Purple Trading Review

Forex brokers play a crucial role in the world of currency trading. They act as intermediaries between traders and the global currency markets, offering the necessary tools and platforms for executing trades. Choosing the right Forex broker is fundamental to a trader’s success, as it affects both the quality of the trading experience and the potential for profits. Factors like regulatory compliance, trading technology, and broker reputation significantly influence the trading outcome.

One broker that has been gaining attention is Purple Trading. This Forex broker stands out with its CySEC Cypriot regulator license, ensuring adherence to stringent financial standards. What truly sets Purple Trading apart is its use of Straight Through Processing (STP) technology, promising enhanced transparency and efficiency in trade executions. This makes Purple Trading a noteworthy consideration for traders seeking a reliable and technologically advanced trading partner.

As an expert trader and seasoned reviewer, I will delve into an in-depth analysis of Purple Trading. This review aims to provide a comprehensive look at Purple Trading, highlighting its various facets. We will examine its features, commission structure, account types, and transaction procedures, among other aspects.

What is Purple Trading?

Purple Trading is a Forex broker recognized for its strong regulatory framework and advanced technology. Licensed by the CySEC (Cyprus Securities and Exchange Commission), it adheres to strict financial regulations, ensuring a secure trading environment for its clients. The use of Straight Through Processing (STP) technology in its operations highlights its commitment to transparency and efficiency in executing trades.

Established in 2016 in Cyprus, Purple Trading has expanded its presence with tied agent offices in the Czech Republic and Slovakia. This geographic expansion reflects its growing influence in the Forex trading community. Purple Trading caters to a diverse range of trading preferences, allowing clients to engage in various trading activities.

The broker’s offerings are comprehensive, including the ability to trade different types of CFDs (Contracts for Difference) and currency pairs. It also provides opportunities for clients to buy and sell real shares of Italian companies and invest in ETFs (Exchange-Traded Funds). This variety of investment options positions Purple Trading as a versatile choice for traders with different investment strategies and goals.

Benefits of Trading with Purple Trading

Trading with Purple Trading has offered me numerous advantages, one of which is the support for various asset classes. This flexibility allows traders to diversify their portfolios across different markets, including CFDs, currency pairs, stocks, and ETFs. Such diversity is essential for managing risks and capitalizing on different market opportunities.

Another significant benefit is the accessible minimum deposit size, making it easier for traders of all levels to start trading. This feature is particularly beneficial for new traders or those looking to test the waters without committing a large amount of capital initially.

The CySEC license and regulation by authoritative EU commissions instill confidence in the safety and reliability of Purple Trading. This regulatory oversight ensures that the broker operates with transparency and adheres to strict financial standards, providing peace of mind for traders.

Additionally, the opportunity to earn passive income through PAMM accounts and invest in ETFs is a noteworthy advantage. PAMM accounts enable traders to allocate their funds to experienced managers, potentially earning returns without actively trading themselves. The inclusion of ETF investments further broadens the scope for diversified investment strategies.

Purple Trading Regulation and Safety

Understanding the regulation and safety measures of a Forex broker is crucial, as it directly impacts the security of your investments. My experience with Purple Trading has given me insight into how its regulatory framework enhances trader safety. Purple Trading is a regulated broker operated by L.F. Investment Limited, a firm granted a license by the Cyprus Securities and Exchange Commission (CySEC). This license is not just a formality; it represents a commitment to adhering to stringent financial regulations and ethical trading practices.

Moreover, Purple Trading’s registration with other European commissions, including Germany’s BaFin, further solidifies its standing as a trustworthy broker. This extensive regulatory oversight by bodies like ESMA (European Securities and Markets Authority) ensures that Purple Trading operates under some of the highest standards in the financial industry.

The safety of client funds is a top priority for Purple Trading. In the unlikely event of a bank’s bankruptcy, clients’ funds are insured up to €100,000. Additionally, as a CySEC license holder, Purple Trading is a member of the Investor Compensation Fund (ICF), which provides a safety net for retail clients. This membership guarantees the payment of insurance up to €20,000 per person, should L.F. Holding Investment Limited face financial collapse. Knowing these protective measures are in place offers significant peace of mind, ensuring that your investments with Purple Trading are secure.

Purple Trading Pros and Cons

Pros

- Funds are stored in segregated accounts at major European banks.

- Negative balance protection for leveraged products.

- Regulated by CySEC and cross border by European authorities.

