PipFarm Review

PipFarm is a proprietary trading firm offering traders a chance to trade with firm capital, minimizing their own financial risk. The firm provides various funding plans, enabling traders to scale up based on performance rather than personal investment. With a focus on forex and crypto trading, PipFarm appeals to those seeking both flexibility and growth.

PipFarm’s account types include evaluation phases that test a trader’s consistency and profitability before offering full funding. These phases ensure traders meet necessary standards to handle real market conditions. The firm’s trading rules, such as drawdown limits, help in managing risk effectively, making it a suitable choice for disciplined traders.

An appealing feature of PipFarm is its competitive profit split, allowing traders to retain a substantial share of their earnings, motivating them toward consistent growth. With a user-friendly platform and supportive resources, PipFarm makes the trading experience accessible to traders of various skill levels.

What is PipFarm?

PipFarm is a proprietary trading firm where traders use the firm’s capital to trade instead of their own, reducing their financial risk. The firm offers several funding plans, allowing traders to grow based on performance without heavy personal investment. This structure appeals to forex and crypto traders looking for both flexibility and potential growth.

To qualify, PipFarm requires traders to pass evaluation phases that measure consistency and profitability before providing full funding. These evaluations ensure traders are prepared for real market conditions. The firm sets trading rules, like drawdown limits, to manage risk and support disciplined trading.

A key feature of PipFarm is its profit split model, where traders retain a significant portion of their earnings. This setup encourages consistent performance, while the platform’s user-friendly interface and support resources make PipFarm accessible for traders at different skill levels.

PipFarm Regulation and Safety

PipFarm is a proprietary trading firm that offers traders the opportunity to manage firm capital, reducing their personal financial risk. The firm provides various funding plans, enabling traders to scale their accounts based on performance rather than personal investment. With a focus on forex and cryptocurrency trading, PipFarm appeals to those seeking flexibility and growth.

PipFarm‘s account types include evaluation phases that test a trader’s consistency and profitability before offering full funding. These phases ensure traders meet necessary standards to handle real market conditions. The firm’s trading rules, such as drawdown limits, help in managing risk effectively, making it a suitable choice for disciplined traders.

An appealing feature of PipFarm is its competitive profit split, allowing traders to retain a substantial share of their earnings, motivating them toward consistent growth. With a user-friendly platform and supportive resources, PipFarm makes the trading experience accessible to traders of various skill levels. It is a simulated trading evaluation firm, mainly focused on Forex trading, even though it offers a substantial list of other instruments that you can trade with.

PipFarm Pros and Cons

Pros

- Single Evaluation

- High Profit Target Split

- Flexible Strategies

- Advanced Platform

Cons

- Limited Assets

- Evaluation Fee

- No Stock Trading

- Inactivity Rule

Benefits of Trading with PipFarm

PipFarm offers traders several practical benefits. One of the key advantages is its single-stage evaluation process, which makes it easier for traders to qualify for funding. This streamlined approach helps traders focus on performance without going through multiple assessment stages.

