Questrade Review

In this review, the article will tackle how important Questrade trading is.Many people in Canada use Questrade, a well-known online broker that lets them buy in many things, such as forex, stocks, ETFs, and options. The site is known for having low fees and commission-free ETF trading, which makes it a good choice for both new and experienced investors who want to save money.

Traders who want to diversify their portfolios can use Questrade’s forex trading tool, which has low spreads and access to major, minor, and exotic currency pairs.

Questrade not only has low prices, but also a lot of study tools and educational materials that traders and investors can use to keep up with market trends. Active traders and passive users who want more control over their investments can both use the platform’s advanced charting tools, portfolios that can be customized, and forex trading tools.

Overall, Questrade is a good choice for Canadian investors and forex users because it is affordable, flexible, and has a lot of features.

What is Questrade?

Questrade is an online brokerage based in Canada that lets the brokers buy in stocks, ETFs, forex, options, and many other things. Questrade is made to appeal to both new and experienced users who want to trade with low-cost options. It is known for its low fees and commission-free ETF trading. The site gives users access to many markets, which helps them spread out their investments.

Questrade also stands out because of its strong customer service and easy-to-use design, which makes it simple for traders of all levels to find their way around the platform. The company has different kinds of accounts, such as registered accounts like RRSPs and TFSAs, which help Canadians grow their money while giving them tax breaks.

Questrade also has teaching tools, like tutorials and market insights, that help users learn more about trading and keep up with market trends. Questrade is a great choice for Canadian investors because it has low fees, a wide range of financial options, and full customer service.

They can trade stocks on Questrade, as well as can also trade foreign exchange (forex). They offer low spreads and a number of currency pairs.

Questrade gives investors the tools, study materials, and easy-to-use platform they need to manage their portfolios and make smart choices. Overall, it comes out as a flexible and low-cost choice for traders and investors in Canada.

Questrade Regulation and Safety

As a highly controlled brokerage, Questrade makes sure that its users can trade safely and securely. It is a part of both the Canadian Investor Protection Fund (CIPF) and the Investment Industry Regulatory Organization of Canada (IIROC). These partnerships make sure that Questrade follows the rules of the industry. They also offer up to $1 million in investment protection in case the broker goes bankrupt, which adds another level of safety for client funds.

To keep users’ personal and financial information safe, Questrade uses advanced encryption technologies and strict verification methods to keep the platform safe. Because Questrade is dedicated to keeping client data safe and is regulated, it is a tool that Canadian traders and investors can trust. Users can trade with trust, knowing that their investments are safe, because the company puts a lot of effort into safety and regulation.

Questrade Pros and Cons

Pros:

- Low fees

- Commission-free ETFs

- Multiple asset options

- Advanced research tools

Cons:

- No 24/7 support

- Limited U.S. account options

- Inactivity fees

- Higher forex spreads

Benefits of Trading with Questrade

Questrade trading has a lot of important benefits, especially for people who want to save money while still having access to many investment choices. There are no commissions or fees to trade ETFs on this site, which means that traders and investors can keep more of their profits.

Questrade also gives people access to many different assets, such as stocks, ETFs, forex, and options, so they can make their portfolios more diverse.

Questrade’s easy-to-use platform and powerful study tools are also big pluses that help traders make smart choices. The brokerage also has learning materials, which makes it a great choice for both new and experienced buyers who want to learn more.

Questrade is a good choice for Canadian buyers who want to make money quickly because it has advanced charting tools, portfolios that can be changed, and competitive forex trading.

