Quantitative tightening is a modern economic policy tool used by central banks that reign in runaway inflation and normalize the balance sheet of a nation. To date, it has never been used because economists and governments fear the effect that it will have on their economies and investors' behavior.

Also Read: What are the Different Types of Traders?

Contents

- U.S. Central Bank: The Federal Reserve System

- What is quantitative tightening?

- What is quantitative easing?

- Why is inflation problematic?

- What is a Taper Tantrum?

- Normalizing the Balance Sheet

- The U.S. Experiment with QT

- U.S. Financial History in Brief

- Key Takeaways

- FAQs

U.S. Central Bank: The Federal Reserve System

In the USA, the Federal Reserve system (the Fed), the central bank of the USA, is responsible for regulating the American economy. It is supposed to implement policies that promote high employment, sustainable economic growth, and stabilize the economy. It does this by loosening and tightening economic policy.

Its policies affect the amount of U.S. dollars in circulation, commercial bank interest rates, investor sentiment, and governmental fiscal policies. The Fed does not print money, that is the job of the U.S. Treasury. However, the Fed can create money electronically and use it to purchase assets, make loans, and fund programs intended to maintain the U.S. economy and/or correct its excesses.

Limitation of the Federal Reserve System

The Fed is run by unelected officials who have spent their lives working with monetary policy, international and domestic. Despite their years of experience and expertise in the area, the Fed is not supposed to interfere with governmental fiscal policies, favor one economic sector over another, or perform duties assigned to Congress or agencies and committees created by Congress.

Example of Potential Fed Interference in the U.S. Economy

For example, there have been complaints that the Fed has been subsidizing the housing industry by keeping interest rates low in the construction and housing development sectors. These low interest loans are funding housing development projects and purchases in a market where sales alone could not justify the rate of development and asset acquisition.

In essence, there have been allegations that the Fed is subsidizing an unsustainable housing bubble. Without the Fed's interference, many believe that the real estate market would have already corrected itself. If the Fed raises interest rates on these types of loans or withdraws its support completely, the real estate bubble will burst.

What is quantitative tightening?

Quantitative tightening is the removal of governmental stimulus and rescue programs, reduction in circulating currency, and increase in interest rates (long-term and short-term), in order to contract the nation's economy. Thus, quantitative tightening (QT) is used to cool off an overheated economy, curb inflation, normalize the nation's balance sheet, and correct economic excesses that occurred during quantitative easing (QE).

What is quantitative easing?

QE is the opposite of QT. When a nation implements QE, it is injecting money into the nation's economy, lowering interest rates, and stimulating economic activity and consumer spending. When QE is successful, it will lead to economic growth.

Over time, economic growth will result in inflation. If the inflation moves out of the 2% to 4% range, the inflation rate for a healthy sustainable economy, then the Fed may begin taking action to reduce the nation's inflation rate.

Why is inflation problematic?

Inflation refers to the decreasing buying power of the local currency. When inflation is high, consumers must spend more money to buy the same things. Since their living costs are higher, workers demand higher wages, scale back their spending, and may begin to hoard money in order to cover their living expenses. All of these activities will result in lower revenues for businesses, a shrinking economy, and may cause the nation to enter a recession or depression.

Inflation is a normal characteristic of a healthy economy. When there is high employment, high demand for goods and services, rising wages, and high levels of consumer spending, a cycle will develop.

In the cycle, the prices of goods and services increase due to greater demand. Workers then demand higher wages so that they can buy the higher priced goods and services. Also, as businesses expand their operations, they need to hire more workers, but, in an economy with high employment, they must pay higher wages to keep the workers they have and attract new workers. The higher cost of wages is passed on to consumers in the form of higher prices. This cycle continues until something disrupts it. The rise in prices that necessitates a rise in workers' wages is called inflation.

Also Read: How To Profit From Inflation? Tips You Should Know

What is a Taper Tantrum?

To reduce the inflation rate, a government will use tapering measures, also referred to as a taper tantrum. Tapering gradually reduces the balance sheet by reducing and/or halting economic stimulus programs, removing currency from circulation, and raising interest rates. It is used to enable the Fed to transition from QE to QT without shocking the economy and sending it into a recession, or, at worst, a depression. The gradual transition from loose monetary policy to tight monetary policy, when done slowly, maintains investors' confidence in the nation's economy, long-term growth, and future investment potential.

