Position sizing is a critical aspect of forex trading that often determines the difference between consistent profitability and significant losses. Properly managing position sizes allows traders to control risk and maximize potential returns. In this article, we will explore several effective position sizing techniques that can contribute to achieving consistent profits in forex trading.

Understanding Position Sizing

Position sizing is a fundamental concept in forex trading that holds significant importance for traders seeking consistent profits. It involves determining the appropriate amount of capital to allocate to each trade based on various factors.

The Importance of Position Sizing in Forex Trading

Position sizing is vital because it directly affects the risk-reward ratio of a trade. By carefully managing the size of each position, traders can control their exposure to potential losses and maximize their chances of achieving profits. Effective position sizing helps traders strike a balance between risk and reward, ensuring they do not risk too much on a single trade or miss out on potential gains by allocating insufficient capital.

The Relationship between Position Size, Risk, and Potential Profit

The position size chosen for a trade determines the monetary value per pip (or point) movement in the currency pair being traded. A larger position size amplifies the potential profit or loss for every pip movement, while a smaller position size limits the potential gains or losses. Traders must consider their risk tolerance, account size, and the risk-reward ratio of the trade to determine an appropriate position size. Balancing these factors allows traders to optimize their potential profits while effectively managing risk.

Impact on Overall Portfolio Management and Risk Management Strategies

Position sizing is not solely about individual trades but also plays a crucial role in overall portfolio management and risk management strategies. Traders allocate a portion of their trading capital to each trade, considering their total account equity and the desired diversification across multiple currency pairs or other assets. By effectively managing position sizes across their portfolio, traders can distribute risk and reduce the impact of potential losses from a single trade on their overall account.

Also Read: What Is Position Trading

Fixed Fractional Position Sizing

Fixed fractional position sizing is a popular and widely used technique in forex trading for managing the size of each position. It involves allocating a fixed percentage of the trading account’s equity to each trade.

The Concept of Fixed Fractional Position Sizing

Fixed fractional position sizing is based on the principle of allocating a consistent percentage of the trading account’s equity to each trade. Instead of risking a fixed dollar amount on each trade, traders determine a specific percentage of their account equity that they are willing to risk. For example, a trader may decide to risk 2% of their account equity on any given trade.

Determining the Appropriate Percentage of Account Equity to Risk per Trade

The percentage of account equity to risk per trade is a crucial decision that depends on a trader’s risk tolerance, trading strategy, and overall account management goals. It is important to strike a balance between risking enough to capture meaningful profits while also preserving capital and managing risk effectively.

Traders should consider their risk appetite, experience level, and the volatility of the currency pairs they are trading. Generally, more aggressive traders might choose a higher percentage, such as 3% or 5%, while conservative traders might opt for a lower percentage, such as 1% or 2%. It is crucial to choose a percentage that aligns with individual risk tolerance and supports consistent profitability.

The Compounding Effect of Fixed Fractional Position Sizing

One of the significant advantages of fixed fractional position sizing is its compounding effect. As the trading account equity grows or declines, the position size automatically adjusts accordingly. When trades are successful and profits accumulate, the position size increases, allowing traders to potentially benefit from compounding returns. On the other hand, if the account experiences losses, the position size decreases, limiting the impact of drawdowns.

The compounding effect of fixed fractional position sizing can accelerate account growth over time, especially when combined with consistent trading performance and effective risk management. By reinvesting profits into larger position sizes, traders can potentially enhance their overall profitability.

Adapting the Position Size as the Account Equity Grows or Declines

Fixed fractional position sizing allows traders to adapt their position sizes as the account equity changes. As the account equity grows due to profitable trades, the position size increases, allowing traders to capture a larger share of potential profits. This adjustment helps traders take advantage of favorable market conditions while managing risk in proportion to the account’s growth.

Volatility-Based Position Sizing

Volatility-based position sizing is a proper position sizing technique that takes into account the volatility of the currency pair being traded. It allows traders to adjust their position sizes based on the level of market volatility.

