Plus500 Review FAQs

Is Plus500 legit?

Yes, Plus500 is a legitimate online broker that has professional accounts and is regulated by reputable financial authorities such as the UK Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). Plus500 also offers negative balance protection to clients, which means that traders can never again lose money when trading for more than their account balance. Additionally, Plus500 is a publicly traded company, with its shares listed on the London Stock Exchange, providing additional transparency and accountability.

Plus500's platform is also secured using SSL encryption, which ensures that all communication between the trader's browser and the server is encrypted and secure. This helps protect against cyberattacks and ensures that traders' personal and financial information is kept confidential. Overall, Plus500's regulation, negative balance protection, and SSL encryption provide a level of security and legitimacy for traders looking to invest in the financial markets. Retail traders are authorised financial services provider for retail cfd accounts. The retail cfd accounts have the minimum deposit of bank account for cyprus securities and also have a demo account balance.

Is my money safe with Plus500?

Plus500 is a UK-based online broker that is authorized and regulated by the Financial Conduct Authority (FCA) in the UK. This means that Plus500 must adhere to strict rules and regulations to ensure the safety of its clients' funds. Plus500 also segregates clients' funds from its own operating funds and holds them in separate bank accounts, which ensures that clients' funds are protected in the event of Plus500's insolvency.

Furthermore, Plus500 provides negative balance protection, which means that clients' accounts cannot go below zero, protecting them from potential losses exceeding their account balance. Overall, Plus500 is a safe and reliable broker for trading financial instruments, and its regulatory compliance and fund segregation measures provide a level of assurance for clients' funds. However, investing in financial instruments always carries some level of risk, and it's important to thoroughly research and understand the risks involved before making any investment decisions.

How long does Plus500 withdrawal take?

The processing time for a withdrawal request on Plus500 can vary depending on various factors such as the payment method, account verification status, and regulatory requirements. Typically, it takes around 1-3 business days for Plus500 to process a withdrawal request, after which the funds will be transferred to the client's account using the same payment method that was used for the deposit.

Some payment providers may have their own processing times that can affect the overall withdrawal time. It's always a good idea to check with Plus500's customer support team or the payment provider for more information on the specific withdrawal processing times for your account and payment method to prevent from some high risk of losing money rapidly.

Plus500 Customer Support

Plus500 offers customer support through various channels to assist traders with their queries and concerns. Here are the different customer support options provided by Plus500:

Email Support: Traders can send an email to Plus500's customer support team to receive help with their queries. The support team usually responds within 24 hours. The email address for customer support is support@plus500.com.

Live Chat: Plus500 offers a live chat feature on its website, which allows traders to chat with a customer support representative in real-time. This is a quick and convenient way to get help with any issues or questions.

Phone Support: Plus500 also provides phone support for traders who prefer to speak with a representative over the phone. The phone support is available 24/7 and can be accessed from different countries.

FAQ Section: Plus500 has an extensive FAQ section on its website that covers a wide range of topics related to the trading experience, account management, and technical issues. Traders can find answers to common questions in this section without having to contact customer support.

Advantages and Disadvantages of Plus500 Customer Support

Security for Investors

Security is an important consideration for investors when choosing a cfd broker to trade with. As investor accounts lose money in cfd trading. Here are the advantages and disadvantages of security for investors.

Withdrawal Options and Fees

Plus500 offers several withdrawal options for traders to withdraw their funds from their trading accounts. The available options include bank transfer, credit/debit card, and electronic wallets such as PayPal and Skrill. Plus500 is authorized and regulated by several top-tier financial monetary authority Here are some important details about Plus500's withdrawal options:

- Bank Transfer: Plus500 allows traders to withdraw money or trading fees to their bank accounts. The minimum withdrawal amount for bank transfers is $100, and the processing time can take up to 5 business days. There are no withdrawal fees for bank transfers. You can also check your bank statement for account details and economic calendar for cfd trading.

- Credit/Debit Cards: Plus500 allows traders to withdraw funds to their credit or debit cards. The minimum withdrawal amount for cards is $50, and the processing time is usually 1-3 business days. There are no withdrawal fees for card withdrawals.

- Electronic Wallets: Plus500 supports popular e-wallets such as PayPal and Skrill for withdrawals. The minimum withdrawal amount for e-wallets is $50, and the processing time is usually 1-2 business days. There are no withdrawal fees for e-wallet withdrawals.

