeguard traders and investors. The increasing presence of unregulated brokers offering forex and CFD trading across different regions has created serious concerns. These brokers represent significant risks to those who engage with them. We strongly advise traders to remain vigilant and avoid unauthorized brokers to protect their capital and ensure a safe trading experience.