If tapering is effective in cooling off the nation's economy and curbing inflation rates, then there will be no need to implement QT. The effectiveness of tapering measures is affected by the level of economic activity, rate of growth in influential economic sectors, and the overall response of the financial system to the tapering.

Normalizing the Balance Sheet

The Fed's balance sheet lists its assets and liabilities. The liabilities are cash reserves and currency in circulation. The assets are treasury notes and bonds, corporate bonds, municipal bonds, mortgage backed securities, (MBSs), and other securities that will mature and yield interest.

Expanding the Balance Sheet

The Fed can expand and shrink its balance sheet at any time. It expands its balance sheet by injecting money into the economy. The injections are done via stimulus and rescue programs, purchase of short-term and long-term securities, and lowering of the federal funds rate, the interest rate paid on loans to commercial banks.

To increase the amount of money in circulation, it may also purchase treasury notes and bonds on the secondary market. As its notes mature, it reinvests the cash proceeds into new treasury notes and bonds with similar maturation dates.

The money from these purchases goes directly into the economy. It is used to stimulate private sector borrowing, expansion of business activities, and consumer spending. The looser monetary policy also encourages investors to funnel money into the economy. They invest in securities because they want to benefit from the potential return on their investments. Inflation is a natural consequence of looser monetary policy, more currency in circulation, economic growth, and high levels of investor confidence.

Shrinking the Balance Sheet

When QE has been too successful, the Fed will use tapering measures to curb inflation. The measures will gradually increase in severity if the desired outcomes are not achieved with more passive measures.

Direct ways to reduce the balance sheet are to decrease stimulus spending and halt rescue programs. The federal funds rate will also be increased in order to deter private sector borrowing that is used to expand commercial activity.

If the aforementioned measures don't work, then the Fed may begin to remove currency from circulation. It does this by not reinvesting the cash proceeds from its mature treasury notes and bonds. If it does not reinvest the cash proceeds the money is removed from the economy. Remember the assets and liabilities must be balanced, so the mature assets pay off the debt used to purchase them.

As more money is removed from the economy, the interest rates on long-term and short term securities will rise. The notes and bonds will have lower purchase prices but higher yields. Most importantly, the long-term notes and bonds will have higher interest rates. These higher interest rates are paid for via higher interest rates on commercial loans.

As more and more money disappears from the economy and the cost of commercial loans rises, the economy contracts and in some cases deflation may occur.

Normalization of the Balance Sheet

Normalization of the balance sheet is corrective action taken to curb excesses caused by monetary policy. When QT leads to rising inflation, tapering measures are implemented to curb the excesses. If the problem persists, more tapering measures are implemented to correct the economy. In the extreme, the central bank of the USA, the Fed, will implement QT.

To date, QT has never been implemented by any country. Most central banks fear that QT will cause drastic loss of investor confidence, markets to plummet, high unemployment and kill or stagnate the economy. Thus, when the Fed announced that it was considering QT in June 2022 to deal with the nation's rising inflation, financial markets recorded losses the next day.

The U.S. Experiment with QT

The Fed is considering implementing QT because the U.S. economy is overheated. Its fear is that if it proceeds too quickly, it will have to rapidly expand its balance sheet again to jumpstart the nation's economy. If it moves too slowly, it will kill its own economy. Runaway inflation, a devalued U.S. dollar, rapid decrease in consumer spending, loss of investor confidence, and consumer panic will also destabilize the U.S. economy.

