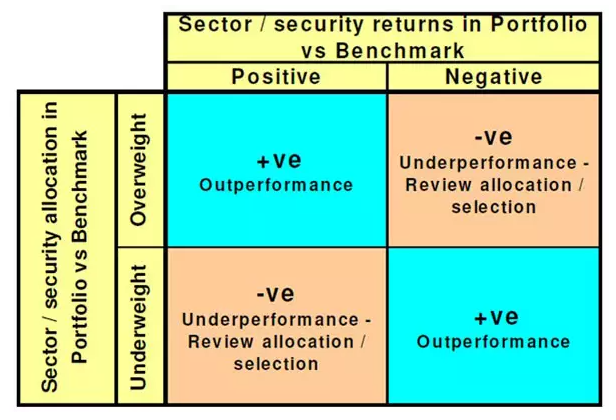

An overweight investment describes an industry sector or asset that comprises a higher-than-normal percent or an index or a portfolio. A trader can opt to devote a more significant portion of the index to a sector that appears more promising. Alternatively, the trader might go overweight on bonds and defensive stock when the price fluctuations are volatile.

Underweight and overweight analysis help commentators and analysts to recommend buying or avoiding some sectors or investments. For instance, when the federal defense spending totals promise to decrease or increase, analysts suggest that the investor is underweight or overweight on defense-related sectors.

In any case, analysts present an overweight endorsement to an asset they are confident will outperform the sector in the following months. The alternative ratings can be equal weight or underweight. Overweight refers to the excess amount that a stock is an investment or a fund portfolio compared to its track records for the benchmark index.

Photo Credit: https://www.google.com/url?sa=i&url=https%3A%2F%2Ffinancebreakout.com%2Fwhat-does-overweight-stock-mean%2F&psig=AOvVaw082T4-7aRg4R-AKetJx0qQ&ust=1636596869890000&source=images&cd=vfe&ved=0CAsQjRxqFwoTCLifnsvcjPQCFQAAAAAdAAAAABAD

To gauge indexes, analysts track stock performance records to represent the index percent that fluctuates depending on the perceived impact. They also estimate mutual funds and devote some percentage of the fund to interest-bearing and cash bonds to manage overall risks. This statement explains why the index performance of mutual funds can fluctuate fractionally from the index and each other.

Also Read: How Does Money Flow Index Work

Contents

- Why do Analysts Weigh Stock?

- Overweight Stock Price Examples

- Overweight Stock Rating

- How to Invest in Overweight Stocks

- Frequently Asked Questions

Why do Analysts Weigh Stock?

Stock weighing is crucial for analysts and investors to understand and classify certain assets' causes against the benchmarks. In other words, more prominent companies represent a more extensive portfolio and index. For instance, the S&P 500 represents the most popular index in America, and it comprises 500 large companies.

Generally, stock weighing is crucial to deter larger companies from taking up an equal percentage index like the smaller companies. Instead, every company ought to represent a proportional amount for their market capitalization relative to other enterprises. This process is vital since it gives an accurate market representation. It also implies that when composing a portfolio, you ought to avoid investing heavily in a particular asset.

Photo Credit: https://www.google.com/url?sa=i&url=https%3A%2F%2Fwww.investopedia.com%2Ffinancial-edge%2F0512%2Funderstanding-analyst-ratings.aspx&psig=AOvVaw2zAgV4CepgtJoZQyUFHqPL&ust=1636596993452000&source=images&cd=vfe&ved=0CAsQjRxqFwoTCKiFoIrdjPQCFQAAAAAdAAAAABAW

Experts recommend the minimal investment of your portfolio in one stock option since it may expose your stock trading business to excessive risk relative to the potential reward. Therefore, risk indicator like the beta is crucial for understanding reasons for the extreme trading risks in the stock market.

However, many investors do not constantly evaluate and redistribute the weight of the assets in a primary index. In simple terms, you ought to note that the overweight stock is a good stock option to purchase, while the underweight stocks tend to trend downwards.

Overweight Stock Price Examples

The stock market changes constantly. Thus, identifying the apt time to buy stocks is crucial to gain profit. Analysts are now aware of more movements in the recovering markets, paving the way for traders to gain profit. Checking closely on what is underweight and overweight can be a practical approach to beat the trends.

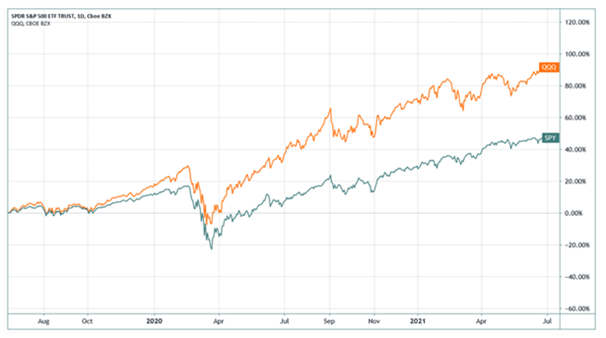

For instance, the tech industry has performed well compared to other assets in the stock market in the past few years. The ETF at QQQ that weighs more in favor of the tech companies on the S&P 500 turned an extra four percent profit to the traders compared to the standard S&P 500 ETF. Yet, an additional percent can be helpful for investors who feel worried about peaking inflation.