It's worth noting that Plus500 requires traders to withdraw funds using the same payment method that was used to deposit funds into their trading accounts. This is to prevent for high risk of investor accounts to lose money when trading or from money laundering and fraud. Forex trading cfds are used as a seychelles financial services authority for proprietary trading platforms.

Plus500 Vs Other Brokers

Plus500 is one of the leading online CFD brokers, offering traders a wide range of trading instruments, competitive spreads, and user-friendly trading platforms. Here's how Plus500 compares to other popular brokers:

#1. Plus500 vs Avatrade

Plus500 and AvaTrade are both reputable online brokers that offer a range of trading instruments and user-friendly platforms. Here's how they compare:

Trading Instruments: Plus500 offers a wider range of trading instruments, including more than 2,000 CFDs, compared to AvaTrade's selection of around 1,000 instruments. Plus500 also offers more cryptocurrencies, which can be attractive to traders interested in this asset class.

Spreads and Fees: Both brokers offer competitive spreads, but Plus500 charges lower commissions on share CFD trades compared to AvaTrade. Plus500 also does not charge any deposit or withdrawal fees retail investor accounts, while AvaTrade charges trading fees for certain payment methods. It also prevent money for the high risk of losing investor accounts lose money laundering and fraud.

Regulation and Security: Both brokers are regulated by reputable financial authorities, with Plus500 being authorized and supervised by the UK FCA, while AvaTrade is regulated by the Central Bank of Ireland and other authorities. Both brokers also offer negative balance protection to clients.

Plus500 is a better choice for traders due to its wider range of tradable instruments, no commissions, proprietary trading platform, mobile trading app, and risk management tools, it's important to emphasize that the decision between the two platforms ultimately depends on the platform quality and demand. Forex trading cfds are used as a seychelles financial services authority for proprietary futures trading platforms.

#2. Plus500 vs Roboforex

Plus500 and RoboForex are both reputable online brokers that offer a range of trading instruments and user-friendly platforms. Here's how they compare:

Trading Instruments: Plus500 offers a wider range of trading instruments, including more than 2,000 CFDs, compared to RoboForex's selection of around 40 currency pairs, metals, and cryptocurrencies. Plus500 also offers more cryptocurrencies, which can be attractive to traders interested in this asset class. Retail traders are authorised financial services provider for retail cfd accounts.

Spreads and Fees: Both brokers offer competitive spreads, but Plus500 charges lower commissions on share CFD trades compared to RoboForex. Plus500 also does not charge any deposit or withdrawal fees exchange commission, or trading fees, while RoboForex charges fees exchange commission and trading fees for certain payment methods.

Regulation and Security: Plus500 is regulated by reputable financial authorities such as the UK FCA, while RoboForex is regulated by the financial sector and the International Financial Services Commission of Belize. Plus500 also offers negative balance protection to clients.

Overall, Plus500 is a better choice than Roboforex because Plus500 is known for its user-friendly interface, which makes it easy for beginners to navigate and start trading. The platform is intuitive and features a simple design, which can be helpful if you're new to trading. Many mobile trading platform are available for beginner traders for trading experience.

#3. Plus500 vs Alpari

Plus500 and Alpari are both reputable online brokers that offer a range of trading instruments and user-friendly platforms. Here's how they compare:

Trading Instruments: Plus500 offers a wider range of trading instruments, including more than 2,000 CFDs, compared to Alpari's selection of around 60 currency pairs and CFDs with this provider. Plus500 also offers more cryptocurrencies, which can be attractive to traders interested in this asset class.

Spreads and Fees: Both brokers offer competitive spreads, but Plus500 charges lower commissions on share CFD trades compared to Alpari. Plus500 also does not charge any deposit or withdrawal fees, while Alpari charges fees for certain payment methods.

Regulation and Security: Plus500 is regulated by reputable financial authorities such as the UK FCA, while Alpari is regulated by the Financial Services Commission of Belize. Plus500 also offers negative balance protection to clients.

Overall, Plus500 is a better choice for traders looking for a wider range of trading instruments and lower commissions on share CFDs, while Alpari is a better choice for traders who prioritize a wider range of trading account types.