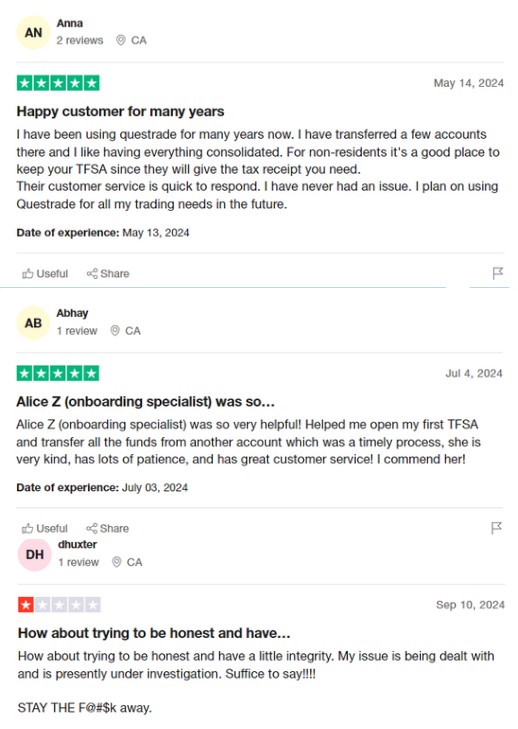

Questrade Customer Reviews

Customers have mostly good things to say about Questrade, especially about how cheap it is to trade and how easy it is to use. A lot of people like that they can trade commission-free ETFs and that they can trade a lot of different assets, like stocks, forex, and options.

A lot of people say that the platform’s easy-to-use layout and helpful customer service are reasons why both new and experienced users choose online broker Questrade.

However, some customers have reported inactive fees and sometimes long wait times for customer service during busy times. Even with these small problems, most Questrade users say that the low fees and wide range of study tools are the best things about it.

Overall, Canadian buyers have a good opinion of Questrade because it is reliable and easy to use.

Questrade Spreads, Fees, and Commissions

Questrade has low spreads and fees, which makes it a good choice for users who want to save money. When it comes to stocks, the site charges as little as one cent per share and as much as $9.95 per trade.

Since there are no fees to buy ETFs, investors can build diversified portfolios without spending a lot of money. When you compare Questrade to other Canadian brokerages, these low fees make them stand out.

Questrade has spreads that are competitive for forex dealing, but they may be a little higher than those at some specialized forex brokers. The site also charges an inactivity fee of $24.95 per quarter for accounts that aren’t traded on.

Even so, Questrade is still a good option for busy traders and long-term investors because its prices are clear and ETF trades are free of fees.

