Pacific Union Review

Forex brokers play a huge role in the world of online trading, serving as intermediaries between retail traders and the vast global currency markets. Choosing the right Forex broker is crucial for traders, impacting not just the quality of their trading experience but also the security of their investments and the potential for profitability. Pacific Union stands out in the crowded Forex broker market by offering an extensive array of trading opportunities.

In this comprehensive review, we delve deep into what makes Pacific Union a preferred choice for many traders. We aim to uncover every aspect that contributes to its appeal, from the variety of account options available to the efficiency of its deposit and withdrawal processes, its commission structures, and more. By combining expert analysis with feedback from actual traders, our goal is to present a balanced and insightful overview, equipping you with all the necessary information to decide if Pacific Union is the right brokerage for your trading needs.

What is Pacific Union?

Pacific Union is a prominent broker in the financial market, facilitating the trading of contracts for difference (CFDs) across a wide array of assets. These assets span various categories, including currencies, stocks, bonds, indices, commodities, metals, and exchange-traded funds (ETFs), offering traders a comprehensive selection for diversifying their portfolios. This broker stands out for its inclusivity, catering to both novice and experienced traders through its offerings.

Pacific Union’s technology infrastructure is robust, featuring support for popular trading platforms such as MetaTrader 4, MetaTrader 5, and WebTrader. This ensures traders have access to powerful tools and charts to inform their trading decisions. Moreover, the broker’s highly-rated mobile platform extends trading capabilities to on-the-go users, ensuring they can manage their trades anytime, anywhere.

In addition to traditional trading, Pacific Union offers avenues for passive income through a standard referral program and an integrated copy trading service. These programs provide opportunities for traders to earn by referring new clients or by allowing others to copy their successful trades, respectively. Such features enhance the broker’s appeal by offering diverse ways for clients to engage with and benefit from the trading ecosystem.

Benefits of Trading with Pacific Union

For newcomers, Pacific Union provides a free demo account, equipped with a balance of 100,000 virtual dollars. This feature is particularly beneficial for beginners, allowing them to practice trading strategies without financial risk. For more seasoned traders, the broker offers real accounts that come in five different types, each designed to meet the specific needs and preferences of traders at different levels of expertise. The accounts vary in terms of trading parameters, ensuring a tailored trading experience.

The flexibility in account types is matched by accessible financial terms, with a minimum deposit requirement of just $20. This low entry barrier makes it easier for individuals to start trading. Additionally, Pacific Union offers floating spreads, which start from 0 or 1.3 pips depending on the chosen account, making it a competitive option for traders seeking cost-effective trading conditions. The broker also supports a high maximum leverage of 1:1000, appealing to traders looking for the potential to amplify their trading positions.

Pacific Union Regulation and Safety

After trading with Pacific Union, I’ve learned about its regulatory background, which is vital for any trader to understand before diving into the trading world. Pacific Union is officially registered in the Seychelles and falls under the regulatory oversight of the Financial Services Authority (FSA) of Seychelles. Knowing the regulatory status of your broker is crucial as it provides a layer of security and trustworthiness to your trading activities.

The regulation by the FSA indicates that Pacific Union adheres to specific financial standards and practices, aimed at protecting investors. This information gave me a sense of security, knowing that there’s a regulatory body overseeing the broker’s operations. It highlights the importance of choosing a regulated broker to ensure that your investments are handled professionally and ethically.

Pacific Union Pros and Cons

Pros

- Low deposit and free demo.

- Many assets and high leverage.

- Low trading costs.

- Various account options.

- Multiple platforms, including mobile.

- Efficient copy trading.

- 24/7 customer support.

Cons

- Only CFD trading.

- Limited passive income options.

- No service in Australia, Singapore, etc.

