Contents

- What Are Open Interest Options

- How Open Interest Options Work

- Open Interest Options Changes

- Trading Volume Vs. Open Interest Options

- Open Interest Options Benefits

- Trend Strength and Open Interest

- Frequently Asked Questions

What Are Open Interest Options

Open interest options refer to the number of outstanding derivative contracts like futures or options that are yet to trade for an asset. In any case, the total open interest options do not count, and the total sells and buy contract. In simple terms, open interest offers an accurate options trading activity picture. It also showcases whether cash flows into the options and futures market are decreasing or increasing.

Also Read: Best Forex Trading Platform

How Open Interest Options Work

It would be best to understand how futures and options contracts work to understand open interest options better. In general, buyers make all option contracts. Yet, every buyer represents a particular seller since one cannot buy something unless it is available for sale. The seller and buyer relationship create one contract, translating to about 100 shares from its underlying assets.

The contract will remain open until one of the two parties close it. The sum of all available contracts from both the seller and buyer gives you the open interest options. When a seller and buyer engage and create a new contract position, the open interest options value rises by one contract. Where the seller and buyer exit from a particular position in the stock market, the open interest options decrease by one contract. Nevertheless, where a seller or buyer passes off a current position in the stock market to another seller or buyer, the open interest options value will remain the same.

Open Interest Options Changes

It would be crucial to note that the open interest options value represents the sum of all active contracts. In other words, it does not refer to the sum of each seller and buyer transaction. Instead, it is the sum of all sells and buys that are active. Thus, the open interest value will only change where a new seller and buyer join the market to create a new active position or when the seller and buyer agree to trade and close both positions.

For instance, if one investor has ten short active contracts (sale) and another investor has ten long active contracts (purchase), and the two parties buy and sell ten active contracts to each other, the stock market will deduct these contracts from the open interest options since they get closed. Generally, open interest options are associated with options and futures markets, where the sum of active contracts changes daily.

This trading option is different from other stock market options, where the company's outstanding shares remain constant even after selling or buying a stock. The most common misconception about the open market is that it lies in a purported predictive position. It is difficult to forecast price fluctuations in open interest. Low and high open interest options reflect investor interest. Nevertheless, this statement does not imply that their positions will be profitable or their views are correct.

