Revolut Review

Revolut is a financial app that offers banking, forex, and investment services all in one place. It’s popular for its real–time currency exchange feature, allowing users to trade forex at interbank rates during weekdays, making it useful for frequent travelers and casual traders.

The app also provides a range of investment options, including stocks, crypto, and commodities, with commission-free trading for stocks. While it offers a convenient way to manage money, Revolut’s forex tools are more suited for casual users rather than professional traders who need advanced features like leverage or margin trading.

What is Revolut?

Revolut is a digital banking app that combines banking, forex, and investment services in one platform. It allows users to manage their money, trade currencies at real-time rates, and invest in stocks and cryptocurrencies without needing separate apps.

The app is known for its commission-free stock trading and low foreign exchange fees, making it useful for people who travel often or want to exchange money easily. With tools like budget tracking, virtual cards, and easy money transfers, Revolut simplifies personal finance management for its users.

Revolut Regulation and Safety

Revolut is regulated by financial authorities in several countries, including the UK Financial Conduct Authority (FCA) or a UK Banking Licence. This means the company must follow strict guidelines to protect users’ funds. In the European Economic Area, Revolut operates with an e-money license, ensuring that customers’ money is kept in segregated accounts, separate from the company’s funds.

For added safety to Revolut Customers, Revolut offers features like two-factor authentication and instant card freezing through the app. While Revolut isn’t a traditional bank in all regions, its strong security measures and regulatory oversight provide a safe environment for managing money and trading.

Revolut Pros and Cons

Pros

- Commission-free stocks

- Real-time exchange

- Easy-to-use app

- Budgeting tools

Cons

- No traditional banking

- Limited forex tools

- Weekday forex trading

- Premium fees

Benefits of Trading with Revolut

Revolut offers commission-free stock trading, making it an affordable option for those looking to invest without high fees. Its real-time exchange feature allows users to trade forex at interbank rates, giving better value compared to traditional banks.

The app is highly user-friendly, making it easy for beginners to start trading stocks, cryptocurrencies, and commodities. With low fees and budget management tools, Revolut simplifies trading for casual investors looking for an all-in-one financial platform.

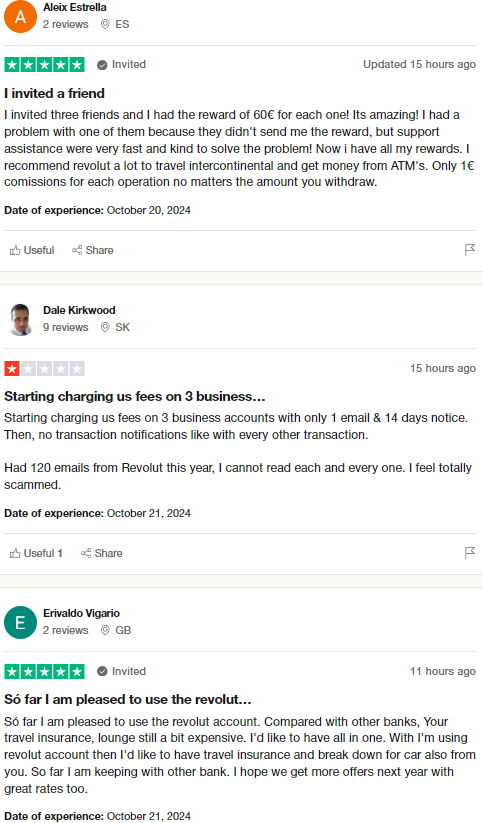

Revolut Customer Reviews

Revolut generally receives positive reviews for its easy-to-use app and low fees on stock trading and forex. Users appreciate the ability to manage multiple currencies and make transactions with real-time rates, especially for travel and everyday use.

However, some customers have raised concerns about customer support response times and the limited availability of advanced trading features. Despite this, many users find Revolut a convenient solution for basic trading and budget management needs.

Revolut Spreads, Fees, and Commissions

Revolut offers competitive forex spreads with access to interbank rates, but there are no commissions on exchanges. However, fees apply on weekends and for users exceeding their monthly free exchange limit, especially on the Standard plan.