Cons

- Mandatory account verification is required to trade.

- Exclusively for EU residents.

- ICF insurance is not applicable to professional traders.

Purple Trading Customer Reviews

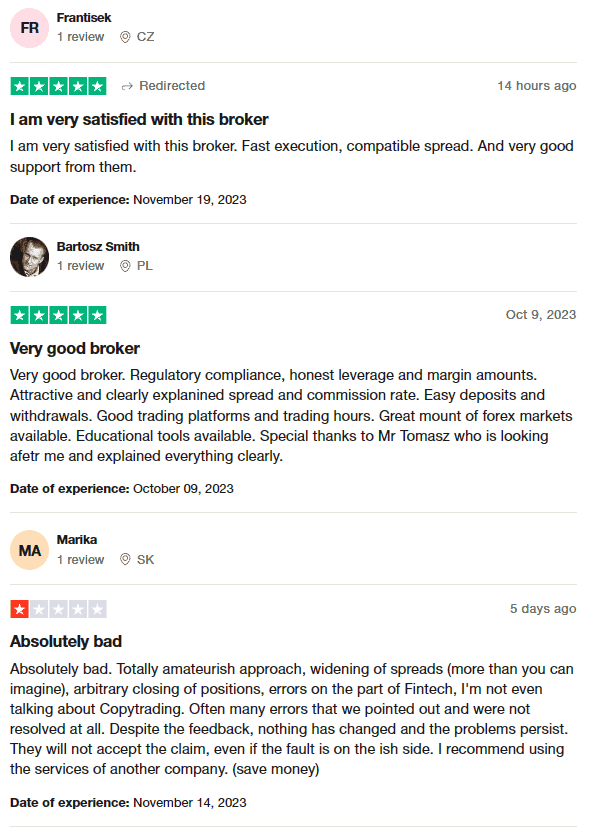

Purple Trading, a Forex broker, currently holds a 2.2-star rating on Trustpilot, reflecting mixed customer experiences. Some clients praise the broker for its fast execution, competitive spreads, and excellent support, highlighting the effectiveness of their trading platforms and the clarity of their spread and commission rates. The availability of educational tools and a wide range of foreign exchange markets, along with easy deposit and withdrawal processes, are also commended.

However, there are criticisms as well, including complaints about widening spreads, arbitrary position closures, and unresolved technical errors. Some customers have expressed dissatisfaction with the broker’s approach to issues like copy trading and claim resolution, recommending potential traders to consider other services.

Purple Trading Spreads, Fees, and Commissions

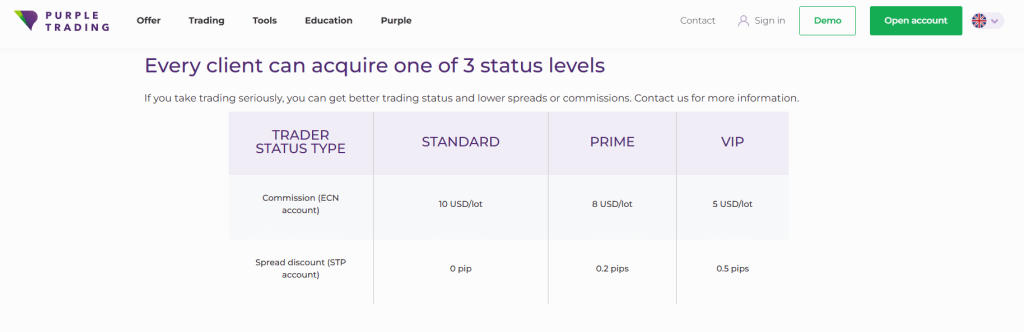

I’ve noticed that they use floating spreads across each Purple Trading account. This means the spreads vary based on market conditions, which is pretty standard in Forex trading. For those using ECN accounts, there’s an additional commission per lot. This commission depends on your trader status; for currency pairs, it might be $5, $8, or $10 per lot, which is something traders should consider when planning their trading strategies.

In terms of stock CFD trading, the costs are quite transparent. The brokerage commission is set at $0.02 for each American share and 0.1% of the transaction’s face value for other shares. If you’re trading CFDs on futures, expect a commission of $10 per lot. For those interested in real shares, the fee is 0.25% of the transaction amount.

One aspect I appreciate about Purple Trading is that they don’t charge for deposits or withdrawals, offering several free options, mostly through banks. Also, if your account is inactive for over six months, there’s a 15 EUR/USD fee charged quarterly. Lastly, they have swap fees, which are commissions for carrying a position overnight. It’s essential for traders to be aware of these fees to manage their trading costs effectively.