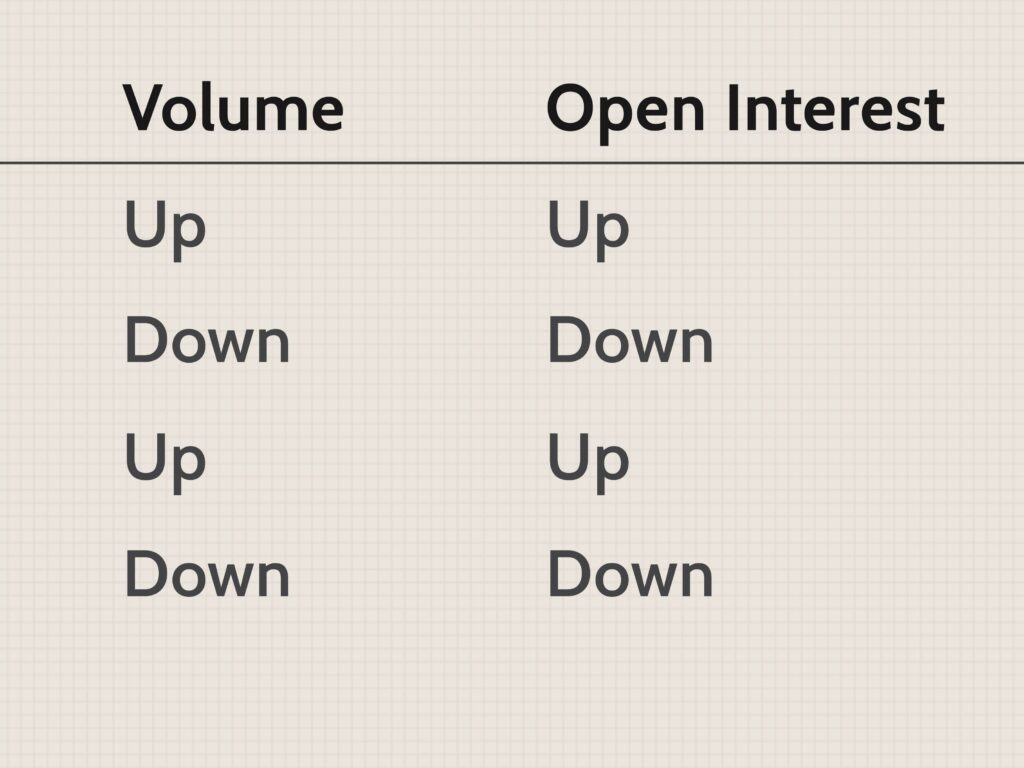

Trading Volume Vs. Open Interest Options

Most traders mistake trading volume for open interest, but these are two different measures. In general, whenever a trader with ten option contracts sells all ten contracts to a trader joining the market for the first time, the transaction will not reflect on the open interest value for this particular transfer. In other words, the transaction does not add a new option contract to the stock market since it is one trader transferring a position to a new trader. Yet, selling these options to an existing option buyer from a current option holder will increase the trading volume value.

Photo Credit: www.investopedia.com/thmb/qh8cuO771M0_BIb1Trk9DYymMJo=/3224×2418/smart/filters:no_upscale()/dotdash_final_Using_Open_Interest_to_Find_Bull_Bear_Signals_Oct_2020-01-af50a62c22ac4a45bbf745029ed87ff8.jpg

Open Interest Options Benefits

Open interest options work like a market activity measure. None or little open interest options imply that the stock market does not have opening positions, or traders have closed nearly all positions. A higher open interest value means that many contracts are available, implying that the stock market participants closely watch it.

Besides, it can work as a cash flow measure in an options and futures market. Raising the open interest value indicates additional or new money in the market. On the other hand, a decrease in the value showcases money flow out of the stock market. In simple terms, open market options are more significant to option investors since it offers vital information about the liquidity of stocks.

Trend Strength and Open Interest

Open interest options can work well as a trend strength indicator. In any case, the rising open interest options value translates to additional interest and money entering the stock market. Therefore, experts interpret the open interest value as an indicator that the existing market trend is likely to continue or gain momentum.

For instance, an increasing open interest often favors market continuation where the trend keeps rising for underlying asset prices like stocks. The same idea would apply to downtrends. Open interest options will support a further price fall whenever the stock price declines and the open interest increases.

Generally, experts believe that open interest options knowledge provides vital information regarding the stock market. For instance, where there is an open interest market deceleration due to a sustained move, it might be an indicator that the trend is ending.

Also Read: Power Hour Stocks

Frequently Asked Questions

1. How does open interest options work?

The open interest option showcases open contracts available on a trading day. This value does not include closed contracts traded within that period. It reflects the present trend in stocks to help predict the trend reversal for the underlying stock. It also involves active secondary market contracts. In simple terms, when the open interest decreases, the value of reasonable spread profits also decreases.

2. How do you trade with open interest?

The open interest option can help to evaluate the overal trading activities in a stock market. It describes all the active contracts available on that stock market at that time. If a seller closes a contract, the open interest option excludes the contract from its value. When a seller opens a new contract, the value also reflects. The idea applies to both the buyer and seller. Joining a contract adds to the value, and closing the contract takes away from the value. If a new buyer in the market buys from an existing seller, it does not affect the value. The open market interprets this move as a transfer of assets.

3. What is highest open interest?

A high open interest means that the contract is still open. For that reason, many investors tend to watch the fluctuation in its prices closely. The highest open interest option has the highest number of views, and traders are interested in the next price. An increase in the open interest value occurs when a new investor joins the market and creates a new contract with a buyer.

4. Should I buy options with high open interest?

It would be best to mention that a high open interest does not indicate an increase in the stock price. Instead, it shows that the stock has a higher liquidity value. In simple terms, traders are looking to trade on that stock shortly. It indicates that purchasing the stock has a guarantee of selling it.