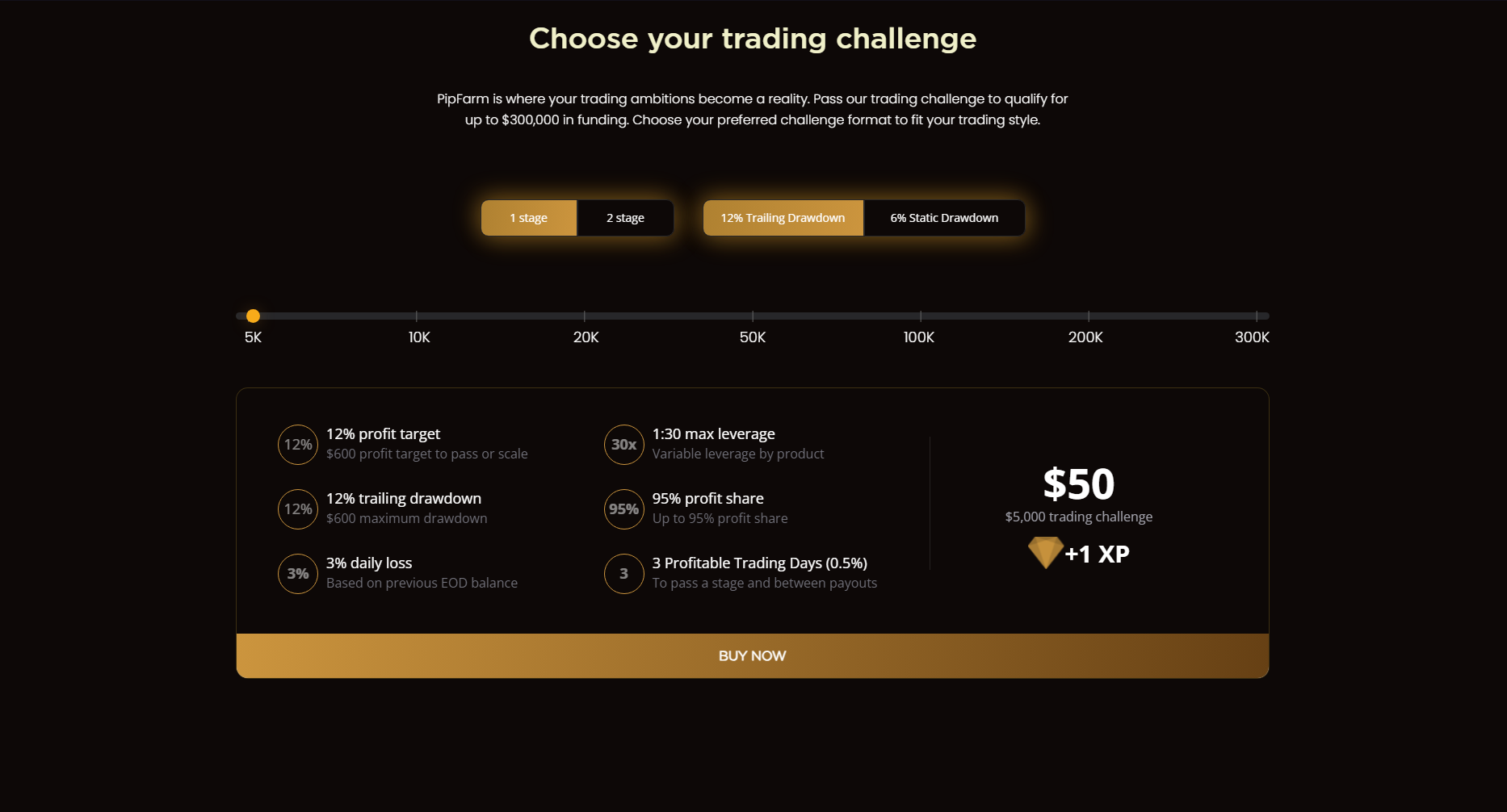

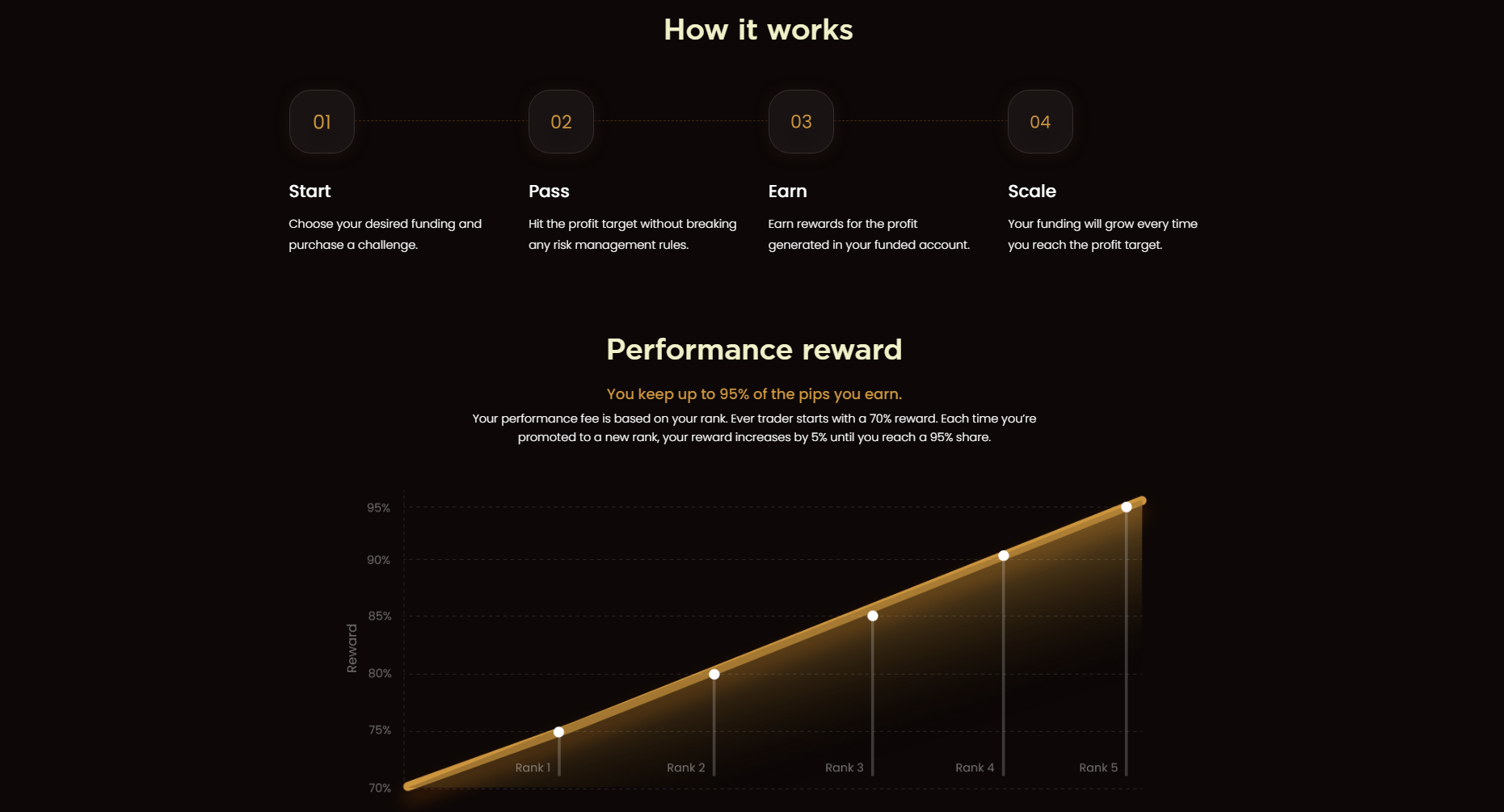

PipFarm provides a competitive profit-sharing model, starting at 70% and potentially increasing to 95% as traders gain more experience and achieve profit target through its XP program. This allows traders to keep a larger portion of their profits, encouraging consistent and profitable trading behavior.

The firm offers flexible trading conditions, permitting strategies like news trading and holding positions overnight or during weekends. This flexibility helps traders adapt to different market situations without restrictive rules.

PipFarm also has a scaling program, which allows traders to grow their account size by 50% every 30 trading days, up to five levels. This makes it possible for successful traders to significantly increase their capital over time and achieve their preferred profit target.

The platform used by PipFarm is cTrader, known for its advanced features and ease of use. This ensures that traders have access to tools that can enhance their trading experience and efficiency. Overall, PipFarm is a solid choice for those looking to grow their trading careers under a supportive system.

