Brokers are always on the lookout for the best return on their investment. Using spells is a possibility for some of them. But on a serious note Quadruple Witching is not that style of trading. Traders can use the phenomenon that takes place four times a year to their advantage and make money.

Quadruple Witching Friday is a trading mechanism in the stock market. Originally, before single stock futures, on the third Friday of the month that ended the quarter. The triple witching hour would take place.

That tradition was kept and now the phenomenon takes place on the third Friday in the months: March, June, September, and December. It is frequently associated with higher trading volumes on the stock exchanges in the USA.

The reason is that before the contracts expire at the end of the day, options and futures investors must release their options and futures positions. Traders may notice a fury of investing activity if they follow the news media.

Contents

- Borrowed from Folklore

- High Trading Volume

- Increased Volatility on the Third Friday

- For Most Brokers is Business as Usual

- Trade Quadruple Witching?

- Stock Index Options and Other Derivatives

- Activity Around Stock Index Futures

- Make Calls on Stock Market Options

- Weird Single Stock Futures Prices

- Conclusion

- FAQ

Borrowed from Folklore

The term witching hour comes from folklore. It refers to people practice witchcraft for a short period, which is especially powerful. The expiration of these contracts influences the performance of the markets the trading day comes to a close. That’s why the term “witching” is thought to be appropriate.

High Trading Volume

The Quadruple Witching dates force traders to close out their trading positions across stock options, stock index futures, and stock index options on triple witching days. They can repurchase or closing out all of their options.

This market activity by the futures and option traders, often results in increased trading for that day on the stock markets in the USA.

Research about the volume of trading that is happening on Quadruple Witching days shows that it can be 50% higher when compared with a regular trading day.

Increased Volatility on the Third Friday

Based on the buying and selling dynamics and the prevailing positions, there can often be an increase in intraday volatility. The extent can depend on various factors. The number of traders that would want to offset their contracts.

The way they want to do it. Are they planning on using the so-called “long-gamma” condition where options traders go against the trend instead of hedging their positions? It can also include the events in the buildup to the Quadruple Witching day.

Keep in mind that the price instabilities are usually intraday and rarely extend to the following trading sessions.

For Most Brokers is Business as Usual

During Quadruple Witching days, there might be increased volume and volatility in certain stocks. But the overall stock market does not look different from a normal non-Quadruple Witching day. Usually, investors don’t even notice the rise in trading volume and volatility on the stock exchanges.

For them, the third Friday of every third month is just another regular day of trading.

Trade Quadruple Witching?

Most investors usually disregard Quadruple Witching days. On the other side, brokers can use exchange-traded funds (ETF) in some cases to benefit from the volatility and trading volume in the market.

If you are interested in trading on a Quadruple Witching hour you should look for professional investment advice.

Stock Index Options and Other Derivatives

Financial contracts are used to speculate on the direction of an asset or to mitigate risk. Derivatives that expire on a Quadruple Witching date.

Stock options are options contracts based on stock. A stock option contract gives the buyer the right, to buy or sell a derivative at a specified price at any date in the USA before they expire or on the expiration day in Europe.