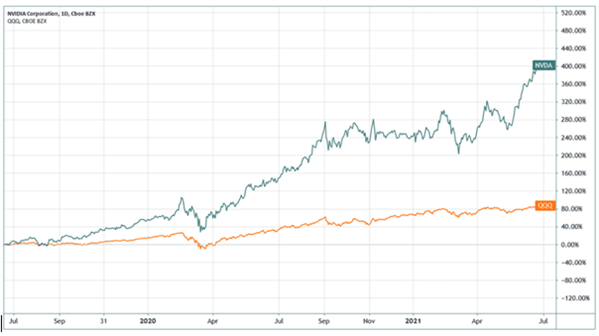

During this period, traders investing heavily in the technology sector had more profits than investors who stuck to an even distribution. Although traders buying at QQQ faced more volatility and a greater risk, the net profit is remarkable. Nvidia is another excellent example of a tech company that is overweight. Forex analysts expect a strong from the company since they have rare products and a dominant market share.

The chart above showcases that QQQ performed at a comparable level for the past three months to the S&P 500. However, NVDA stocks massively outperformed their stock during this period. QQQ presented extra insulation and diversity than purchasing single security. Yet, a lack of diversity can produce greater profits for the traders. Thus, it is not the industries alone that get propped up.

Although QQQ presents a better representation of the technology companies, it is crucial to note that traders can trade down further and identify certain companies that make a sector more attractive. This statement is more prevalent when trading for large companies like Apple and Amazon. Yet, you can apply the same strategy when checking on the stock market daily since some good news and a few companies can change the whole market quickly.

There are no sure plans in the stock market. The fact that the stock can be overweight does not imply that the company cannot experience a lousy report to miss its earning goals. Therefore, it would be best to closely check the trend to invest rightly and make some profits.

Overweight Stock Rating

Different investment firms employ other weighting systems. Understanding what underweight and overweight stock means require you to check on the basics of the stock market trends. It would be best to mention that terms can change based on your tool to evaluate the stock market.

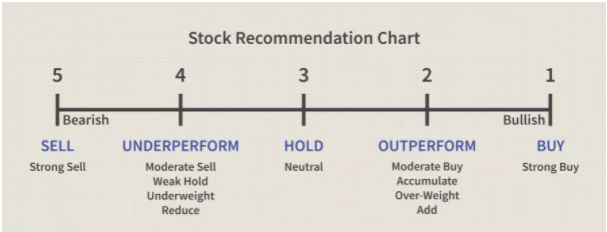

The 3-tier rating system is one of the most popular metrics. It checks on whether a form issues recommendations to buy, hold or sell assets. Buy correlates to overweight while sell relates to underweight stocks. On the other hand, forex hold stocks may apply for assed that do not show any solid trends or are simply underperforming. Investing in stocks that showcase a strong trading trend can help to protect you from market volatility. Yet, investors ought to understand why an asset or the company shows no trends to avoid value traps.

How to Invest in Overweight Stocks

It can be easy to invest in overweight stocks if you use a reliable broker. Also, it is the easiest way to make money from the stock market based on one asset investment. Nevertheless, traders should understand that stock market ratings are recommendations that anyone can offer. They can be from asset owners who do not want to sell their open positions. Investment firms and analysts are fallible. Thus, it would be best to conduct extensive research about the stock market.

It would be best to stay clear about how long you will keep your position open in the stock market. An overweight stock might generate profit for several months before dropping. Therefore, ensure that you adjust according to the fluctuations and stay careful about unexpected tax liabilities.

The most effective approach to investing in the stock market with overweight assets would be to consider the factors determining your investment timeline, balance, and plan. Ensure that you prioritize your portfolio based on the mutual fund and index with enough allocations depending on your risks.

Also Read: Best Day Trading Stocks

Frequently Asked Questions

1. Should I buy overweight stocks?

It would be best to conduct extensive research before opening any positions in the stock market. Although it can be somewhat to follow the trend and buy whatever stocks other people are buying, you might end up with regrettable losses if you don’t research. Investing in overweight stock can be an excellent idea since it can generate more returns in a short period. Yet, it can be more profitable for long-term traders to keep their money in ETF or mutual funds.

2. How can I identify outperforming stocks in the stock market?

It is simple to identify outperforming stocks in the market by checking on their recent returns against the S&P 500 average indicator. If the stock growth is somewhat more significant than the S&P 500, it is outperforming in the stock market.

3. What does an outperform stock rating mean?

An outperforming stock price rating in the exchange market means that the asset showcases more growth than other similar stocks. In other words, the investment promised to outperform other assets in the market. The stock asset might also be outcompeting other companies in the same niche. The stock promises that it will deliver unbeatable results in the few coming months.

4. What is the meaning of an overweight rating from a broker?

When a broker provides an overweight rating for a particular asset, it implies that experts at the brokerage firm are confident that the stock asset will rise within a short timeframe. Overweight ratings suggest that traders ought to increase the investment amounts in that particular stock. Stocks with the equal weight stock price often feature the same fluctuation habits.