Conclusion: Plus500 Review

Plus500 is a reputable online broker that offers a wide range of trading instruments, competitive spreads, and a user-friendly trading platform. The broker is regulated by reputable financial authorities such as the UK FCA and offers negative balance protection to clients, providing a level of security for investors. Plus500 also does not charge any deposit or withdrawal fees, which can be a significant cost savings for traders.

Plus500's trading platform is intuitive and easy to navigate, making it suitable for both beginner traders and traders. The platform offers a range of advanced charting tools and technical indicators, allowing traders to perform technical analysis and make informed trading decisions. Additionally, the broker offers a range of risk management tools, including stop loss and take profit orders, as well as guaranteed stop loss orders for an additional fee.

One potential downside of Plus500 is that it offers limited research and educational resources compared to other brokers. Additionally, while the broker offers a range of trading instruments, it may not be suitable for traders looking for specific instruments or more advanced trading features. Overall, Plus500 is a solid choice for traders looking for a user-friendly platform, a wide range of trading instruments, and competitive pricing.

Plus500 Review FAQs

Is Plus500 legit?

Yes, Plus500 is a legitimate online broker that has professional accounts and is regulated by reputable financial authorities such as the UK Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). Plus500 also offers negative balance protection to clients, which means that traders can never again lose money when trading for more than their account balance. Additionally, Plus500 is a publicly traded company, with its shares listed on the London Stock Exchange, providing additional transparency and accountability.

Plus500's platform is also secured using SSL encryption, which ensures that all communication between the trader's browser and the server is encrypted and secure. This helps protect against cyberattacks and ensures that traders' personal and financial information is kept confidential. Overall, Plus500's regulation, negative balance protection, and SSL encryption provide a level of security and legitimacy for traders looking to invest in the financial markets. Retail traders are authorised financial services provider for retail cfd accounts. The retail cfd accounts have the minimum deposit of bank account for cyprus securities and also have a demo account balance.

Is my money safe with Plus500?

Plus500 is a UK-based online broker that is authorized and regulated by the Financial Conduct Authority (FCA) in the UK. This means that Plus500 must adhere to strict rules and regulations to ensure the safety of its clients' funds. Plus500 also segregates clients' funds from its own operating funds and holds them in separate bank accounts, which ensures that clients' funds are protected in the event of Plus500's insolvency.

Furthermore, Plus500 provides negative balance protection, which means that clients' accounts cannot go below zero, protecting them from potential losses exceeding their account balance. Overall, Plus500 is a safe and reliable broker for trading financial instruments, and its regulatory compliance and fund segregation measures provide a level of assurance for clients' funds. However, investing in financial instruments always carries some level of risk, and it's important to thoroughly research and understand the risks involved before making any investment decisions.

How long does Plus500 withdrawal take?

The processing time for a withdrawal request on Plus500 can vary depending on various factors such as the payment method, account verification status, and regulatory requirements. Typically, it takes around 1-3 business days for Plus500 to process a withdrawal request, after which the funds will be transferred to the client's account using the same payment method that was used for the deposit.

Some payment providers may have their own processing times that can affect the overall withdrawal time. It's always a good idea to check with Plus500's customer support team or the payment provider for more information on the specific withdrawal processing times for your account and payment method to prevent from some high risk of losing money rapidly.

Position in Rating | Overall Rating | Trading Terminals |

2nd  | 4.8 Overall Rating |  |

Plus500 Review

Plus500 is a well-known online trading platform that offers a wide range of financial instruments such as stocks, forex, cryptocurrencies, and more. Founded in 2008, Plus500 has become one of the most popular trading platforms in the world, with millions of users across Europe, Asia, and Australia. Plus500 is known for its user-friendly trading platform, which allows traders to easily access a wide range of financial instruments and execute trades with just a few clicks.

Plus500 is regulated by several reputable financial markets authority, including the UK's Financial Conduct Authority (FCA), which ensures that trading environment the platform adheres to strict security and transparency standards. In this review, we will examine all these aspects and more, so that you can make an informed decision about whether Plus500 is the right trading platform for you.

What is Plus500?

Plus500 is an online trading platform that allows users to trade a variety of financial instruments, including CFDs (Contracts for Difference) on forex, stocks, commodities, and cryptocurrencies. Plus500 is headquartered in Israel and is regulated by several top-tier financial sector, including the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC).

The platform is available in over 50 countries and supports multiple languages, making it accessible to traders around the world. The user interface of Plus500 is user-friendly and easy to navigate, making it a popular choice of trading environment for both novice and experienced traders.

