DeFi investors have been starting to focus on PancakeSwap as of late, and the attention received by the elusive Binance Smart Chain is beginning to rival standard DEX options such as SushiSwap and Uniswap. The question many are asking, is if the hype is warranted and what makes PancakeSwap so appealing?

Being a Binance Smart Chain decentralized exchange, PancakeSwap is a big competitor of Ethereum.

What makes things more curious, is that the Binance Smart Chain blockchain is a product of Binance, the biggest global centralized crypto exchange. Meaning that Binance, thanks to PancakeSwap is effectively going head-to-head with Ethereum and Uniswap, a couple of distinct cryptocurrency establishments.

But the full scope of the intrigue is not limited to the previously mentioned fact, because PancakeSwap can outperform Binance if the exchange volume increases. These details are fun to ponder, but the reality is PancakeSwap is currently the biggest DeFi protocol. That’s why it’s a priority for new investors to learn how the PancakeSwap functions.

The guide we are offering will provide fundamental elements about the dynamic of a decentralized exchange. Plus, how the liquidity protocol works, and the best option to profit from them.

Also Read: Binance Review 2022 Uncovered

Contents

- What Is Pancakeswap?

- How does PancakeSwap Work?

- PancakeSwap vs. SushiSwap vs. Uniswap

- Token for Revenue Sharing

- Affordable and Speedy Transactions

- Farming Liquidity Provider Tokens

- Gamified Exchange Experience

- How to Use PancakeSwap

- Transfering Crypto Coin from Your Wallet

- Add Liquidity Pool

- Choose Farming Pool

- Staking on PancakeSwap

- PancakeSwap DEX

- Binance Bridge

- Providing Liquidity to PancakeSwap

- Working With PancakeSwap Syrup Pools

- Playing the PancakeSwap Lottery

- Initial Farm Offering

- Yield Farming on PancakeSwap

- Is PancakeSwap Better than Uniswap?

- Is PancakeSwap Exchange Safe to Use?

- Conclusion

- FAQs

What Is Pancakeswap?

Pancakeswap enables the swapping of BEP-20 tokens. BEP-20 is a Binance token standard that has to get observed on the Binance Smart Chain. And the acronym represents Binance Smart Chain Evolution Proposal.

When other token standards, should be transferable on PancakeSwap, there is a requirement to be enveloped in the BEP-20 standard for the exchange.

The largest attraction for investors is the fact they are using a compliantly decentralized exchange that automatically processes trades and orders via smart contracts.

It’s a new addition to the market, after it made its debut in September of 2020, by a team of developers that prefers to stay away from the spotlight. But this is no reason for concern, considering that blockchain security companies regularly audit the platform.

PancakeSwap implements an automated market maker model (AMM). Every trade occurs counter a liquidity pool, and when trading digital assets, no order book is present, where investors get matched with someone else.

How does PancakeSwap Work?

PancakeSwap uses a propitiatory token called CAKE, which gets implemented in various ways in the platform.

A few of the options include:

- PancakeSwap staking

- Yield Farming

- Voting on Governance Proposals

- PancakeSwap Lottery

It is clear the CAKE token is very practical. But let’s have a closer inspection of other aspects of PancakeSwap Finance.

Users, basically perform trades on the platform by collecting liquidity from a single or multiple liquidity pools that get restored following the finalization of the trade.

Putting in liquidity on PancakeSwap is a process whereby members of the platform, add liquidity to pools, this gets performed by the member that possesses assets in a wallet like Binance Smart Wallet.

Trades happening in this palace take liquidity from one segment of the pool and offer it to another in turn altering the pool from the aspect of relative values.

The pools of liquidity are replenished by members of the platform that lock tokens via smart contracts. The effect of this is that transactions happen between the trader and liquidity pool.

When an investor performs an exchange, they get required to pay a commission, and a percentage of that is given to the providers of the liquidity. With a segment going to budget for the project, plus buybacks of CAKE and burn proposals.

That way members of the platform can exchange tokens and get rewards. What fascinates many trades is that registration is not necessary, but also verification. This expedites the process of getting started on the platform. At the same time provides anonymity for users.

The positive aspect is that the fees are on a lower scale, and the transactions are faster if contrasted to exchanges based on the Ethereum network.

When planning to perform a transaction, there is no need to move every token to an account the exchange, the only thing needed is to work with a cryptocurrency wallet that’s supported.

There are several options to generate extra cash with the platform, mostly through a lottery, staking, and yield farming.