The Role of Volatility in Forex Trading

Volatility refers to the degree of price fluctuations or price variability of a financial instrument over a specific period. In forex trading, volatility is a crucial aspect as it directly impacts the potential profit or loss of a trade. Highly volatile currency pairs tend to exhibit larger price swings, offering greater profit opportunities but also carrying increased trade risk. Conversely, low-volatility currency pairs typically have smaller price movements, resulting in potentially smaller profits or losses.

Calculating and Understanding Volatility Indicators such as Average True Range (ATR)

Volatility indicators help traders measure and assess the level of market volatility. One commonly used volatility indicator is the Average True Range (ATR). The ATR calculates the average price range over a specific period, considering gaps and price jumps, providing insights into the current volatility of a currency pair.

Traders can use the ATR or other volatility indicators to gain a better understanding of the market conditions and gauge the potential magnitude of price movements. A higher ATR value indicates increased volatility, while a lower ATR value suggests lower volatility.

Adjusting Position Size Based on Market Volatility

Volatility-based position sizing involves adjusting the position size based on the level of market volatility. The rationale behind this approach is to align the position size with the potential risk associated with volatile market conditions.

When the market is highly volatile, the potential for larger price movements and increased risk is higher. In such cases, traders may consider reducing their position sizes to mitigate the potential impact of sharp price fluctuations. By decreasing the position size during high volatility, traders can limit potential losses while maintaining exposure to the market.

Using Volatility-Based Position Sizing to Adapt to Different Currency Pairs or Market Conditions

Different currency pairs and market conditions exhibit varying levels of volatility. Volatility-based position sizing enables traders to adapt their position sizes accordingly. Some currency pairs may be inherently more volatile, while others may be more stable.

Risk-Adjusted Position Sizing

Risk-adjusted position sizing is a position sizing technique that focuses on managing risk by aligning position sizes with individual risk tolerance and establishing appropriate stop-loss levels for each trade. It involves calculating the position size based on the distance between the entry price and the predetermined stop-loss level.

Defining Risk Tolerance and Risk Appetite

Risk tolerance refers to the level of risk that an individual trader is willing to accept. It is influenced by factors such as trading experience, financial goals, and personal comfort with potential losses. Risk appetite, on the other hand, reflects a trader’s willingness to take on more significant risks for the possibility of higher returns.

Establishing a Stop-Loss Level for Each Trade

A stop-loss level is a predetermined price level at which a trader exits a trade to limit potential losses. Setting a stop-loss order is a crucial risk management tool as it helps protect trading capital and prevents substantial drawdowns. Traders should determine their stop-loss levels based on technical analysis, support and resistance levels, or other predetermined criteria.

Calculating Position Size Based on the Distance between Entry and Stop-Loss Levels

Once the stop-loss level is determined, traders can calculate the position size based on the desired risk per trade. The risk per trade is typically defined as a percentage of the trading account equity that a trader is willing to risk on a single trade. For example, a trader may decide to risk 2% of their account equity on each trade.

Managing Risk Exposure by Adjusting Position Size to Align with Acceptable Levels of Risk

Risk-adjusted position sizing allows traders to manage their risk exposure by adjusting position sizes to align with acceptable levels of risk. If the calculated position size exceeds the trader’s risk tolerance, they can reduce the proper position size to bring it within their comfort zone. This adjustment ensures that position sizes are not excessively large, reducing the potential impact of losses.

