Position in Rating | Overall Rating | Trading Terminals |

250th  | 2.0 Overall Rating |  |

Ox Securities Review

Ox Securities is a trusted forex broker established on core principles of integrity, honesty, and transparency. Since 2013, it has provided traders with access to a wide range of global markets, including Forex CFDs, Indices CFDs, Commodities CFDs, and Cryptocurrency CFDs. By offering diverse trading opportunities, Ox Securities caters to both novice and experienced traders looking to capitalize on financial market movements.

The broker leverages advanced trading technology to ensure smooth execution across multiple platforms and devices, enhancing the overall trading experience. Ox Securities also prioritizes client fund safety by adhering to strict global financial regulations and holding funds in top-tier regulated banks worldwide. With 24/5 exceptional customer service and a focus on delivering quality trading solutions, Ox Securities stands out as a reliable choice for online traders.

Features of Ox Securities including all its tradable markets, trading platforms, customer support, and precautionary measures undertaken by Ox Securities with regard to client fund safety are presented in this review. Ox Securities aims at bringing that secure and efficient human experience to all kinds of traders through quality solutions and phenomenal customer service operating twenty-four hours a day, five days a week.

What is Ox Securities?

Ox Securities is an online trading broker providing access to over 80+ currency pairs, including major, minor, and exotic options. Traders can execute orders directly on the MetaTrader 5 (MT5) platform, a trusted platform known for its reliability and advanced features. The platform supports 24/5 trading, giving traders the flexibility to trade at any time during the week and take advantage of constant Forex market opportunities.

The broker has really competitive advantages in tight spreads that reduce trading costs with great speed of execution to minimize slippage. With a really deep liquidity pool, Ox Securities can fill even the largest trade orders efficiently and at the best price. This makes it possible for traders to execute their strategies in perfect confidence while maximizing the chances of trade efficiency.

Ox Securities also allows diversification with a range of tradable products like Forex CFDs, along with other international access to different markets. Ox Securities caters to providing very competitive conditions, deep market access, and reliable technology making it a very practical choice for such traders in realizing the opportunities that exist in the market.

Ox Securities Regulation and Safety

Ox Securities is regulated by two financial authorities: the Australian Securities and Investments Commission (ASIC) and the Financial Services Authority (FSA) of St. Vincent and the Grenadines. ASIC, a Tier-1 regulator based in Australia, is known for its stringent consumer protection standards, ensuring brokers operate transparently and fairly. On the other hand, the FSA, a Tier-3 regulator, offers less rigorous oversight and does not provide additional client protection measures like compensation funds. This dual regulation structure allows Ox Securities to operate across various markets while maintaining compliance with international standards.

An outstanding reputation for reliability and safety in the trading industry has been built by Ox Securities, which has over eight years’ experience. The brokerage has put in place checks and balances to ensure compliance with required regulatory requirements through the implementation of Know Your Customer verification that helps to ascertain the identification of traders and prevents fraud. One drawback, however, is that there is no negative balance protection; thus, traders may end up losing more than their initial deposit during extreme market fluctuations. This is especially critical for traders who use high-risk instruments since market volatility can quickly increase losses.

On the other hand, Ox Securities remains a good option for the individual who seeks a controlled and secure broker, which means that it certainly is neither of the above. Although lacking negative balance protection, the regulatory aspect of some clients emphasizes the broker’s emphasis on consumer safety and the ethics of operation. Due diligence and careful implementation of risk management strategies would alert traders to safeguard their investments, especially those trading in very volatile markets.

Ox Securities Pros and Cons

Pros

- Tier-1 Regulation

- 8+ Years Experience

- KYC Verification

- Global Market Access

Cons

- No Negative Balance Protection

- Limited FSA Oversight

- No Compensation Fund

- No Specific Fund Protection

Benefits of Trading with Ox Securities

Ox Securities provides the traders with a funding option that secures as well as flexible with instant deposits and no hidden fees. There were a lot of supported base currencies, with starting and managing funds made efficient and simple. There is also a dynamic leverage of up to 1:500 enabled at Ox Securities, allowing the traders to adjust their leverage in accordance with their trading needs. With such a feature, control is granted when the risk exposure is maximized at the same time with opportunities; therefore, it is an ideal platform for both beginners with smaller investments and experienced traders seeking more market exposure.