While trading forex during weekdays remains fee-free up to a limit, premium account holders benefit from higher limits and fewer restrictions. This makes Revolut a cost-effective option for casual traders but less suitable for high-volume or professional forex traders.

Account Types

There are many ways to acquire a Revolut account to different enough money and lifestyles. Whether you’re looking for basic financial tools or premium perks, Revolut account has a plan that fits. Each Revolut account type comes with its own set of features, from commission-free trading, forex to travel insurance and cashback rewards and fee free accounts. Let’s break down each option so you can choose the one that suits you best.

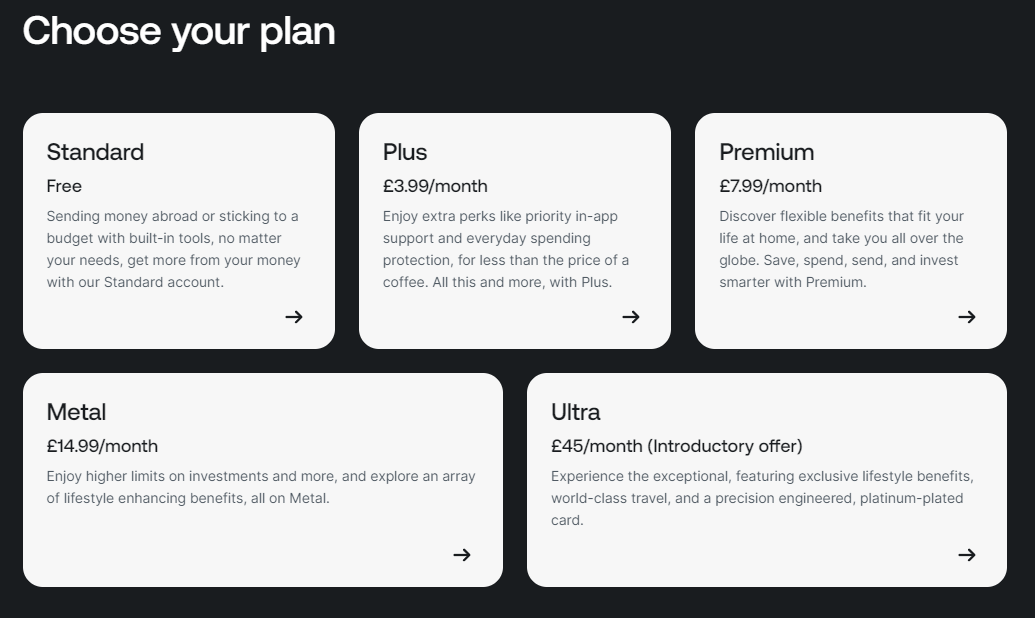

Standard Account

The Standard account is Revolut’s free tier and includes essential features like commission-free stock trading and forex with a monthly limit. It’s ideal for those looking to try the app’s basic services without any upfront cost.

Plus Account

The Plus account offers everything in the Standard plan but with added perks like higher foreign currency limits and priority customer support. It’s a good option for users who want extra convenience and a bit more protection for a low monthly fee.

Premium Account

The Premium account steps it up with unlimited exchange, travel insurance, and access to crypto trading. It’s designed for users who need more advanced features, such as global travel benefits and fewer restrictions on their transactions.

Metal Account

The Metal account is the top-tier plan, offering exclusive perks like 1% cashback on card purchases, higher ATM withdrawal limits, and a sleek metal card. It’s aimed at frequent travelers and active traders who want the full suite of Revolut’s premium services.

Airport lounge access in Revolut is a benefit offered to Premium and Metal account holders, allowing them to access airport lounges worldwide.

How to Open Your Account

Opening a Revolut account through the web is a simple and secure process that takes just a few minutes. Whether you’re looking to manage your money, trade, or exchange currencies, Revolut makes it easy to get started online. Follow these straightforward steps to open your account and gain access to Revolut’s wide range of financial services.