PipFarm Customer Reviews

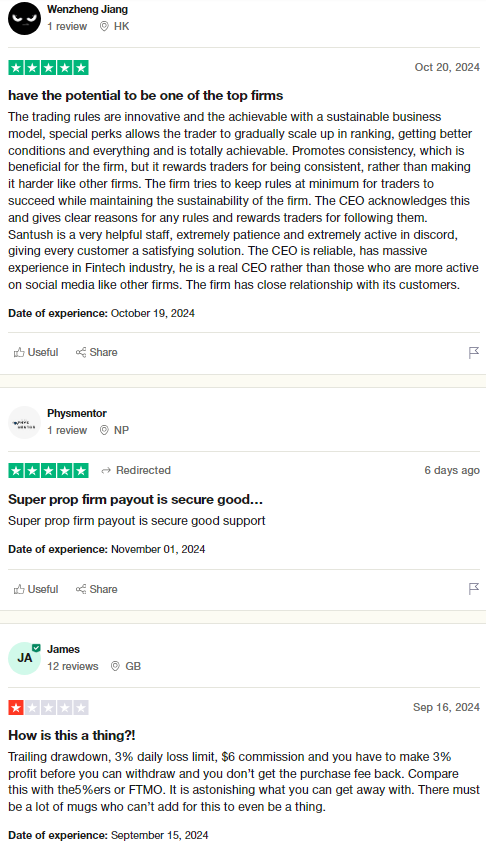

PipFarm has received generally positive customer reviews. On Trustpilot, PipFarm holds a rating of 4.6 out of 5, with most users awarding 5 stars. Customers appreciate the streamlined evaluation process and competitive profit-sharing model, seeing these as essential benefits for traders aiming to grow.

Many users highlight PipFarm‘s supportive trading environment and flexible conditions, which make it easier for traders to adapt to market demands. Reviews suggest that PipFarm‘s commitment to trader development and clear rules make it a popular choice among traders. These positive experiences underline PipFarm‘s reputation as a reliable and user-centered platform.

The prop firm PipFarm provided actually helps the customers on their trading journey. Especially on the risk management, PipFarm customer’s actually vouched them for good proprietary trading firms. Using the advanced trading tools and innovative trading platform, funded traders achieved their profit targets with minimal trading fees with no maximum loss.

PipFarm Spreads, Fees, and Commissions

PipFarm provides competitive spreads, fees, and commissions to make trading more affordable. For major forex pairs, spreads start from as low as 0.1 to 0.2 pips, offering a cost-effective trading environment. The firm charges a standard commission of $6 per lot round turn, which can be reduced to $3 or eliminated through its XP program, benefiting experienced traders.

A one-time evaluation fee applies for each account type, ranging from $60 for a $5,000 account to $1,100 for a $200,000 account. PipFarm does not charge recurring fees, inactivity fees, or any fees on deposits and withdrawals, helping traders manage their costs more effectively. This transparent fee structure is designed to support traders at various experience levels.

Account Types

PipFarm offers various account types designed to suit traders at different experience levels and risk appetites. Each account type provides unique features and requirements, allowing traders to find the best fit for their trading goals. Below is an overview of each account type offered by PipFarm.

Evaluation Account

The Evaluation Account is PipFarm‘s entry-level option, allowing traders to demonstrate their consistency and profitability. Traders must pass a single-stage evaluation process to qualify for firm funding. This account helps PipFarm assess a trader’s skills under real market conditions.

Funded Account

After successfully completing the evaluation phase, traders are moved to the Funded Account. This account type provides access to PipFarm’s capital, allowing traders to trade with minimal personal financial risk. Traders keep a percentage of their profits based on PipFarm’s profit-sharing model.

Scaling Account

The Scaling Account is for traders who have consistently performed well and are looking to expand their capital. PipFarm increases the account size by a specified percentage every 30 trading days, up to certain limits. This account allows successful traders to grow their trading capital gradually.

Demo Account

The Demo Account is a practice account designed for traders who want to explore PipFarm‘s platform and tools without financial risk. It mirrors real trading conditions, allowing users to develop and test strategies before moving to live accounts.

Funded account is good for traders who’s into online trading industry. The risk management for this account is easy to manage since funded account is great for both expert and beginners. Pipfarm is actually one of the few prop firms that offers the members a profit share of up to 90%, although traders might see a few prop firms that offers more that but the security, trading instrument, and risk management PipFarm can provide in the prop trading industry is good.

How to Open Your Account

Opening an account with PipFarm is designed to be a simple process, making it easy for traders to get started. Each step guides the user through setting up their account and choosing the best trading path to fit their needs. Below are the steps to open an account with PipFarm.

Step 1: Visit the PipFarm Website

To begin, visit the official PipFarm website. Navigate to the account registration page, where you’ll find the different account types and funding options available.