Ox Securities, as said, is based on high quality of the services, which includes security and transparency. They are kept in the very highest quality, global tier banks, meaning that all client funds are completely segregated from company funds and include the best protection and reliability that can offer. Traders can be sure that their money is secured and responsibly managed. Moreover, Ox Securities provides 24/5 multilingual customer support to clients through live chat, phone, and email, in the event that you have any technical inquiries or want to understand how the platform works. That way, the support team is ever ready, ensuring that nothing gets in the way of a smooth and efficient experience of trading.

It would then show that Ox Securities possesses real trust and integrity with its clients through taking on a transparent, dependable trading environment. Dynamic trading offers flexible funding choices, security for client funds, and excellent customer support to complete the necessary facilities for a trader to accomplish success. This all together makes Ox Securities one of the reputable brokers for trading safely in global markets.

Ox Securities Customer Reviews

Ox Securities receives positive feedback for its excellent customer support and user-friendly platform. Many traders highlight the responsive and efficient service, even across long distances, ensuring timely resolutions for account setup and follow-up issues. Customers appreciate the helpful, fast, and accurate support, which is crucial when “time is money” in trading.

However, not all reviews are entirely positive. Some users have experienced delays, such as taking over a week to process withdrawals, with limited communication from the support team after initial contact. Additionally, issues with the platform freezing during major news events have also been reported, which can disrupt trading during critical moments.

Ox Securities Spreads, Fees, and Commissions

Ox Securities provides traders with competitive spreads to help manage trading costs effectively. Spreads start as low as 0 pips, which is ideal for those looking to minimize expenses on each trade. For traders who prefer cost-effective options, Ox Securities also offers accounts with $0 commissions, removing additional fees that can eat into profits.

Ox Securities ensure that every trader gets a fair price structure that complements their financial objectives by making all these low-cost trading opportunities available to them. The advantage of no minimum deposit by Ox Securities is that it has made accessible trading for all—well in their pockets and experience levels. New entrants have this flexibility to start trading without a significant upfront investment, something that builds their confidence as they take baby steps into the industry.

On the other hand, experienced traders can expand their strategies and investments without funding limits. In addition, the minimum trading size of 0.01 allows traders to start small and manage their risk through time. This offers a great way to test strategies or increase position sizes gradually over time.

Maximized by Ox Securities is the leverage you can get up to 1:500, thus providing great potential for trading as a trader promises to increase their positions but maintain control over capital. This dynamic leverage caters to the needs of the conservative and aggressive trader. Traders can therefore adjust their exposure to align with their risk profile and open end market opportunities. With low spreads, no commission, flexible trade sizes and the list goes on, Ox Securities leads the way in creating a bright, clear, and user-friendly trading environment for all types of traders.