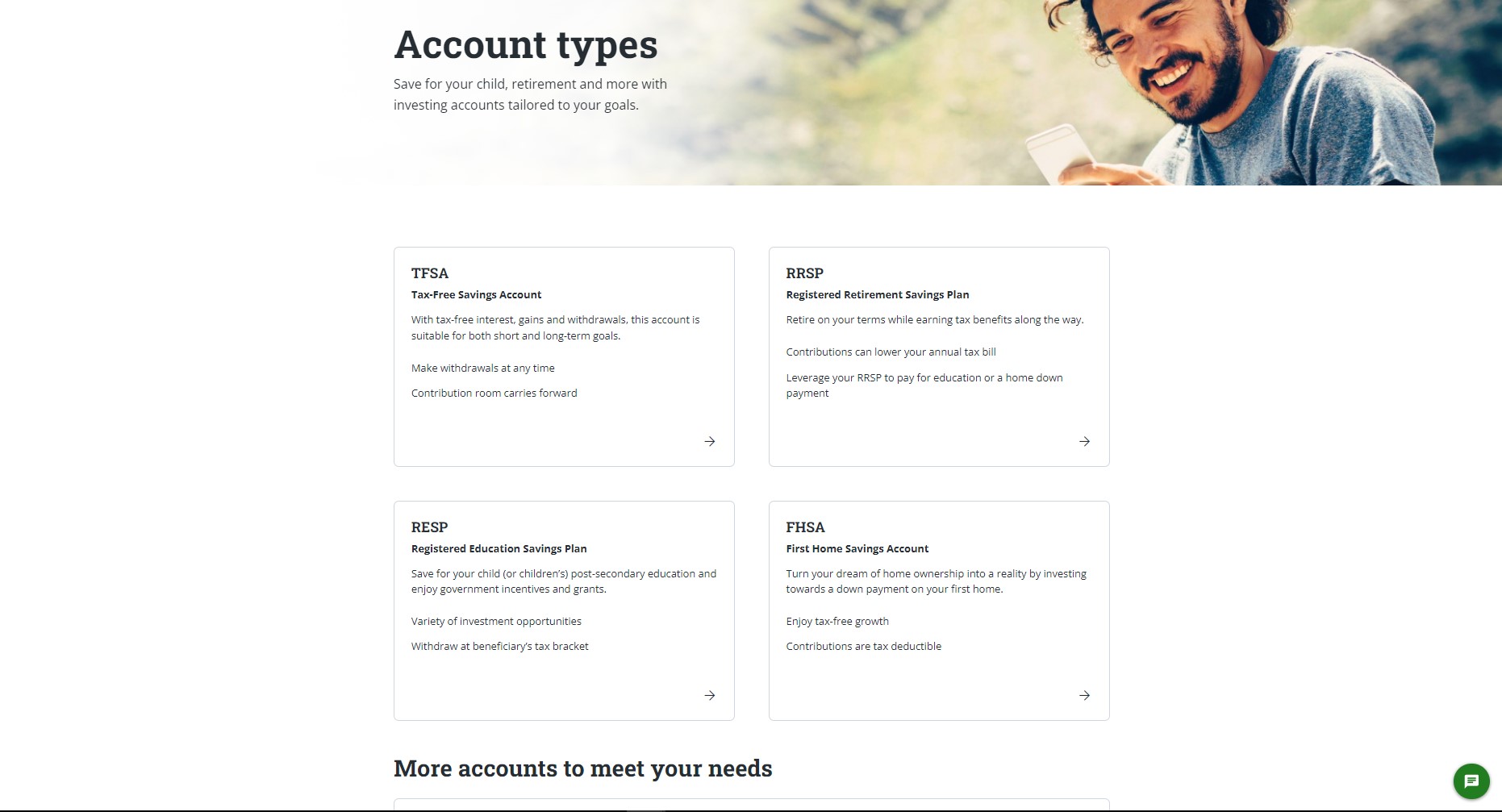

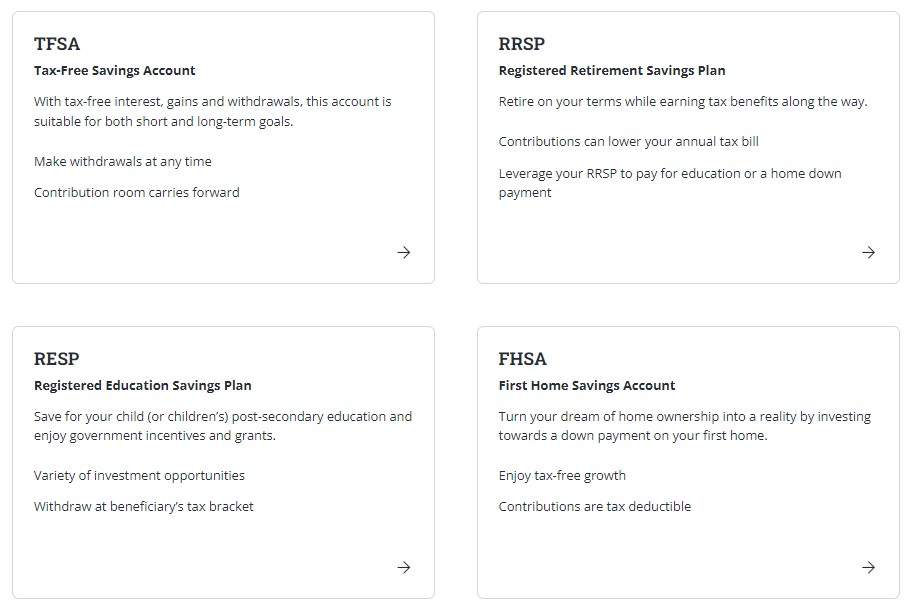

Account Types

To open a Questrade account, the trading platforms are accessible in this accounts so the users must follow these:

Margin accounts: it’ll let you borrow money to trade, which gives you more buying power for stocks, ETFs, and other products.