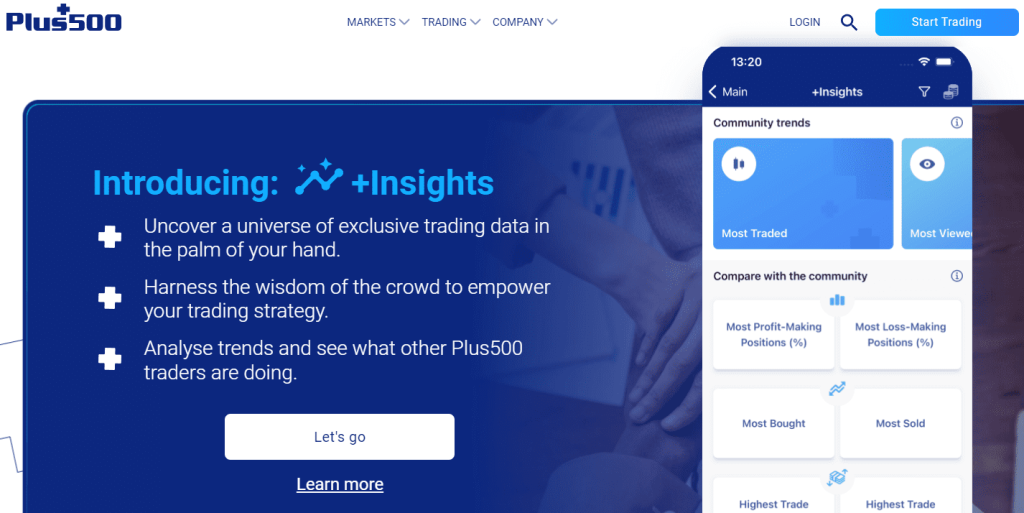

Plus500 offers a range of tools and features to help traders make informed trading decisions, including real-time charts, various and economic calendar calendars, and news feeds. The platform also offers a demo account, allowing users to practice trading without risking real money.

Advantages and Disadvantages of Trading with Plus500

Benefits of Trading with Plus500

Trading with Plus500 offers several benefits for traders, including:

- Access to a Wide Range of Financial Instruments: Plus500 offers a variety of financial instruments, including CFDs on forex, stocks, commodities, and cryptocurrencies. This allows traders to diversify their portfolios and take advantage of opportunities across multiple markets.

- Low Trading Costs: Plus500 charges no commission on trades and offers competitive spreads on popular instruments. This means that traders can keep their trading costs low and maximize their profits.

- Regulated Platform: Plus500 is authorized and regulated by several top-tier financial monetary authority, including the FCA in the UK and ASIC in Australia. This regulatory oversight gives traders confidence in the security and safety of their funds.

- Negative Balance Protection: Plus500 offers negative balance protection, which ensures that traders can never lose more than their account balance. The retail cfd accounts have the minimum deposit of bank account for cyprus securities and also have a demo account balance.

Plus500 Pros and Cons

Here are the Plus500 Pros and Cons.

Pros

- User-friendly platform

- Low trading costs

- Wide range of financial instruments

- Regulated platform.