Step 1: Go to Revolut Website or App

Go to the official Revolut app or website. The site will guide you to the account setup process. Ensure you’re on the correct site to avoid phishing attempts.

Step 2: Click on “Sign Up”

Once on the homepage, locate and click the “Sign Up” button. This will start the personal account creation process, where you’ll provide necessary details to begin setting up your account.

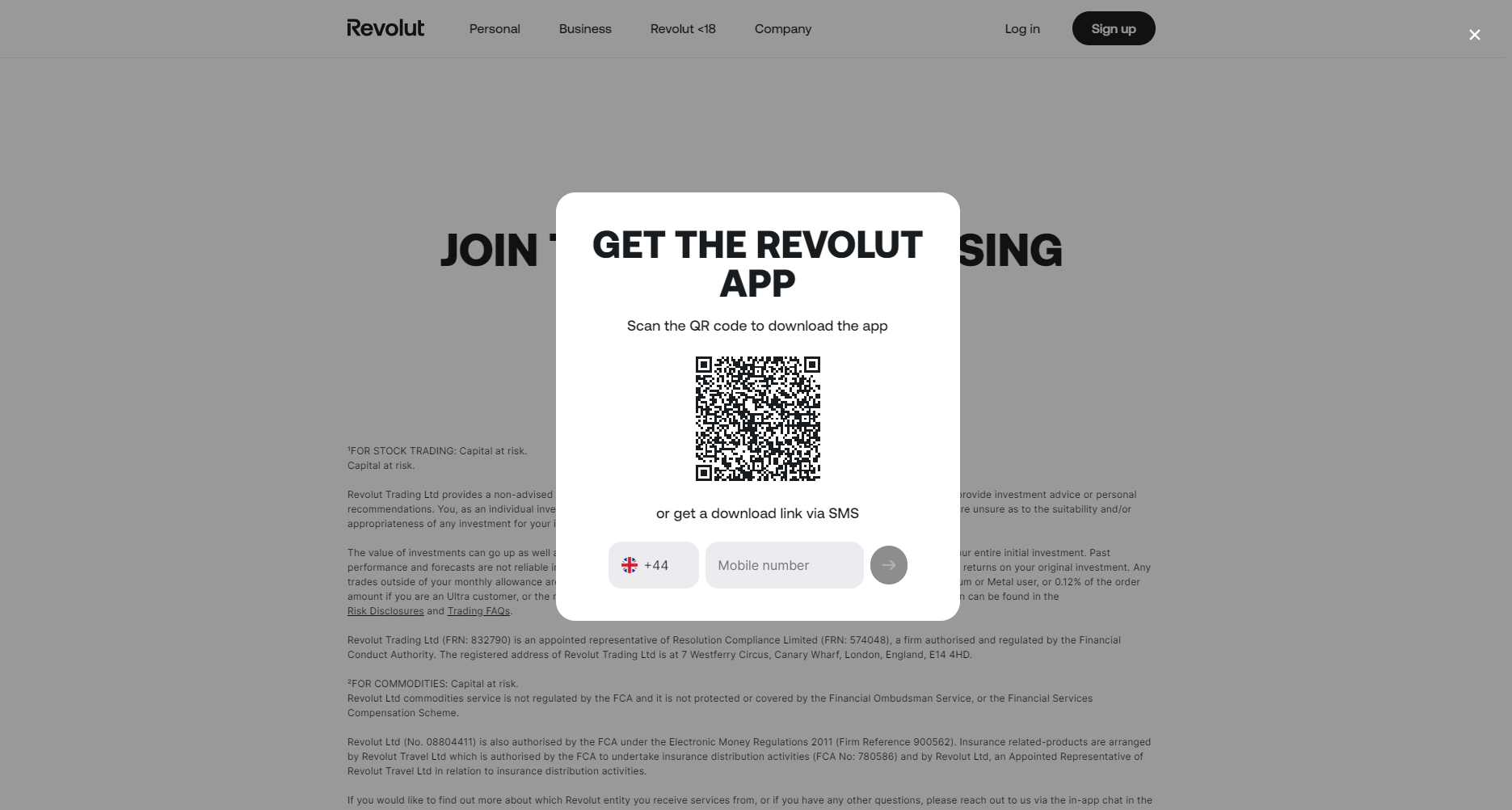

Step 3: Enter Your Phone Number

You’ll be prompted to enter your phone number. Revolut uses this to send you a verification code via SMS, which you’ll need to enter on the website to continue.