Account Types

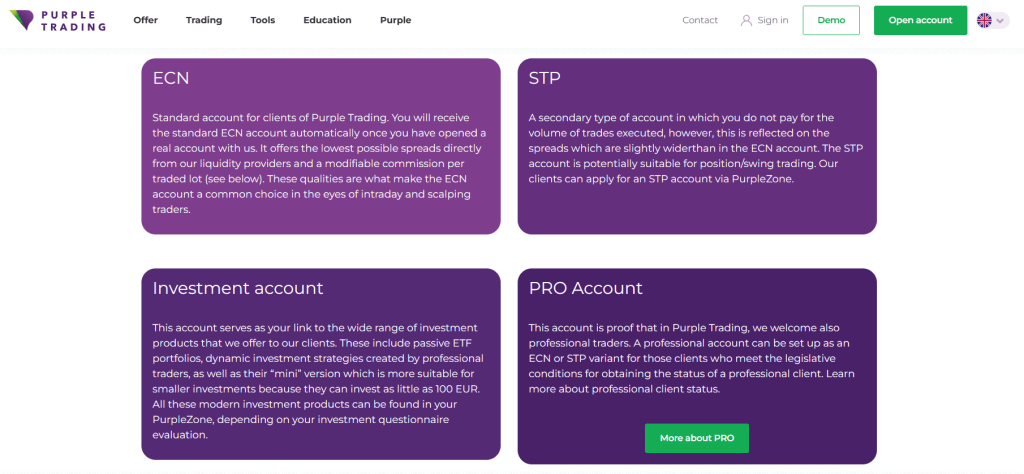

After testing the various account types offered by Purple Trading, I can provide a clear overview of each. Their account types cater to different trading preferences and strategies, making it easier for traders to choose one that fits their needs.

STP Account

- Type: Direct Market Access.

- Trading Options: All available currency pairs and CFDs, except CFDs on cryptocurrencies.

- Minimum Deposit: None

- Spreads: Vary by status.

- Starter and Standard: From 1.3 pips.

- Prime: From 1.14 pips.

- VIP: From 0.8 pips.

ECN Account

- Spreads: From 0.3 pips.

- Features: Supports cryptocurrency trading via MT4.

- Minimum Deposit: None

- Commission per Lot:

- Starter and Standard: $10.

- Prime: $8.

- VIP: $5.

PRO Account

- Eligibility: Only for Professional eligible status clients.

- Features: Trade with increased leverage, particularly on currency pairs.

- Leverage Based on Account Balance:

- Up to €10,000: Up to 1:500.

- €10,000 to €100,000: 1:200.

- Over €100,000: 1:100.

Each account type is designed to meet specific trading goals and experience levels, from the basic STP account to the more advanced ECN and PRO accounts for experienced traders seeking more leverage and tighter spreads.

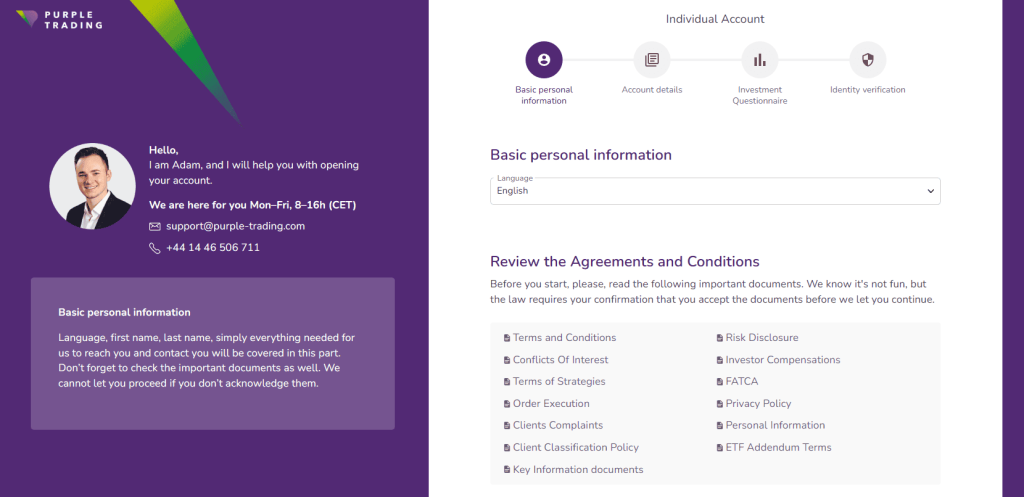

How to Open Your Account

- Visit the Purple Trading website and select ‘Open Account’.