Registered accounts: like RRSPs and TFSAs, are tax-advantaged ways to save for retirement and invest for the long term. They help Canadians get richer while lowering their tax bills.

Forex and CFD Accounts: These are separate accounts that can be used to trade forex and contracts for difference (CFDs). They come with competitive spreads and choices for using leverage.

Questwealth: Portfolios are managed accounts where professional portfolio managers make investment decisions. These accounts are great for people who want to invest passively and pay less than traditional planners.

These Questrade accounts are very viable and reliable whether what type of account the user avails.

How to Open Your Account

To become one of Questrade clients, the user must follow the tutorial for a Questrade Account:

1. Go to the website for Questrade: Visit the Questrade website and click on the “Open an Questrade Account” link.

2. Pick the type of account: You can choose a Margin, Registered, Forex & CFD, or Questwealth Portfolio account based on your needs.

3. Make a registered account: To make a registered account, you need to give your name, email address, and phone number, among other things.

4. Check Your Identity: In order to follow the rules, you have to upload the name verification documents, like a government-issued ID and proof of address.

5. Fund Your Account: To start trading, add money to your account through a bank transfer, an electronic transfer, or some other way that is available.

6. Once your account has been verified and credited with money, you are now one of Questrade clients can go to the website and start trading the assets you want.

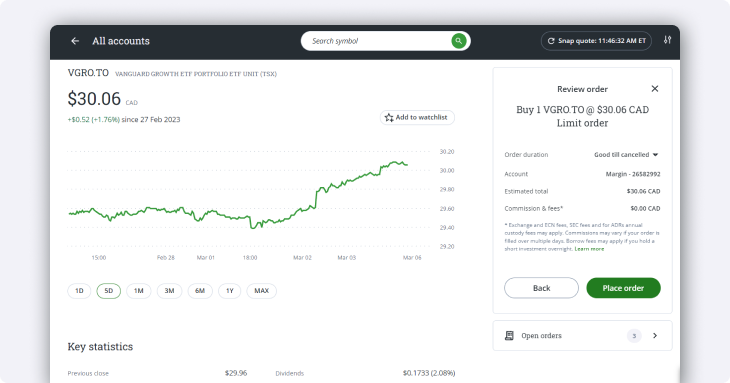

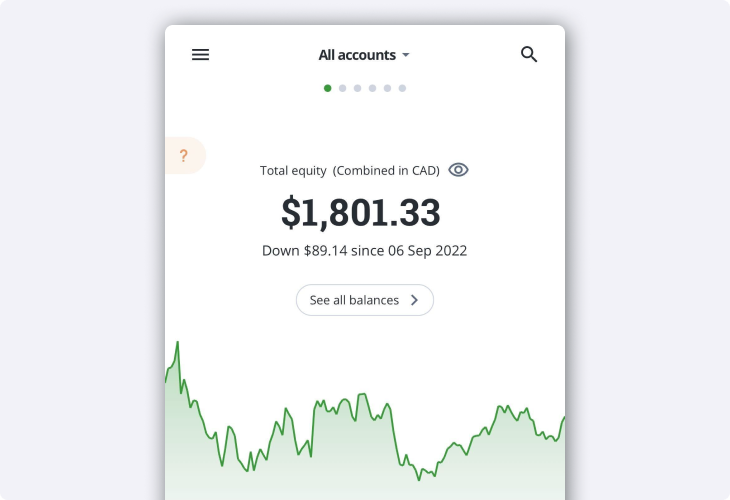

Questrade Trading Platforms

It has its own trading platform thru their applications and websites. Whether mobile or PC, the users can use it and enjoy the trading journey. Questrade account has a variety of trading platforms that are made to meet the wants of traders of all skill levels.

Questrade Trading, the main tool, is a web-based interface that makes it easy for users to log in to their accounts, make trades, and keep an eye on the market inside the trading platforms.