PancakeSwap makes it possible for users to purchase tokens in the initial phase of a project before the public launch. Offering more excitement for investors that may want to participate in the projects from the start, and capture larger returns at a later date.

PancakeSwap vs. SushiSwap vs. Uniswap

The current landscape in the cryptocurrency market gets dominated by 3 decentralized exchanges.

- Uniswap: This is the DeFi liquidity protocol created on Ethereum. It’s the go-to platform for investors searching for an easy method for trading cryptocurrency with ERC-20 tokens and ETH pairs.

- PancakeSwap : This is a clone of Uniswap created on BSC to offer speedy and cheap trades with BEP-20 tokens.

- SushiSwap: It’s a community-governed Uniswap that developed into a DeFi hub providing crypto borrowing, token swaps, and farming.

All three are nearly identical, with community governance, liquidity provider, and yield farming opportunities, but only PancakeSwap and Sushi pay rewards to holders of tokens that are staking tokens.

Token for Revenue Sharing

CAKE holders that stake tokens get SYRUP, allowing holders to get paid in CAKE. This is similar to what holders of SUSHI that stake tokens receive, more precisely an xSUSHI, and a form of sharing revenue that is produced by protocols transaction fees.

The crucial discrepancy between the 3 protocols is that the UNI gets exclusively implemented for governance. This shows the significant migration of the liquidity from Uniswap to PancakeSwap and Sushi, when LPs are searching for wealth.

Affordable and Speedy Transactions

Price-wise PancakeSwap is cheaper than Uniswap and Sushi. At the same time offering fast transactions than both of the previously mentioned. This is because PancakeSwap is created on Binance Smart Chain, a blockchain to rival Ethereum.

The scaling capacity of BSC is because it’s not as centralized as Ethereum, but that is not stopping users from benefiting from the low transaction fees. PancakeSwap offers a great resource for smaller wallets that don’t have substantial funds.

Users of Ethereum will adapt to PancakeSwap easily because the connection on the exchange is through Metamask, the same way as when using SushiSwap and Uniswap.

Farming Liquidity Provider Tokens

Yield farmin is very simple. Investors have to locate an asset pair of assets they hold activate the Metamask wallet, make a deposit, and start farming.

The advantage of farming with Pancakeswap is in the lower expanse of making a deposit. Binance Smart Chain is drastically more affordable if compared with Ethereum, and this is due to the fact it’s more centralized.

Gamified Exchange Experience

PancakeSwap tries to offer a little fun with the PancakeSwap Lottery. Users get to deposit CAKE tokens into the lottery on a daily basis and expect the announcement of winning numbers.

With more deposits create a bigger pot and better stakes. Improving chances of winning is done by depositing more CAKE.

How to Use PancakeSwap

The first step in using PancakeSwap is to connect to the cryptocurrency wallet you are using.

PancakeSwap implements several types of binance chain wallet, from which the most recommended are:

- Binance Smart Wallet

- MetaMask Wallet

- Trust Wallet PancakeSwap

If you are unsure about the method of connecting a wallet to PancakeSwap, you will be surprised to learn it’s a simple process, requiring only to click the connect button on the upper right corner of the menu that opens a list of wallets that get supported with instruction on proper usage.

Before starting a trade check the PancakeSwap price predictions, and inspect the PancakeSwap tokenomics.

Users must connect to a crypto wallet to PancakeSwap.

Transfering Crypto Coin from Your Wallet

Moving crypto coins from your wallet, is done by navigating to the sidebar menu and selecting “Trade”, and then “Exchange” after that, you need to choose the token you plan to exchange, and the one you plan to get in return. To finish the transfer, it’s necessary to verify it in the wallet. The method is identical for purchasing PancakeSwap, by swapping one token for another.

Add Liquidity Pool

To create liquidity for a pool, open the “Trade” button and then the “Liquidity” icon and click the “Add Liquidity” after that select the token pair that you intend to deposit to create liquidity. Following the verification of the transaction, traders get an LP token comparable with the originally provided pair.

Select “Add Liquidity” and then choose the pair of tokens that you plan to deposit and provide liquidity.

Choose Farming Pool

To farm, investors must select the “Earn” and then “Farms”, after that choose a farm for the LP tokens, and define the quantity to farm and verify the operation.

Staking on PancakeSwap

Traders that are interested to stake PancakeSwap, must acquire CAKE tokens to perform it with favorable results.

Staking begins by activating the “Earn” button after that “Pools” and choosing the wanted pool. You will have to deliver the CAKE tokens to that preferred pool. The profit that gets generated can be claimed via the “Harvest” option and can get invested through the “Compound” option.