Step 4: Provide Personal Information

Next, fill in your personal details, such as your name, address, and date of birth. This information is used for account verification and compliance with regulatory requirements.

Step 5: Identity Verification

For security, you’ll be required to upload a photo of a government-issued ID (passport or driver’s license) and take a selfie for identity verification. This ensures your account is protected and meets regulatory standards.

Step 6: Choose Your Account Type

After your identity is verified, you can select the account type that suits your needs—whether it’s the Standard, Plus, Premium, Metal plan or even a joint accounts. Each offers different benefits depending on your usage preferences.

Step 7: Fund Your Account

To complete your setup, link your bank account or use a debit/credit card to deposit funds into your Revolut account. Once your account is funded, you’re ready to start using Revolut for forex trading or everyday spending.

After that, the traders can avail either prepaid card and also a Revolut card. Prepaid card and Revolut card is very convenient to Revolut customers who don’t want cash transactions.

Revolut Trading Platforms

Revolut offers a mobile-first trading platform available through its app, designed for both iOS and Android users. The app provides access to commission-free stock trading, cryptocurrencies, and commodities, all in one place. It’s easy to use, making it ideal for beginners who want to trade on the go.

For desktop users, Revolut also offers a web-based platform, allowing you to manage your trades from any device with internet access. Both platforms provide real-time data, basic charting tools, and instant access to forex at interbank rates. While it lacks advanced tools for professional traders, Revolut’s platforms are perfect for those seeking simplicity and convenience.

What Can You Trade on Revolut

Revolut offers a variety of trading options, making it easy for users to diversify their investments. Whether you’re interested in stocks, cryptocurrencies, commodities, or forex, Revolut provides a straightforward platform to get started. Here’s a breakdown of what you can trade on Revolut to help you explore the available options.

Stocks

Revolut allows users to trade US stocks commission-free, making it easy to invest in popular companies listed on the New York Stock Exchange and NASDAQ. It’s designed for casual traders who want to buy and sell shares with minimal fees.

Cryptocurrencies

Revolut offers trading for popular cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. Users can easily buy, sell, or hold digital assets directly within the app, though it’s more suited for beginners due to its basic trading features.

Commodities

Revolut also enables users to trade commodities like gold and silver. This is perfect for those looking to diversify their portfolio with physical assets, which can be bought and sold instantly through the app.

Forex

Revolut offers a real-time forex feature for over 30 fiat currencies at interbank rates, mainly for personal use. While not a full forex trading platform, it allows users to exchange currencies easily, especially useful for travelers and casual users.

Revolut Customer Support

Revolut offers 24/7 customer support, primarily through its in-app live chat feature. While the Premium and Metal account holders receive priority support, users on the Standard plan may experience longer response times.

For basic inquiries, Revolut also provides a comprehensive help center with FAQs and guides. While customer service is generally responsive, some users report delays during high-traffic periods, especially for non-premium accounts.

Advantages and Disadvantages of Revolut Customer Support

Withdrawal Options and Fees

Revolut offers a variety of withdrawal options to suit different needs, from ATM withdrawals to bank account transfers and international transfers. Each option comes with its own limits and fee free spending depending on your account type. Here’s a breakdown of the available withdrawal methods and their associated costs to help you manage your finances efficiently.

ATM Withdrawals

Revolut allows users to withdraw cash from ATMs worldwide. For Standard and Plus accounts, free withdrawal fees are limited to £200 per month, while Premium and Metal account holders have higher limits of £400 and £800, respectively. Once the limit is exceeded, a fee of 2% is applied.