- Complete the registration form with your first name, last name, email, country, and phone number.

- Choose the currency for your account.

- Use your email and password to log into your member’s area.

- Within the member’s area, open a new trading account.

- Make a deposit through the member’s area.

- Continue to follow the on-screen instructions to complete the account setup.

- Once your account is set up, start exploring the trading options available to you.

Trading Platforms of Purple Trading

Based on my experience, Purple Trading offers two robust trading platforms: cTrader and MetaTrader4 (MT4).

cTrader is a platform known for its intuitive interface and advanced trading capabilities. It is particularly favored by traders who appreciate detailed charting tools, one-click trading options, and algorithmic trading support. This platform is ideal for both new and experienced traders looking for a user-friendly yet comprehensive trading environment.

MetaTrader4, on the other hand, is a widely recognized platform in the Forex trading world. MT4 is renowned for its reliability, a vast array of analytical tools, and customizable features. It supports automated trading through expert advisors (EAs) and offers extensive back-testing capabilities. My use of MT4 with Purple Trading has been seamless, catering to both basic and advanced trading needs.

What Can You Trade on Purple Trading

In my experience with Purple Trading, the range of trading instruments available is quite extensive, catering to various trading preferences and strategies. Firstly, clients have the opportunity to trade a wide variety of CFDs (Contracts for Difference) and numerous currency pairs. These options provide flexibility, allowing traders to speculate on price movements in different markets without owning the underlying asset.

Apart from CFDs and Forex, Purple Trading also enables the buying and selling of real shares of Italian companies. This offers a more traditional investment avenue, particularly appealing to those looking to invest directly in the equity market. Additionally, the option to invest in ETFs (Exchange-Traded Funds) is available, which is ideal for diversifying portfolios and managing risk.

The platform doesn’t stop there; it also includes CFDs on stocks, indices, commodities, and futures, along with the increasingly popular cryptocurrencies. This variety ensures that traders have access to a broad spectrum of financial instruments, meeting the needs of both short-term traders and long-term investors. My trading experience with Purple Trading has been enriched by this diverse range of instruments, allowing for a well-rounded trading approach.

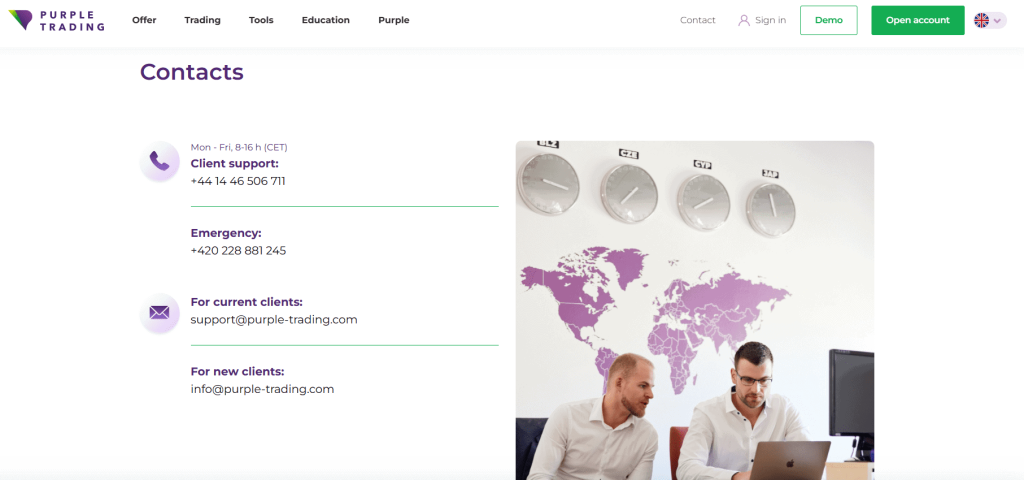

Purple Trading Customer Support

Based on my experience, Purple Trading offers a range of options for customer support, ensuring that help is readily available when needed. One of the most direct ways to get assistance is by phone, with the number conveniently listed in the Contact section on their website. This option is particularly useful for urgent inquiries or complex issues that require a detailed discussion.