The same method gets used to stake PancakeSwap in a trusted wallet. Keep in mind to check the PancakeSwap price impact.

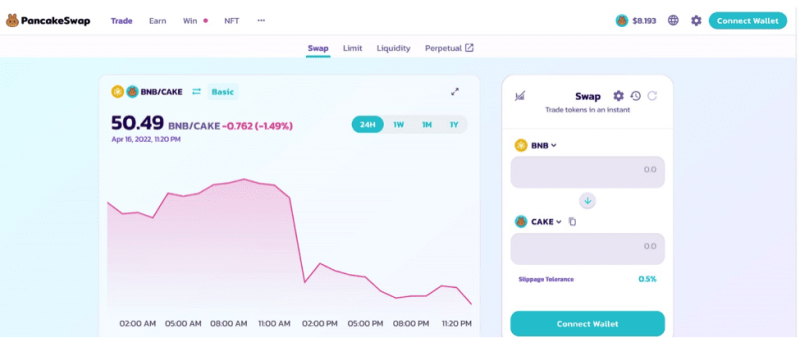

PancakeSwap DEX

For the use of PancakeSwap decentralized exchange, traders must visit Pancakeswap.finance, by selecting the Trade button.

Following this investors have a couple of choices: Liquidity and Exchange. By opening Exchange, you can access the Swap option.

The next step is to choose inputs for the exchange. Select the cryptocurrencies that you plan to exchange. If trading crypto on PancakeSwap, investors are transacting counter the AMM liquidity pools produced by users and not the order book.

With this swaps are faster, easier, and more flexible if correlated to a centralized exchange because everybody can make a pair, add liquidity, and create a new DEX market.

After you have chosen the assets that you intend to exchange, activate the Swap button, verify the transaction in the wallet, and that will complete the transaction.

It’s crucial to know that only BEP-20 tokens can get traded on the PancakeSwap DEX. The reason for this is that PancakeSwap gets created on Binance Smart Chain. Yet if owning ERC-20 tokens, you are still able to trade. The process requires implementing the Binance Bridge to wrap the assets that will get used on PancakeSwap.

Binance Bridge

Investors interested in transacting ERC-20 tokens on PancakeSwap must encase them on the Binance Bridge to transform them into BEP-20 assets.

This is done with the Binance Bridge and a connection to the wallet. If for example, you are working from a Metamask wallet on the Ethereum main network, then you will be required to verify the transaction on the Ethereum side, and this comes with a price tag settled in ETH.

Although this can get pricey because of large Ethereum fees, when the crypto assets are cloaked and bridged with BSC, investors save large amounts that otherwise would have to be paid in fees, and this is because of the low costs with PancakeSwap.

Binance Bridge can get used for other things, not only cross-chain assets in trading. It can get implemented for bridging Ethereum assets, which can get used for yield farming and liquidity on PancakeSwap.

When you have completed the operations on PancakeSwap and plan on transforming BEP-20 assets into ERC-20, it’s only necessary to perform the identical steps but in reverse with the Binance Bridge.

Providing Liquidity to PancakeSwap

Traders can be a provider of liquidity on PancakeSwap to get rewards. This is not a problem and makes the AMM liquid for users of the exchange.

Select Liquidity, plus the Add liquidity icon but check that the wallet is unlocked. At this point, you will have to choose the tokens that you create liquidity for. It should get noted that providing liquidity on PancakeSwap is performed in pairs, which requires a trader to provide two tokens.

Liquidity can get provided to current pools or a pool formed by the trader.

Forming a pool is typically performed with new projects searching for opportunities to showcase a cryptocurrency token. Some investors are more inclined to add liquidity to a current pool.

When you choose a pair that you are going to provide liquidity for, deposit by verifying the transaction. Following the deposit, you get FLIP, which is an LP token that represents the stake you have in the pool.

The advantage of having a FLIP LP token is that every time an exchange occurs it accesses the liquidity of your pool, and for this, you receive a segment of the rewards. To redeem the rewards, investors need to claim the FLIP tokens to unlock the given assets that have risen in value.

Working With PancakeSwap Syrup Pools

We covered the basics concerning yield farming mechanics and adding liquidity, yet what if a different pool gets encountered.

PancakeSwap Syrup Pools provide a method to stake a CAKE token in swapped for a Binance Smart Chain new token. The procedure is as follows, traders deposit a CAKE in a pool and in return get the project’s BEP-20.

Investors receive a new token that can increase in value, but the project gets liquidity and listing on the PancakeSwap exchange.