Pacific Union Customer Reviews

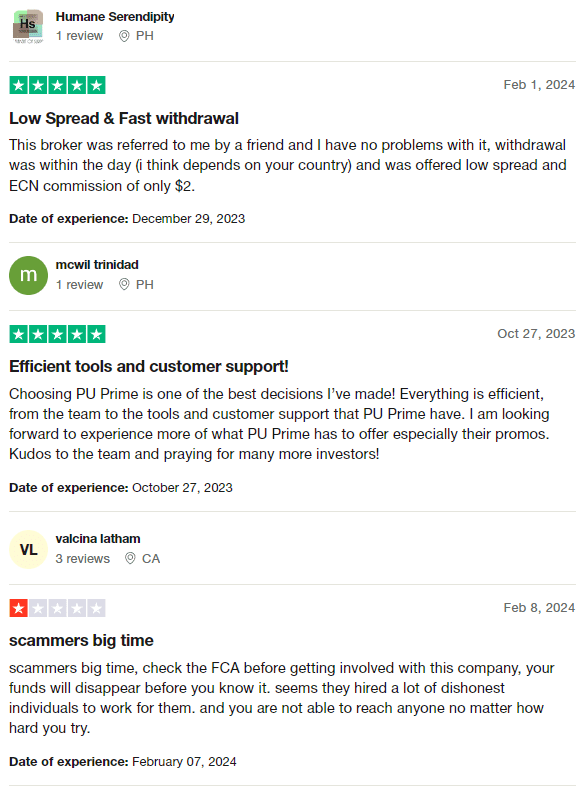

Pacific Union has received a mixed range of customer reviews. Some users praise the broker for its quick withdrawal process, low spreads, and competitive ECN commissions, highlighting the efficiency of the team, tools, and customer support. They appreciate the overall trading experience and look forward to more promotional offers from the broker. However, there are also critical voices, with some customers labeling the broker as untrustworthy, advising potential users to check regulatory bodies like the FCA before engaging. These detractors report issues with disappearing funds and difficulty in contacting support, suggesting a discrepancy in user experiences. This variety of feedback underscores the importance of thorough research and caution when choosing a broker.

Pacific Union Spreads, Fees, and Commissions

Trading with Pacific Union, I noticed their flexible spread options. Spreads begin at either 0 or 1.3 pips, based on the account you choose. For those opting for the Prime account, there’s a $3.5 commission per standard lot, which is crucial to factor into your trading costs. The Islamic account presents a unique fee structure, starting at $0 and capping at $3.5, accommodating various trading strategies without interest charges.

When it comes to withdrawals, I found some fees linked to specific payment channels: 1% for Skrill, 2% for Neteller, and 0.5% for Faspay. Interestingly, withdrawing to Visa or MasterCard bank cards incurs no direct fees from Pacific Union. However, it’s important to remember that third parties, like banks, may apply their charges. This insight into Pacific Union’s spreads, fees, and commissions highlights the importance of understanding all potential costs associated with your trading account to manage your finances effectively.

Account Types

Exploring Pacific Union, I discovered a range of account types tailored to different trader needs:

- Cent Account: Ideal for beginners, you need just $20 to start trading. With spreads from 1.3 pips and no commissions, it’s a low-risk option. However, it’s limited to USD and offers a maximum leverage of 1:500.

- Standard Account: Requiring a $50 minimum deposit, this account also starts with 1.3 pips spreads without commissions. It’s more flexible, accepting all base currencies, and maintains the 1:500 leverage.

- Pro Account: This account ups the ante with a $50 minimum deposit but offers a significant leverage of 1:1000. Like the Standard, spreads begin at 1.3 pips, no commissions, and it supports all base currencies.

- Prime Account: For the more serious trader, a $1000 deposit is necessary. It boasts 0 pips spreads with a $3.50 commission per lot. It supports all base currencies and provides leverage up to 1:500.

- Islamic Account: Designed to meet Sharia law requirements, it requires a $50 deposit. Spreads start at 1.3 pips, and the commission ranges from $0 to $3.50 per lot. It accepts all base currencies and offers 1:500 leverage.

How to Open Your Account

- Visit puprime.com and click on “Join Now” in the upper left corner after selecting “Personal.”