Cons

- Limited educational resources for beginners

- Limited research tools for advanced traders

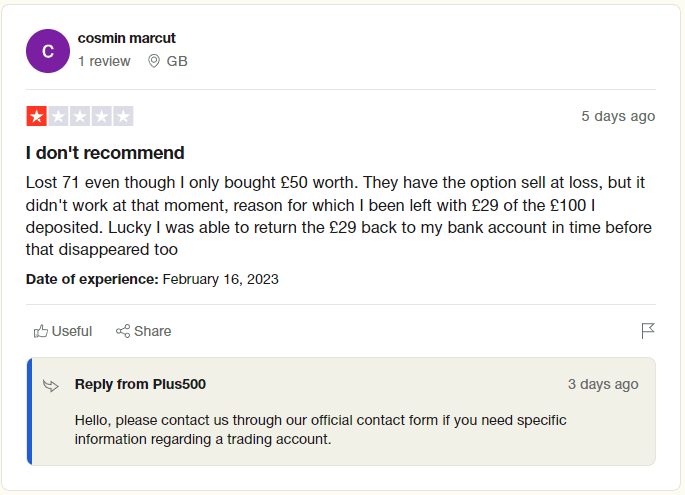

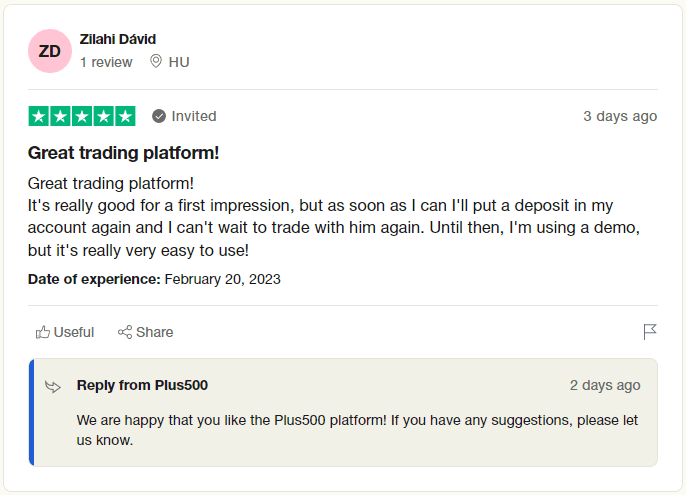

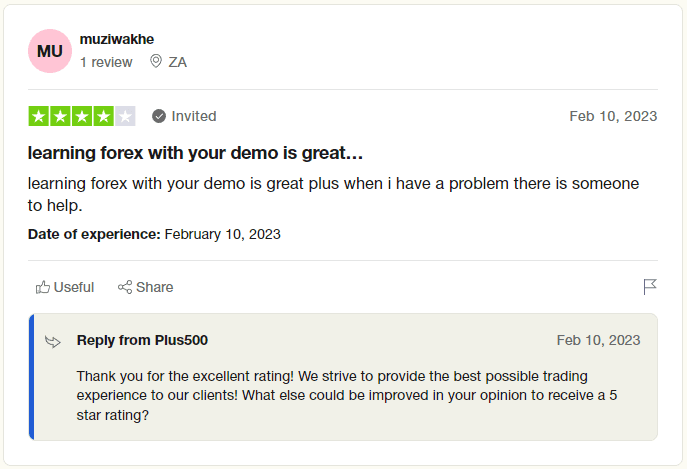

Plus500 Customer Reviews

Customer reviews for Plus500 are mixed. Some customers praise the platform's user-friendly interface, low fees, and wide range of financial instruments. They also appreciate the platform's regulatory oversight and focus on security and safety. Other customers, however, criticize the platform's limited educational resources and research tools.

Some customers have also reported issues with the platform's customer support, particularly with regards to resolving technical issues. Overall, customer reviews suggest that while Plus500 offers many benefits for traders, there is room for improvement in certain areas, particularly in terms of education and customer support.

Plus500 Spreads, Fees, and Commissions

Plus500 is a popular online trading platform that allows users to trade a variety of financial services provider, such as stocks, forex, commodities, and cryptocurrencies. When trading on Plus500, users may encounter three types of charges: spreads, fees, and commissions.

- Spreads: The spreads offered by Plus500 can vary depending on the asset being traded, market conditions, and other factors. However, in general, the spreads are relatively competitive compared to other CFD brokers. For example, the typical spread on major Forex pairs like EUR/USD and USD/JPY is 0.8 pips, while the spread on popular stocks like Apple and Amazon is 0.23% and 0.21%, respectively.

- Fees: Plus500 charges a few fees, such as overnight funding fees, inactivity fees, and currency conversion fees. Overnight funding fees are charged on positions held overnight and are based on the underlying instrument's interest rate. Inactivity fees are charged if you don't log in to your account for a certain period.

- Commissions: Plus500 does not charge a commission on trades. Instead, it makes money through the spread. You can also use retail investor accounts for proprietary trading platform.

Account Types

Plus500 is a leading provider of online trading services that offers a variety of account types to suit the needs of different traders. These accounts include:

Demo Account

A demo account is a practice account that allows traders to learn and test trading strategies without risking real money. Plus500 offers a free demo account that traders can use to get familiar with the trading platform and try out different trading strategies.

Standard Account

A standard account is the most common type of account offered by Plus500. This account allows traders to trade a wide range of financial instruments, including forex, stocks, commodities, and cryptocurrencies. The minimum deposit for a standard account is $100, and traders can access maximum leverage, of up to 1:30.