Bank Transfers

Users can withdraw funds via bank accounts transfers to their linked banking services accounts. Bank accounts transfers are usually fee-free, but can take 1-2 business days to process. Transfers in non-local currencies may incur a small conversion fee depending on the plan.

International Transfers

Revolut supports international money transfers in multiple currencies. While Premium and Metal users enjoy no fees for these transfers, Standard and Plus users might be charged a small fee based on the currency and amount.

Instant Transfers

Revolut offers instant transfers to other Revolut users for free such as Apple pay. These transfers are immediate and can be made in multiple currencies without any fees, making it a convenient option for sending money to friends and family who also use the app.

Revolut Vs Other Brokers

#1. Revolut vs AvaTrade

Revolut and AvaTrade serve different purposes in the financial space. Revolut is primarily a digital banking app offering commission-free stock trading, currency exchange, and crypto trading aimed at casual traders and everyday users. It lacks advanced trading features such as leveraged forex trading or CFDs that professional traders may seek. In contrast, AvaTrade is a dedicated online brokerage specializing in forex, CFDs, and other derivatives, offering tools like advanced charting, leverage, and multiple trading platforms (including MetaTrader 4/5), which cater to experienced traders. While Revolut focuses on simplicity and accessibility for personal finance, AvaTrade is tailored to active and professional traders needing deeper market tools and strategies.

Verdict: For casual users who want basic trading and banking services, Revolut offers convenience and simplicity. However, if you’re an experienced trader looking for advanced features like leveraged forex trading and CFDs, AvaTrade is the more suitable choice.

#2. Revolut vs RoboForex

Revolut and RoboForex cater to different types of traders. Revolut is a digital financial app designed for everyday banking, offering commission-free stock trading, cryptocurrency, and basic currency exchange, but lacks advanced trading tools like leverage or CFDs. It’s ideal for casual traders who want to manage their finances and investments in one place. On the other hand, RoboForex is a specialized forex and CFD broker offering leveraged forex trading, multiple asset classes, and advanced platforms like MetaTrader and cTrader. RoboForex is built for experienced traders who seek comprehensive trading tools, automated strategies, and access to a broader range of assets, including commodities, indices, and forex.

Verdict: Revolut is great for those who want an all-in-one banking and basic trading app, but lacks the professional-grade tools traders need. RoboForex, with its advanced platforms and leveraged trading, is the better choice for serious traders looking for more sophisticated trading options.

#3. Revolut vs Exness

Revolut and Exness serve different market needs. Revolut is a digital financial app offering basic services like stock trading, cryptocurrency trading, and currency exchange, primarily aimed at casual users managing everyday finances. It provides simple, user-friendly tools without advanced trading features such as leverage or professional charting tools. Exness, in contrast, is a dedicated forex and CFD broker designed for professional traders, offering leveraged forex trading, metals, cryptocurrencies, and indices with access to platforms like MetaTrader 4/5. Exness is equipped with advanced trading features, including tight spreads, high leverage, and algorithmic trading, making it suitable for those seeking a more professional trading environment.

Verdict: For users who want basic financial services alongside light trading options, Revolut is convenient and accessible. For advanced traders seeking professional-grade tools and leveraged forex or CFD trading, Exness is the better choice.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: Revolut Review

Revolut is a versatile financial app that combines banking, forex, and trading in one user-friendly platform. It’s ideal for casual traders and individuals looking for a simple, all-in-one solution for managing their finances, from commission-free stock trading to crypto and commodities. While it lacks advanced trading features suited for professional traders, Revolut’s low fees, real-time exchange, and ease of use make it a solid choice for everyday users.

Revolut Review: FAQs

Is Revolut safe?

Yes, Revolut is regulated and uses strong security features like two-factor authentication.

Can you trade forex on Revolut?

You can exchange currencies, but no advanced forex tools like leverage.

Are there trading fees?

Stock trades are commission-free, but fees apply for crypto and forex beyond limits.

OPEN AN ACCOUNT NOW WITH REVOLUT AND GET YOUR BONUS