Step 2: Choose Your Account Type

Select the account type that aligns with your trading goals, such as the Evaluation Account or Demo Account. Each option comes with specific requirements and benefits, so choose based on your experience level and objectives with PipFarm.

Step 3: Complete the Registration Form

Fill out the registration form with your personal information, including your full name, email address, and preferred account type. This information helps PipFarm set up your account and tailor the experience to your needs.

Step 4: Submit Payment for Evaluation (If Required)

If you are opting for an Evaluation Account, pay the one-time evaluation fee based on your selected funding level. This fee covers the evaluation process, which determines your eligibility for funded trading with PipFarm.

Following these steps ensures a smooth account setup process with PipFarm, allowing traders to start their journey with firm capital and support for growth in the trading world.

PipFarm Trading Platforms

PipFarm uses the cTrader platform, recognized for its advanced features and ease of use. cTrader allows traders to customize their workspaces, adjusting layouts, color schemes, and chart configurations to fit their preferences. This flexibility supports both manual and automated trading through cBots, giving traders a range of options for strategy execution.

The platform includes over 70 technical indicators, enabling traders to analyze markets thoroughly. Available on desktop, web, and mobile devices, cTrader makes account management accessible across different platforms. By using cTrader exclusively, PipFarm provides traders with a reliable and efficient trading environment designed to enhance their trading experience.

What Can You Trade on PipFarm

PipFarm offers traders a diverse range of instruments across multiple asset classes, enabling them to implement various trading strategies. This variety allows traders to diversify their portfolios and capitalize on different market opportunities. Below is an overview of the available trading options on PipFarm.

Forex

PipFarm provides access to major, minor, and exotic currency pairs, allowing traders to participate in the global foreign exchange market. This includes popular pairs like EUR/USD, GBP/JPY, and AUD/CHF, facilitating strategies based on currency fluctuations.

Commodities

Traders can engage with commodities such as precious metals and energies. PipFarm offers instruments like gold (XAU/USD), silver, and crude oil, enabling traders to speculate on commodity price movements.

Indices

PipFarm offers trading on major global indices, including the S&P 500, FTSE 100, and DAX. This allows traders to speculate on the performance of a group of stocks representing a specific market segment.

Cryptocurrencies

For those interested in digital assets, PipFarm provides access to popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP). This enables traders to participate in the volatile cryptocurrency markets.

By offering these diverse trading instruments, PipFarm caters to a wide range of trading preferences and strategies, supporting traders in achieving their financial objectives.

PipFarm Customer Support

PipFarm offers 24/7 customer support through live chat, email, and Discord, ensuring traders can access assistance at any time. The support team is well-trained to handle various issues, providing prompt and effective solutions. This round-the-clock availability is particularly beneficial for traders engaging in markets that operate beyond standard business hours. Additionally, PipFarm maintains an active community on Discord, where traders can share experiences and seek advice, fostering a collaborative environment. This comprehensive support system enhances the overall trading experience, making PipFarm a reliable choice for traders seeking consistent and accessible assistance.

Advantages and Disadvantages of PipFarm Customer Support

Withdrawal Options and Fees

PipFarm offers traders multiple withdrawal options to access their earnings efficiently. The firm does not charge fees for withdrawals, ensuring that traders receive their full profits. Below are the available withdrawal methods provided by PipFarm.

PayPal

Traders can use PayPal for withdrawals, benefiting from its widespread acceptance and user-friendly interface. This option is suitable for those who prefer electronic payment systems.

Skrill

Skrill is another e-wallet option available for withdrawals. It offers quick processing times and is favored by traders who utilize online payment platforms.

Binance Pay

For those who prefer cryptocurrency transactions, PipFarm supports Binance Pay. This method allows for secure and swift transfers, catering to traders comfortable with digital currencies.

USDT (Tether)

PipFarm also facilitates withdrawals via USDT, a stablecoin pegged to the US dollar. This option provides stability and is ideal for traders who prefer cryptocurrency transactions without exposure to volatility.

By offering these diverse withdrawal methods without additional fees, PipFarm ensures that traders can access their funds conveniently and cost-effectively.