Professional Account

A professional account is designed for experienced traders, who meet certain criteria, such as having a significant trading history or high trading volumes. This account offers higher leverage of up to 1:300 and lower margin requirements. Professional traders can also access additional features, such as negative balance protection and priority customer support.

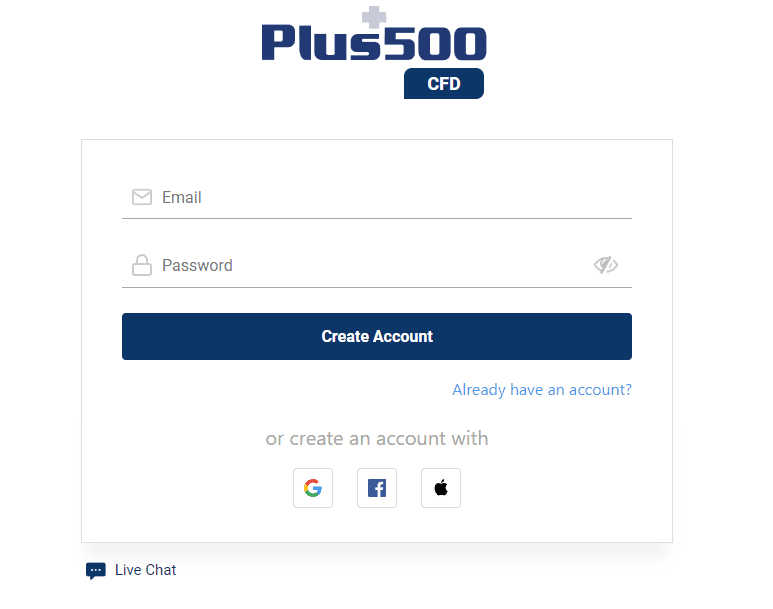

How To Open Your Account?

Opening an account on Plus500 is a simple and straightforward process. Here are the steps to follow:

Visit the Plus500 website

Go to the Plus500 website and click on the “Start Trading Now” button.

Fill in the registration form

Fill in the registration form with your personal information, including your name, email address, and phone number.

Verify your Identity

You will need to verify your identity by providing a valid form of ID, such as a passport or driver's license. You can upload your documents directly on the website or via email.

Fund your account

Once your account is verified, you can fund it with a minimum deposit of $100. Plus500 offers a variety of payment options, including credit cards, bank account and e-wallets.

Start trading

Once your account is funded, you can start trading a wide range of financial instruments, including forex, stocks, commodities, and cryptocurrencies.

What Can You Trade on Plus500?

Plus500 is a leading online trading platform that offers a wide range of financial instruments for traders to trade. Here are some of the markets that traders can access on Plus500:

- Forex: Plus500 offers a comprehensive selection of forex currency pairs, including major, minor, and exotic pairs. Traders can access leverage of up to 1:30 on forex trades.

- Stocks: Plus500 offers a wide range of stocks from global markets, including the US, Europe, Asia, and Australia. Traders can take long or short positions on stocks and access leverage of up to 1:5. London stock exchange is also a famous Trading cfds.

- Commodities: Plus500 allows traders to trade a variety of commodities, including gold, silver, oil, and natural gas. Traders can access leverage of up to 1:20 on commodity trades. You can also use retail investor accounts for proprietary trading platform.

- Cryptocurrencies: Plus500 offers a range of popular cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple. Traders can access leverage of up to 1:2 on cryptocurrency trades.

Plus500 Customer Support

Plus500 offers customer support through various channels to assist traders with their queries and concerns. Here are the different customer support options provided by Plus500:

Email Support: Traders can send an email to Plus500's customer support team to receive help with their queries. The support team usually responds within 24 hours. The email address for customer support is support@plus500.com.

Live Chat: Plus500 offers a live chat feature on its website, which allows traders to chat with a customer support representative in real-time. This is a quick and convenient way to get help with any issues or questions.

Phone Support: Plus500 also provides phone support for traders who prefer to speak with a representative over the phone. The phone support is available 24/7 and can be accessed from different countries.

FAQ Section: Plus500 has an extensive FAQ section on its website that covers a wide range of topics related to the trading experience, account management, and technical issues. Traders can find answers to common questions in this section without having to contact customer support.