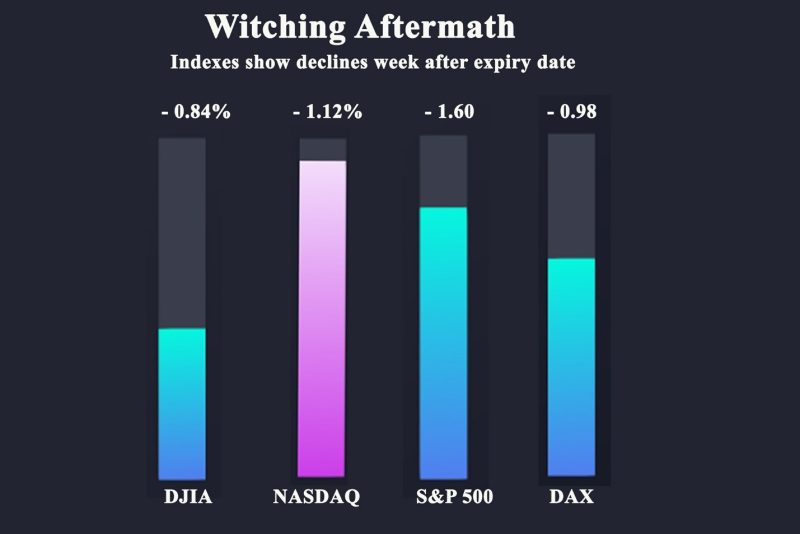

Stock index futures, known as equity index futures, are futures contracts based on a market index such as the DJIA, NASDAQ, DAX, and S&P 500. They are agreements to buy or sell the underlying asset at a specific price on a specific date.

Single stock futures are futures contracts based on a single stock. It is an agreement to buy or sell a single stock at a specific price on a specific date. They are only traded in the United States.

Stock index options are options contracts based on a market index. An options contract gives the buyer the option to buy or sell the underlying financial index at a specified price at any date before or at the expiration date. Depending on if it is traded in Europe or the USA.

Activity Around Stock Index Futures

Let’s say you are a trader who has to decide on a quad witching day. You have 5,000 shares of an illiquid stock Gama long. You have written 50 calls against the position. In effect creating a buy-write. The calls expire on the next Quadruple Witching Friday.

The day comes around, and your calls are going to expire and be worthless. A month previously you planned to roll them to the next expiration date. Unfortunately, the idea slipped your mind. The day has come and you are in a bind.

Make Calls on Stock Market Options

You decide to roll the calls over to the next quarter. You buy back your calls. Then in the following expiration you write another 50. This activity is one potential situation of trading that is happening on that day.

Many brokers find themselves in the same position. They are, rolling, closing, or letting your derivatives expire. This is not just unusually level of volume for the derivatives markets. There is a role played by the market makers.

Weird Single Stock Futures Prices

When we mentioned that Gama is illiquid. There is a good bet to be made, that market makers are on the other side of your trade. That investor is trading quantitatively. In accordance with their options pricing model. They have a motive to take on your risk.

The product of this is that they have to delta-hedge the position. This is done by purchasing a proportional number of stocks. When the delta on your calls is 0.50. In order to hedge the position, you will have to purchase 50 shares of stock per call. Market maker hedging of this style happens regularly.

When the hedging exceeds the normal daily volume. You can observe some strange price action. This is one of the reasons traders used the scary name of Quadruple Witching for this day.

The last hour of the day can make for some exciting quadruple witching hours. Past performances with individual stocks don’t bring future results.

Conclusion

If you are a derivatives trader, then Quadruple Witching days and expiration Friday, create many trading opportunities.

If you are a directional trader, then you will have to create a more extensive research to locate patterns.

It is OK to try and keep it simple. Using your regular trading plan. You can also take a day of during the four days a year that Quadruple Witching occurs.

The time and opportunities for research are limited. In most cases it is better to work on your core trading strategies, instead of running after potential edges outside of your core knowledge.

FAQ

Should you buy during quadruple witching?

Quadruple Witching days have the potential of causing chaos in the financial markets due to the expiration of the contracts of four financial assets on the same day. If you closely watch the market, you may be able to determine which securities may sell off and jump in to pick up bargains.

Is Quadruple Witching bullish or bearish?

The event is neither bullish nor bearish. Over the past decade, June Quadruple Witching days have been bullish days over 70% of the time for the DOW.

How often does quad witching happen?

Quadruple Witching days occur once every quarter. The date is set on the third Friday of March, June, September, and December.

What is AMC Quadruple Witching day?

It refers to the AMC Entertainment Holding stock that is traded on the Quadruple Witching day. These types of price moves are strange. This phenomenon happens when stocks with high short interest are often very volatile. Stock traders will often look for such stocks. The reason short interest and the price can potentially quickly rise as traders with open short positions move to cover.