Accessing the Syrup Pool is done by pressing Pools, then choosing a token that you find appealing. Then depositing a CAKE and getting new tokens.

Playing the PancakeSwap Lottery

The volatility that is a characteristic of crypto at times resembles playing a lottery. PancakeSwap Lottery makes it possible to do precisely that with the CAKE tokens.

Select Lottery, then purchase the tickets with CAKE tokens. The odds of winning increase as the number of CAKE you spend rises. If 2 or more of the winning numbers on your tickets are a match, you get a segment of the CAKE pot.

Lottery sessions occur multiple times per day, making a large turn over creating better chances for success.

Initial Farm Offering

PancakeSwap is promoting an ICO model referred to as Initial Farm Offering.

The IFO empowers CAKE-BNB liquidity providers to purchase new project tokens. Accessing an IFO is easy for CAKE-BNB liquidity providers, they only have to deposit LP tokens on the IFO page.

Traders that are interested to take part in an IFO, but don’t possess CAKE-BNB LP tokens have to get them first. Purchase BNB and CAKE tokens at the same amount, that you plan to use. Deposit the tokens in the CAKE-BNB liquidity pool, and you will get the LP tokens.

Revisit the IFO page, and deposit the LP tokens, when the IFO is completed, you will in exchange receive the project’s tokens.

Yield Farming on PancakeSwap

It’s crucial not to mix yield farming and adding liquidity on PancakeSwap, they are two separate things.

Providing liquidity is the rise of the original quantities of the assets in the pool that’s implemented for transaction exchanges. The term yield farming indicates that a deposit of tokens gets used to mint other tokens.

When you plan on yield farming on PancakeSwap, choose the Farms button. Be careful that the toggle is activated in the Live farms, that way, you can observe what is happening at the moment. A large catalog of options will fill the page together with plenty of farms with pairs from BND and BUSD.

Select farms that appeal to you, and inspect the details to find out the amount of CAKE every farm produces. Across several pairs farming with APY is high, and farms such as DUSK-BNB generate substantial earnings.

Following the activation of the Details button, PancakeSwap will make you unlock the wallet and recognize the currencies stored in it, permitting investors to deposit the crypto onto the farm. Following the deposit, the page gets updated with the earned CAKE.

Is PancakeSwap Better than Uniswap?

When inspecting an exchange it’s always a good idea not to look only at its features to see how it stack up again the competition. The rivals of PancakeSwap have to be analyzed and determine if it’s better than Uniswap.

There is a lot of liquidity on PancakeSwap, and because of this, it’s a fantastic decentralized exchange. However, it’s not a better option than its rival.

PancakeSwap is not completely decentralized, yet this offers a few advantages.

It’s quicker and less expensive than Uniswap offering similar liquidity. The only problem is that for trading ERC-20 tokens, the Binance Bridge must get used, and depending on costs, it can get expensive.

The best user experience for PancakeSwap is for investors that possess BEP-20 tokens and are ready to proceed with the activities on Binance Smart Chain.

Is PancakeSwap Exchange Safe to Use?

PancakeSwap is a DeFi-based DEX exchange, and Certik audits its smart contracts. Smart contracts have risks. The fact they get audited is not a guarantee that every vulnerability gets eliminated, and errors in the platform can result in asset loss.

Conclusion

PancakeSwap is the future of decentralized finance (DeFi) and is created on the Binance Smart Chain, facilitating drastically cheap fees for transactions and fast verification time.

Keeping a well-structured portfolio is crucial for novice investors that can use PancakeSwap for their trading strategy. There are multiple other features that offer extra practicality for CAKE tokens holders.

The PancakeSwap exchange is in a part community-governed, where CAKE holders can use the voting portal and decide on proposals. This is the largest AMM project built on the Binance Smart Chain (BSC) and opens innovative features that make it a profitable consideration for investors.

FAQs

How do I use PancakeSwap?

When you verify the entry of the new network, return to the menu and select Browser. The wallet will request a connection to PancakeSwap.

How do you buy on PancakeSwap?

PancakeSwap implements an automated market maker that users trade counter a liquidity pool. These pools are filled by users that deposit funds in the pool and get liquidity provider tokens.

Do you need Binance to use PancakeSwap?

To start using PancakeSwap, you don’t need a Binance account. PancakeSwap is a decentralized application, and investors are not required to register.

Which wallet is best for PancakeSwap?

PancakeSwap works with several wallets, but the preferred options are MetaMask Wallet, rust Wallet PancakeSwap and Binance Smart Wallet.