Advantages and Disadvantages of Plus500 Customer Support

Security for Investors

Security is an important consideration for investors when choosing a cfd broker to trade with. As investor accounts lose money in cfd trading. Here are the advantages and disadvantages of security for investors.

Withdrawal Options and Fees

Plus500 offers several withdrawal options for traders to withdraw their funds from their trading accounts. The available options include bank transfer, credit/debit card, and electronic wallets such as PayPal and Skrill. Plus500 is authorized and regulated by several top-tier financial monetary authority Here are some important details about Plus500's withdrawal options:

- Bank Transfer: Plus500 allows traders to withdraw money or trading fees to their bank accounts. The minimum withdrawal amount for bank transfers is $100, and the processing time can take up to 5 business days. There are no withdrawal fees for bank transfers. You can also check your bank statement for account details and economic calendar for cfd trading.

- Credit/Debit Cards: Plus500 allows traders to withdraw funds to their credit or debit cards. The minimum withdrawal amount for cards is $50, and the processing time is usually 1-3 business days. There are no withdrawal fees for card withdrawals.

- Electronic Wallets: Plus500 supports popular e-wallets such as PayPal and Skrill for withdrawals. The minimum withdrawal amount for e-wallets is $50, and the processing time is usually 1-2 business days. There are no withdrawal fees for e-wallet withdrawals.

It's worth noting that Plus500 requires traders to withdraw funds using the same payment method that was used to deposit funds into their trading accounts. This is to prevent for high risk of investor accounts to lose money when trading or from money laundering and fraud. Forex trading cfds are used as a seychelles financial services authority for proprietary trading platforms.

Plus500 Vs Other Brokers

Plus500 is one of the leading online CFD brokers, offering traders a wide range of trading instruments, competitive spreads, and user-friendly trading platforms. Here's how Plus500 compares to other popular brokers:

#1. Plus500 vs Avatrade

Plus500 and AvaTrade are both reputable online brokers that offer a range of trading instruments and user-friendly platforms. Here's how they compare:

Trading Instruments: Plus500 offers a wider range of trading instruments, including more than 2,000 CFDs, compared to AvaTrade's selection of around 1,000 instruments. Plus500 also offers more cryptocurrencies, which can be attractive to traders interested in this asset class.

Spreads and Fees: Both brokers offer competitive spreads, but Plus500 charges lower commissions on share CFD trades compared to AvaTrade. Plus500 also does not charge any deposit or withdrawal fees retail investor accounts, while AvaTrade charges trading fees for certain payment methods. It also prevent money for the high risk of losing investor accounts lose money laundering and fraud.

Regulation and Security: Both brokers are regulated by reputable financial authorities, with Plus500 being authorized and supervised by the UK FCA, while AvaTrade is regulated by the Central Bank of Ireland and other authorities. Both brokers also offer negative balance protection to clients.

Plus500 is a better choice for traders due to its wider range of tradable instruments, no commissions, proprietary trading platform, mobile trading app, and risk management tools, it's important to emphasize that the decision between the two platforms ultimately depends on the platform quality and demand. Forex trading cfds are used as a seychelles financial services authority for proprietary futures trading platforms.

#2. Plus500 vs Roboforex

Plus500 and RoboForex are both reputable online brokers that offer a range of trading instruments and user-friendly platforms. Here's how they compare:

Trading Instruments: Plus500 offers a wider range of trading instruments, including more than 2,000 CFDs, compared to RoboForex's selection of around 40 currency pairs, metals, and cryptocurrencies. Plus500 also offers more cryptocurrencies, which can be attractive to traders interested in this asset class. Retail traders are authorised financial services provider for retail cfd accounts.

Spreads and Fees: Both brokers offer competitive spreads, but Plus500 charges lower commissions on share CFD trades compared to RoboForex. Plus500 also does not charge any deposit or withdrawal fees exchange commission, or trading fees, while RoboForex charges fees exchange commission and trading fees for certain payment methods.

Regulation and Security: Plus500 is regulated by reputable financial authorities such as the UK FCA, while RoboForex is regulated by the financial sector and the International Financial Services Commission of Belize. Plus500 also offers negative balance protection to clients.

Overall, Plus500 is a better choice than Roboforex because Plus500 is known for its user-friendly interface, which makes it easy for beginners to navigate and start trading. The platform is intuitive and features a simple design, which can be helpful if you're new to trading. Many mobile trading platform are available for beginner traders for trading experience.