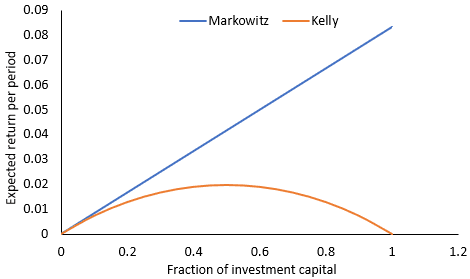

The Kelly Criterion

The Kelly Criterion is a mathematical formula that helps traders determine the optimal position size based on their win rate and risk-reward ratio. It provides a systematic approach to position sizing that aims to maximize long-term growth while managing risk. Here’s a brief exploration of the key aspects of the Kelly Criterion:

Understanding the Principles and Calculations behind the Kelly Criterion

The Kelly Criterion was developed by John L. Kelly Jr., a mathematician, in the 1950s. It is based on the concept of maximizing the expected logarithmic growth rate of capital. The formula takes into account the probability of winning trades, the probability of losing trades, and the risk-reward ratio.

The Kelly Criterion formula is as follows: Kelly % = (W – (1 – W)) / R Where:

- W represents the win rate (the probability of a winning trade)

- R represents the risk-reward ratio (the ratio of the potential profit to the potential loss)

The resulting Kelly % represents the percentage of the trading account equity that should be allocated to each trade.

Utilizing the Kelly Criterion to Determine Optimal Position Size

The Kelly Criterion helps traders determine the optimal position size based on their win rate and risk-reward ratio. By plugging in the respective values into the formula, traders can calculate the percentage of their trading account equity that should be risked on each trade.

Monte Carlo Simulation

Monte Carlo simulation is a statistical technique used to model and analyze the uncertainty and variability of outcomes in a system. In the context of forex trading, Monte Carlo simulation can be employed to evaluate the performance of position sizing techniques and assess the robustness of trading strategies.

Overview of Monte Carlo Simulation and Its Applications in Forex Trading

Monte Carlo simulation involves generating multiple random simulations based on probabilistic inputs to analyze the range of potential outcomes. In forex trading, Monte Carlo simulation can be applied to assess the effectiveness of different position sizing techniques and understand the distribution of potential returns.

Generating Multiple Simulations with Varying Position Sizes to Assess Strategy Performance

In Monte Carlo simulation for forex trading, traders generate multiple simulations by randomly selecting position sizes from a specified range. These simulations represent various scenarios that reflect the potential outcomes of the trading strategy under different position sizing conditions.

Analyzing the Distribution of Outcomes to Evaluate the Robustness of Position Sizing Techniques

One of the key benefits of Monte Carlo simulation is that it allows traders to assess the robustness of their position sizing techniques. By analyzing the distribution of outcomes across the simulations, traders can evaluate the probability of achieving various levels of returns and assess the associated risks.

Using Monte Carlo Simulation Results to Fine-Tune Position Sizing Strategies

The insights gained from the Monte Carlo simulation can be used to fine-tune position sizing strategies. Traders can adjust their position sizing techniques based on the analysis of the simulations, aiming to optimize risk management and enhance the probability of consistent profits.

Also Read: Position Size Calculator

Conclusion

Position sizing techniques play a crucial role in achieving consistent profits in forex trading. By employing appropriate position sizing methods, such as fixed fractional sizing, volatility-based sizing, risk-adjusted sizing, the Kelly Criterion, and Monte Carlo simulation, traders can effectively manage risk, maximize returns, and maintain consistency in their trading performance.

It is essential to choose position sizing techniques that align with individual trading goals, risk tolerance, and market conditions. Regular evaluation and adjustment of position sizing techniques based on performance analysis will further contribute to long-term success in forex trading.

Frequently Asked Questions

Why is position sizing important in forex trading?

Position sizing is crucial in forex trading because it determines the amount of account risk limit taken on each trade relative to the trading account size. It helps manage risk, optimize capital allocation, and ensure consistency in trading performance.

How do I determine the appropriate position size in forex trading?

The appropriate position size can be determined by considering factors such as risk tolerance, account equity, stop-loss level, and desired risk per trade.

Can I adjust my position size as my account equity grows or declines?

Yes, it is advisable to regularly review and adjust position sizes as your account equity changes. As your account grows, you may consider increasing position sizes to capitalize on larger profit potential.