Real-time data, customizable watchlists, and advanced charting tools make it easy for anyone to use. This makes it good for a wide range of trading methods.

Questrade IQ Edge has a desktop program for more active traders that has advanced features like the ability to trade multi-leg options, better charting, and more in-depth technical analysis tools. Questrade also has a mobile app that lets traders control their portfolios and make trades while they’re out and about.

With these platforms, Questrade can serve a lot of different users by giving them options and strong tools to help them make better choices using the trading platforms.

What Can You Trade on Questrade

Questrade trading lets traders choose from a lot of different assets, which makes it a flexible tool for building diversified portfolios. Traders can get stocks from big exchanges, which lets them put their money into top companies in Canada, the U.S., and other countries. The site also lets you trade ETFs without any fees, which is great for people who want to make a cheap, diversified investment plan.

Questrade lets users deal foreign exchange (forex), which means they can use major, minor, and exotic currency pairs. Questrade is a great choice for people who want to trade on the global fx market because it has low spreads and a variety of leverage options. The platform also has advanced tools and real-time market info that forex traders can use to their advantage.

On Questrade, traders can also look at commodities, options, and CFDs. With these tools, you can use more complex strategies, like hedging and betting on how prices will change. You can sell a lot of different assets on Questrade so you can reach your financial goals no matter if you are a long-term investor or a trader.

Questrade Customer Support

Questrade offers a number of ways for Questrade clients traders and users to get help with their problems. You can get in touch with the support team through live chat, email, and the phone, so users can get help in the way that works best for them. This makes it easy for buyers to quickly fix problems or get answers to questions about their accounts, which improves the overall user experience.

The extensive Frequently Asked Questions (FAQ) part and educational materials are two of the best things about Questrade’s customer service. Users can use these tools to fix common problems or learn more about the platform’s features on their own. People who want to solve their own problems without waiting for direct help will love this self-service method.

Questrade has good customer service, but some users have said that reaction times can be unpredictable, especially when the site is very busy. But the platform’s overall dedication to customer service and its many support choices make sure that most problems are fixed quickly. Questrade is known as a responsive and user-focused brokerage in part because it offers both self-help resources and direct assistance.

Advantages and Disadvantages of Questrade Customer Support

Withdrawal Options and Fees

Questrade financial group gives its users a lot of withdrawal choices to make things easier for them. Traders can get their money out of the account through an electronic funds transfer (EFT), a bank transfer, or by writing a check. The most popular way is to use an electronic funds transfer, which makes sending money directly to a Canadian brokers bank account easy and cheap.

Withdrawals through EFT don’t cost anything, which is a big plus for Canadian brokers mutual funds. Other methods, like wire transfers, charge account fees that start at $20 per transaction and vary by currency and location. It is important for traders to know about these trading fees, especially if they plan to take money often or send money to another country.

Questrade charges a currency conversion fee to clients who are not Canadian brokers or who use foreign currencies. These trading fees may change how much it costs to make withdrawals total in mutual funds. Even though Questrade has fees, its clear fee structure and variety of withdrawal choices give users who want to get to their money quickly a lot of options.

Questrade Vs Other Brokers

#1. Questrade vs AvaTrade

Questrade and AvaTrade are both good for traders, but they are for different types of dealers. Questrade is a brokerage in Canada that is known for having low trading fees and selling exchange-traded funds (ETFs) without any exchange fees. This makes it a good choice for long-term investors and traders in Canada. It lets you trade stocks, ETFs, forex, and options, among other things. Its main goals are to provide an easy-to-use tool and low prices.

If you want to trade forex or CFDs, AvaTrade is a global exchange that does both. AvaTrade lets you trade on more foreign markets and has over 1,000 assets you can buy and sell, including cryptocurrencies. It’s perfect for active traders who want advanced tools and a wide range of assets to choose from. MetaTrader 4 and MetaTrader 5 are also offered by AvaTrade. These systems are popular with forex traders because they offer advanced charting and technical analysis tools.