- Choose “Live Account,” fill in your country, name, email, and phone number, then click “Submit.”

- Provide detailed personal information including your nationality, birth details, and identity document numbers, then click “Next” to proceed.

- Follow the on-screen instructions, answer required questions, and upload necessary documents for verification.

- If you need to pause, use the “Continue Application” option to resume the process.

- After document verification, access your user account to manage or open new accounts and deposit funds.

- Select your account type, make a deposit, and then download the trading platform from the “Downloads” section.

- With the trading platform installed, you’re ready to start trading.

Pacific Union Trading Platforms

Based on my experience, Pacific Union offers a variety of trading platforms that cater to different trader needs. MetaTrader 4 (MT4) is available for those who prefer a classic and widely recognized trading environment. It’s known for its reliability, comprehensive analytical tools, and ease of use. For traders looking for advanced features, MetaTrader 5 (MT5) is the next step, offering more timeframes, technical indicators, and the ability to trade stocks and futures.

Additionally, Pacific Union provides a WebTrader platform that allows for trading directly from your web browser without the need to download any software. This option is perfect for traders who seek flexibility and accessibility, enabling trading on the go or from different devices. My experience with these platforms has been positive, highlighting Pacific Union’s commitment to providing efficient and adaptable trading solutions.

What Can You Trade on Pacific Union

In my trading journey with Pacific Union, I’ve explored a wide range of trading instruments that cater to diverse trading interests and strategies. The platform offers Contracts for Difference (CFDs) on various asset classes, providing a comprehensive trading experience. For those interested in the forex market, CFDs on currencies present numerous opportunities to trade major, minor, and exotic pairs, capitalizing on fluctuations in global currency values.

For traders inclined towards the stock market, Pacific Union provides access to CFDs on shares from leading companies across the globe, allowing for speculation on the price movements without owning the actual stocks. Additionally, the platform offers CFDs on bonds and indices, enabling traders to diversify their portfolios by investing in government securities and benchmark market indices.

Moreover, Pacific Union caters to those interested in commodities trading, with CFDs on a variety of commodities including oil, gold, and agricultural products. This variety allows traders to hedge against inflation or speculate on market trends. The platform also includes CFDs on metals and Exchange-Traded Funds (ETFs), further broadening the investment opportunities. My experience has shown that Pacific Union’s diverse range of instruments can meet the needs of traders looking for market exposure across different sectors and asset classes.

Pacific Union Customer Support

During my time trading with Pacific Union, I found their customer support to be exceptionally responsive and helpful. The support team operates in multiple languages, offering round-the-clock assistance, although it’s important to note this service is available only on weekdays. This feature is especially beneficial for traders who may encounter issues or have questions outside of standard business hours.

I interacted with their support through various communication channels, including telephone, email, and LiveChat. The LiveChat feature is particularly convenient, accessible directly on the website, within the user account, and even through the broker’s mobile application. This level of accessibility ensured that help was always just a few clicks away, making my trading experience smoother and more efficient.

Advantages and Disadvantages of Pacific Union Customer Support

Withdrawal Options and Fees

When trading with Pacific Union, starting risk-free is possible by using a demo account. This allows for practicing trades with virtual funds, ensuring there’s no financial risk involved, but also no real profits to be gained. Transitioning to a real account opens up the potential for actual earnings, dependent on successful trades. Profits from these trades can be withdrawn anytime, with no restrictions on the frequency of withdrawals, all managed easily through the user’s account.

For withdrawals, Pacific Union adopts a user-friendly policy: the first withdrawal each month is free of any commission fees. However, for any additional bank transfer withdrawals within the same month, a fee of $20 is charged. It’s important to note that the minimum amount for any withdrawal is set at $40; requests below this amount are not processed. The processing time for withdrawals is commendably swift, typically within one business day, though requests made over the weekend are processed the following Monday.