For those who prefer online communication, Purple Trading provides an online chat feature on their website. This is handy for quick questions and real-time assistance during trading hours. Alternatively, you can reach out to their support team via email, which is a good option for less urgent queries or when you need to provide detailed information or attachments.

Advantages and Disadvantages of Purple Trading Customer Support

Withdrawal Options and Fees

I found their withdrawal process to be quite efficient and user-friendly. They guarantee that every withdrawal request will be processed within one working day, which is a significant advantage for traders needing quick access to their funds.

Regarding withdrawal fees, there are some costs to be aware of. Withdrawals via card incur a fee of €7 per transaction. However, internal bank transfers in Czech crowns, euros, and zloty are free of charge, which is a cost-effective option. For international transfers, the fee is 0.5% (minimum €5 and maximum €100). Notably, for withdrawals over 25,000 PLN, there’s no fee, which is beneficial for larger transactions.

The timeline for money transfers varies. Domestic transfers in Czech crowns, euros, and zloty are processed within 1-2 business days, while international transfers may take 3-5 business days. Withdrawals to cards can take between 2 to 14 business days.

As for transaction limits, you can withdraw up to PLN 25,000 at once to a local bank account, with a monthly maximum of PLN 100,000. The minimum amount for card withdrawals is €8, with the maximum being equal to the deposited amount. These limits and timelines are important for traders to consider when planning their financial transactions with Purple Trading.

Purple Trading Vs Other Brokers

#1. Purple Trading vs AvaTrade

Purple Trading, with its CySEC regulation and focus on CFDs and Forex, contrasts with AvaTrade‘s broader global reach and extensive range of financial instruments. AvaTrade, established in 2006, offers a more diverse portfolio with over 1,250 instruments and caters to a large customer base globally, except in the US. It’s heavily regulated with a strong presence in Australia, Ireland, the British Virgin Islands, and Japan.

Verdict: For traders looking for a wider range of instruments and global market access, AvaTrade might be the better choice. Purple Trading, however, offers a more focused Forex and CFD trading experience with robust European regulation.

#2. Purple Trading vs RoboForex

RoboForex, since 2009, has differentiated itself with a massive array of over 12,000 trading options and various platform choices like MetaTrader, cTrader, and RTrader. It’s known for its cutting-edge technologies and personalized trading terms. On the other hand, Purple Trading is more focused on offering straightforward trading options in Forex and CFDs.

Verdict: For traders seeking technological variety and a vast array of trading options, RoboForex is the preferable choice. Purple Trading is more suited for those who prefer a more streamlined trading experience in Forex and CFDs with European regulatory security.

#3. Purple Trading vs Exness

Exness, established in 2008, offers a wide range of CFDs, including over 120 currency pairings, stocks, metals, and energies, with a strong monthly trading volume. It is notable for its low commissions, instant order execution, and unique offer of infinite leverage on small deposits. Purple Trading, while offering a comprehensive range of CFDs and Forex options, doesn’t match the sheer volume and diversity of Exness.

Verdict: For traders seeking a wide variety of trading instruments and the option for high leverage, Exness stands out as the better option. Purple Trading, however, might appeal more to traders who prefer a focused range of instruments with a strong regulatory framework in Europe.

Conclusion: Purple Trading Review

Based on my insights and user feedback, Purple Trading emerges as a reliable Forex and CFD broker, particularly for those prioritizing regulatory security and technological efficiency. Its use of STP technology and regulation by CySEC ensure transparent and secure trading operations. The diverse range of trading instruments, including currency pairs, CFDs, and the option to invest in real Italian shares and ETFs, caters to various trading preferences.

However, it’s important to note the limitations of Purple Trading. The broker operates primarily within the EU, restricting its accessibility to a broader global audience. Additionally, the floating spreads and varied commission structures based on account types require careful consideration by potential clients. The mixed customer reviews, particularly concerning aspects like customer support and technical issues, also highlight areas where Purple Trading could improve.

Also Read: Admiral Markets Review 2024 – Expert Trader Insights

Purple Trading Review: FAQs

Is Purple Trading suitable for beginner traders?

Yes, Purple Trading’s user-friendly platforms and educational resources make it a good option for beginners.

Can I trade cryptocurrencies with Purple Trading?

Purple Trading does not offer CFDs on cryptocurrencies.

Does Purple Trading offer customer support in multiple languages?

Yes, Purple Trading provides customer support in six languages, enhancing accessibility for a diverse clientele.