U.S. Financial History in Brief

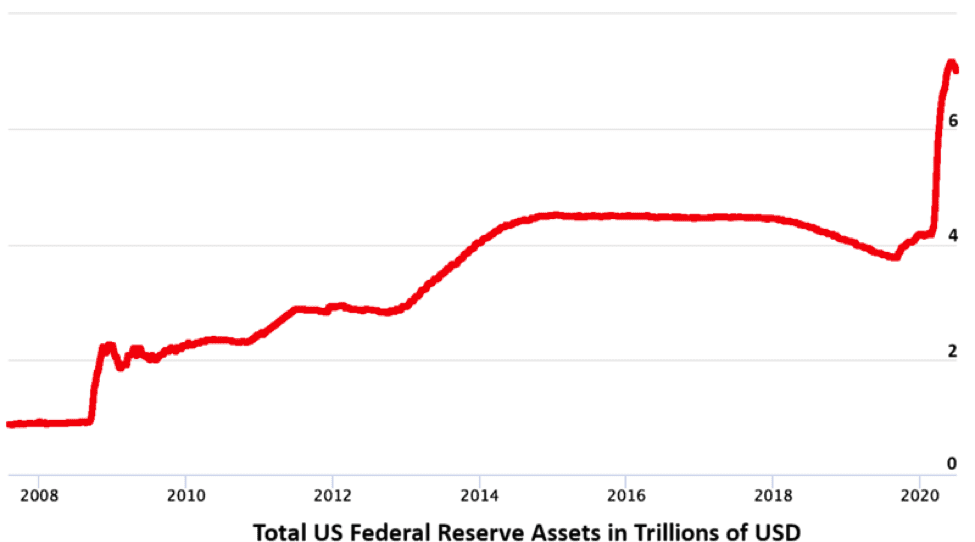

The subprime mortgage crisis plunged the U.S. into a recession for almost two years, 2008 to 2009. From 2009 to 2020 the U.S. had a bull market that was caused by the COVID-19 pandemic. The COVID-19 pandemic caused a short recession, and the Fed revived the economy with stimulus spending and low interest rates.

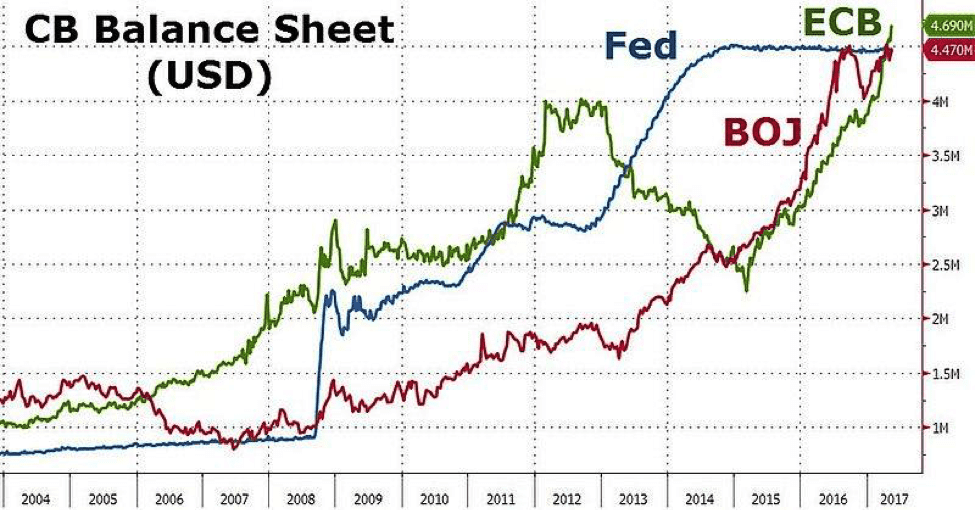

Now that inflation is climbing and there is too much money in circulation the Fed is looking for a quick way to cool the overheated economy. It is doing this while the European Central Bank (ECB) continues to expand its balance sheet, and the Japanese Central Bank (JCB) maintains its QE measures.

Key Takeaways

QT and QE are modern economic policy tools that are being tested in economies that are interconnected and suffering from lack of natural growth. Central banks are trying to keep their economies from growing too fast, too slowly, or not at all. JCB was the first to implement QE with the Fed, ECB, and Bank of England doing the same at a later time,

It seems that the USA will be the first to experiment with QT. The Fed is using tapering now and preparing investors for more tighter monetary policies to curb current market excesses. If done well, QT will not plunge the USA into a recession. If not done poorly, it may undo all the progress made from 2009 to 2020.

FAQs

Can the Federal Reserve create money?

Yes and no. The Federal Reserve cannot print money. Only the U.S. Treasury can print U.S. currency. However, it can electronically create money and use that money to purchase assets in secondary markets.

When was quantitative easing first used?

Quantitative easing was first used by Japan's central bank in 2000. Japan has been implementing QE since 2000.

It has never used quantitative tightening because Japan has really low interest rates, a stagnant economy, and its central bank accounts for almost 94% of its gross domestic product (GDP).

Why is quantitative tightening used to curb inflation?

Quantitative tightening (QT) curbs inflation by reducing the amount of currency in circulation, raising interest rates, and making it more expensive to access credit and loans. QT is used to fight the devaluation of a currency. If a currency is devalued too quickly, the nation's economy may go into recession, investors will panic, and consumers may begin to hoard cash and reduce their spending.