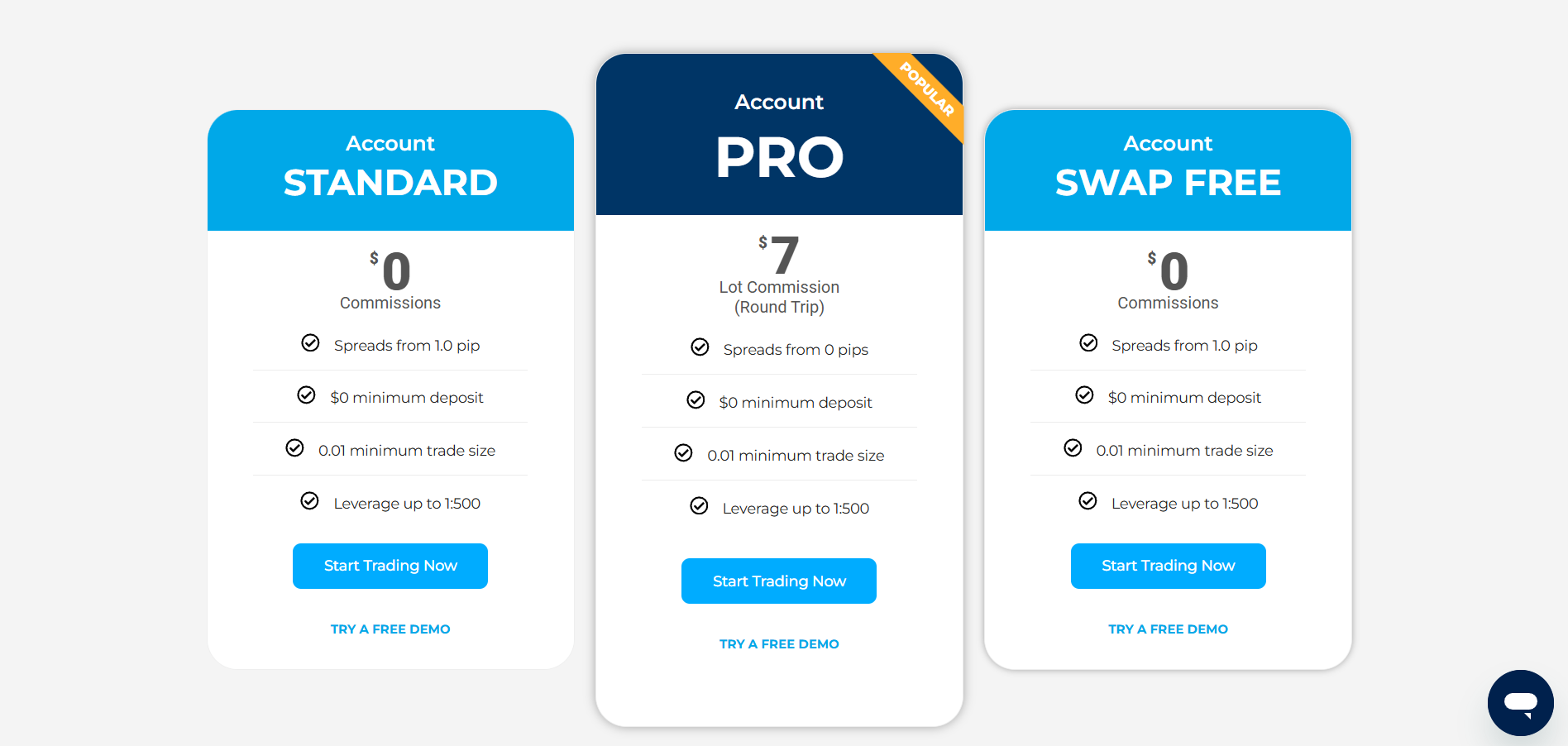

Account Types

Ox Securities offers a range of account types designed to meet the needs of all traders, from beginners to experienced professionals. Each account provides competitive trading conditions, including low spreads, no minimum deposit, and leverage up to 1:500, ensuring flexibility and affordability for every trading style.

Standard Account

The Standard account is a great option for traders who want a commission-free trading experience. It features spreads starting from 1.0 pip and allows for a 0.01 minimum trade size, making it ideal for those looking to trade with smaller positions and lower costs.

Pro Account

The Pro account is tailored for traders seeking tighter spreads and more precise pricing. With spreads starting from 0 pips, it offers exceptional value for high-volume traders, with a competitive $7 commission per round trip. This account combines affordability with access to the tightest spreads in the market.

Swap Free Account

The Swap Free account is designed for traders who cannot pay or receive swaps due to religious beliefs. It offers spreads starting from 1.0 pip, no commissions, and the same 0.01 minimum trade size and leverage options, ensuring an ethical and cost-effective trading experience for all.

How to Open Your Account

Opening an account at Ox Securities is quick and straightforward, allowing you to start trading in just a few simple steps. Whether you’re new to trading or experienced, this process ensures you can access the global markets efficiently and securely. Here’s how you can get started:

Step 1: Register

Visit the Ox Securities website and complete the fast and secure online registration form. Provide your basic details, such as your name, email, and phone number, to create your trading account.

Step 2: Verify Your Account

Submit the required identification documents to verify your account. This step ensures compliance with security regulations and keeps your account protected.

Step 3: Choose Your Account Type

Select the account type that best suits your trading needs, whether you prefer commission-free trading, tighter spreads, or swap-free options. Each account offers competitive conditions tailored to different trading styles.