#3. Plus500 vs Alpari

Plus500 and Alpari are both reputable online brokers that offer a range of trading instruments and user-friendly platforms. Here's how they compare:

Trading Instruments: Plus500 offers a wider range of trading instruments, including more than 2,000 CFDs, compared to Alpari's selection of around 60 currency pairs and CFDs with this provider. Plus500 also offers more cryptocurrencies, which can be attractive to traders interested in this asset class.

Spreads and Fees: Both brokers offer competitive spreads, but Plus500 charges lower commissions on share CFD trades compared to Alpari. Plus500 also does not charge any deposit or withdrawal fees, while Alpari charges fees for certain payment methods.

Regulation and Security: Plus500 is regulated by reputable financial authorities such as the UK FCA, while Alpari is regulated by the Financial Services Commission of Belize. Plus500 also offers negative balance protection to clients.

Overall, Plus500 is a better choice for traders looking for a wider range of trading instruments and lower commissions on share CFDs, while Alpari is a better choice for traders who prioritize a wider range of trading account types.

Conclusion: Plus500 Review

Plus500 is a reputable online broker that offers a wide range of trading instruments, competitive spreads, and a user-friendly trading platform. The broker is regulated by reputable financial authorities such as the UK FCA and offers negative balance protection to clients, providing a level of security for investors. Plus500 also does not charge any deposit or withdrawal fees, which can be a significant cost savings for traders.

Plus500's trading platform is intuitive and easy to navigate, making it suitable for both beginner traders and traders. The platform offers a range of advanced charting tools and technical indicators, allowing traders to perform technical analysis and make informed trading decisions. Additionally, the broker offers a range of risk management tools, including stop loss and take profit orders, as well as guaranteed stop loss orders for an additional fee.

One potential downside of Plus500 is that it offers limited research and educational resources compared to other brokers. Additionally, while the broker offers a range of trading instruments, it may not be suitable for traders looking for specific instruments or more advanced trading features. Overall, Plus500 is a solid choice for traders looking for a user-friendly platform, a wide range of trading instruments, and competitive pricing.

Plus500 Review FAQs

Is Plus500 legit?

Yes, Plus500 is a legitimate online broker that has professional accounts and is regulated by reputable financial authorities such as the UK Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). Plus500 also offers negative balance protection to clients, which means that traders can never again lose money when trading for more than their account balance. Additionally, Plus500 is a publicly traded company, with its shares listed on the London Stock Exchange, providing additional transparency and accountability.

Plus500's platform is also secured using SSL encryption, which ensures that all communication between the trader's browser and the server is encrypted and secure. This helps protect against cyberattacks and ensures that traders' personal and financial information is kept confidential. Overall, Plus500's regulation, negative balance protection, and SSL encryption provide a level of security and legitimacy for traders looking to invest in the financial markets. Retail traders are authorised financial services provider for retail cfd accounts. The retail cfd accounts have the minimum deposit of bank account for cyprus securities and also have a demo account balance.

Is my money safe with Plus500?

Plus500 is a UK-based online broker that is authorized and regulated by the Financial Conduct Authority (FCA) in the UK. This means that Plus500 must adhere to strict rules and regulations to ensure the safety of its clients' funds. Plus500 also segregates clients' funds from its own operating funds and holds them in separate bank accounts, which ensures that clients' funds are protected in the event of Plus500's insolvency.

Furthermore, Plus500 provides negative balance protection, which means that clients' accounts cannot go below zero, protecting them from potential losses exceeding their account balance. Overall, Plus500 is a safe and reliable broker for trading financial instruments, and its regulatory compliance and fund segregation measures provide a level of assurance for clients' funds. However, investing in financial instruments always carries some level of risk, and it's important to thoroughly research and understand the risks involved before making any investment decisions.

How long does Plus500 withdrawal take?

The processing time for a withdrawal request on Plus500 can vary depending on various factors such as the payment method, account verification status, and regulatory requirements. Typically, it takes around 1-3 business days for Plus500 to process a withdrawal request, after which the funds will be transferred to the client's account using the same payment method that was used for the deposit.

Some payment providers may have their own processing times that can affect the overall withdrawal time. It's always a good idea to check with Plus500's customer support team or the payment provider for more information on the specific withdrawal processing times for your account and payment method to prevent from some high risk of losing money rapidly.