When you compare the two, Questrade is better for long-term investors who want to trade stocks and ETFs at low costs, while AvaTrade is better for forex and CFD traders who want more advanced tools and a wider range of assets. Every platform has its own set of tools, so traders can pick the one that best fits their wants and strategies.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

#2. Questrade vs RoboForex

Questrade and RoboForex each have their own benefits that make them better for different types of traders. Questrade, a broker based in Canada, is great for long-term buyers who want to trade stocks, ETFs, and options with low fees and no trading commissions for ETFs. Its platform is easy to use, which makes it a good choice for Canadian traders who want to use tax-advantaged accounts like RRSPs and TFSAs to build diverse portfolios.

RoboForex, on the other hand, is a global broker that focuses on forex and CFD trading. It gives you access to more markets and more ways to use leverage. RoboForex is liked by busy traders because it has low spreads, different account types, and advanced platforms such as MetaTrader 4 and MetaTrader 5. This platform also works with more assets, such as cryptocurrencies, which makes it a good choice for users who want more trading options and higher leverage.

Questrade, on the other hand, is better for investors who want to grow their money over the long term through standard assets and tax-efficient investments. RoboForex, on the other hand, is the best choice for forex and CFD traders who want advanced trading tools, leverage, and access to a larger international market. Both platforms are flexible enough to fit the needs of different traders and their trading methods.

Also Read: RoboForex Review 2024 – Expert Trader Insights

#3. Questrade vs Exness

Brokers Questrade and Exness are both well-known, but they cater to different types of buyers. There are low fees and no commissions to trade ETFs on Questrade, a site based in Canada made for long-term investors who want to trade stocks, ETFs, options, and forex. It’s especially appealing to Canadian investors who focus on low-cost investment methods and take advantage of tax-advantaged accounts like RRSPs and TFSAs.

Forex and CFD trading is what Exness does best. It is a global broker that is known for its high leverage and tight spreads. Active traders who want quick delivery and access to a lot of different currency pairs, commodities, and indices are drawn to Exness. The platform also has tools like MetaTrader 4 and MetaTrader 5, which are known for their advanced charting and trading automation features. This makes it perfect for experienced traders who want to find more complex trading chances.

Questrade is better for long-term, low-cost investing, especially for people who want to focus on stocks and ETFs. Exness, on the other hand, is better for busy forex and CFD traders who need high leverage and advanced trading tools. Each site has its own benefits that make it better for different investors and traders.

Also Read: Exness Review 2024 – Expert Trader Insights

Conclusion: Questrade Review

In conclusion, Questrade stands out as a top choice for online brokers seeking a low-cost platform with access to a wide range of assets, including stocks, ETFs, forex, and options. Its user-friendly interface, competitive fees, and commission-free ETF trading make it particularly appealing to long-term investors and online brokers looking to build diversified portfolios. Questrade’s support for tax-advantaged accounts like RRSPs and TFSAs adds significant value for Canadians focused on growing wealth efficiently.

While there are some minor drawbacks, such as inactivity fees and limited 24/7 support, Questrade’s overall balance of affordability, research tools, and flexibility make it an excellent brokerage for both beginner and experienced traders. With strong regulation and a focus on investor education, Questrade continues to be a trusted platform for those looking to take control of their investments.

Questrade Review: FAQs

How much does it cost to trade on Questrade?

Stock trades cost as low as 1 cent per share, with a minimum of $4.95 and a maximum of $9.95 per trade. ETF trading is commission-free, and other fees vary based on the assets traded.

Does Questrade offer tax-advantaged accounts?

Yes, Questrade supports tax-advantaged accounts such as RRSPs, TFSAs, and other registered accounts, allowing Canadian investors to grow their wealth tax-efficiently.

What withdrawal options does Questrade offer?

Questrade offers electronic funds transfers (EFTs), wire transfers, and check withdrawals. EFTs are free, while wire transfers may incur fees depending on the currency and destination.

OPEN AN ACCOUNT NOW WITH QUESTRADE AND GET YOUR BONUS