Step 4:Fund Your Account

Add funds to your trading account using one of Ox Securities’ secure and flexible payment methods. With no minimum deposit required, you can start with any amount that fits your budget.

Step 5: Start Trading

Once your account is funded, you can start trading immediately. Access the global markets across all your devices and begin placing trades with confidence.

Ox Securities Trading Platforms

Ox Securities offers access to the world’s most popular trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are known for their reliability, user-friendly interface, and powerful tools, making them ideal for both beginners and experienced traders. Whether you’re analyzing charts, using automated trading strategies, or placing trades manually, MT4 and MT5 provide everything you need for a seamless trading experience.

Both platforms are available across all devices, including desktops, smartphones, and tablets, ensuring you can trade anytime and anywhere. With advanced charting tools, real-time market data, and customization options, Ox Securities ensures traders have the technology to stay on top of the global markets. This flexibility and accessibility allow you to execute trades efficiently and manage your positions on the go.

What Can You Trade on Ox Securities

Ox Securities provides a wide range of trading options, allowing traders to access global financial markets through various CFDs (Contracts for Difference). Whether you are interested in currencies, commodities, or shares, Ox Securities ensures a diverse and flexible trading experience suited for all types of traders.

Forex CFDs

Trade the world’s most popular currency pairs with Forex CFDs. Ox Securities offers tight spreads, dynamic leverage, and access to major, minor, and exotic pairs, providing opportunities to trade 24/5 in the world’s largest financial market.

Indices CFDs

With Indices CFDs, you can trade the performance of global stock markets without buying individual shares. Gain exposure to popular indices like the S&P 500, Dow Jones, or FTSE 100 and take advantage of price movements in leading economies.

Commodities CFDs

Ox Securities allows you to trade commodities like gold, oil, and agricultural products. With commodities CFDs, you can benefit from price fluctuations in global resources, making it a great way to diversify your portfolio.

Cryptocurrency CFDs

Trade popular cryptocurrencies, such as Bitcoin, Ethereum, and others, without needing a digital wallet. Ox Securities offers crypto CFDs that allow you to take advantage of market volatility in this rapidly growing asset class.

Shares CFDs

Gain access to global company stocks through Shares CFDs. Trade the price movements of well-known companies like Apple, Tesla, and Amazon without owning the shares, enabling you to profit from both rising and falling markets.

Ox Securities Customer Support

Ox Securities provides reliable and efficient customer support to ensure clients get the assistance they need when it matters most. Their dedicated team is available 24/5, operating during market hours from Monday at 00:00 to Friday at 24:00 (GMT+3). This means you can rely on consistent support throughout the trading week for smooth and uninterrupted trading experiences.

The support team at Ox Securities consists of financial experts who are well-versed in the FX market and equipped to address clients’ questions and concerns. Whether you’re a new trader seeking guidance or an experienced investor needing technical help, the team is committed to delivering accurate and helpful solutions promptly.

Ox Securities focuses on customer satisfaction, making dependable support a key priority in their services. Clients can access customer assistance through multiple channels, such as live chat and phone support, ensuring they can quickly get in touch when needed. This focus on availability and expertise makes Ox Securities a trusted choice for traders worldwide.

Advantages and Disadvantages of Ox Securities Customer Support

Withdrawal Options and Fees

Ox Securities offers a variety of convenient and secure withdrawal options to ensure traders can access their funds quickly and easily. Whether you prefer traditional bank methods or modern digital currencies, the platform provides flexibility to suit your needs.

Bank Transfer

Bank transfers are a reliable and widely used method for withdrawals. This option allows you to securely transfer funds directly to your bank account. While Ox Securities does not charge any fees for bank transfers, keep in mind that transaction costs may be deducted if no relevant trading activity has been conducted.

Credit/Debit Card

Withdrawals through credit or debit cards offer a fast and straightforward way to access your funds. This method is ideal for traders looking for quick processing times without additional costs. Like other methods, fees will only apply if the deposited amount was not used for trading.

Crypto USDT

For traders preferring digital currencies, Ox Securities supports USDT withdrawals via Ethereum and Tron networks. Although Ox Securities does not typically charge fees, a small fee is applied for large crypto withdrawals to cover conversion costs from fiat to cryptocurrency. This ensures smooth processing for those leveraging blockchain technology.

