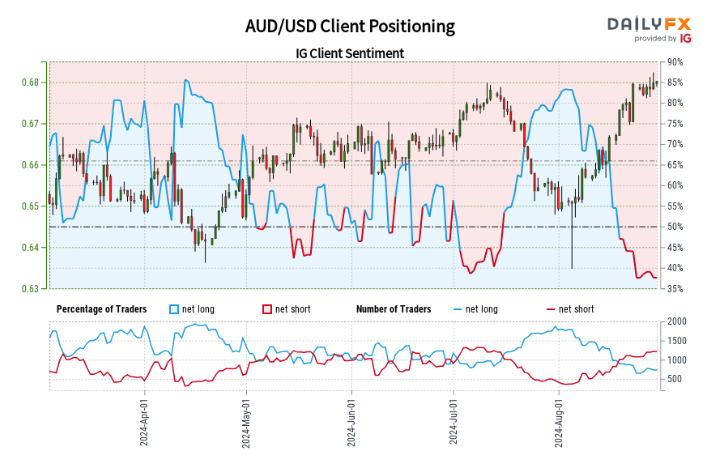

AUD/USD Insights:

- 37.84% of traders are positioned long, creating a short-to-long ratio of 1.64:1.

- Long positions have increased by 1.20% from yesterday but are down 12.53% from last week.

- Short positions have climbed 1.79% from yesterday and are up 15.53% from last week.

Retail traders often counter the prevailing market trend, which is usually not advantageous in a trending environment. The principle that “the trend is your friend” supports the idea that a contrarian approach to sentiment can be valuable.

Recent data on AUD/USD shows a marked shift towards short positions over the past week. While there has been a reduction in long positions, short positions have surged significantly. This shift towards a net-short stance implies that, from a contrarian perspective, AUD/USD prices may continue to trend upward. The combination of current positioning with these changes points to a stronger bullish outlook for AUD/USD.

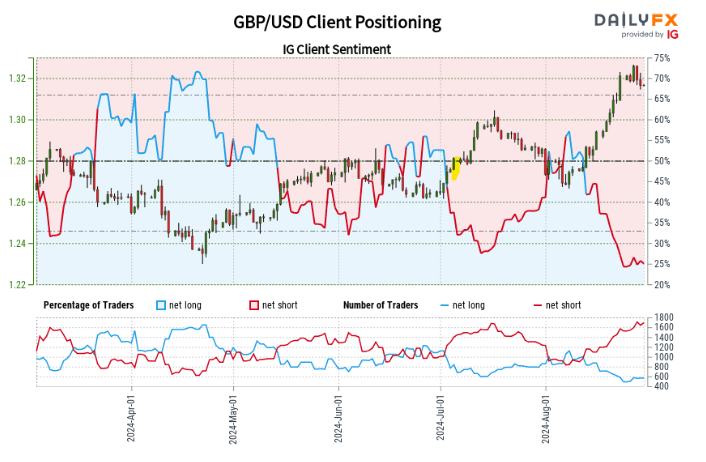

GBP/USD Insights:

- 24.91% of traders are positioned long, resulting in a short-to-long ratio of 3.01:1.

- Long positions have declined 1.91% from yesterday and 5.04% from last week.

- Short positions have grown 2.84% from yesterday and increased by 8.96% over the last week.

For GBP/USD, the retail sentiment reveals a much stronger bias toward short positions. The number of traders holding long positions has consistently decreased both day-over-day and week-over-week, while short positions have risen significantly. This increasing net-short sentiment generally suggests that GBP/USD may continue to rise. The current stance, coupled with recent shifts, reinforces a bullish contrarian bias for GBP/USD.