The broker facilitates withdrawals through various channels, including Visa and MasterCard, bank transfers, Neteller, Skrill, and Faspay. It’s worth mentioning that the availability of withdrawal methods may vary depending on the trader’s geographical location, offering flexibility to accommodate different regional requirements.

Pacific Union Vs Other Brokers

#1. Pacific Union vs AvaTrade

Pacific Union and AvaTrade are distinguished online brokers with unique offerings. Pacific Union is known for its wide range of account types, high leverage options, and extensive withdrawal methods, making it appealing for traders looking for flexibility and various financial instruments. On the other hand, AvaTrade excels with its strong regulatory framework, a vast array of financial instruments exceeding 1,250, and a global presence, emphasizing its commitment to secure and diverse trading opportunities.

Verdict: AvaTrade might be better for traders prioritizing regulatory security, diverse trading instruments, and global market access. Its long-standing reputation and commitment to trader education and resources offer a robust trading environment. Pacific Union, while offering competitive features, might appeal more to those seeking higher leverage and varied account options.

#2. Pacific Union vs RoboForex

Comparing Pacific Union to RoboForex, the latter stands out with its extensive range of trading platforms, including MetaTrader, cTrader, and RTrader, catering to a broad spectrum of trading preferences. RoboForex also boasts a significant number of trading instruments and is recognized for its technology-driven trading conditions. Pacific Union, however, offers competitive advantages such as high leverage and a diverse selection of withdrawal channels.

Verdict: RoboForex may be better for tech-savvy traders and those looking for a wide range of trading platforms and instruments. Its emphasis on cutting-edge technology and customizable trading conditions provides a tailored trading experience. Pacific Union remains a strong contender for traders valuing high leverage and flexible withdrawal options.

#3. Pacific Union vs Exness

Exness and Pacific Union cater to different trader needs through their unique offerings. Exness is renowned for its incredibly high trading volume and offers the unique feature of unlimited leverage, making it an attractive option for traders looking to maximize their trading positions. Additionally, Exness provides a range of CFDs and over 120 currency pairs, including cryptocurrencies, appealing to traders interested in a wide variety of markets.

Verdict: Exness might be the better choice for traders looking for high leverage and a wide array of trading instruments, including cryptocurrencies. Its focus on low commissions, instant order execution, and the availability of various account types tailored to different trader needs places it slightly ahead for those seeking flexibility and expansive market access. Pacific Union, while offering a competitive suite of services, is more suited for traders prioritizing diverse withdrawal options and account types.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH PACIFIC UNION

Conclusion: Pacific Union Review

Pacific Union stands out as a competitive option in the crowded field of online brokers, offering a broad range of financial instruments and account types. Its flexibility in account options and high leverage opportunities cater to traders with varying experience levels and investment strategies. However, while these features are attractive, potential users should consider their own trading needs and risk tolerance.

The broker’s withdrawal process and policies are notably user-friendly, providing several methods without fees for the first withdrawal each month. This aspect, combined with the broker’s efficient customer support available in multiple languages, enhances the overall trading experience. Nonetheless, the limitation on instant response options and absence of weekend support might be a drawback for some traders.

Also Read: ZFX Broker Review 2023 – Expert Trader Insights

Pacific Union Review: FAQs

What types of accounts does Pacific Union offer?

Pacific Union provides a variety of account types, including Cent, Standard, Pro, Prime, and Islamic accounts, catering to different trading preferences and levels of experience. Each account type comes with specific features like varying spreads, leverage options, and commission structures to suit diverse trading strategies.

Can I trade cryptocurrencies with Pacific Union?

Yes, Pacific Union offers trading in contracts for difference (CFDs) on a range of financial instruments, including cryptocurrencies. This allows traders to speculate on the price movements of cryptocurrencies without owning the underlying assets directly.

Is Pacific Union regulated?

Yes, Pacific Union is officially registered in Seychelles and regulated by the Financial Services Authority (FSA), ensuring a level of oversight and protection for traders’ investments and activities on the platform.

OPEN AN ACCOUNT NOW WITH PACIFIC UNION AND GET YOUR BONUS