PipFarm Vs Other Brokers

#1. PipFarm vs AvaTrade

PipFarm and AvaTrade differ in their approach and offerings. PipFarm is a proprietary trading firm that provides traders with firm capital after a single-stage evaluation, allowing traders to focus on forex and crypto with minimal risk to personal funds. PipFarm operates on the cTrader platform, which is known for its advanced features and customization options. AvaTrade, on the other hand, is a traditional online broker offering a wider range of assets, including stocks, commodities, and indices, in addition to forex and crypto. AvaTrade supports various platforms, including MetaTrader 4 and MetaTrader 5, catering to different trading styles. While PipFarm has a competitive profit split model, AvaTrade earns primarily through spreads and overnight fees, with traders bearing full financial risk on their trades.

Verdict: PipFarm suits traders who want to trade with firm capital and focus on forex and crypto with limited risk, while AvaTrade is better for traders looking to invest in a broader range of assets and are comfortable with a traditional brokerage model. Both offer valuable resources, but their trading conditions and structures cater to different trading preferences.

#2. PipFarm vs RoboForex

PipFarm and RoboForex cater to different trader needs. PipFarm is a proprietary trading firm that provides traders with firm capital after a single-stage evaluation, allowing them to trade forex and cryptocurrencies without risking personal funds. It operates exclusively on the cTrader platform, known for its advanced features and user-friendly interface. In contrast, RoboForex is a traditional online broker offering a broader range of assets, including stocks, commodities, and indices, alongside forex and cryptocurrencies. RoboForex supports multiple platforms, such as MetaTrader 4, MetaTrader 5, and its proprietary R StocksTrader, accommodating various trading styles. While PipFarm offers a profit-sharing model where traders keep a significant portion of their earnings, RoboForex generates revenue through spreads and commissions, with traders bearing full financial responsibility for their trades.

Verdict: PipFarm is ideal for traders seeking to trade with firm capital and focus on forex and cryptocurrencies, minimizing personal financial risk. RoboForex suits traders interested in a wider array of assets and who prefer traditional brokerage services, accepting full financial responsibility for their trading activities.

#3. PipFarm vs Exness

PipFarm and Exness serve different trader profiles. PipFarm is a proprietary trading firm offering traders the opportunity to manage firm capital after passing a single-stage evaluation, focusing primarily on forex and cryptocurrencies. It operates exclusively on the cTrader platform, known for its advanced features and user-friendly interface. In contrast, Exness is a traditional online broker providing a broader range of assets, including forex, commodities, cryptocurrencies, and indices. Exness supports multiple platforms, such as MetaTrader 4 and MetaTrader 5, catering to various trading styles. While PipFarm offers a profit-sharing model where traders retain a significant portion of their earnings, Exness generates revenue through spreads and commissions, with traders bearing full financial responsibility for their trades.

Verdict: PipFarm is ideal for traders seeking to trade with firm capital and focus on forex and cryptocurrencies, minimizing personal financial risk. Exness suits traders interested in a wider array of assets and who prefer traditional brokerage services, accepting full financial responsibility for their trading activities.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: PipFarm Review

PipFarm presents a well-rounded option for traders interested in proprietary trading with firm capital. Its single-stage evaluation process, competitive profit-sharing, and flexible trading conditions make it accessible and appealing to traders at various experience levels. By using the advanced cTrader platform, PipFarm ensures that traders have robust tools and a user-friendly interface to enhance their trading.

Customer support is available 24/7, with additional community support through Discord, giving traders access to assistance and shared knowledge. Overall, PipFarm stands out as a reputable choice for traders seeking growth opportunities, cost-effective trading conditions, and a supportive environment for their trading journey.

PipFarm Review: FAQs

What is the evaluation process for funding?

PipFarm requires traders to pass a single-stage evaluation that tests consistency and profitability. This step ensures traders meet standards before receiving full funding.

What profit-sharing model does PipFarm offer?

Traders start with a 70% profit share, which can increase to 95% through PipFarm’s XP program as they demonstrate consistent performance.

Are there any fees for trading with PipFarm?

PipFarm charges a one-time evaluation fee based on account size but does not charge recurring fees, inactivity fees, or fees on deposits and withdrawals.

OPEN AN ACCOUNT NOW WITH PIPFARM AND GET YOUR BONUS