Ox Securities Vs Other Brokers

#1. Ox Securities vs XM

Ox Securities offers traders tight spreads, a variety of CFD instruments, and reliable trading platforms like MetaTrader 4 and MetaTrader 5. With flexible leverage up to 1:500 and no fees on most withdrawals, it appeals to cost-conscious traders while supporting bank transfers, credit/debit cards, and cryptocurrency. On the other hand, XM is a globally recognized broker with a low minimum deposit of $5, making it accessible to beginners. XM provides competitive spreads, commission-free trading on most accounts, and extensive educational resources. It also offers leverage up to 1:888, depending on the region, with multiple account types suited to different trading styles.

Verdict: Ox Securities is great for traders seeking high leverage, diverse CFDs, and affordable crypto withdrawals, while XM appeals to beginners with its low entry barrier and educational resources. Choose based on your priorities.

#2. Ox Securities vs RoboForex

Ox Securities offers competitive spreads, flexible leverage up to 1:500, and cost-effective withdrawal options through bank transfers, credit/debit cards, and cryptocurrency. With access to MetaTrader 4 and MetaTrader 5, no minimum deposit, and low trading costs, it appeals to traders seeking affordability and flexibility. In comparison, Roboforex provides diverse account types, multiple platforms like MetaTrader 4, MetaTrader 5, and cTrader, and leverage up to 1:2000 for higher exposure. It also features cashback programs, bonuses, and a wide range of instruments, making it attractive for active traders looking to maximize returns.

Verdict: Both brokers have unique strengths. Ox Securities offers transparent fees, cost-effective withdrawals, and flexible trading, while Roboforex provides high leverage and bonus programs. The choice depends on your priorities.

#3. Ox Securities vs Exness

Ox Securities offers competitive spreads, leverage up to 1:500, and cost-effective withdrawal options, including cryptocurrency, bank transfers, and credit/debit cards, making it appealing to traders seeking flexibility and affordability. With access to MetaTrader 4 and MetaTrader 5, it provides robust tools for both beginners and experienced traders. In comparison, Exness provides leverage up to 1:2000, multiple account types, ultra-low spreads, and instant withdrawals. Its multi-language customer support and user-friendly platforms make it a strong choice for international traders seeking higher exposure and convenience.

Verdict: Ox Securities is ideal for traders seeking cost-effective withdrawals and accessible trading conditions, while Exness stands out for its high leverage, instant withdrawals, and global reach. The best broker depends on whether you prioritize affordability or advanced features.

Also Read: XM Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH OX SECURITIES

Conclusion: Ox Securities Review

Ox Securities is a trusted broker that caters to traders of all experience levels, offering competitive spreads, flexible leverage up to 1:500, and access to advanced trading platforms like MetaTrader 4 and MetaTrader 5. The broker excels in providing a transparent fee structure and cost-effective withdrawal options, with support for multiple payment methods, including cryptocurrency, credit/debit cards, and bank transfers. These features make Ox Securities an appealing option for traders who value affordability, flexibility, and seamless access to global financial markets.

Additionally, Ox Securities has no minimum deposit requirement, making it accessible to new traders, while its professional trading tools and wide range of CFDs also meet the needs of experienced investors. The broker’s focus on customer satisfaction, supported by responsive customer service and user-friendly platforms, ensures a smooth trading experience. Whether you are new to trading or a seasoned professional, Ox Securities offers a robust combination of features to trade with confidence and efficiency.

Also Read: LiteForex Review 2024 – Expert Trader Insights

Ox Securities Review: FAQs

What trading platforms does Ox Securities offer?

Ox Securities provides access to MetaTrader 4 and MetaTrader 5, offering advanced tools and features for traders of all levels.

What are the withdrawal options at Ox Securities?

Traders can withdraw funds via bank transfers, credit/debit cards, and cryptocurrency, with most withdrawals free of charge.

What leverage does Ox Securities offer?

Ox Securities offers flexible leverage up to 1:500, allowing traders to choose a level that matches their strategy.

Is there a minimum deposit required?

No, Ox Securities does not require a minimum deposit, making it accessible for traders of all budgets.

OPEN AN ACCOUNT NOW WITH OX SECURITIES AND GET YOUR BONUS